Goldman Sachs Group believes that global copper inventories are likely to reach an all-time low by the end of the year, is expected to have a serious imbalance between supply and demand in the copper market, and raised the forecast of copper prices by the end of the year to 10500 US dollars / tonne. Citigroup, on the other hand, believes that copper demand will shrink in the next three months, and copper prices will fall by another 10%.

Last month, Goldman Sachs Group, the "standard-bearer of commodities", released a report that attracted the attention of the industry, predicting that oil prices would be the tipping point for the next round of commodity prices.

Oil prices have risen more than 16 per cent since the release of the report in mid-September, and US WTI crude rose to a high of $82 yesterday, setting a new record for more than a decade.

Goldman Sachs Group gave the reason is the shortage of inventory, in the context of low inventory, supply constraints may push up commodity prices further.

Commodity market bullish needs to follow the basic principle of supply and demand: regardless of the rate of economic growth, as long as demand is higher than supply, prices will rise. At a time when commodity inventories continue to fall and demand levels will continue to rise.A small increase in demand will cause prices to soar.

After the "prediction" of oil prices came true, Goldman Sachs Group pointed out in his latest reportCopper price will be the next tipping point.. The reason this time is also inventory.

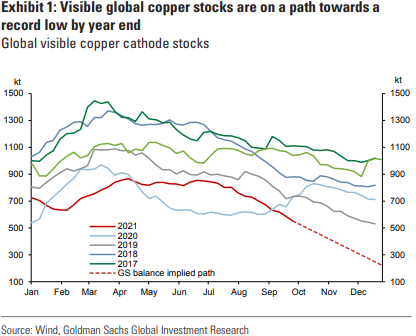

"with copper inventories shrinking rapidly, global copper inventories are likely to reach an all-time low by the end of the year, there is expected to be a serious imbalance between supply and demand in the copper market, and copper prices are expected to rise to $10500 a tonne by the end of the year."

Signs of a rise in copper prices have actually emerged, with spot copper on the London Metal Exchange (LME) rising to a high yesterday. In addition, Codelco, the world's leading copper miner, has proposed to increase the European copper premium by 31 per cent by 2022 at a price of $128a premium to futures.

Goldman Sachs Group believes that the rapid reduction of copper inventories will lead to a shortage of supply, aggravating the upward risk of copper prices, and analyzing the supply situation of the copper market from three aspects: the slowdown in copper mining, the impact of power shortages on smelting, and the recovery of scrap copper.

Copper price upward catalyst-tight inventory, shortage of supply

Goldman Sachs Group reported that copper is the most undervalued commodity at present.The mispricing in the market is due to the neglect of the important factor of inventory reduction.

At present, copper inventory in the spot market is declining rapidly.Decreased by nearly 40% in the past four months.。Global copper inventories are likely to reach an all-time low by the end of the year and are expected to run out in the second quarter of 2022 if copper prices remain low.At the same time, the decline in inventories, coupled with the need for delivery of futures contracts, will further reduce the supply of copper, which will eventually lead to a rise in copper prices.

Goldman Sachs Group believes that the following three factors will affect the spot supply of copper.

Goldman Sachs Group believes that the following three factors will affect the spot supply of copper.

1. The shortage of electricity aggravates the shortage of copper resources.One of the main concerns in the market is the impact of power shortage on the copper market.

Goldman Sachs Group thinksPower shortage affects metal smelting and other manufacturers, which in turn affects copper production and causes supply shortage.First of all, there is a strong positive correlation between coal supply and the sharp decline in copper stocks. Energy consumption data show that the smelting industry has been hit far more severely than downstream manufacturing (energy demand has fallen 1 per cent year-on-year since the power problem began). Simply put, power problems have reduced copper supply by more than its downstream demand.

There are some seasonal factors in China's copper market, and demand usually exceeds supply in the fourth quarter. Between 2015 and 2019, demand grew by 16% month-on-month in the fourth quarter, while capacity increased by only 9%. This means that offsetting the seasonal tightening requires greater adjustment and contraction on the demand side, which is unlikely to happen for the time being.

2, from the perspective of copper recycling market, copper scrap recycling can not alleviate the short-term supply problem.Scrap copper recycling accounts for 20% of global refined copper production and nearly 30% of semi-finished copper consumption, which is an important factor affecting the short cycle of the copper market. Scrap copper supply grew strongly at the beginning of the year and then suddenly tightened. The supply of scrap copper has been declining in the second half of the year, from a peak at the end of the first quarter to a year-on-year contraction of nearly 15 per

This reflects that the long-term destocking phase caused by price and demand factors reduced scrap copper inventory in the supply chain from the third quarter of 2020 to the early second quarter of 2021.

In addition, Malaysian regulations on the quality of scrap copper exports are more stringent, limiting the supply of scrap copper. These indicate that the scrap copper market has turned into the current tightening trend. If there is no scrap copper inventory to replenish supply, the potential supply will be lower than demand and lead to higher prices. While higher copper prices will help stimulate the supply of scrap copper, given the low inventory, the lag effect is obvious.

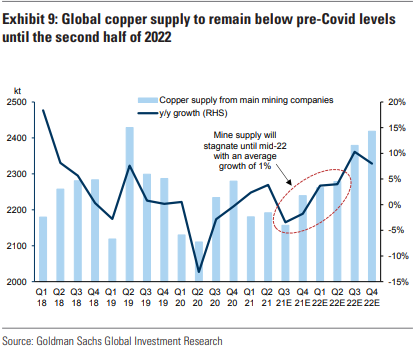

3. Copper mining has entered a stage of multi-quarter stagnation.Goldman Sachs Group pointed out that a common misunderstanding of copper fundamentals is that the supply of copper in the market is reduced and copper mines can be mined to quickly replenish supply.

Although the global supply of copper minerals is expected to increase by 5% in the first quarter of 2021. However, the problem of copper shortage remains to be solved in the short term, with the outbreak of the COVID-19 epidemic in the first quarter of 2020 and a sharp reduction in copper mining.

Production has leveled off since the third quarter of last year, peaking in December. Since the beginning of this year, the mining volume has declined slightly in a row. Goldman Sachs Group expects global mineral supply growth to slow in the second half of this year and not pick up until the second half of 2022.

This means that 3/4 of the supply of the copper market will stagnate with few new mine project approvals and capital expenditure growth.

Goldman Sachs Group VS Citi

There is no consensus on the future of copper on Wall Street, and Citigroup is on the short side.The reason to be bearish is on the demand side, not on the supply side.

It believes that the soaring cost of natural gas and electricity will make the copper market unbearable and could trigger a new round of stagflation, with a sharp drop in demand from consumers and manufacturers, but the cost of goods and raw materials remains high.

Citigroup Commodity Research team warnsCopper demand will shrink over the next three months and copper prices will fall another 10 per cent.Max Layton, head of commodity research at Citi, saidThe main reason for his bearishness is that the electricity, oil and gas crisis in Europe is spreading and the copper market will get worse.

In Europe, a measure of manufacturing business activity by the IHS Markit last month saw the biggest decline since April 2020, when the epidemic began. Companies such as CF Industries, Yaran International and BASF said they would cut production and growth in new orders, output and employment would slow sharply because of high energy prices.

Juan Benavides, chairman of Codelco, also said in an interview that the copper market has not seen any signs that manufacturers are reducing demand because of high energy prices. Nevertheless, the macroeconomic outlook is uncertainHe thinks copper prices may not hit new highs in the short term.。

Of course, there are many people who agree with Goldman Sachs Group's point of view.

Kostas Bintas, head of copper trading at Trafigura Trading Group, believes that apart from the fact that commodities are rising, global stock markets are falling faster.It is obvious that the copper market is facing a serious shortage.。

Copper prices surged to more than $10700 a tonne in May as blockade restrictions triggered an increase in demand for housing and consumer goods. Many traders and banks are betting that prices will rise further, believing that as manufacturing grows and demand for electric cars increases, so will demand for copper.

Bank of America Corporation saidIf problems occur on the supply and demand side at the same time, the price of copper could reach $20000 a tonne.

David Lilley, a London-based metal hedge fund firm Drakwood Capital Management, said the tension in the spot market could help push copper prices to another record high.Perhaps before the end of the year, this is roughly the same as Goldman Sachs Group's forecast.. Lilley said in an interview

The obvious fact is that all the energy in the world is running out.Global copper stocks are declining, showing no sign of rising。

Edit / Ray