概念版塊個股詳情

印度概念

添加自選

- 1501.094

- +0.720+0.05%

交易中 05/10 15:00 (美東)

1503.937最高價1497.863最低價

1500.425今開1500.374昨收1779.41萬股成交量9上漲20.63市盈率(靜)5.91億成交額--平盤0.15%換手率3733.57億總市值8下跌3345.08億流通值

成分股: 17只領漲股: G+5.09%

分時

- 5日

- 日K

- 周K

- 月K

- 季K

- 年K

成分股

代碼股票名稱

最新價漲跌額漲跌幅成交量成交額今開昨收最高最低總市值流通市值總股本流通股本5日漲跌幅10日漲跌幅20日漲跌幅60日漲跌幅120日漲跌幅250日漲跌幅年初至今漲跌幅股息率TTM換手率市盈率TTM市盈率(靜)振幅所屬行業

G簡伯特

33.6801.630+5.09%194.02萬6595.59萬33.34032.05034.81033.28060.62億55.63億1.80億1.65億+7.47%+9.00%+7.91%-5.08%+1.73%-7.17%-2.54%1.63%1.18%9.689.884.77%資訊技術服務

SIFYSify Technologies

1.2100.020+1.67%9.54萬11.44萬1.2301.1901.2301.1602.22億3542.76萬1.83億2927.90萬0.00%+1.68%-2.42%-6.20%-22.93%+0.83%-35.12%--0.33%403.33403.335.88%電信服務

WNSWNS控股

49.6900.660+1.35%19.71萬978.96萬49.35049.03050.19048.74022.70億22.27億4568.41萬4481.40萬+10.03%+23.70%-3.21%-15.03%-14.34%-30.14%-21.38%--0.44%17.5617.562.96%資訊技術服務

IFN印度基金

17.6900.070+0.40%15.23萬268.84萬17.65017.62017.75017.5905.49億5.49億3105.63萬3105.63萬-2.16%-3.23%-8.81%-10.51%+6.01%+22.26%-1.21%9.27%0.49%5.485.480.91%資產管理

IIF摩根士丹利印度基金

23.4400.070+0.30%4.12萬97.05萬23.41023.37023.68023.3902.33億2.33億994.69萬994.69萬-1.26%+0.09%+2.09%+2.27%+20.52%+33.62%+9.18%13.38%0.41%4.774.771.24%資產管理

HDBHDFC銀行

55.4400.110+0.20%82.64萬4578.87萬55.20055.33055.65055.0901405.06億1398.49億25.34億25.23億-5.25%-4.97%-2.82%+5.04%-4.07%-17.54%-17.39%0.99%0.03%17.3917.391.01%銀行 - 地區性

MMYTMakeMyTrip

74.7350.135+0.18%38.14萬2837.71萬75.03074.60075.05073.67081.51億39.70億1.09億5312.73萬+3.24%+10.77%+8.91%+30.06%+75.27%+190.23%+59.08%--0.72%162.47虧損1.85%旅遊服務

IBN印度工業信貸投資銀行

26.7950.045+0.17%131.66萬3524.61萬26.77026.75026.82526.700941.13億937.62億35.12億34.99億-1.99%+1.00%+2.51%+8.79%+20.37%+17.56%+12.40%0.72%0.04%18.7923.360.47%銀行 - 地區性

RDY如瑞迪博士

69.5400.080+0.12%35.40萬2462.90萬69.61069.46070.03069.160115.80億83.34億1.67億1.20億-7.54%-6.72%-2.63%-7.94%+4.78%+28.56%-0.06%0.69%0.30%17.3417.341.25%藥品製造商 - 專業和通用

PIN印度ETF-Invesco

26.680-0.070-0.26%3.87萬103.32萬26.82026.75026.82026.6252.29億2.29億860.00萬860.00萬-2.63%-1.62%-0.30%+0.64%+16.32%+28.74%+4.22%0.39%0.45%0.990.000.73%

INDYiShares安碩印度50 ETF

49.550-0.140-0.28%4.63萬229.55萬49.69049.69049.83049.4808.52億8.52億1720.00萬1720.00萬-2.56%-2.06%-1.06%-0.70%+9.30%+16.54%+0.61%0.15%0.27%0.990.000.70%

INFY印孚瑟斯

16.915-0.055-0.32%670.26萬1.13億16.94016.97016.96016.790700.38億605.64億41.41億35.80億-0.09%-0.15%-4.54%-16.18%-2.06%+15.17%-7.97%2.54%0.19%22.2622.261.00%資訊技術服務

SMINiShares安碩MSCI印度小盤股ETF

72.590-0.260-0.36%6.76萬491.91萬73.00072.85073.25072.5608.71億8.71億1200.00萬1200.00萬-3.85%-4.22%-0.23%+0.15%+10.61%+36.75%+4.01%0.06%0.56%0.990.000.95%

INDAiShares安碩MSCI印度ETF

51.365-0.205-0.40%491.40萬2.53億51.65051.57051.65051.24097.75億97.75億1.90億1.90億-2.59%-1.83%-0.59%+1.09%+14.20%+24.55%+5.23%0.16%2.58%0.990.000.80%

YTRAYatra Online

1.450-0.010-0.68%10.41萬14.84萬1.4501.4601.4701.3909333.47萬4289.35萬6436.88萬2958.17萬+0.69%+11.54%-4.61%-11.59%-3.01%-27.50%-11.04%--0.35%虧損虧損5.48%旅遊服務

INDLDirexion Daily MSCI India Bull 2X Shares ETF

60.730-0.580-0.95%1.83萬111.23萬61.47061.31061.47060.6088502.19萬8502.19萬140.00萬140.00萬-5.18%-3.89%-1.64%+0.18%+25.03%+42.55%+7.28%1.58%1.31%0.980.001.41%

WITWipro

5.310-0.070-1.30%62.72萬334.39萬5.3105.3805.3685.310277.27億75.65億52.22億14.25億-1.67%-2.75%-2.75%-13.38%+13.70%+14.68%-4.47%0.23%0.04%21.0721.411.07%資訊技術服務

新聞

爲什麼 Diodes 的股票交易價格下跌了約 10%?以下是週五午盤交易中其他股票的走勢

Diodes Incorporated(納斯達克股票代碼:DIOD)的股價在週五的交易中大幅下跌,此前該公司公佈的季度財務業績低於預期。Diodes公佈的調整後收益爲28美分

Genpact公佈了樂觀的收益,週五加入了Groupon、Natera、Funko、CarGurus和其他走高的大型股票

美國股市大多走高,道瓊斯指數週五上漲超過100點。Genpact Limited(紐約證券交易所代碼:G)的股價在週五的交易日大幅上漲,此前該公司公佈的表現好於預期

巴克萊維持對雷迪博士實驗室的增持,將目標股價上調至81美元

巴克萊分析師巴拉吉·普拉薩德維持雷迪博士實驗室(紐約證券交易所代碼:RDY)增持,並將目標股價從80美元上調至81美元。

雷迪博士實驗室分析師評級

日期上行/下行分析師公司目標股價變動評級變動之前/當前評級 2024 年 8 月 5 日 13.48% 巴克萊 80 美元 → 81 美元維持增持 2024 年 1 月 29 日 12.08% 巴克萊 75 美元 → 80 美元維持增持 O

Wipro 和 Kognitos 宣佈合作部署基於 Genai 的企業就緒業務自動化解決方案

Wipro 和 Kognitos 宣佈合作部署基於 Genai 的企業就緒業務自動化解決方案

Infosys披露了與Yunex Traffic的合作,以幫助加快其在包括美國、英國和德國在內的16個國家的SAP S/4HANA領導的數字化轉型之旅

Infosys披露了與Yunex Traffic的合作,以幫助加快其在包括美國、英國和德國在內的16個國家的SAP S/4HANA領導的數字化轉型之旅

評論

Hi, I am Molly. I would share with you information about wealth management, especially the holdings and opinions of professional investors, as well as the books for beginners.

![]()

![]() Thanks for following me!

Thanks for following me!

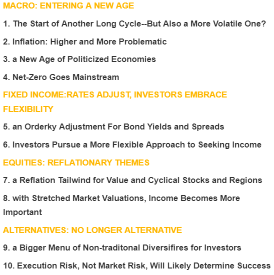

As 2021 drew to a close, I read many articles about 2022 outlook and would pick some interesting opinions to share with you. This Tuesday, we read Morgan Stanley's report. Today, I want to share Nerberger Berman's report.

Nerberger Berman published SOLVING FOR 2022 and summarized 10 themes.

Let's get more information about equities.

They think inflationary expansion is likely to support cyclical over defensive sectors, value over growth stocks, smaller over larger companies and non-U.S. over U.S. markets.

That pattern was interrupted after Treasury yields hit their peak in March 2021, but could reassert itself as yields start to edge up again—particularly if this is accompanied by a weaker U.S. dollar.

This environment would normally bode well for emerging markets, but substantial headwinds mean we tend to favor only specific opportunities, such as leading companies in India's innovation sectors.

As we all know, there are three sources of equity returns: multiple expansion, earnings growth and compounded dividend income.

They also think that multiples appear stretched, and earnings have been growing above trend—which suggests to us that income may be more reliable over the coming year. Over the past 50 years, income has accounted for around 30% of equity total returns. Moreover, in an inflationary environment with low but rising rates, equity income is also a way to get short duration and inflation exposure into portfolios at relatively attractive valuations.

Looking back, Nerberger Berman said If 2020 has taught us anything, it is humility--it remains important to diversify across style factors.

$納斯達克綜合指數(.IXIC.US$ $標普500指數(.SPX.US$ $恒生指數(800000.HK$ $恒生科技指數(800700.HK$ $上證指數(000001.SH$ $印度概念(LIST2455.US$

As 2021 drew to a close, I read many articles about 2022 outlook and would pick some interesting opinions to share with you. This Tuesday, we read Morgan Stanley's report. Today, I want to share Nerberger Berman's report.

Nerberger Berman published SOLVING FOR 2022 and summarized 10 themes.

Let's get more information about equities.

They think inflationary expansion is likely to support cyclical over defensive sectors, value over growth stocks, smaller over larger companies and non-U.S. over U.S. markets.

That pattern was interrupted after Treasury yields hit their peak in March 2021, but could reassert itself as yields start to edge up again—particularly if this is accompanied by a weaker U.S. dollar.

This environment would normally bode well for emerging markets, but substantial headwinds mean we tend to favor only specific opportunities, such as leading companies in India's innovation sectors.

As we all know, there are three sources of equity returns: multiple expansion, earnings growth and compounded dividend income.

They also think that multiples appear stretched, and earnings have been growing above trend—which suggests to us that income may be more reliable over the coming year. Over the past 50 years, income has accounted for around 30% of equity total returns. Moreover, in an inflationary environment with low but rising rates, equity income is also a way to get short duration and inflation exposure into portfolios at relatively attractive valuations.

Looking back, Nerberger Berman said If 2020 has taught us anything, it is humility--it remains important to diversify across style factors.

$納斯達克綜合指數(.IXIC.US$ $標普500指數(.SPX.US$ $恒生指數(800000.HK$ $恒生科技指數(800700.HK$ $上證指數(000001.SH$ $印度概念(LIST2455.US$

29

閱讀更多