Yew Kian Onn

Set a live reminder

$Sea(SE.US$

Sea Limited Q1 2024 earnings conference call is scheduled for May 14 at 7:30 AM ET /May 14 at 7:30 PM SGT /May 14 at 9:30 PM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Sea Limited's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what managements have to say!

Disclaimer:

This presentation is for information and educa...

Sea Limited Q1 2024 earnings conference call is scheduled for May 14 at 7:30 AM ET /May 14 at 7:30 PM SGT /May 14 at 9:30 PM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Sea Limited's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what managements have to say!

Disclaimer:

This presentation is for information and educa...

10

Yew Kian Onn

liked

$TGUAN(7034.MY$ $BPPLAS(5100.MY$ $SLP(7248.MY$

SCIENTX announced its results in March. Although the profit of the packaging business declined year by year, the forecast is that it will recover in the future. According to investment bank tracking, TGUAN also mentioned that demand will begin to recover this year.

However, BPPLAS's net profit in FY2023 has grown 15.4% year-on-year, so this year's stock price increase was the most aggressive. Today, SLP announced its latest results. Net profit was a six-quarter high, and YOY grew 63.1%. Turnover did not grow much, but as the product mix improved and raw material costs declined, margin increased a lot.

2023 was a difficult year for many manufacturing industries, mainly because customers bought too many products before, so last year they were out of stock. The situation has improved this year, exports have begun to recover, and the packaging industry will usher in a good year.

It is expected that the next performance of the above 4 packaging companies will turn upwards from the bottom. In an environment where the industry is strong and the packaging business is recovering, SCIENTX is also a bit closer to a long-term market capitalization of RM 10 billion.

Earnings are expected to recover, and stock prices have already set sail in the past month. As long as profits can be met, I believe the value of these companies will also be seen by more investors. Mutual encouragement.

SCIENTX announced its results in March. Although the profit of the packaging business declined year by year, the forecast is that it will recover in the future. According to investment bank tracking, TGUAN also mentioned that demand will begin to recover this year.

However, BPPLAS's net profit in FY2023 has grown 15.4% year-on-year, so this year's stock price increase was the most aggressive. Today, SLP announced its latest results. Net profit was a six-quarter high, and YOY grew 63.1%. Turnover did not grow much, but as the product mix improved and raw material costs declined, margin increased a lot.

2023 was a difficult year for many manufacturing industries, mainly because customers bought too many products before, so last year they were out of stock. The situation has improved this year, exports have begun to recover, and the packaging industry will usher in a good year.

It is expected that the next performance of the above 4 packaging companies will turn upwards from the bottom. In an environment where the industry is strong and the packaging business is recovering, SCIENTX is also a bit closer to a long-term market capitalization of RM 10 billion.

Earnings are expected to recover, and stock prices have already set sail in the past month. As long as profits can be met, I believe the value of these companies will also be seen by more investors. Mutual encouragement.

Translated

46

2

Yew Kian Onn

liked

$POHUAT(7088.MY$ $HOMERIZ(5160.MY$ $SYNERGY(0279.MY$

Malaysia's KLCI index has broken through a 2-year high, and many industries have gradually seen improvements. According to Malaysia 🇲🇾 trade data for March, exports of wood products, rubber products (gloves 🧤), plastic products, metals, etc. all showed signs of growing year by year.

As a result, our industrial services index rose 📈 10.3% this year, getting rid of the dilemma of falling in 2023. Furthermore, the US dollar strengthened in Q1, and it is expected that the results announced in May will result in foreign exchange profits. The Federal Reserve stopped raising interest rates, and Malaysian stocks are expected to stabilize. Q2 foreign exchange profit/loss will depend on foreign exchange trends at the end of June.

SYNERGY, which went public last year, is trending wild this year. It announced a record high net profit in February. This year, it has risen by more than 100%, and is already the target price given by all investment banks. The results of POHUAT and HOMERIZ were released in March and April, respectively. Their turnover grew by YOY and QOQ when inventory was replenished, and they also broke through a 52-week high after the results were released.

POHUAT's quarterly decline in cash was mainly due to increased turnover, and Inventories and Trade Receivables increased due to increased order turnover. Inventory will continue to be replenished in the next 1-2 quarters, and stable performance is expected. But the longer term hasn't...

Malaysia's KLCI index has broken through a 2-year high, and many industries have gradually seen improvements. According to Malaysia 🇲🇾 trade data for March, exports of wood products, rubber products (gloves 🧤), plastic products, metals, etc. all showed signs of growing year by year.

As a result, our industrial services index rose 📈 10.3% this year, getting rid of the dilemma of falling in 2023. Furthermore, the US dollar strengthened in Q1, and it is expected that the results announced in May will result in foreign exchange profits. The Federal Reserve stopped raising interest rates, and Malaysian stocks are expected to stabilize. Q2 foreign exchange profit/loss will depend on foreign exchange trends at the end of June.

SYNERGY, which went public last year, is trending wild this year. It announced a record high net profit in February. This year, it has risen by more than 100%, and is already the target price given by all investment banks. The results of POHUAT and HOMERIZ were released in March and April, respectively. Their turnover grew by YOY and QOQ when inventory was replenished, and they also broke through a 52-week high after the results were released.

POHUAT's quarterly decline in cash was mainly due to increased turnover, and Inventories and Trade Receivables increased due to increased order turnover. Inventory will continue to be replenished in the next 1-2 quarters, and stable performance is expected. But the longer term hasn't...

Translated

60

Yew Kian Onn

liked

$SOP(5126.MY$

SARAWAK OIL PALMS, SOP is a planting company from East Masarawak, and the largest shareholder is Shin Yang Plantation.

In 2016, SOP acquired more shares in subsidiaries through bank loans and additional shares to increase the profit contribution of the planting business. Although the price of palm oil was not high at the time, the company was able to maintain profits and wait for spring to arrive.

Beginning in 2020, palm oil prices continued to rise to a peak of RM8,000 in 2022. Although the price has declined since then, it has remained between RM3,500 and 4,500 for the past year, which is far better than before the pandemic. As a result, I have earned close to RM1,400 mil in the past 4 years, which is an explosive level of profit.

From the chart, you can see that SOP's bank loans continued to decline and eventually became net cash Net Cash, which reached RM846 mil. The company has no place to expand in the short term, because of the new planting site and the very, very limited, at most, only proper replanting.

If the company does not increase dividends in the next few years, it will not be difficult for net cash to reach RM1,000 mil. It could be the next cash cow, similar to HLIND. The profit of plantation stocks still depends on the price of palm oil, but if SOP wants to maintain a net profit of RM250 - 350 mil, it should still be possible.

The more you grow high-dividend stocks...

SARAWAK OIL PALMS, SOP is a planting company from East Masarawak, and the largest shareholder is Shin Yang Plantation.

In 2016, SOP acquired more shares in subsidiaries through bank loans and additional shares to increase the profit contribution of the planting business. Although the price of palm oil was not high at the time, the company was able to maintain profits and wait for spring to arrive.

Beginning in 2020, palm oil prices continued to rise to a peak of RM8,000 in 2022. Although the price has declined since then, it has remained between RM3,500 and 4,500 for the past year, which is far better than before the pandemic. As a result, I have earned close to RM1,400 mil in the past 4 years, which is an explosive level of profit.

From the chart, you can see that SOP's bank loans continued to decline and eventually became net cash Net Cash, which reached RM846 mil. The company has no place to expand in the short term, because of the new planting site and the very, very limited, at most, only proper replanting.

If the company does not increase dividends in the next few years, it will not be difficult for net cash to reach RM1,000 mil. It could be the next cash cow, similar to HLIND. The profit of plantation stocks still depends on the price of palm oil, but if SOP wants to maintain a net profit of RM250 - 350 mil, it should still be possible.

The more you grow high-dividend stocks...

Translated

34

2

Yew Kian Onn

voted

Hey fellow traders and enthusiasts! Today marks a historic moment as $Reddit(RDDT.US$ takes its first steps into the trading world. We're thrilled to announce a special event to celebrate this milestone and get our community buzzing with excitement!

Guess Reddit's closing price on its debut!![]()

![]()

![]()

![]() Rules:

Rules:

● To participate, simply place your vote down below.

● You can also comment your guess for Reddit's exact closing price on i...

Guess Reddit's closing price on its debut!

● To participate, simply place your vote down below.

● You can also comment your guess for Reddit's exact closing price on i...

56

117

Yew Kian Onn

liked

$Arm Holdings(ARM.US$ When the lockdown ends on the 12th, a large number of stocks may be released! But it's a gradual process! Institutions will buy in large quantities. Currently, options trading is all buys!! This stock has a smaller circulation scale and is not suitable for institutional hype! The proportion of institutions is too small! There are 1,028 million shares and 95.5 million tradable shares, and daily transactions are only about a few million to 20 million! The proportion is extremely small! Even if SoftBank releases shares, the proportion should be small; no matter how much it releases, it will be eaten up in large quantities! Because there aren't many similar stocks! Although it will fluctuate between 118 and 154 in the short term! The fluctuation range of options from April to August is between 150 and 250!

Translated

1

Yew Kian Onn

reacted to and commented on

Yew Kian Onn

voted

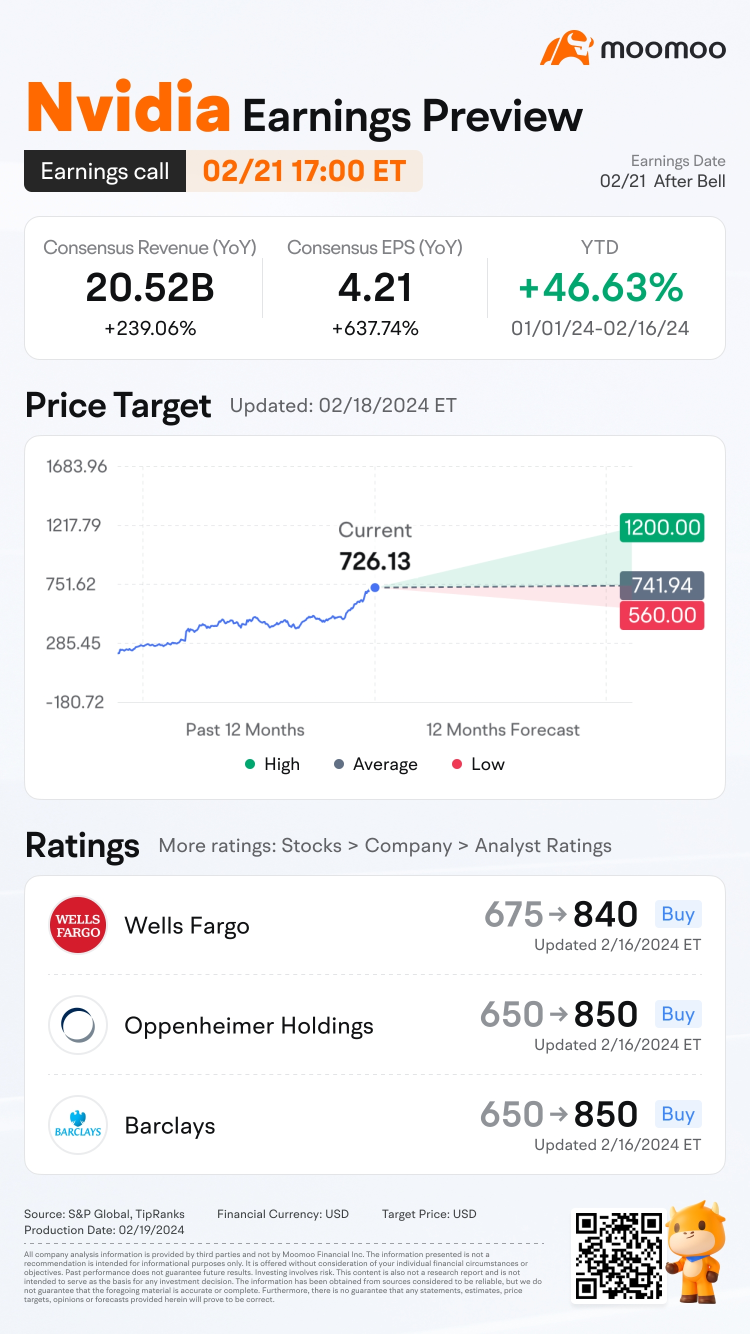

$NVIDIA(NVDA.US$ is releasing its Q4 FY24 earnings on Feburary 21, after the U.S. stock market close. How will the market react to the company's quarterly results? Vote your answer to participate!

Rewards

● An equal share of 10,000 points: For mooers who correctly guess the price range of $NVIDIA(NVDA.US$'s opening price at 9:30 AM ET Feb 22 (e.g., If 50 mooers make a correct guess, each of them will get 200 points!...

Rewards

● An equal share of 10,000 points: For mooers who correctly guess the price range of $NVIDIA(NVDA.US$'s opening price at 9:30 AM ET Feb 22 (e.g., If 50 mooers make a correct guess, each of them will get 200 points!...

147

111

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)