我最近听到一个我喜欢的词: 思想流动性.当世界发生变化或人们遇到新信息时,如何能够迅速放弃以前的理念的能力.毋庸置疑心理流动性是稀缺的.改变主意是很难的,因为欺骗自己相信谎言比承认错误更容易些.

爱因斯坦曾经一度很讨厌量子物理学的说法.

他自己的物理学理论是基于经典牛顿物理学的.牛顿物理学认为宇宙以纯净、理性、可以精确测量的方式运行.然而量子理论却认为物理世界的某些部分是无法测量的.因为测量亚原子粒子的行为本身就改变了物体的运动.在尝试衡量世界这个部分时,我们能做的最好的事情就只能是用概率和可能性.

这对爱因斯坦来说几乎是异端谬论,他也清楚地让他的量子理论同行知道他的评判和观点.

1927 年他曾对一群物理学家说“一个人无法根据大量‘可能’得出一个理论”他说上帝“不会去掷骰子”

他的同行很失望,说 “爱因斯坦,你怎么能这么说呢”量子物理学家保罗·埃伦费斯特说.他觉得这位伟大的物理学家和那些曾经怀疑爱因斯坦相对论的人一样固执.

五年内一批量子物理学家获得了诺贝尔奖,科学界承认了他们的贡献并验证了量子理论.

但颁奖典礼上没有提及的却是该获奖小组是由爱因斯坦本人提名的.

“我相信这...

爱因斯坦曾经一度很讨厌量子物理学的说法.

他自己的物理学理论是基于经典牛顿物理学的.牛顿物理学认为宇宙以纯净、理性、可以精确测量的方式运行.然而量子理论却认为物理世界的某些部分是无法测量的.因为测量亚原子粒子的行为本身就改变了物体的运动.在尝试衡量世界这个部分时,我们能做的最好的事情就只能是用概率和可能性.

这对爱因斯坦来说几乎是异端谬论,他也清楚地让他的量子理论同行知道他的评判和观点.

1927 年他曾对一群物理学家说“一个人无法根据大量‘可能’得出一个理论”他说上帝“不会去掷骰子”

他的同行很失望,说 “爱因斯坦,你怎么能这么说呢”量子物理学家保罗·埃伦费斯特说.他觉得这位伟大的物理学家和那些曾经怀疑爱因斯坦相对论的人一样固执.

五年内一批量子物理学家获得了诺贝尔奖,科学界承认了他们的贡献并验证了量子理论.

但颁奖典礼上没有提及的却是该获奖小组是由爱因斯坦本人提名的.

“我相信这...

ColumnsAbout the advantages

David Brooks distinguished the difference between “the merits mentioned in the life history” and the “merits mentioned in the eulogy”.

The merits mentioned in resumes are often income, position, and house size; the merits mentioned in eulogies often refer to being helpful, caring, honest, and being remembered.

But ironically, many people yearn for the latter, but focus all their energy on the former.

Excerpt from Morgan Housel Feb 2023

The merits mentioned in resumes are often income, position, and house size; the merits mentioned in eulogies often refer to being helpful, caring, honest, and being remembered.

But ironically, many people yearn for the latter, but focus all their energy on the former.

Excerpt from Morgan Housel Feb 2023

Translated

ColumnsThe aftersound wraps around

One of my university professors once worked for Adobe. He said that the engineers who created Photoshop didn't know how users would use every filter and tool detail in the software. They just tried to develop every imaginable way to manipulate image tools. And they believed artists and designers would discover the power of their creative tools.

Many things work this way: their value to the world is not entirely known or predicted by their creators.

Visa founder Dee Hock said, “A book is far more than just a part of what the author wrote; it includes everything you can imagine and add after reading it”

Writer James Patterson (James Patterson) said, “One of the best things about reading is that when you're not reading, you can always think of things that extend from the book.”

Mark Twain (Mark Twain) said it best, “Wagner's music is more intriguing than it sounds.”

Excerpt from Morgan Housel Feb 2023

Many things work this way: their value to the world is not entirely known or predicted by their creators.

Visa founder Dee Hock said, “A book is far more than just a part of what the author wrote; it includes everything you can imagine and add after reading it”

Writer James Patterson (James Patterson) said, “One of the best things about reading is that when you're not reading, you can always think of things that extend from the book.”

Mark Twain (Mark Twain) said it best, “Wagner's music is more intriguing than it sounds.”

Excerpt from Morgan Housel Feb 2023

Translated

1

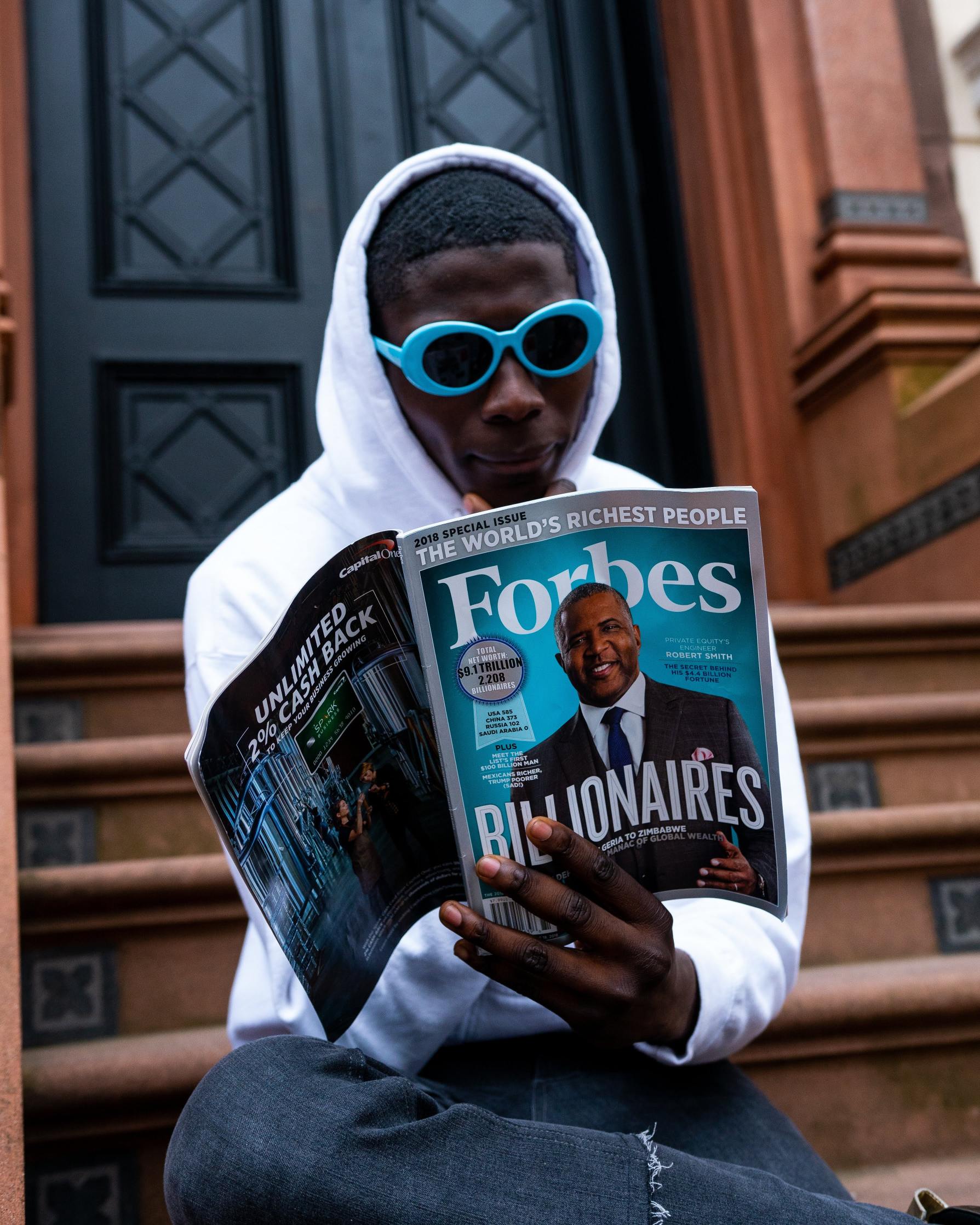

ColumnsPoor and rich

William Vanderbilt is one of the richest heirs of all time. But don't be envious — because his life isn't at all happy.

Just before his death in 1920, Vanderbilt told the New York Times, “I'm not destined to be happy in my life. Inherited wealth is a real obstacle to happiness. Just as cocaine destroys morals, it kills ambition”

What's interesting is that the other side of the topic—excessive ambition—can be just as painful.

Half a century ago Mark Twain wrote to William Vanderbilt's grandfather Cornelius Vanderbilt:

How sorry I am for you, this is true. You are old and should take a break, yet you have to struggle, deny yourself, lose your sleep and peace of mind because you need money so much, and I sympathize with “poor and destitute” people like you.

Don't get me wrong, Vanderbilt has $70 million. But you and I all know that what a person has isn't just wealth. Satisfying what a person has right now is real wealth.

Excerpt from Morgan Housel Feb 2023

Just before his death in 1920, Vanderbilt told the New York Times, “I'm not destined to be happy in my life. Inherited wealth is a real obstacle to happiness. Just as cocaine destroys morals, it kills ambition”

What's interesting is that the other side of the topic—excessive ambition—can be just as painful.

Half a century ago Mark Twain wrote to William Vanderbilt's grandfather Cornelius Vanderbilt:

How sorry I am for you, this is true. You are old and should take a break, yet you have to struggle, deny yourself, lose your sleep and peace of mind because you need money so much, and I sympathize with “poor and destitute” people like you.

Don't get me wrong, Vanderbilt has $70 million. But you and I all know that what a person has isn't just wealth. Satisfying what a person has right now is real wealth.

Excerpt from Morgan Housel Feb 2023

Translated

Physical attractiveness is something that everyone can see and understand with their intuitive senses, yet difficult to put into words.

So what makes for a charming face? It's hard to describe. When you see a good example, you only know it's one.

Several studies have tried to decipher this facial code. I think the most appealing argument is that average faces tend to be the most attractive.

Take 1000 people as an example, and let the software program generate the average value of their face — an artificial face with average cheekbone height, average eye spacing, average lip fullness, etc. In particular, cross-cultural (mixed) images are often the images people are most likely to judge as the most attractive and frequently used.

One evolutionary explanation is that non-average traits may have a higher-than-average risk of reproduction. They may or may not affect reproductive health at all, but it's like nature is implying, “Why risk it? It's fine to aim for average”

People like familiarity. This applies not only to faces, but also to products, occupations, and styles. It's almost like nature's risk management system.

Excerpt from Morgan Housel Feb 2023

So what makes for a charming face? It's hard to describe. When you see a good example, you only know it's one.

Several studies have tried to decipher this facial code. I think the most appealing argument is that average faces tend to be the most attractive.

Take 1000 people as an example, and let the software program generate the average value of their face — an artificial face with average cheekbone height, average eye spacing, average lip fullness, etc. In particular, cross-cultural (mixed) images are often the images people are most likely to judge as the most attractive and frequently used.

One evolutionary explanation is that non-average traits may have a higher-than-average risk of reproduction. They may or may not affect reproductive health at all, but it's like nature is implying, “Why risk it? It's fine to aim for average”

People like familiarity. This applies not only to faces, but also to products, occupations, and styles. It's almost like nature's risk management system.

Excerpt from Morgan Housel Feb 2023

Translated

Author R.L. Stine is one of the best-selling authors of all time. His series of horror children's books with goosebumps has sold over 400 million copies.

But horror wasn't his first act. Stine spent the first two decades of his career writing children's joke books.

He found that it's easier to scare people than make them laugh.

“Everyone has a different sense of humour, but we all have the same fears,” he said. “Kids are all afraid of the dark, afraid of getting lost, afraid of coming to a new place. These fears will never change”

Everyone has different personalities and tastes, but emotions — especially fear and greed — are often universal.

Excerpted from Morgan Housel Feb 2023

But horror wasn't his first act. Stine spent the first two decades of his career writing children's joke books.

He found that it's easier to scare people than make them laugh.

“Everyone has a different sense of humour, but we all have the same fears,” he said. “Kids are all afraid of the dark, afraid of getting lost, afraid of coming to a new place. These fears will never change”

Everyone has different personalities and tastes, but emotions — especially fear and greed — are often universal.

Excerpted from Morgan Housel Feb 2023

Translated

A year ago, after the huge bull market in 2021, I pointed out that investors chasing hot results are often burned to death, and just last week I described how investors fleeing volatility may always not get what they want.

Blogger Ben Carlson recently pointed out: The two columns are almost a full year apart, like bookends. They show the opposite polarization of the stock market and shareholders. Why is it so difficult to buy low and sell high?

When you buy high and sell low, you choose the path of least resistance: in a bull market, buying high feels great. Bash! But selling at a high price — or just buying more at a high price — is hard to do. It feels like you can't discourage people at a party; you must participate. I'm afraid I'll miss out on the best opportunity to make money easily.

In a bear market, selling at a low price brings relief (at least in the short term). At the same time, buying at a low price — or even staying the same when others panic — feels like throwing money around.

Buying and holding investments is often derided as a blind “one and for all” approach. But don't ignore the fact that resisting extreme market forces requires great emotional discipline.

It's relatively easy to set it up, and the hardest part is to forget it. Every day the investment industry bombards you with hype about recent performance and pretend to anticipate the future, trying to get you to buy high and sell low. That's why discipline is so important.

Just like Cliff Asness, founder of AQR Capital Management...

Blogger Ben Carlson recently pointed out: The two columns are almost a full year apart, like bookends. They show the opposite polarization of the stock market and shareholders. Why is it so difficult to buy low and sell high?

When you buy high and sell low, you choose the path of least resistance: in a bull market, buying high feels great. Bash! But selling at a high price — or just buying more at a high price — is hard to do. It feels like you can't discourage people at a party; you must participate. I'm afraid I'll miss out on the best opportunity to make money easily.

In a bear market, selling at a low price brings relief (at least in the short term). At the same time, buying at a low price — or even staying the same when others panic — feels like throwing money around.

Buying and holding investments is often derided as a blind “one and for all” approach. But don't ignore the fact that resisting extreme market forces requires great emotional discipline.

It's relatively easy to set it up, and the hardest part is to forget it. Every day the investment industry bombards you with hype about recent performance and pretend to anticipate the future, trying to get you to buy high and sell low. That's why discipline is so important.

Just like Cliff Asness, founder of AQR Capital Management...

Translated

ColumnsRisks and Regrets

Actor David Cassidy's last words are “I've wasted too much time in my life”

It's scary to realize it too late in life. As many of us spend all day aimlessly playing with our phones, this waste of time will become more common.

Regrets are dangerous liabilities because their final costs are often hidden for years or decades. Decisions that are easy to make in the short term tend to be more costly in the long run.

Daniel Kahneman (Daniel Kahneman) once said that to be a good investor, one important quality is an accurate perception of one's future regrets. If things aren't going as you'd expect, you need to understand and get the direction right.

Regret is the best definition of risk.

Risk isn't how much money you might lose. It's not even how you feel when you lose it—over time, many painful experiences become valuable lessons. The real risk is that you may regret it years or decades later.

Jeff Bezos (Jeff Bezos) once described his decision to launch an online bookstore, Amazon in the mid-1990s: “The framework that made the decision incredibly easy was how to minimize regret. Predict yourself to be 80, then look back on your life, and minimize your regrets. When you're 80, you don't regret trying to participate in this thing called the Internet; it's a very important thing when you're 80, you don't regret trying to participate in this thing called the Internet.”

“But I know the things I'll really regret are things like...

It's scary to realize it too late in life. As many of us spend all day aimlessly playing with our phones, this waste of time will become more common.

Regrets are dangerous liabilities because their final costs are often hidden for years or decades. Decisions that are easy to make in the short term tend to be more costly in the long run.

Daniel Kahneman (Daniel Kahneman) once said that to be a good investor, one important quality is an accurate perception of one's future regrets. If things aren't going as you'd expect, you need to understand and get the direction right.

Regret is the best definition of risk.

Risk isn't how much money you might lose. It's not even how you feel when you lose it—over time, many painful experiences become valuable lessons. The real risk is that you may regret it years or decades later.

Jeff Bezos (Jeff Bezos) once described his decision to launch an online bookstore, Amazon in the mid-1990s: “The framework that made the decision incredibly easy was how to minimize regret. Predict yourself to be 80, then look back on your life, and minimize your regrets. When you're 80, you don't regret trying to participate in this thing called the Internet; it's a very important thing when you're 80, you don't regret trying to participate in this thing called the Internet.”

“But I know the things I'll really regret are things like...

Translated

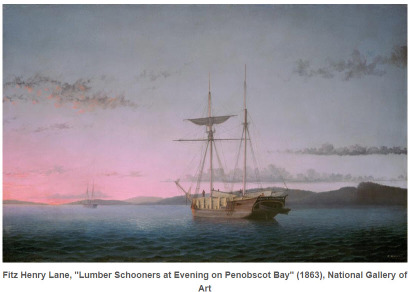

This basically dates back to 14th century Italy, when bankers did business and trade on a large bench. They called it a bench, but it looked more like a large table.

But for all intents and purposes, they'll sit on this bench. They have tables, and in Italy they basically sit on benches around tables. You can imagine places like Venice, where all these bankers sit in the yard and they do their banking business on this bench.

If the bankers are insolvent and they are unable to continue borrowing or making payments, then publicly state and leave in shame to let people know that he is insolvent and is unable to continue and be out of the game. That person left a half-bench is a public sign of bankruptcy.

The Italian phrase at the time was bancar rta. It meant a bad bench. It meant bankruptcy. This is where our word bankruptcy comes from.

Excerpt from Feb5 2023 Investor Amnesia Jamie Catherwood

But for all intents and purposes, they'll sit on this bench. They have tables, and in Italy they basically sit on benches around tables. You can imagine places like Venice, where all these bankers sit in the yard and they do their banking business on this bench.

If the bankers are insolvent and they are unable to continue borrowing or making payments, then publicly state and leave in shame to let people know that he is insolvent and is unable to continue and be out of the game. That person left a half-bench is a public sign of bankruptcy.

The Italian phrase at the time was bancar rta. It meant a bad bench. It meant bankruptcy. This is where our word bankruptcy comes from.

Excerpt from Feb5 2023 Investor Amnesia Jamie Catherwood

Translated

Investing once won't make you rich;

only possible with continued investment;

Exercising once will not make you healthy;

It is only possible if you exercise relentlessly;

Reading it once won't make you smart;

It is only possible if you read consistently;

Persistent action is the key to getting everything you want.

Excerpted from Brian Feroldi Jan 31 2023

only possible with continued investment;

Exercising once will not make you healthy;

It is only possible if you exercise relentlessly;

Reading it once won't make you smart;

It is only possible if you read consistently;

Persistent action is the key to getting everything you want.

Excerpted from Brian Feroldi Jan 31 2023

Translated

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)