StevenTHC

讚了

$DiDi Global Inc(DIDIY.US$ 該公司週一表示,獲得了中國網絡安全監管機構的批准,恢復其接送服務的新用戶註冊,這是最新跡象表明北京正在放鬆其互聯網巨頭的控制權。

Didi 在其微博社交媒體帳戶上表示,星期一恢復新用戶註冊。這表明 Didi 的應用程序將很快返回移動應用程序商店![]()

![]()

流: Didi 獲批准重新啟動接送服務的新用戶註冊

Didi 在其微博社交媒體帳戶上表示,星期一恢復新用戶註冊。這表明 Didi 的應用程序將很快返回移動應用程序商店

流: Didi 獲批准重新啟動接送服務的新用戶註冊

已翻譯

10

8

StevenTHC

表達了心情

6

3

StevenTHC

評論了

StevenTHC

讚了

$Grab Holdings(GRAB.US$ 明天的最大痛苦還是 12 美元!我正在加入非常便宜的 1dte 電話。這個短暫的推動可能會涵蓋了一些知道 MM 將在 AH 或明天上升,以減少他們賣出的交易損失。戴上扣。

已翻譯

5

StevenTHC

讚了

StevenTHC

讚了

$Antero Midstream(AM.US$星期五將恢復 1.00 點。每股收益超過估計,石油和天然氣仍在上漲。

已翻譯

1

StevenTHC

評論了

每週市場回顧

標準普爾 500 指數創下自 2 月以來最好的一周,創下新紀錄的收盤,由於擔心 Omicron 冠狀病毒變體引發的大盤賣,股票期貨週日在隔夜交易中保持穩定。

$道瓊斯指數(.DJI.US$ 期貨交易上漲 35 點。 $標普500指數(.SPX.US$ 期貨上漲 0.1% 及 $納斯達克100指數(.NDX.US$ 期貨平衡。

這一夜行動是隨著華爾街一周強勁,投資者忽略了熱的通脹讀數。上週藍籌道士指數上漲 4%,突破四週連續跌幅,創下 3 月以來最佳的每週表現。標準普爾 500 指數和納斯達克綜合指數上週分別上漲 3.8% 和 3.6%,均表現自 2 月初以來最佳的每週表現。

投資者深入了整體通脹數據上升,11 月同比較為 6.8%,是自 1982 年以來最大的漲幅。印度略高於 6.7% 道瓊斯估計。

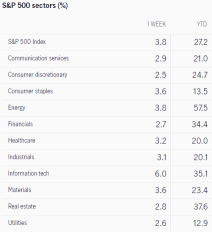

以下看看標普 500 行業的回報

本週未來焦點

本週投資者將專注於 美聯儲 2021 年最終貨幣政策決定,這可能包括在通脹上升和經濟背景加強的情況下,更多信號顯示貨幣政策調整。

聯邦開放市場委員會成員將於星期二和星期三舉行兩天的政策制定會議,之後他們將發布他們的貨幣政策聲明,並與美聯儲主席傑羅姆鮑威爾舉行新聞發布會。十二月份聲明還將附有經濟預測摘要(自 9 月以來第一份),概述了會員對未來幾年的經濟狀況和利率的期望。

許多經濟學家現在預計本月的會議將成為美聯儲官員提高其資產購買計劃的縮減率的平台。在疫情期間超過一年半,美聯儲以每月 120 億美元的價格購買國庫和機構按揭證券(MBS),該計劃是支持病毒感染的經濟的關鍵工具。上個月,美聯儲開始終止這個計劃,在 11 月和 12 月的每個月減緩其購買 15 億美元,因為經濟顯示跡象表明在沒有額外的貨幣政策支持的情況下可以繼續從大流行中恢復。

零售銷售

本週發布的一個關鍵經濟數據將是 11 月零售銷售,可以了解消費者在節日購物季節期間的實力。

根據彭博社的數據顯示,共識經濟學家預計 11 月份零售銷售額將與 10 月相比增長 0.8%。與 10 月份的 1.7% 的每月增長相比,這將放緩,但仍是連續第四次的每月增長。

美國央行經濟學家 Michelle Meyer 週五在一份筆記中估計:「這種增長應該受到節日銷售支持,服裝在主要行業中顯示最大的連續增長。」話雖如此,鑑於 10 月份銷售的大幅上漲驚喜,我們確實認為風險偏向下行。」

10 月份零售銷售額的增長大於預期的原因是多種類別的強勁。非店舖零售商或電子商務平台的銷售額增長 4%,而加油站銷售額和電子產品和電器商店則分別錄得 3.9% 和 3.8%。一些經濟學家認為,每月上漲可能是由於消費者今年早些時候進行假期購物,以嘗試擺脫供應鏈中斷和運輸延誤的情況。

11 月份其他私人消費數據表現強勁,進一步表明零售銷售額再次穩定上升。Adobe Analytics 在 11 月 30 日發布的一次更新中表示,消費者在 11 月 1 日至 11 月 29 日期間已經在線上花費了 109.8 億美元,與去年相比,這個數字增長 11.9%。

經濟日曆

-星期一:沒有預定發布的重要報告

-星期二:NFIB 小型企業樂觀 11 月(預計 98.4,10 月 98.2);生產者價格指數 11 月(預計 0.5%,10 月 0.6%);11 月份生產物價格指數(預計 0.4%,0.4%);11 月份生產物價格指數(預計 9.2%,10 月份 8.6%);食品和能源指數不包括在同期,11 月份(預期為 6.8%,10 月份為 6.8%)

-星期三:截至 12 月 10 日的工商管理碩士按揭申請(上週 2.0%);11 月零售銷售額(預計 0.8%,10 月 1.4%);11 月進口價格指數(預計 0.8%,10 月 1.2%);10 月業務庫存(預計 1.0%,9 月 0.7%);NAHB 房屋市場指數,12 月(預計 84 年 11 月份,83 年); 聯邦公開市場委員會利率決定

-星期四:截至 12 月 11 日的初始失業索償(預計 199,000,上週為 184,000);截至 12 月 4 日的持續索償(上週 1,992 百萬);11 月按月開放房屋(預計 3.3%,10 月 -0.7%);11 月份建築許可證(預計 0.4%,費城 4.2%);美聯儲商業展望指數 12 月 39.0(預計 30.0,預計 30.0,11 月份 0);11 月工業生產(預計 0.7%,10 月份為 1.6%);11 月產能利用率(預計 76.8%,10 月份為 76.4%);製造業生產,11 月(預計 0.7%,10 月份為 1.2%);馬基特美國製造業採購經理人指數(預期為 58.5,11 月 58.3);Markit 美國綜合採購經理人指數 12 月初步(11 月為 57.2);馬基特美國服務採購經理人指數 12 月初步(11 月為 58.0);堪薩斯城聯邦儲備制造業活動 12 月(11 月 24 日)

-星期五:沒有預定發布的重要報告

收益日曆

-星期一:沒有預定發布的重要報告

-星期二:沒有預定發布的重要報告

-星期三: $萊納建築(LEN.US$ 市場關閉後

-星期四: $Adobe(ADBE.US$, $聯邦快遞(FDX.US$, $Rivian Automotive(RIVN.US$ 市場關閉後

-星期五: $達登飯店(DRI.US$ 市場開市前

資料來源:CNBC、JH 投資、雅虎金融

標準普爾 500 指數創下自 2 月以來最好的一周,創下新紀錄的收盤,由於擔心 Omicron 冠狀病毒變體引發的大盤賣,股票期貨週日在隔夜交易中保持穩定。

$道瓊斯指數(.DJI.US$ 期貨交易上漲 35 點。 $標普500指數(.SPX.US$ 期貨上漲 0.1% 及 $納斯達克100指數(.NDX.US$ 期貨平衡。

這一夜行動是隨著華爾街一周強勁,投資者忽略了熱的通脹讀數。上週藍籌道士指數上漲 4%,突破四週連續跌幅,創下 3 月以來最佳的每週表現。標準普爾 500 指數和納斯達克綜合指數上週分別上漲 3.8% 和 3.6%,均表現自 2 月初以來最佳的每週表現。

投資者深入了整體通脹數據上升,11 月同比較為 6.8%,是自 1982 年以來最大的漲幅。印度略高於 6.7% 道瓊斯估計。

以下看看標普 500 行業的回報

本週未來焦點

本週投資者將專注於 美聯儲 2021 年最終貨幣政策決定,這可能包括在通脹上升和經濟背景加強的情況下,更多信號顯示貨幣政策調整。

聯邦開放市場委員會成員將於星期二和星期三舉行兩天的政策制定會議,之後他們將發布他們的貨幣政策聲明,並與美聯儲主席傑羅姆鮑威爾舉行新聞發布會。十二月份聲明還將附有經濟預測摘要(自 9 月以來第一份),概述了會員對未來幾年的經濟狀況和利率的期望。

許多經濟學家現在預計本月的會議將成為美聯儲官員提高其資產購買計劃的縮減率的平台。在疫情期間超過一年半,美聯儲以每月 120 億美元的價格購買國庫和機構按揭證券(MBS),該計劃是支持病毒感染的經濟的關鍵工具。上個月,美聯儲開始終止這個計劃,在 11 月和 12 月的每個月減緩其購買 15 億美元,因為經濟顯示跡象表明在沒有額外的貨幣政策支持的情況下可以繼續從大流行中恢復。

零售銷售

本週發布的一個關鍵經濟數據將是 11 月零售銷售,可以了解消費者在節日購物季節期間的實力。

根據彭博社的數據顯示,共識經濟學家預計 11 月份零售銷售額將與 10 月相比增長 0.8%。與 10 月份的 1.7% 的每月增長相比,這將放緩,但仍是連續第四次的每月增長。

美國央行經濟學家 Michelle Meyer 週五在一份筆記中估計:「這種增長應該受到節日銷售支持,服裝在主要行業中顯示最大的連續增長。」話雖如此,鑑於 10 月份銷售的大幅上漲驚喜,我們確實認為風險偏向下行。」

10 月份零售銷售額的增長大於預期的原因是多種類別的強勁。非店舖零售商或電子商務平台的銷售額增長 4%,而加油站銷售額和電子產品和電器商店則分別錄得 3.9% 和 3.8%。一些經濟學家認為,每月上漲可能是由於消費者今年早些時候進行假期購物,以嘗試擺脫供應鏈中斷和運輸延誤的情況。

11 月份其他私人消費數據表現強勁,進一步表明零售銷售額再次穩定上升。Adobe Analytics 在 11 月 30 日發布的一次更新中表示,消費者在 11 月 1 日至 11 月 29 日期間已經在線上花費了 109.8 億美元,與去年相比,這個數字增長 11.9%。

經濟日曆

-星期一:沒有預定發布的重要報告

-星期二:NFIB 小型企業樂觀 11 月(預計 98.4,10 月 98.2);生產者價格指數 11 月(預計 0.5%,10 月 0.6%);11 月份生產物價格指數(預計 0.4%,0.4%);11 月份生產物價格指數(預計 9.2%,10 月份 8.6%);食品和能源指數不包括在同期,11 月份(預期為 6.8%,10 月份為 6.8%)

-星期三:截至 12 月 10 日的工商管理碩士按揭申請(上週 2.0%);11 月零售銷售額(預計 0.8%,10 月 1.4%);11 月進口價格指數(預計 0.8%,10 月 1.2%);10 月業務庫存(預計 1.0%,9 月 0.7%);NAHB 房屋市場指數,12 月(預計 84 年 11 月份,83 年); 聯邦公開市場委員會利率決定

-星期四:截至 12 月 11 日的初始失業索償(預計 199,000,上週為 184,000);截至 12 月 4 日的持續索償(上週 1,992 百萬);11 月按月開放房屋(預計 3.3%,10 月 -0.7%);11 月份建築許可證(預計 0.4%,費城 4.2%);美聯儲商業展望指數 12 月 39.0(預計 30.0,預計 30.0,11 月份 0);11 月工業生產(預計 0.7%,10 月份為 1.6%);11 月產能利用率(預計 76.8%,10 月份為 76.4%);製造業生產,11 月(預計 0.7%,10 月份為 1.2%);馬基特美國製造業採購經理人指數(預期為 58.5,11 月 58.3);Markit 美國綜合採購經理人指數 12 月初步(11 月為 57.2);馬基特美國服務採購經理人指數 12 月初步(11 月為 58.0);堪薩斯城聯邦儲備制造業活動 12 月(11 月 24 日)

-星期五:沒有預定發布的重要報告

收益日曆

-星期一:沒有預定發布的重要報告

-星期二:沒有預定發布的重要報告

-星期三: $萊納建築(LEN.US$ 市場關閉後

-星期四: $Adobe(ADBE.US$, $聯邦快遞(FDX.US$, $Rivian Automotive(RIVN.US$ 市場關閉後

-星期五: $達登飯店(DRI.US$ 市場開市前

資料來源:CNBC、JH 投資、雅虎金融

已翻譯

+2

124

15

StevenTHC

讚了

目前,對中國當前和潛在的監管行動的一系列存在很多恐懼,不確定性和懷疑。毫無疑問,這是一個購買機會,因為許多中國股票在歷史上都處於巨大的折扣之前,但在情況清潔(可能需要幾年的時間)之前,我認為價值投資者對中國股票開張頭寸有風險。恆大傳奇的影響是現在的另一個威脅。無論如何,短期交易者和期權交易者都應該能夠找到獲利的機會。

$滴滴(已退市)(DIDI.US$ $中國平安(ADR)(PNGAY.US$ $好未來(TAL.US$ $新東方(EDU.US$ $嗶哩嗶哩(BILI.US$ $百度(BIDU.US$ $微博(WB.US$ $CHINA EVERGRANDE GROUP(EGRNF.US$ $拼多多(PDD.US$ $京東(JD.US$ $阿里巴巴(BABA.US$ $蔚來(NIO.US$ $小鵬汽車(XPEV.US$ $美团(ADR)(MPNGF.US$ $BYD Co.(BYDDF.US$

免責聲明: 以上是我個人的意見。這不是財務建議或投資建議。在作出任何投資決定之前,請諮詢財務顧問。

退房 長期投資-在不失睡眠的情況下提高回報的策略 https://www.moomoo.com/community/feed/107495017873414?lang_code=2

$滴滴(已退市)(DIDI.US$ $中國平安(ADR)(PNGAY.US$ $好未來(TAL.US$ $新東方(EDU.US$ $嗶哩嗶哩(BILI.US$ $百度(BIDU.US$ $微博(WB.US$ $CHINA EVERGRANDE GROUP(EGRNF.US$ $拼多多(PDD.US$ $京東(JD.US$ $阿里巴巴(BABA.US$ $蔚來(NIO.US$ $小鵬汽車(XPEV.US$ $美团(ADR)(MPNGF.US$ $BYD Co.(BYDDF.US$

免責聲明: 以上是我個人的意見。這不是財務建議或投資建議。在作出任何投資決定之前,請諮詢財務顧問。

退房 長期投資-在不失睡眠的情況下提高回報的策略 https://www.moomoo.com/community/feed/107495017873414?lang_code=2

已翻譯

127

4

StevenTHC

讚了

坦白說,這不是一個容易回答的問題。我對中國股市仍然樂觀(謹慎樂觀)。我確實有一些中國股票處於水下,我仍在持有,例如 $阿里巴巴(BABA.US$ $嗶哩嗶哩(BILI.US$ $富途控股(FUTU.US$會等待一段時間,因為監管不斷變化的風險是真實的 😔。建議刪除上市 $滴滴(已退市)(DIDI.US$已經在市場引發了震驚,投資者感到焦慮。Ride Hailing 公司於 12 月 2 日發出的聲明中保證,它將確保美股可在另一個認可證的證券交易所轉換為可自由交易股票。這有助於平靜市場,但對中國股市的擔憂仍然存在。

我認為某些中國股票目前的估值很好,可以考慮長期遊戲 😊。

我認為某些中國股票目前的估值很好,可以考慮長期遊戲 😊。

已翻譯

43

3

StevenTHC

讚了

$滴滴(已退市)(DIDI.US$ 由於該中國接送公司宣布退出紐約證券交易所以,該股價下跌後,數個對沖基金可能因投注 Didi Global Inc。

迪迪的股票比 6 月 30 日 IPO 價格下跌 56.8%。該公司週五宣布計劃從紐約證券交易所取消上市並追求在香港上市後,隨著中國監管機構對美國首次亮相憤怒的中國監管機構而憤怒。

根據業界追踪器 Symmetric 編製的美國 13F 文件,對沖基金在 9 月底投資了 Didi 的 94.4 萬股,比上季度下跌 13.2 萬股。

目前尚不清楚對沖基金自那時起是否進一步減少投資,但路透的計算顯示,9 月底至 12 月 7 日期間的迪迪股價下跌 7.9% 將從這些頭寸中消除了合計 60.9 萬美元的價值。

部分內容來自雅虎。

迪迪的股票比 6 月 30 日 IPO 價格下跌 56.8%。該公司週五宣布計劃從紐約證券交易所取消上市並追求在香港上市後,隨著中國監管機構對美國首次亮相憤怒的中國監管機構而憤怒。

根據業界追踪器 Symmetric 編製的美國 13F 文件,對沖基金在 9 月底投資了 Didi 的 94.4 萬股,比上季度下跌 13.2 萬股。

目前尚不清楚對沖基金自那時起是否進一步減少投資,但路透的計算顯示,9 月底至 12 月 7 日期間的迪迪股價下跌 7.9% 將從這些頭寸中消除了合計 60.9 萬美元的價值。

部分內容來自雅虎。

已翻譯

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)