最新

人気

払わないでください $アーム・ホールディングス(ARM.US$700億ドルの評価額を支払わないでください。 $エヌビディア(NVDA.US$認可で失敗した、彼らを400億ドルの評価額で評価しました。 ARMはその評価を受け入れました!

ソフトバンクは2016年に240億ポンドで買収しました。

10年間ほどスケールしておらず、AIブームに乗るIPOブームにお金を払う理由はありません。

ソフトバンクは2016年に240億ポンドで買収しました。

10年間ほどスケールしておらず、AIブームに乗るIPOブームにお金を払う理由はありません。

翻訳済み

8

4

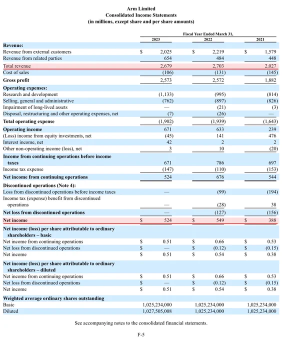

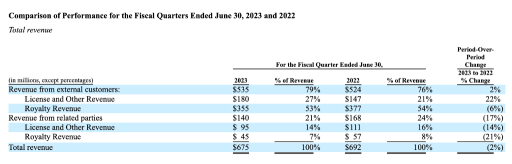

$ソフトバンクグループ (ADR)(SFTBY.US$ $アーム・ホールディングス(ARM.US$ARMの財務諸表は悲惨に見えます!売上高は26.8億ドルで、昨年は1%、前四半期は2.5%と実際に縮小し、利益は前四半期に53%減少しました。彼らはCNBCによると60-70億ドルでIPOをしたいと考えていますが、22-26倍の売上高を意味しています。誰がこれを支払うのでしょうか?そして、マサは何を吸っているのでしょうか?![]() 誰がこれを支払うのでしょうか?そして、マサは何を吸っているのでしょうか?

誰がこれを支払うのでしょうか?そして、マサは何を吸っているのでしょうか?

翻訳済み

9

1

ChatGPTに使用されているような生成的人工知能の台頭により、AIに関連する株式は今年、上昇し続けている。英国のチップデザイナーであるArmの今回のIPOは、この市場の熱狂と親会社のソフトバンク自身の人工知能の野望を試すことになる。

AIの波に乗るArmは、来月ナスダック上場を申請する予定であり、今年最大の新規上場となる可能性がある。ディーロジックによれば、米国のIPOの総額は2023年にこれまでわずか130億ドルに達している。新規上場市場は、不振だった2022年以降、最近になってようやく回復の兆しを見せ始めたばかりである。

AIの波に乗るArmは、来月ナスダック上場を申請する予定であり、今年最大の新規上場となる可能性がある。ディーロジックによれば、米国のIPOの総額は2023年にこれまでわずか130億ドルに達している。新規上場市場は、不振だった2022年以降、最近になってようやく回復の兆しを見せ始めたばかりである。

翻訳済み

6

2

Arm has officially filed for an initial public offering (IPO), setting the price range for each American Depositary Share (ADS) between $47 and $51. The company aims to raise approximately $4.87 billion through this IPO. Following the issuance, SoftBank will maintain a 90.6% ownership stake in Arm. It is worth noting that the current valuation of the company stands at around $54 billion, which falls below the previously anticipated range of $60-70 billion.

2.What does A...

2.What does A...

8

ソフトバンクグループが所有するチップデザイン会社Armは、米国でIPOを申請しました。市場関係者は、この公開資本金が史上最高の技術企業の1つになると予想し、総評価額は70億ドル以上に達すると予想されています。

この動きは、ソフトバンクが16億ドルで会社の残りの25%を取得した後に行われました。これにより、チップ企業の評価額は64億ドルに相当します。ブルームバーグによると、Armは約100億ドルを調達することを目指しており、公開オファリングで公開される公式株式数はまだ明らかにされていません。

この動きは、ソフトバンクが16億ドルで会社の残りの25%を取得した後に行われました。これにより、チップ企業の評価額は64億ドルに相当します。ブルームバーグによると、Armは約100億ドルを調達することを目指しており、公開オファリングで公開される公式株式数はまだ明らかにされていません。

翻訳済み

6

Moomooで私をフォローして、最新情報を入手し、つながりを保ちましょう!

アームホールディングスのIPO

アームホールディングスは最近IPOプロセスを開始し、今年後半に上場する予定です。現在、アームホールディングスはソフトバンクグループ(OTCPK: SFTBY)が所有しており、ソフトバンクグループが株式を売却します。アームホールディングス自体は、株式を一般に売却しません。 つまり、新しい現金は生まれません。代わりに、収益は最終的にソフトバンクに流れます。 それはお金を稼ぐことができるでしょう...

アームホールディングスのIPO

アームホールディングスは最近IPOプロセスを開始し、今年後半に上場する予定です。現在、アームホールディングスはソフトバンクグループ(OTCPK: SFTBY)が所有しており、ソフトバンクグループが株式を売却します。アームホールディングス自体は、株式を一般に売却しません。 つまり、新しい現金は生まれません。代わりに、収益は最終的にソフトバンクに流れます。 それはお金を稼ぐことができるでしょう...

翻訳済み

2

3

Armの初公開株式公開に関心のある投資家たちは、同社が中国に対する曝露について警告した後、「重大なリスク」があると懸念しています。4つの異なるファンドのマネージャーがArmへの投資を検討していると、Financial Timesは報じた。9月のNasdaqに計画された上場のための説明書は、ワシントンとの関係悪化の中でグローバル半導体業界についての彼らの懸念のいくつかを確認していると述べている。

翻訳済み

5

$エヌビディア(NVDA.US$ $ソフトバンク(9434.JP$ $ソフトバンクグループ (ADR)(SFTBY.US$

しかし、ソンとアームのAIの約束は、少なくとも多少、会社の可能性を過大評価している可能性があります。Armベースのチップは、スマートフォンやタブレット以外のガジェットでも採用されており、消費電力が少ないサーバーなどにも使用されています。ただし、ArmはAIチップを製造しておらず、AIが目的のチップを製造しているNvidiaなどの直接の競合他社でもありません。Nvidia...

しかし、ソンとアームのAIの約束は、少なくとも多少、会社の可能性を過大評価している可能性があります。Armベースのチップは、スマートフォンやタブレット以外のガジェットでも採用されており、消費電力が少ないサーバーなどにも使用されています。ただし、ArmはAIチップを製造しておらず、AIが目的のチップを製造しているNvidiaなどの直接の競合他社でもありません。Nvidia...

翻訳済み

5

Electronic Engineering Album、Armは上場計画を繰り返し延期し、8月21日に米国証券取引委員会に正式に提出されました。IPO申請は、上場時期は未定で、今年9月に米国ナスダック市場に上場される予定です。 ロイター通信によると、アームの上場時の総時価は約600億ドルから700億ドルと推定されており、話題になる可能性があります...

翻訳済み

4

コンピューターに使用される半導体やその他のマイクロテクノロジーを設計するアームは、現在、日本のソフトバンクが過半数を所有しています。メディアの報道によると、 ソフトバンクは最近、ベンチャーキャピタルの子会社であるビジョンファンドからアームの25%の株式を、アームを約640億ドルと評価する取引で買収しました。

4月、アームは米国の規制当局に機密の暫定IPO書類を提出したと発表しました、そしてブルームバーグは報告しました...

4月、アームは米国の規制当局に機密の暫定IPO書類を提出したと発表しました、そしてブルームバーグは報告しました...

翻訳済み

4

Upncoming1841 : 取引初日に基本的なことは関係ありません。ワイルドなライドになるでしょう!待ちきれない!

J L 7 2 Upncoming1841: 1日は市場に上場しないので、まだ待つ必要があります

Spinosaurus : ARMのチップはあらゆるものに使われています...株を買わない方が狂っていると言えます

patient Antelope_438 : 誇大広告が消えるのを待つべきです。アームを購入する前に