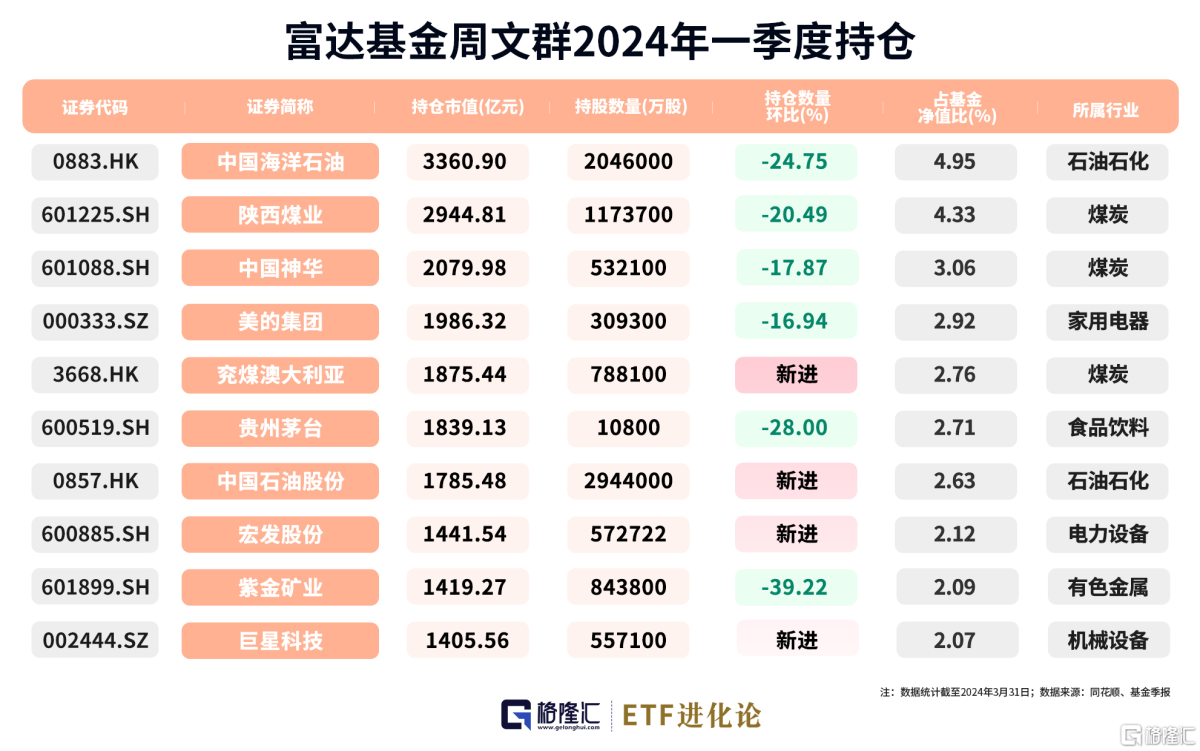

Zhou Wenqun of Fidelity Funds has the latest management scale of 680 million yuan. The first quarter heavy stocks of the Fidelity Heritage 6-Month Stock Fund under its management include CNOOC, Shaanxi Coal, China Shenhua, Midea Group, Yancoal Australia, etc., and its holdings are mainly energy stocks.

Fidelity Inheritance drastically increased its allocation of Hong Kong stocks, increasing its allocation ratio from 14.4% at the end of last year to 24.31%. Fund manager Zhou Wenqun said in the quarterly report: “The fund has increased its allocation to the upstream sector, which is the main source of excess income; the overequipped household appliances and under-equipped pharmaceutical sectors have also brought certain positive contributions. On the other hand, stock selection, oversized food and beverage, and low-grade banking sectors within the TMT sector have had a certain impact on overall performance. Combined with weak domestic demand, the allocation of targets related to food, drink and real estate has been reduced.”

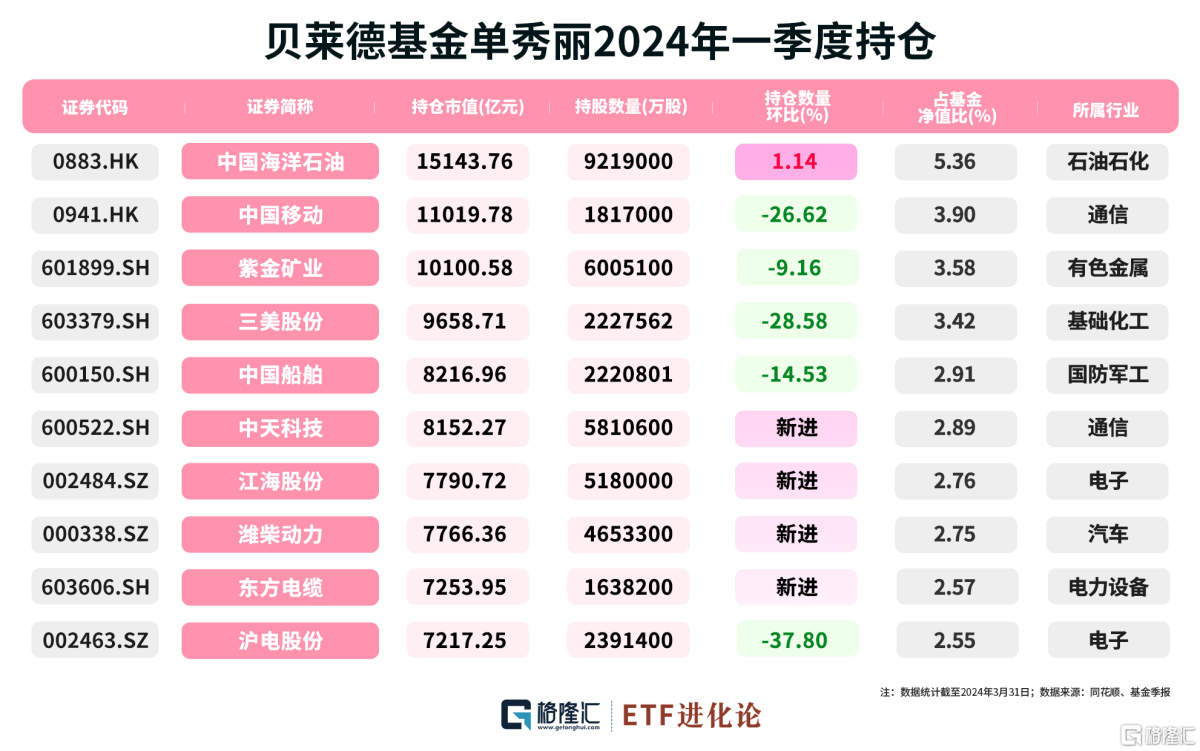

BlackRock Fund's latest management scale is 2,825 billion yuan. BlackRock China New Vision and BlackRock Hong Kong Stock Connect Vision's heavy stocks in the first quarter include CNOOC, China Mobile, Zijin Mining, Sanmei, and China Shipping, which focus on energy and technology.

BlackRock China New Vision's Hong Kong stock allocation ratio increased slightly, from 13.16% to 16.1%. Shan Xiuli said in a quarterly report, “The selection of positions around the Spring Festival was basically correct. Before the Spring Festival, the fund's management resolutely reduced holdings of individual stocks whose performance could not be achieved quickly in the short term and lacked valuation support. Balancing the portfolio allocation and adhering to undervalued high-dividend assets had good results; actively increasing the allocation of growth stocks and assets benefiting from inflation after the Spring Festival also achieved good results.”

Lubomai's latest management scale of Wei Xiaoxue was 2,906 billion yuan. Its subsidiary Lubomai China Opportunity Hybrid Fund held heavy stocks in the first quarter, including Sannuo Biotech, Tsingtao Brewery, Bowei Alloy, Lixun Precision, Xinbao, Conn Bay, and Gushengtang, etc., mainly energy and pharmaceuticals.

Lubomac China Opportunity slightly increased its share allocation to Hong Kong stocks to 12.17%, an increase of nearly 3%. Fund manager Wei Xiaoxue said that during the first quarter, positions remained neutral and cautious, and the position structure was biased towards balance. The deployment of upstream resource companies was increased, and the export-related consumer industry, which benefited greatly from the depreciation of the RMB this year, was maintained. The dividend rates of holding companies have been sorted out, and they prefer individual stocks that are willing to actively increase dividend rates and that are still at a low level of valuation. At the same time, in the context of China's economic transformation, investment opportunities with strong growth attributes such as high-end manufacturing upgrades, automobile and electric vehicle industry development, and technological opportunities brought about by the wave of AI technology have been gradually added.