-

市場

-

產品

-

資訊

-

Moo社區

-

課堂

-

查看更多

-

功能介紹

-

費用費用透明,無最低余額限制

投資選擇、功能介紹、費用相關信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 淺色

Options Corner: A Look at What the Big Money Thinks of Pfizer's Options

Options Corner: A Look at What the Big Money Thinks of Pfizer's Options

Financial giants have made a conspicuous bullish move on Pfizer. Our analysis of options history for $Pfizer (PFE.US)$ revealed 15 unusual trades.

Delving into the details, we found 66% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $160,280, and 13 were calls, valued at $525,336.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.0 to $50.0 for Pfizer over the last 3 months.

Volume & Open Interest Trends

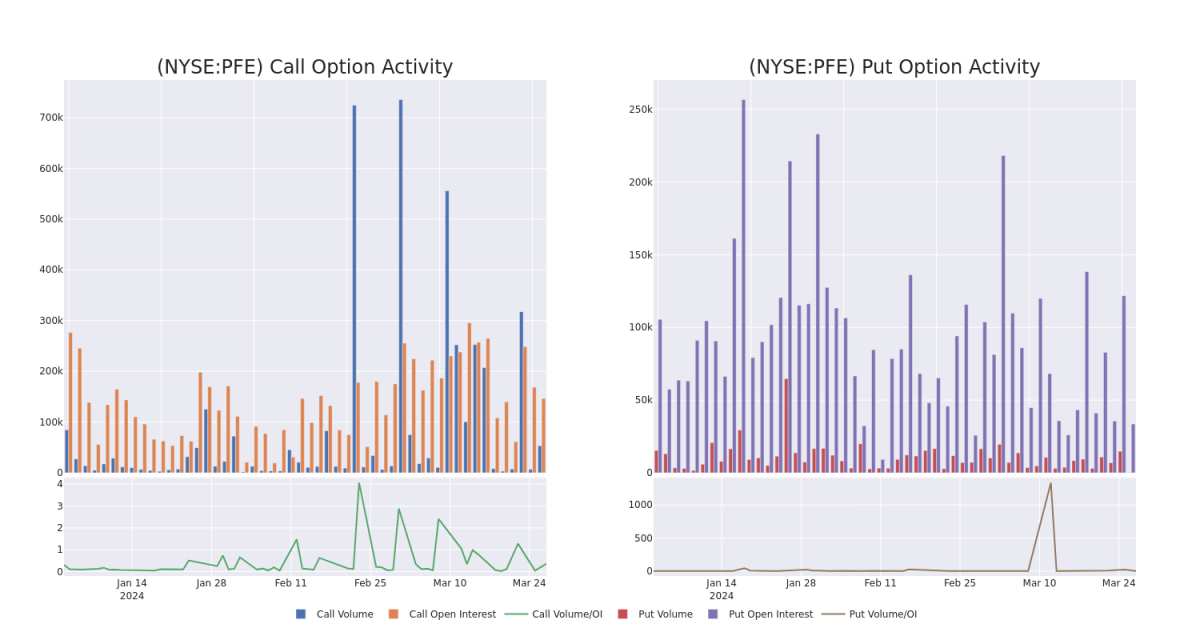

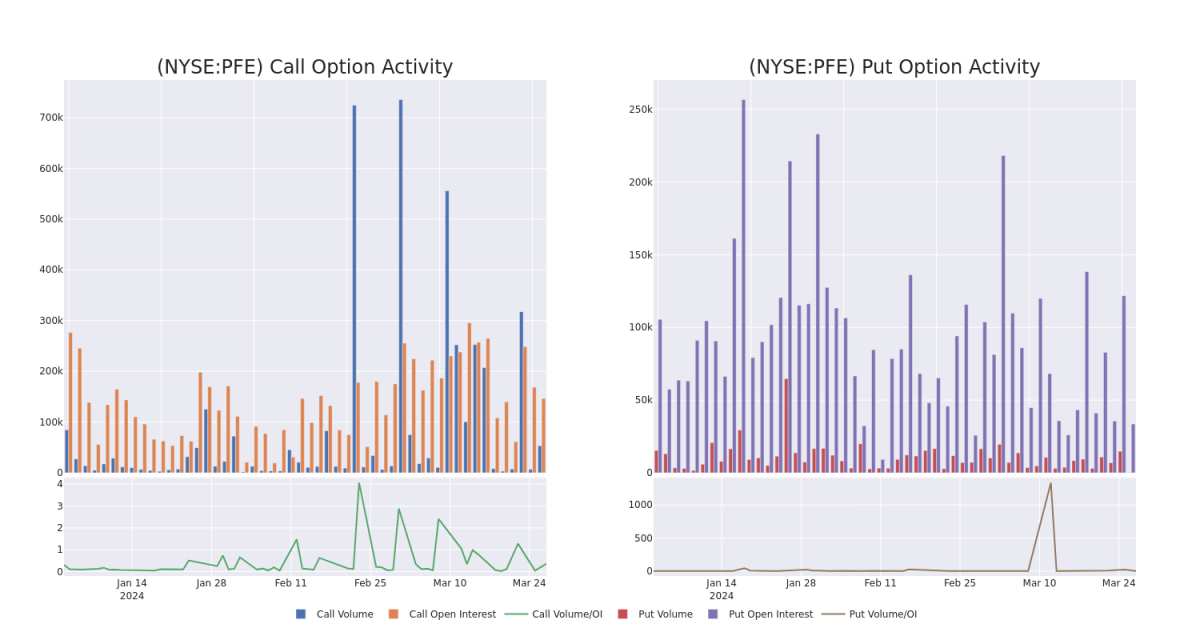

In today's trading context, the average open interest for options of Pfizer stands at 20000.89, with a total volume reaching 53,584.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Pfizer, situated within the strike price corridor from $20.0 to $50.0, throughout the last 30 days.

Pfizer Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

PFE | PUT | SWEEP | BULLISH | 01/17/25 | $35.00 | $98.2K | 33.5K | 151 |

PFE | CALL | SWEEP | BULLISH | 04/05/24 | $27.00 | $65.8K | 21.3K | 10.0K |

PFE | PUT | SWEEP | BULLISH | 01/17/25 | $35.00 | $62.0K | 33.5K | 68 |

PFE | CALL | SWEEP | BEARISH | 03/28/24 | $27.00 | $50.6K | 67.9K | 10.7K |

PFE | CALL | TRADE | BULLISH | 10/18/24 | $30.00 | $50.0K | 586 | 410 |

About Pfizer

Pfizer is one of the world's largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

In light of the recent options history for Pfizer, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Pfizer

Currently trading with a volume of 15,877,576, the PFE's price is up by 0.4%, now at $27.7.

RSI readings suggest the stock is currently may be approaching overbought.

Anticipated earnings release is in 35 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

Financial giants have made a conspicuous bullish move on Pfizer. Our analysis of options history for $Pfizer (PFE.US)$ revealed 15 unusual trades.

金融巨頭對輝瑞採取了明顯的看漲舉動。我們對期權歷史的分析 $輝瑞 (PFE.US)$ 透露了15筆不尋常的交易。

Delving into the details, we found 66% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $160,280, and 13 were calls, valued at $525,336.

深入研究細節,我們發現66%的交易者看漲,而33%的交易者表現出看跌趨勢。在我們發現的所有交易中,有兩筆是看跌期權,價值爲160,280美元,13筆是看漲期權,價值525,336美元。

Predicted Price Range

預測的價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.0 to $50.0 for Pfizer over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將輝瑞的價格定在20.0美元至50.0美元之間。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

In today's trading context, the average open interest for options of Pfizer stands at 20000.89, with a total volume reaching 53,584.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Pfizer, situated within the strike price corridor from $20.0 to $50.0, throughout the last 30 days.

在今天的交易背景下,輝瑞期權的平均未平倉合約爲20000.89,總交易量達到53,584.00。隨附的圖表描繪了過去30天輝瑞高價值交易的看漲期權和看跌期權交易量以及未平倉合約的變化,行使價走勢從20.0美元到50.0美元不等。

Pfizer Option Activity Analysis: Last 30 Days

輝瑞期權活動分析:過去 30 天

Largest Options Trades Observed:

觀察到的最大期權交易:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|

PFE |

PUT |

SWEEP |

BULLISH |

01/17/25 |

$35.00 |

$98.2K |

33.5K |

151 |

PFE |

CALL |

SWEEP |

BULLISH |

04/05/24 |

$27.00 |

$65.8K |

21.3K |

10.0K |

PFE |

PUT |

SWEEP |

BULLISH |

01/17/25 |

$35.00 |

$62.0K |

33.5K |

68 |

PFE |

CALL |

SWEEP |

BEARISH |

03/28/24 |

$27.00 |

$50.6K |

67.9K |

10.7K |

PFE |

CALL |

TRADE |

BULLISH |

10/18/24 |

$30.00 |

$50.0K |

586 |

410 |

符號 |

看跌/看漲 |

交易類型 |

情緒 |

Exp。日期 |

行使價 |

總交易價格 |

未平倉合約 |

音量 |

|---|---|---|---|---|---|---|---|---|

PFE |

放 |

掃 |

看漲 |

01/17/25 |

35.00 美元 |

98.2 萬美元 |

33.5K |

151 |

PFE |

打電話 |

掃 |

看漲 |

04/05/24 |

27.00 美元 |

65.8 萬美元 |

21.3K |

10.0K |

PFE |

放 |

掃 |

看漲 |

01/17/25 |

35.00 美元 |

62.0 萬美元 |

33.5K |

68 |

PFE |

打電話 |

掃 |

粗魯的 |

03/28/24 |

27.00 美元 |

50.6 萬美元 |

67.9K |

10.7K |

PFE |

打電話 |

貿易 |

看漲 |

10/18/24 |

30.00 美元 |

50.0 萬美元 |

586 |

410 |

About Pfizer

關於輝瑞

Pfizer is one of the world's largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

輝瑞是全球最大的製藥公司之一,年銷售額接近 500 億美元(不包括 COVID-19 產品的銷售額)。儘管它歷來銷售許多類型的醫療保健產品和化學品,但現在處方藥和疫苗佔銷售額的大部分。最暢銷的產品包括肺炎球菌疫苗Prevnar 13、抗癌藥物Ibrance和心血管治療藥物Eliquis。輝瑞在全球銷售這些產品,國際銷售額佔總銷售額的近50%。在國際銷售中,新興市場是主要貢獻者。

In light of the recent options history for Pfizer, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於輝瑞最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Present Market Standing of Pfizer

輝瑞目前的市場地位

Currently trading with a volume of 15,877,576, the PFE's price is up by 0.4%, now at $27.7.

RSI readings suggest the stock is currently may be approaching overbought.

Anticipated earnings release is in 35 days.

PFE目前的交易量爲15,877,576美元,價格上漲了0.4%,目前爲27.7美元。

RSI讀數表明,該股目前可能接近超買。

預計收益將在35天后發佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧