Fieryfury

參與了投票

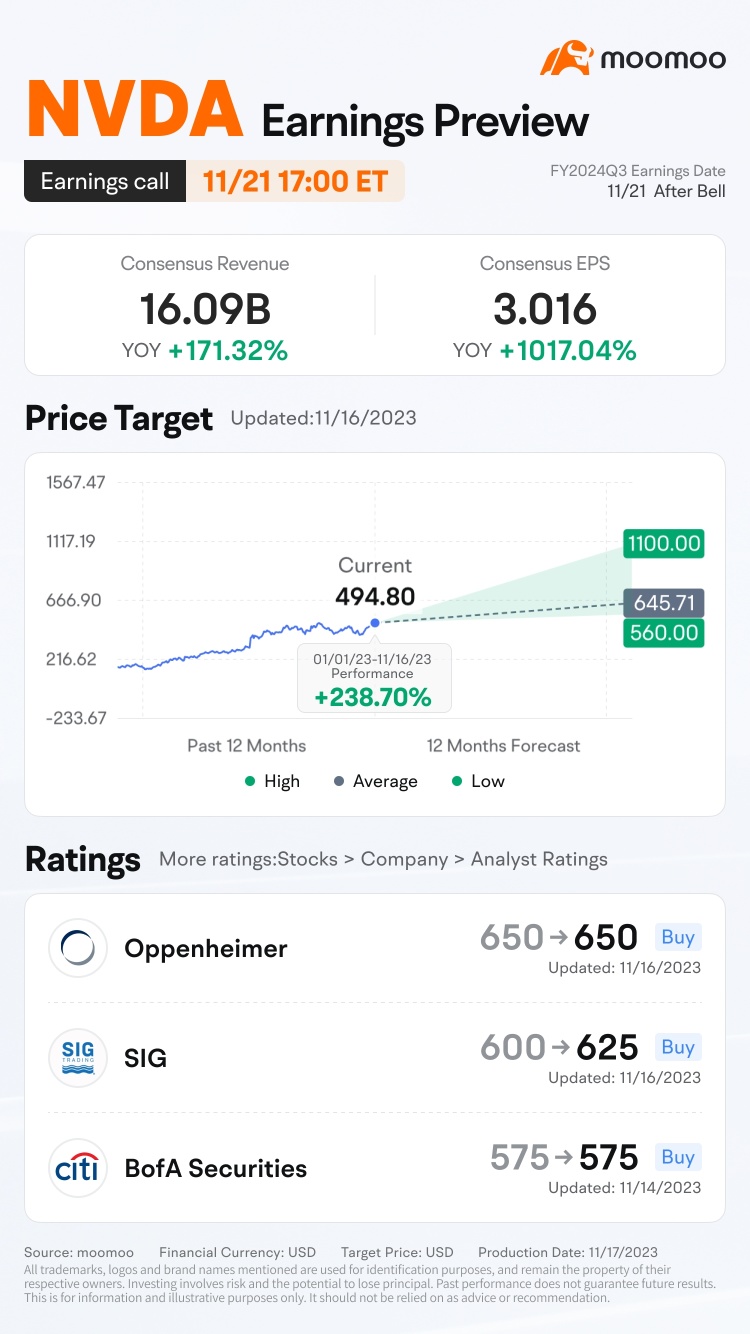

$英偉達(NVDA.US$ 在響鈴之後,11 月 21 日公布其 24 財年第三季度收益。 ![]()

市場對公司季度業績將如何反應? 投票您的答案以參加!

獎勵

● 10,000 分的等分: 對於正確猜測的 mooer們 價格範圍 $英偉達(NVDA.US$'s 開放價格 東部時間十一月二十二日上午九時三十分 (例如,如果 50 個摩歐爾們做出正確的猜測,他們每個都將獲得 200 分!)

(投票將...

市場對公司季度業績將如何反應? 投票您的答案以參加!

獎勵

● 10,000 分的等分: 對於正確猜測的 mooer們 價格範圍 $英偉達(NVDA.US$'s 開放價格 東部時間十一月二十二日上午九時三十分 (例如,如果 50 個摩歐爾們做出正確的猜測,他們每個都將獲得 200 分!)

(投票將...

已翻譯

94

78

Fieryfury

參與了投票

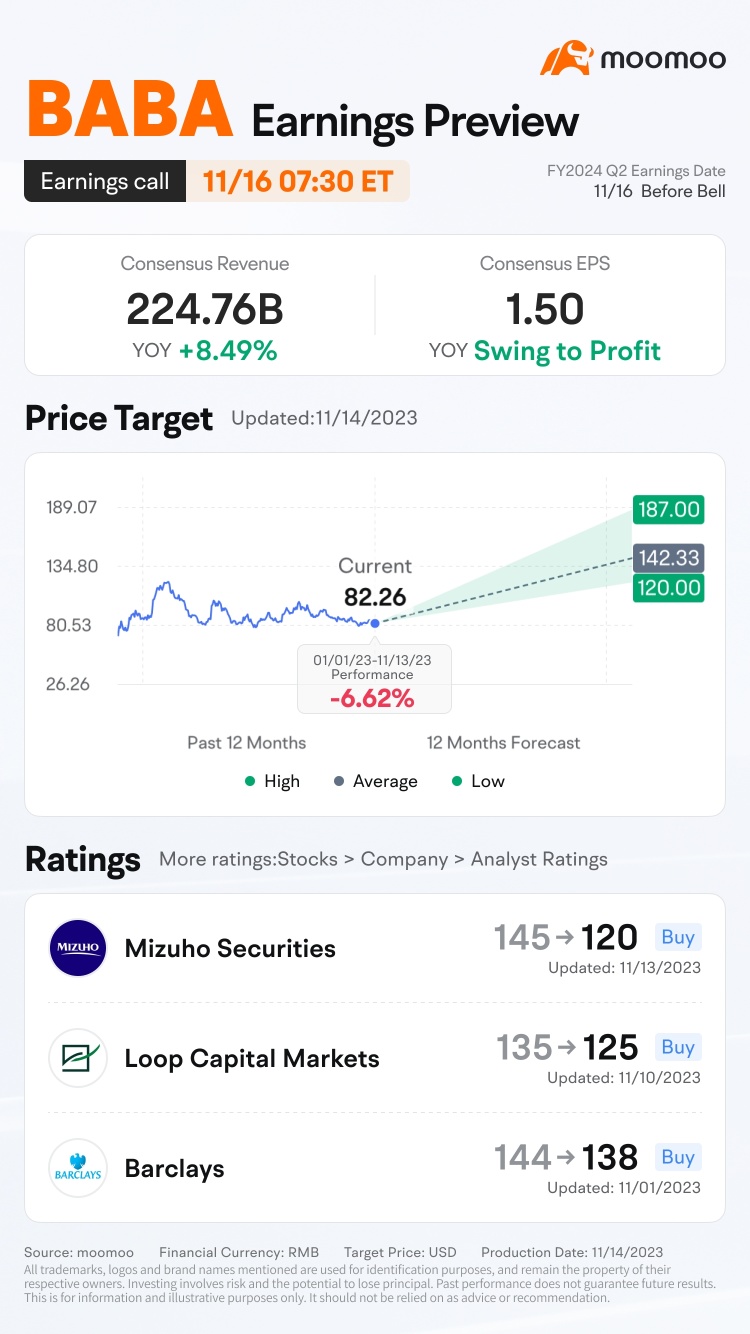

$阿里巴巴(BABA.US$ 將於十一月十六日發布 2024 財年第二季度收益。

市場對公司季度業績將如何反應? 投票您的答案以參加!

獎勵

● 同等分為 1,000 分: 對於正確猜測的 mooer們 價格範圍 $阿里巴巴(BABA.US$'s 開放價格 時間:東部時間下午 4 時 十一月十六日 (例如,如果 50 個摩歐爾們做出正確的猜測,他們每個人都將獲得 20 分。)

(說...

市場對公司季度業績將如何反應? 投票您的答案以參加!

獎勵

● 同等分為 1,000 分: 對於正確猜測的 mooer們 價格範圍 $阿里巴巴(BABA.US$'s 開放價格 時間:東部時間下午 4 時 十一月十六日 (例如,如果 50 個摩歐爾們做出正確的猜測,他們每個人都將獲得 20 分。)

(說...

已翻譯

40

20

Fieryfury

評論了

US stocks closed: the three major indexes collectively closed down, and the NASDAQ fell more than 1%

$納指100ETF-Invesco QQQ Trust(QQQ.US$ The U.S. stock market opened higher and went lower, continuing the recent decline. All the three major stock indexes closed lower, and the NASDAQ fell more than 1%. At the close, it was 10.5% lower than the historical closing high set in November last year, entering the technical correction range. As of the close, the Dow Jones index fell 0.96% to 35028.65; The S & P 500 i...

$納指100ETF-Invesco QQQ Trust(QQQ.US$ The U.S. stock market opened higher and went lower, continuing the recent decline. All the three major stock indexes closed lower, and the NASDAQ fell more than 1%. At the close, it was 10.5% lower than the historical closing high set in November last year, entering the technical correction range. As of the close, the Dow Jones index fell 0.96% to 35028.65; The S & P 500 i...

5

1

Fieryfury

讚了

始終應用 90-10 的概念到您的投資組合;

請記住,投資是 不 貿易

投資 = 5 年以上財富增長

交易 = 在動態下賭博

90% 長期投資持有

範例:

-總市場基金,例如 $標普500ETF-Vanguard(VOO.US$ $標普500ETF-iShares(IVV.US$ $投資組合標普500指數ETF-SPDR(SPLG.US$

始終擁有這個看漲市場總是只上漲的一部分動力

-股息增長股

自己做...

請記住,投資是 不 貿易

投資 = 5 年以上財富增長

交易 = 在動態下賭博

90% 長期投資持有

範例:

-總市場基金,例如 $標普500ETF-Vanguard(VOO.US$ $標普500ETF-iShares(IVV.US$ $投資組合標普500指數ETF-SPDR(SPLG.US$

始終擁有這個看漲市場總是只上漲的一部分動力

-股息增長股

自己做...

已翻譯

52

Fieryfury

讚了

冰島旅遊行銷活動「Inspired by Iceland」昨天發布的一個視頻旨在於 10 月發布的馬克扎克伯格視頻,宣布 Facebook 更名為 Meta。在其中,扎克伯格推廣所謂的「元宇宙」,這是一個「將成為移動互聯網的繼承者」的虛擬世界。 ![]()

![]()

![]()

如果目標是讓人們談論冰島,那麼一個新的旅遊視頻不僅是成功。![]()

![]()

![]()

扎克伯格說,元宇宙的定義品質是「存在的感覺... 就像你和其他人一起在一起」。![]()

![]()

![]()

該視頻讚揚冰島的「完全沉浸式」體驗,例如其真實的岩石,真實的人類和「您可以用眼球看到的天空」。![]()

![]()

![]()

對這部影片的反應非常積極,人們讚揚冰島官員的「奧林匹克級特技」,而許多人表示願意參觀。

Mooer們,觀看這個視頻後你想去冰島嗎?![]()

![]()

![]()

如果目標是讓人們談論冰島,那麼一個新的旅遊視頻不僅是成功。

扎克伯格說,元宇宙的定義品質是「存在的感覺... 就像你和其他人一起在一起」。

該視頻讚揚冰島的「完全沉浸式」體驗,例如其真實的岩石,真實的人類和「您可以用眼球看到的天空」。

對這部影片的反應非常積極,人們讚揚冰島官員的「奧林匹克級特技」,而許多人表示願意參觀。

Mooer們,觀看這個視頻後你想去冰島嗎?

已翻譯

173

45

Fieryfury

讚了

Q&A is a session under a company's earnings conference that institutional and retail investors ask some most-concerned questions to the management. On this page, you may discover info that might affect the stock price in the following weeks. $騰訊控股(ADR)(TCEHY.US$ $騰訊控股(00700.HK$

Attitudes: management is proactively embracing the new regulatory environment, which should contribute to a more sustainable development path for the industry.

Products: Wild Rift successfully reactivated an enlarged League of Legends user base by extending the authentic PC experience to mobile devices. In October 2021, it ranked second by DAU among all mobile games in China.

The number of active Mini Programs increased by over 40% year on year.

How would you assess your positioning in the Metaverse, the next iteration of the Internet?

So on Metaverse, I think this is actually sort of a very exciting but a little bit big concept. And as a result, we felt it's going to be an opportunity that really add the growth to the existing industries. For example, it will be an addition to the gaming industry. It will also be an addition to the social networking industry. And in some cases, when you have real-life applications like business applications, it actually also can be a growth engine for that industry too. So all in all, we felt that we have a lot of tech and capability building blocks that will allow us to approach the Metaverse opportunity through the multiple pathways we talked about.

How should we look at regulatory stance in terms of Metaverse given the heavy focus on addiction issue on the games side of the world?

In terms of any service, you just have to be compliant in the different territories that you operate, right? So for the global market, there will be a set of regulations. For the China market, there will be another set of regulations. But we felt it's not fundamentally averse to the development of Metaverse. Metaverse in itself will be tech-driven. As James talked about, there's a lot of technologies that's related to the development of games as well as for the Metaverse. And as a result, the Chinese government will be in support of the development of such technologies as long as the user experience is actually provided under the regulatory framework.

You discussed some of the challenged verticals such as education, games and insurance and whatnot. I was wondering if you can share a little bit more on how much do these verticals contribute to the advertising business?

In terms of making up for weakness, we commented that we expect weakness to persist for several quarters. So I want to emphasize the adjective several, which is not something that we believe will return to prior trends immediately. In terms of how much those categories contribute, then directionally speaking, games would be in the low to mid-teens. Education has dropped to the low single digits now, and insurance is a subset of finance but, again, will be a low single-digit percentage. In terms of categories that are relatively healthier, then financial services, ex insurance, and personal care products and clothing, food and beverage.

On the online game front, in particular, for overseas expansion, can you discuss what are some of the challenges you may anticipate amid our overseas expansion efforts for online game?

Just to touch on two that are front of mind at the moment. One is the war for talent. We believe that the game industry is really a talent-driven industry. And so we spend a lot of time at our own studios and also working with our investee and daughter studios working on the most appropriate compensation plans. And each situation is a little bit different. And we think we're there, and we can remain in that good position going forward because it is something we spend a great deal of time and energy on. Another issue for the game industry, because I believe that's front of mind for the industry as a whole in mobile games, the app stores take a bigger profit pool than the game developers do.

On WeChat, Mini Programs, and the eCommerce GMV growth there and the ads growth there. If we could get an update on how that's contributing to the advertising growth?

So on Mini Programs, in terms of GMV and ads growth, I think that overall message we want to tell you is it remains healthy and strong. And as long as the trend is intact, we don't talk about the specific numbers this time around. And you can see the number of Mini Programs have actually increased 40%, which means that it's actually a very vibrant ecosystem, covering an increasing number of different industries and types of applications. And this is exactly one of the key drivers behind the strong growth of GMV and ads growth. So that's sort of what we do want to share with you this time around.

Regarding your new versions of the CRM, SaaS, CDN. It seems like you will be launching a new version by the end of this year to provide a deeper integration between the Tencent Meeting and also the WeCom. So how should we think about this upcoming online advertising opportunity?

It is a good observation that we're actually starting to integrate more among our different enterprise facing SaaS. And there will be more integration between WeCom and Tencent Meeting and Tencent Docs and CDN and potentially other SaaS as well. And WeCom also provide a link into the WeChat ecosystem, right? So I would say there's fundamental benefits for these different SaaS apps to be talking to each other, and that actually sort of provide a more unified experience for anyone, any enterprise customer who wants to use one or two or many of our SaaS applications. And then in terms of being able to connect these SaaS to the consumers within Weixin in a controlled and secured way is actually very helpful, both for the enterprise as well as for the consumers so that they can actually get served by the different businesses in a well-protected manner.

This article is a script from the Q&A session of TCEHY's earnings call on Nov 10. In order to facilitate reading, we have made appropriate cuts. If you want to know more details, you can click here to re-watch the earnings call.

Attitudes: management is proactively embracing the new regulatory environment, which should contribute to a more sustainable development path for the industry.

Products: Wild Rift successfully reactivated an enlarged League of Legends user base by extending the authentic PC experience to mobile devices. In October 2021, it ranked second by DAU among all mobile games in China.

The number of active Mini Programs increased by over 40% year on year.

How would you assess your positioning in the Metaverse, the next iteration of the Internet?

So on Metaverse, I think this is actually sort of a very exciting but a little bit big concept. And as a result, we felt it's going to be an opportunity that really add the growth to the existing industries. For example, it will be an addition to the gaming industry. It will also be an addition to the social networking industry. And in some cases, when you have real-life applications like business applications, it actually also can be a growth engine for that industry too. So all in all, we felt that we have a lot of tech and capability building blocks that will allow us to approach the Metaverse opportunity through the multiple pathways we talked about.

How should we look at regulatory stance in terms of Metaverse given the heavy focus on addiction issue on the games side of the world?

In terms of any service, you just have to be compliant in the different territories that you operate, right? So for the global market, there will be a set of regulations. For the China market, there will be another set of regulations. But we felt it's not fundamentally averse to the development of Metaverse. Metaverse in itself will be tech-driven. As James talked about, there's a lot of technologies that's related to the development of games as well as for the Metaverse. And as a result, the Chinese government will be in support of the development of such technologies as long as the user experience is actually provided under the regulatory framework.

You discussed some of the challenged verticals such as education, games and insurance and whatnot. I was wondering if you can share a little bit more on how much do these verticals contribute to the advertising business?

In terms of making up for weakness, we commented that we expect weakness to persist for several quarters. So I want to emphasize the adjective several, which is not something that we believe will return to prior trends immediately. In terms of how much those categories contribute, then directionally speaking, games would be in the low to mid-teens. Education has dropped to the low single digits now, and insurance is a subset of finance but, again, will be a low single-digit percentage. In terms of categories that are relatively healthier, then financial services, ex insurance, and personal care products and clothing, food and beverage.

On the online game front, in particular, for overseas expansion, can you discuss what are some of the challenges you may anticipate amid our overseas expansion efforts for online game?

Just to touch on two that are front of mind at the moment. One is the war for talent. We believe that the game industry is really a talent-driven industry. And so we spend a lot of time at our own studios and also working with our investee and daughter studios working on the most appropriate compensation plans. And each situation is a little bit different. And we think we're there, and we can remain in that good position going forward because it is something we spend a great deal of time and energy on. Another issue for the game industry, because I believe that's front of mind for the industry as a whole in mobile games, the app stores take a bigger profit pool than the game developers do.

On WeChat, Mini Programs, and the eCommerce GMV growth there and the ads growth there. If we could get an update on how that's contributing to the advertising growth?

So on Mini Programs, in terms of GMV and ads growth, I think that overall message we want to tell you is it remains healthy and strong. And as long as the trend is intact, we don't talk about the specific numbers this time around. And you can see the number of Mini Programs have actually increased 40%, which means that it's actually a very vibrant ecosystem, covering an increasing number of different industries and types of applications. And this is exactly one of the key drivers behind the strong growth of GMV and ads growth. So that's sort of what we do want to share with you this time around.

Regarding your new versions of the CRM, SaaS, CDN. It seems like you will be launching a new version by the end of this year to provide a deeper integration between the Tencent Meeting and also the WeCom. So how should we think about this upcoming online advertising opportunity?

It is a good observation that we're actually starting to integrate more among our different enterprise facing SaaS. And there will be more integration between WeCom and Tencent Meeting and Tencent Docs and CDN and potentially other SaaS as well. And WeCom also provide a link into the WeChat ecosystem, right? So I would say there's fundamental benefits for these different SaaS apps to be talking to each other, and that actually sort of provide a more unified experience for anyone, any enterprise customer who wants to use one or two or many of our SaaS applications. And then in terms of being able to connect these SaaS to the consumers within Weixin in a controlled and secured way is actually very helpful, both for the enterprise as well as for the consumers so that they can actually get served by the different businesses in a well-protected manner.

This article is a script from the Q&A session of TCEHY's earnings call on Nov 10. In order to facilitate reading, we have made appropriate cuts. If you want to know more details, you can click here to re-watch the earnings call.

76

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)