102614667

评论了

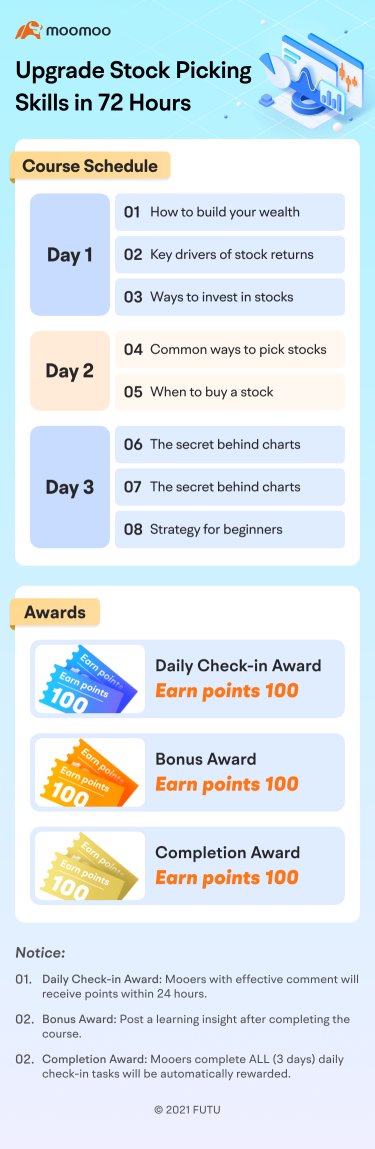

嗨 mooers,如果你错过了我们之前的学习营,不用担心,这是我们的升级版!!![]()

最近,市场波动很大,加上美联储加息。一些mooers可能会面临两难境地,即现在是否是购买的好时机。![]()

我强烈建议你参加这个股票学习活动,在当前的环境中做出更明智的决定!

加入这个之后,您将对h... 有更好的了解

最近,市场波动很大,加上美联储加息。一些mooers可能会面临两难境地,即现在是否是购买的好时机。

我强烈建议你参加这个股票学习活动,在当前的环境中做出更明智的决定!

加入这个之后,您将对h... 有更好的了解

已翻译

+1

141

733

102614667

评论了

注意:所有在 2 月 25 日 15:00(新加坡时间)之前评论 “注册” 的 mooers 都将在本周日之前被邀请加入我们的学习小组!![]()

![]()

![]()

你好 mooers,欢迎加入我们的学习营!![]()

你有没有注意到自 COVID-19 疫情爆发以来,生活成本越来越高?

由于通货膨胀会吞噬我们的钱,我们变得焦虑并开始赚取额外的收入。![]()

投资股票因其高昂的收益而受到公众的欢迎。

你好 mooers,欢迎加入我们的学习营!

你有没有注意到自 COVID-19 疫情爆发以来,生活成本越来越高?

由于通货膨胀会吞噬我们的钱,我们变得焦虑并开始赚取额外的收入。

投资股票因其高昂的收益而受到公众的欢迎。

已翻译

![注册学习选股并赢取 1000 点积分![注册已结束]](https://ussnsimg.moomoo.com/moo-1645617135-71220648-iPhone-2-org.gif/thumb)

![注册学习选股并赢取 1000 点积分![注册已结束]](https://ussnsimg.moomoo.com/moo-1645616562-71220648-iPhone-1-org.jpg/thumb)

![注册学习选股并赢取 1000 点积分![注册已结束]](https://ussnsimg.moomoo.com/7436745710015408638.gif/thumb)

+1

106

703

102614667

赞了

我希望MooMoo能够通过活动和测验与用户进行更多的互动。就我个人而言,我从每天参加的每日测验中继承了很多知识。我觉得这激发了我学习更多的动力,因为有太多我所不知道的投资。像跳过障碍物这样的迷你游戏非常有趣(对不起记不起游戏的名字了),我非常喜欢这个挑战。考虑到这些,我希望 MooMoo 能够继续开发如此有趣的互动,我一定会继续支持这家公司!感谢你成为我的 2021 年的一员! ![]()

已翻译

3

1

102614667

赞了

大家好,我是老李

没有只涨不跌的市场,也没有只跌不涨的市场。跳得越高,跌倒的痛苦就越大,蹲得越深,将来跳得越高,跳得越远。

尽管今天市场再次创下新低,但这一新低可以用作中期市场的起点。由于悲观情绪的释放更为彻底,从交易量的角度来看,市场看起来基金将在指数跌至新低后进入市场。如果明天市场走出大幅上涨,这将进一步刺激增量资金的加速进入。

它对市场的短期流动性具有缓解作用。

$恒生指数(800000.HK$恒生指数在创下新低后再次反弹,短期市场风向没有改变。然而,在市场持续下跌和外盘复苏之后,该指数已经没有太大的下跌空间,但短期内大幅反弹的概率也不大。是的,等待低位收敛并选择主方向。在技术层面上,恒生指数继续保持在下行通道中,日内支撑23,000,高于24,300的压力等待方向的选择。

$比亚迪股份(01211.HK$比亚迪完全再现了特斯拉的低位和高位走势。应该指出的是,短期内估值过高。其次,尽管行业景气度没有改变,但业绩的增长速度会影响估值的调整,而随着上游价格的上涨挤压下游的利润,临近年底,确实存在高低切换的可能性。当前价格居高不下,等待调整结束。如果盘中支撑位240突破打开向下空间,则向上反弹压力280为上升趋势线压力。,等待调整结束。

$中芯国际(00981.HK$中芯国际今天继续下跌,但仍维持昨日的观点。这种下降不是坏消息造成的,市场情绪下降了。Kdj直接向上分歧,预计这将形成金叉,推动股价迎来反卡车。这个位置越仔细地变成金坑。

$中国平安(02318.HK$中国平安继续整合。可以看出,中国平安最近有明显的走强迹象,并没有跟随指数的波动。负面因素用尽后,预计将在年内纠正下降趋势。每日支撑位主要是55个逢低买入,顶部稳定,开盘价为63个。反弹空间。

$腾讯控股(00700.HK$腾讯继续下跌趋势,并在短期内再次测试了之前的低点。当前的股价仍在区间底部波动。但是,可以看出,阿里巴巴的波动性 $阿里巴巴-SW(09988.HK$ , $美团-W(03690.HK$,以及 $小米集团-W(01810.HK$最近已经下跌,基本面已经耗尽。

中国的概念股现在处于左边,左边的赔率已经足够了,但稳定和上涨,并尝试尽可能低地买入需要时间。

没有只涨不跌的市场,也没有只跌不涨的市场。跳得越高,跌倒的痛苦就越大,蹲得越深,将来跳得越高,跳得越远。

尽管今天市场再次创下新低,但这一新低可以用作中期市场的起点。由于悲观情绪的释放更为彻底,从交易量的角度来看,市场看起来基金将在指数跌至新低后进入市场。如果明天市场走出大幅上涨,这将进一步刺激增量资金的加速进入。

它对市场的短期流动性具有缓解作用。

$恒生指数(800000.HK$恒生指数在创下新低后再次反弹,短期市场风向没有改变。然而,在市场持续下跌和外盘复苏之后,该指数已经没有太大的下跌空间,但短期内大幅反弹的概率也不大。是的,等待低位收敛并选择主方向。在技术层面上,恒生指数继续保持在下行通道中,日内支撑23,000,高于24,300的压力等待方向的选择。

$比亚迪股份(01211.HK$比亚迪完全再现了特斯拉的低位和高位走势。应该指出的是,短期内估值过高。其次,尽管行业景气度没有改变,但业绩的增长速度会影响估值的调整,而随着上游价格的上涨挤压下游的利润,临近年底,确实存在高低切换的可能性。当前价格居高不下,等待调整结束。如果盘中支撑位240突破打开向下空间,则向上反弹压力280为上升趋势线压力。,等待调整结束。

$中芯国际(00981.HK$中芯国际今天继续下跌,但仍维持昨日的观点。这种下降不是坏消息造成的,市场情绪下降了。Kdj直接向上分歧,预计这将形成金叉,推动股价迎来反卡车。这个位置越仔细地变成金坑。

$中国平安(02318.HK$中国平安继续整合。可以看出,中国平安最近有明显的走强迹象,并没有跟随指数的波动。负面因素用尽后,预计将在年内纠正下降趋势。每日支撑位主要是55个逢低买入,顶部稳定,开盘价为63个。反弹空间。

$腾讯控股(00700.HK$腾讯继续下跌趋势,并在短期内再次测试了之前的低点。当前的股价仍在区间底部波动。但是,可以看出,阿里巴巴的波动性 $阿里巴巴-SW(09988.HK$ , $美团-W(03690.HK$,以及 $小米集团-W(01810.HK$最近已经下跌,基本面已经耗尽。

中国的概念股现在处于左边,左边的赔率已经足够了,但稳定和上涨,并尝试尽可能低地买入需要时间。

已翻译

+1

109

102614667

赞了

The Hang Seng Index continued to fall today, once again came to the previous low near the low, the technical level is still maintained in the downward channel of the shock, for this week's Hang Seng Index this trend, if there is no force king of the big Yang line to support it, the possibility of breaking the new low is very large, pay attention to the previous low of 23100 If it can not be stabilized, then the index center of gravity will move down, the shock fell. If it falls below the previous new low and quickly retracts, it is expected to continue to rebound. The upper support is still the downside channel at 24300.

Individual stocks:

$比亚迪股份(01211.HK$ BYD yesterday fell below the trend line after continuing to oscillate downward, the trend is completely expected, for BYD's decline, a large part of the reason is because the peripheral market Tesla fell below the short-term support, and the reduction of bearish bearish is also fermenting, for BYD's next view is that if the continuous decline is mainly observed, if the volume of transactions appears to be large yin line, short-term is expected to rebound, you can bo. Below support near 240, if broken below it would accelerate the risk of falling.

$中芯国际(00981.HK$ SMIC continues to break down, from the AH linkage up, and does not meet the signs of the linkage downward, so this is not caused by bearish but emotionally caused by the selling pressure, here is the long-term sideways after the break, with the possibility of gold pit, if the next can return to 21 continues to be the bullish range, the lower support to see near 16.

$中国平安(02318.HK$ China Ping An is still maintained within the convergence, although the index is weak, but the overall direction of Ping An is still converging waiting for a breakthrough, and the fundamentals also have signs of improvement, and regardless of whether there is an opportunity to reverse, at least in the decline of the year, there is a possibility of correction, short-term continue to maintain the 55 support near the low suck mainly.

$腾讯控股(00700.HK$ Tencent continues to resonate with the broader market, falling below the rising channel, but do not worry too much, the current Tencent activity is enough, so Tencent does not break the lower edge of the box is still the main shock, the current Tencent belongs to the left side of the transaction, as low as possible to suck mainly.

$阿里巴巴-SW(09988.HK$ $京东集团-SW(09618.HK$ $哔哩哔哩-W(09626.HK$

Individual stocks:

$比亚迪股份(01211.HK$ BYD yesterday fell below the trend line after continuing to oscillate downward, the trend is completely expected, for BYD's decline, a large part of the reason is because the peripheral market Tesla fell below the short-term support, and the reduction of bearish bearish is also fermenting, for BYD's next view is that if the continuous decline is mainly observed, if the volume of transactions appears to be large yin line, short-term is expected to rebound, you can bo. Below support near 240, if broken below it would accelerate the risk of falling.

$中芯国际(00981.HK$ SMIC continues to break down, from the AH linkage up, and does not meet the signs of the linkage downward, so this is not caused by bearish but emotionally caused by the selling pressure, here is the long-term sideways after the break, with the possibility of gold pit, if the next can return to 21 continues to be the bullish range, the lower support to see near 16.

$中国平安(02318.HK$ China Ping An is still maintained within the convergence, although the index is weak, but the overall direction of Ping An is still converging waiting for a breakthrough, and the fundamentals also have signs of improvement, and regardless of whether there is an opportunity to reverse, at least in the decline of the year, there is a possibility of correction, short-term continue to maintain the 55 support near the low suck mainly.

$腾讯控股(00700.HK$ Tencent continues to resonate with the broader market, falling below the rising channel, but do not worry too much, the current Tencent activity is enough, so Tencent does not break the lower edge of the box is still the main shock, the current Tencent belongs to the left side of the transaction, as low as possible to suck mainly.

$阿里巴巴-SW(09988.HK$ $京东集团-SW(09618.HK$ $哔哩哔哩-W(09626.HK$

+2

20

102614667

赞了

大家好,我是 Old Lee

早盘受到周末乐观预期的经济会议纪要的刺激,而高预期直接刺激了恒生市场一度高开,上证综合指数也一度冲破了3700点。

这就是我经常称之为预期的力量。因为市场从来不是经济的晴雨表,而是预期的晴雨表。

今天,恒生指数冲高,遇到了下跌的压力,但大反弹趋势并未结束,但目前的反弹是新低之后的反弹,因为能量不足,需要确认。

但是现在基本面环境在改善,加上今年的跌幅比较大,所以这里的修正预期远大于继续下跌的概率,所以今天追高的小伙伴们不必太担心,

技术面来看,日线受下行通道中心轴的压力,如果短期内无法突破则有回撤的可能,但大结构仍处于反弹周期,下方支撑23800可以被低位吸入,等待站在24300压力上方,开辟新的反弹空间

个股

$腾讯控股(00700.HK$腾讯和 $美团-W(03690.HK$美股持续反弹,短线冲高下跌,但整体反弹结构仍在,等待恒生指数二次反弹后开始共振上涨,目前两只股票偏左,以低吸为主,腾讯上行通道460支撑,MEG在238附近的支撑位下方,震荡行情不追涨。

$比亚迪股份(01211.HK$比亚迪近期一直处于弱势震荡,因其或维持先前的观点,短期资本分化更为严重,需要关注280这条上升趋势线和下行趋势线的分水岭,如果跌破短期头部空间,则需要加快调整。

$中国平安(02318.HK$平安目前的反弹力度仍然不强,目前很难走出这个低点区域,但是从盘面内部来看,有走强的迹象,而且华夏幸福近期表现更强,如果利润空缺,平安将立即向上反弹修复跌势,而且赔率很高,技术支撑55仍可见,如果跌破前期低点50附近,粗体低点等待根本性变化真烂。

$中信证券(06030.HK$中信证券今日冲高下跌,属于短线AH联动看来短线多头利润下跌,但大方向仍存在继续上涨的可能性,基本面上市属于好经纪商的注册制,而且年内涨幅不大,短线可以等着在20附近回撤低吸力为主,毕竟移动平均线偏差比较高,接下来看22这个关口,如果突破,新一轮的崛起即将开始。

早盘受到周末乐观预期的经济会议纪要的刺激,而高预期直接刺激了恒生市场一度高开,上证综合指数也一度冲破了3700点。

这就是我经常称之为预期的力量。因为市场从来不是经济的晴雨表,而是预期的晴雨表。

今天,恒生指数冲高,遇到了下跌的压力,但大反弹趋势并未结束,但目前的反弹是新低之后的反弹,因为能量不足,需要确认。

但是现在基本面环境在改善,加上今年的跌幅比较大,所以这里的修正预期远大于继续下跌的概率,所以今天追高的小伙伴们不必太担心,

技术面来看,日线受下行通道中心轴的压力,如果短期内无法突破则有回撤的可能,但大结构仍处于反弹周期,下方支撑23800可以被低位吸入,等待站在24300压力上方,开辟新的反弹空间

个股

$腾讯控股(00700.HK$腾讯和 $美团-W(03690.HK$美股持续反弹,短线冲高下跌,但整体反弹结构仍在,等待恒生指数二次反弹后开始共振上涨,目前两只股票偏左,以低吸为主,腾讯上行通道460支撑,MEG在238附近的支撑位下方,震荡行情不追涨。

$比亚迪股份(01211.HK$比亚迪近期一直处于弱势震荡,因其或维持先前的观点,短期资本分化更为严重,需要关注280这条上升趋势线和下行趋势线的分水岭,如果跌破短期头部空间,则需要加快调整。

$中国平安(02318.HK$平安目前的反弹力度仍然不强,目前很难走出这个低点区域,但是从盘面内部来看,有走强的迹象,而且华夏幸福近期表现更强,如果利润空缺,平安将立即向上反弹修复跌势,而且赔率很高,技术支撑55仍可见,如果跌破前期低点50附近,粗体低点等待根本性变化真烂。

$中信证券(06030.HK$中信证券今日冲高下跌,属于短线AH联动看来短线多头利润下跌,但大方向仍存在继续上涨的可能性,基本面上市属于好经纪商的注册制,而且年内涨幅不大,短线可以等着在20附近回撤低吸力为主,毕竟移动平均线偏差比较高,接下来看22这个关口,如果突破,新一轮的崛起即将开始。

已翻译

+3

80

1

102614667

赞了

当前,人们对中国当前和潜在的一系列监管行动充满恐惧、不确定性和怀疑。毫无疑问,这提供了一个买入机会,因为许多中国股票的折扣幅度历来很大,但是在情况消失(可能需要几年的时间)之前,我认为价值投资者开设中国股票头寸是有风险的。恒大传奇的后果是另一个即将到来的威胁。无论如何,短期交易者和期权交易者都应该能够找到获利的机会。

$滴滴(已退市)(DIDI.US$ $中国平安(ADR)(PNGAY.US$ $好未来(TAL.US$ $新东方(EDU.US$ $哔哩哔哩(BILI.US$ $百度(BIDU.US$ $微博(WB.US$ $CHINA EVERGRANDE GROUP(EGRNF.US$ $拼多多(PDD.US$ $京东(JD.US$ $阿里巴巴(BABA.US$ $蔚来(NIO.US$ $小鹏汽车(XPEV.US$ $美团(ADR)(MPNGF.US$ $BYD Co.(BYDDF.US$

免责声明: 以上是我个人的看法。这不是财务建议或投资建议。在做出任何投资决定之前,请咨询财务顾问。

去看看 长期投资——一种在没有不眠之夜的情况下增加回报的策略 https://www.moomoo.com/community/feed/107495017873414?lang_code=2

$滴滴(已退市)(DIDI.US$ $中国平安(ADR)(PNGAY.US$ $好未来(TAL.US$ $新东方(EDU.US$ $哔哩哔哩(BILI.US$ $百度(BIDU.US$ $微博(WB.US$ $CHINA EVERGRANDE GROUP(EGRNF.US$ $拼多多(PDD.US$ $京东(JD.US$ $阿里巴巴(BABA.US$ $蔚来(NIO.US$ $小鹏汽车(XPEV.US$ $美团(ADR)(MPNGF.US$ $BYD Co.(BYDDF.US$

免责声明: 以上是我个人的看法。这不是财务建议或投资建议。在做出任何投资决定之前,请咨询财务顾问。

去看看 长期投资——一种在没有不眠之夜的情况下增加回报的策略 https://www.moomoo.com/community/feed/107495017873414?lang_code=2

已翻译

127

4

102614667

赞了

Hello everyone, I'm Lao Li

Hong Kong stocks continued to rebound today, rising 900 points for three consecutive days, positive recovery in sentiment, these days should be the most happy stage of this year's Hong Kong stock investors, the market rose all the way up to buy all make money, as if back to the bull market atmosphere.

Although the market style is now warm, but the overall trend did not reverse the structure, and the market this wave is a contraction rebound, that means that you also need to step back to confirm that if tomorrow can not put the station on the 24300 points, that big probability is to step back. Operation is not easy to catch up with high, beware of the market rush high fall back.

Technically, the Hang Seng Index today continues to maintain the rebound daily level close to the channel pressure, rebound strength significantly weakened, waiting for the back pedal to confirm the support mainly, the current channel pressure 24300 near, if not effective breakthrough to guard against high fall, the support below 23800 near the low suction.

stock aspect

00700 Tencent and the index resonant rebound, 3690 U.S. group is the same, although these two structures are still low shock rebound, but the rebound is not as strong as the index. From the current emotional point of view, some easing, after the recovery waiting for repair mainly, the main concern is whether the price can stand on the convergence pressure 500 above, stand firm then rise space open, under support 460, within the day near 460 can be low suction, not easy to catch up.

00981 SMIC trend, short-term large probability continues to maintain consolidation, and AH linkage, in the low waiting resonance rhythm, from the industry, the market sentiment is unchanged, so the supply side did not keep up before, there is still the possibility of upward, short-term need to wait for consolidation breakthrough, the day around 21 yuan can continue to maintain low suction, waiting to break through 23 pressure, if standing firm 23 will accelerate the possibility of rising.

2318 China Ping An, because the decline during the year is relatively large and did not keep up with the strength of the index, short-term large volatility did not appear, it is not appropriate to chase up, waiting for low suction-based, timely level of the moving average slow bonding there is the possibility of long rebound, day support 55 near can be low suction, waiting to break through the above 63 prices to open up space,

01211 because of the differentiation of new energy, leading investors to BYD's trend is more worried about the mood, stock prices are weak shock, short-term trend if falling below the upward trend line 280, must withdraw in time, although BYD I am also long-term bullish, but if once fall below the adjustment cycle will pull longer.

$腾讯控股(00700.HK$ $阿里巴巴-SW(09988.HK$ $比亚迪股份(01211.HK$ $美团-W(03690.HK$ $中国平安(02318.HK$ $中芯国际(00981.HK$

Hong Kong stocks continued to rebound today, rising 900 points for three consecutive days, positive recovery in sentiment, these days should be the most happy stage of this year's Hong Kong stock investors, the market rose all the way up to buy all make money, as if back to the bull market atmosphere.

Although the market style is now warm, but the overall trend did not reverse the structure, and the market this wave is a contraction rebound, that means that you also need to step back to confirm that if tomorrow can not put the station on the 24300 points, that big probability is to step back. Operation is not easy to catch up with high, beware of the market rush high fall back.

Technically, the Hang Seng Index today continues to maintain the rebound daily level close to the channel pressure, rebound strength significantly weakened, waiting for the back pedal to confirm the support mainly, the current channel pressure 24300 near, if not effective breakthrough to guard against high fall, the support below 23800 near the low suction.

stock aspect

00700 Tencent and the index resonant rebound, 3690 U.S. group is the same, although these two structures are still low shock rebound, but the rebound is not as strong as the index. From the current emotional point of view, some easing, after the recovery waiting for repair mainly, the main concern is whether the price can stand on the convergence pressure 500 above, stand firm then rise space open, under support 460, within the day near 460 can be low suction, not easy to catch up.

00981 SMIC trend, short-term large probability continues to maintain consolidation, and AH linkage, in the low waiting resonance rhythm, from the industry, the market sentiment is unchanged, so the supply side did not keep up before, there is still the possibility of upward, short-term need to wait for consolidation breakthrough, the day around 21 yuan can continue to maintain low suction, waiting to break through 23 pressure, if standing firm 23 will accelerate the possibility of rising.

2318 China Ping An, because the decline during the year is relatively large and did not keep up with the strength of the index, short-term large volatility did not appear, it is not appropriate to chase up, waiting for low suction-based, timely level of the moving average slow bonding there is the possibility of long rebound, day support 55 near can be low suction, waiting to break through the above 63 prices to open up space,

01211 because of the differentiation of new energy, leading investors to BYD's trend is more worried about the mood, stock prices are weak shock, short-term trend if falling below the upward trend line 280, must withdraw in time, although BYD I am also long-term bullish, but if once fall below the adjustment cycle will pull longer.

$腾讯控股(00700.HK$ $阿里巴巴-SW(09988.HK$ $比亚迪股份(01211.HK$ $美团-W(03690.HK$ $中国平安(02318.HK$ $中芯国际(00981.HK$

+1

36

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)