Author of this article: Zhang Yifan

Editor: Shen Siqi

Source: Hard AI

In the competition between tech giants, the competition for chip performance has always been the focus. Just when people thought Apple was far ahead in the field of mobile chips, Qualcomm brought exciting news.

That is, Qualcomm, which has repeatedly lagged behind Apple in terms of performance over the past five or six years. This time, it may catch up with or even surpass Apple in the next generation Snapdragon 8 gen4.

why? This is the story of Apple catching up with Apple.

As we all know, although Qualcomm and Apple both use ARM architectures, there are obvious differences in chip development routes.

There are two licensing methods for ARM chips: one is to directly use the CPU architecture designed by ARM, commonly known as the public version; the other is to obtain an ARM architecture license and develop independently.

Apple chose self-developed chips based on the ARM architecture, emphasizing performance first. Starting with the A5, Apple developed its own chips. Thanks to self-research, Apple began an era of domination of high-end mobile phone chips.

Qualcomm, on the other hand, has directly purchased ARM's public design for a long time, making it difficult to expect the performance of its products to match Apple's.

As a result, although the two companies account for the majority of the high-end mobile phone SoC market, Qualcomm always lags behind Apple in terms of performance, which directly causes Android to be suppressed in terms of performance for a long time.

Just when the industry was pessimistic about whether Qualcomm could close the gap with Apple, the addition of the NUVIA team injected a dose of strength into Qualcomm.

And the founder of NUVIA is Gerard Williams, Apple's multi-core chip engineer.

1. From Apple's CPU core architecture design company NUVIA

At the beginning of 2021, Qualcomm spent 1.4 billion dollars to acquire the CPU core architecture design company NUVIA.

The acquisition aims to achieve Qualcomm's goal of developing its own chips based on the ARM architecture.

Looking back at the beginning, it was precisely because Apple developed its own A6 chip based on ARM, that it began an era of dominance in the field of high-end chips. Subsequently, Apple gradually expanded the scope of application of its own chips, from iPhones to Macs to servers. The M1 chip, which everyone is familiar with, is a major breakthrough for Apple in the field from mobile phones to computers.

These breakthroughs in the chip field have made some Apple engineers look forward to it even more.

In 2019, Apple's core chip engineer Gerard Williams left the company and founded NUVIA. In order to differentiate itself from Apple products, it was said at the time that they were committed to developing ARM-based server CPUs.

Gerard Williams has a very impressive history. Since 2010, he has been involved in chip development work at Apple, participating in the entire process from A4 to M1, and is one of the core architects behind Apple's CPU and SoC development.

The other two founders of NUVIA also have extensive experience in Apple chip development. Manu Gulati joined Apple in 2009 as an SoC architect and participated in projects from A5X to A12X until his departure in 2017. John Bruno worked as a systems architect from 2012 to 2017. Furthermore, according to public data, most NUVIA employees have Apple and ARM work backgrounds.

Shortly after its establishment, NUVIA launched its self-developed Phoenix architecture in 2020. The architecture is twice as fast as AMD, Intel, Apple, and Qualcomm CPU chips without increasing power consumption.

At this point, the turning point of the story occurred.

It turns out that Gerard Williams, the founder of NUVIA, initially had a bold idea: he wanted to sell this revolutionary chip architecture back to his old owner, Apple, to pay for his “defection.” This plan may seem smart, but in Apple's view, it's tantamount to a “job-hopping” employee taking the skills they learned from the company and then selling the product back at a high price. Although NUVIA's technology was really tempting, Apple executives flatly rejected this seemingly cost-effective deal.

On the one hand, it is difficult for Apple to accept the sky-high price offered by NUVIA; on the other hand, Apple cannot accept the practice of employees using technology developed by the company to start businesses abroad and then using the company as a cash machine. Once such a precedent is set, it will undoubtedly bring unforeseen hidden dangers to enterprise management.

Gerard Williams' carefully planned 'sell-out' plan has gone awry, but the technology in his hands is bound to set off a storm in the chip world...” Qualcomm seized this once-in-a-lifetime opportunity.

They are keenly aware that NUVIA, a rising star, may be the golden key to breaking the impasse in chip development. As a result, in 2021, Qualcomm took a decisive step and took NUVIA under its command.

The subsequent release of Snapdragon X Elite shocked the industry even more.

The launch of Snapdragon X Elite is not only an important milestone for Qualcomm in the PC market, but also a concentrated demonstration of its technical strength. The perfect combination of NPU, CPU, and GPU makes its overall AI computing power as high as 75 TOPS, which is outstanding in the industry. And all of this is due to the addition of the NUVIA team.

What is interesting is that Qualcomm's move is tantamount to inviting Apple's “insiders” to compete head-on with Apple.

The NUVIA team knows all about Apple chips. Coupled with their technical accumulation, Qualcomm is not only expected to catch up with Apple's M-series chips in terms of performance and efficiency, but may even leave them behind. When we saw the Snapdragon X Elite's sky high frequency of 4.26GHz, everything seemed no longer surprising.

2. Redesigned Snapdragon 8 gen4 with NuVIA's Phoenix architecture may be released

Qualcomm's chip industry's “bombshell” is about to explode! According to person familiar with the matter @jasonwill101透露, Qualcomm is making final preparations for the return of the king.

Their secret weapon is the Snapdragon 8 Gen4 processor, which is being redesigned using Nuvia's Phoenix architecture.

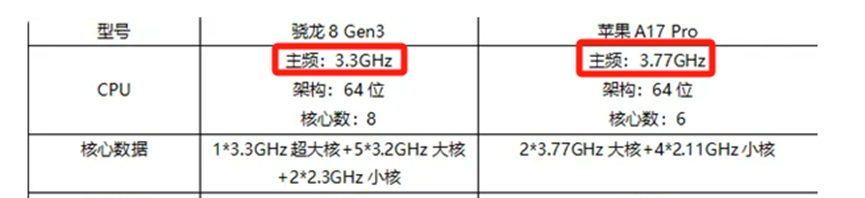

Most impressive, however, is its astonishing 4.26GHz target frequency. You need to know that the previous generation Snapdragon 8Gen 3 had a frequency of only 3.3 GHz, far lower than the 3.77 GHz of the Apple A17 Pro. And this time, 4.26 GHz is not only up nearly 30% from the previous generation Snapdragon 8 Gen 3, but it also pushes Apple's latest A17 Pro 13% away. The single-core performance of Qualcomm chips, which has always been criticized, seems to have finally ushered in a qualitative leap forward.

What is puzzling, however, is that such a breakthrough actually only took more than half a year. Could it be that the legendary NUVIA team has left their mark on Gen4? Can the next Qualcomm chip really be smoother than Apple's?

The industry's eyes are all on Qualcomm. A “fairy fight” in the chip industry seems to have begun.

3. Qualcomm faces a new scuffle in the ARM era

Although Qualcomm holds the trump card NUVIA, it still has to overcome many hurdles to reach the pinnacle of high-end chips. Lawsuits, ecology, and competition, like three mountains, stand in the way of Qualcomm's path forward.

1) Lawsuit

Since NUVIA used ARM's instruction set, Qualcomm had a patent dispute with ARM after acquiring NUVIA. ARM believes that NUVIA's license was terminated in March 2022, but Qualcomm continues to use designs based on these agreements. Meanwhile, Qualcomm's side also counterclaimed that there was no legal basis for ARM's previous accusation that Qualcomm violated the license agreement and trademark.

Despite Qualcomm's strong legal capabilities and status as a major ARM customer, the lawsuit may eventually be settled. However, it is clear that before the Snapdragon X Elite and Snapdragon 8 gen4 are officially launched, lawsuits need to be handled properly.

2) Ecology

Unlike Apple, which has mastered the hardware and iOS ecosystem, Qualcomm only has hardware and lacks a supporting software ecosystem. Although Microsoft's Windows on Arm program has signed an exclusive contract with Qualcomm, it has been difficult to improve due to insufficient ecological support. The Wintel ecosystem is disintegrating, but in Windows systems, Arm CPUs are still niche players. NUVIA's architecture is certainly excellent, but without Microsoft's ecological support, it is still unknown whether its potential can be fully unleashed. Microsoft introduced the Windows on Arm (WoA) concept as early as 2011 and signed an exclusive contract with Qualcomm for the SnapdragonX series, but it has been difficult to improve due to lack of support from the supporting ecosystem, and this exclusive agreement will expire in 2024.

The advent of ARM has accelerated the collapse of the Wintel ecosystem. But in Microsoft's Windows ecosystem, ARM's CPU is still a niche player.

NUVIA's architecture is certainly excellent, but without Microsoft's ecological support, it is still unknown whether its potential can be fully unleashed.

3) Competition

Currently, Intel is still in the top position in the PC market, accounting for 72% of the laptop CPU market. In order to meet the demand for AI, Meteor Lake series chips were launched.

AMD's Ryzen chips were on the lookout, and MediaTek later collaborated with Nvidia to develop ARM architecture processors for Windows PCs.

The transformation from X86 to ARM architecture has allowed many major players in the industry to join the battle for the AI PC market. Relying on TSMC's advanced manufacturing process, everyone's previous gap was quickly narrowed, and the pressure on Qualcomm is also imaginable.

But for users, probably the best way is to prepare the wallet for the AI PC era.