ColumnsPepsiCo 4Q22: DB Sees Upside to Consensus Estimates for Organic Growth, Leading to Higher EPS

Deutsche Bank believes the current consensus EPS appears likely to be elevated given ongoing cost pressures, supply chain bottlenecks, growing BTL headwinds, and PEP's own propensity to reinvest. Therefore, while constructive on PEP's performance in the current quarter following the recent pullback, Deutsche Bank maintains its Hold rating with a $186 price target as it awaits further clarity on the cost ...

3

Related to future considerations, although Deutsche Bank believes K should be positioned to meet its long-term sales and operating profit targets in FY23 (i.e., FX-neutral sales growth of +1%-3% and FX-neutral operating profit growth of +4%-6%), it notes that +DD cost inflation and supply disruptions could challenge such expectations. Thus, Deutsche Bank maintains the Hold rating but lowers the forward estimat...

2

1

Despite a weak advertising market leading to less-than-impressive revenue in this segment, solid parks and competitive park attendance have allowed Disney to remain positive in revenue. UBS expects the price target on the Disney F1Q23 preview to be $122 and maintains a buy rating based on the following analysis.

Solid Parks and slightly improved DTC dilution benefit total revenue growth

With the continued Parks strength and the slightly improved DTC ...

Solid Parks and slightly improved DTC dilution benefit total revenue growth

With the continued Parks strength and the slightly improved DTC ...

1

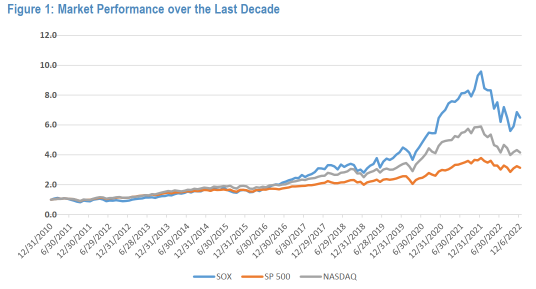

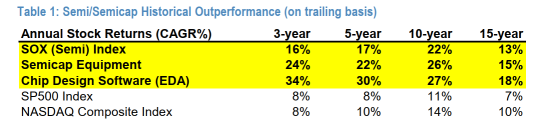

Over the past decade, semiconductor and semiconductor equipment stocks have consistently outperformed the broader markets, on average, by ~1100 bps per year, withannual outperformances in seven out of the last 10 years (trailing basis).

semiconductor and semiconductor equipment stocks should outperform the broader markets longer term on five key drivers:

1) realization that semiconductors are the foundational building block for all...

semiconductor and semiconductor equipment stocks should outperform the broader markets longer term on five key drivers:

1) realization that semiconductors are the foundational building block for all...

5

$WUXI BIO(02269.HK$ is a global leader in biologics CRDMO (integrated business model from drug discovery to commercial production), with services covering the whole cycle of biologics development. With the accelerated aging of the population and the continued impact of epidemics, the biologics industry has a bright future. CITIC Securities analyzes the investment value of WuXi Biologics from two perspectives:...

1

$PDD Holdings(PDD.US$ released its 2022Q3 financial results on Nov. 28. 22Q3 revenue growth was strong, with operating income of 35.504 billion yuan, up 65.1% year-over-year; earnings growth exceeded expectations, with Non-GAAP net income attributable to parents of 12.447 billion yuan, up 295.1% year-over-year. With solid consumer mindset, obvious competitive advantage in agricultural products, continued branding upgrade and rapid development of international busine...

1

On November 22nd, $ZTO Express(ZTO.US$ announced its third quarter earnings report, which showed a significant year-over-year increase in revenue of RMB 8.94 billion (YoY + 21.0%) and adjusted net profit of RMB 1.87 billion (YoY + 63.1%), with the significant growth in earnings mainly due to the increase in both volume and revenue per ticket as well as continued cost optimization. Against the backdrop of slowing volume growth in the industry, the market s...

2

$Dingdong(DDL.US$ released its 2022Q3 results on November 11, with revenues of 5.943 billion yuan, down 4% YoY, and an adjusted net loss of 290 million yuan, compared to a loss of 1.98 billion yuan a year ago, a significant narrowing of losses from last year. After releasing the earnings report, company's founder and CEO Changlin Liang said, "At the current rate of development, it is fully possible to basically achieve No...

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)