rxuyEJKtVL

liked and commented on

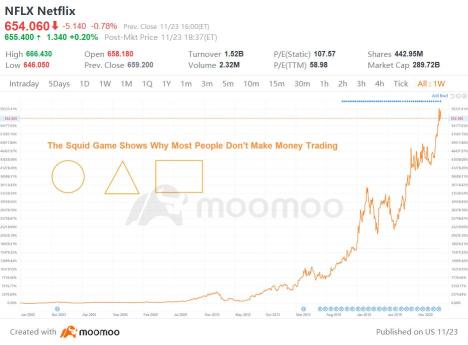

Squid game is the hottest series on $Netflix(NFLX.US$ right now, in which 456 players join a game of death, where they have a chance to win 456 Billion Korean Won (KRW), or 38.5 Milllion US Dollars.

What’s interesting about this series is that it depicts human sentiment in a very realistic way. We could see how market participants think and act by looking at the participants of the squid game.

A random guy appears at the subway station, and offers to play card flip, where he’d slap the player if he wins, and pay $100 if he loses. He actually ends up paying the players, stimulating their curiosity. Later, players are taken to a remote island where they have no clue what game they’re playing, with hopes of potentially winning life-changing money.

Beginners Luck turns to Attribution Bias

People who join the stock market are not different. They don’t know what game they’re playing, and what rules there are. Just as the subway guy invokes curiosity from the players by paying them small amounts of actual money, people are dragged into the stock market through stories of their friends and acquaintances making life-changing money by trading.

You try to remember the name of the stock or cryptocurrency your friend mentioned, and buy it without doing any due dilligence. You participate in the game of the market with 0 understanding of the game and rules.

When the stock/crypto you bought goes up (by chance), you fall into the trap of beginner’s luck. Beginner’s luck refers to a phenomenon or situation in which a beginner experiences a disproportionate ferquency of success against even experts in a certain field or activity. It’s often used in gambling and sports. But beginner’s luck leads to overconfidence and attribution bias.

Overconfidence refers to one’s excessive trust in his decisions based on gut-feeling and his cognitive abilities. This often leads to overtrading, and the market participant ends up paying excessive trading fees. Overconfident traders also tend to neglect statistics, and put all their eggs in one basket. They hardly listen to other people, and tend to choose the stocks/crypto they invest in themselves.

Attribution bias, or cognitive bias, is when people find reasons for their own and others’ behaviors. So when they’re in profit, they think that it’s all thanks to their amazing prediction. When they’re at a loss, it’s because the market was in an unfavorable situation, or simply because they were unlucky. Essentially, they constantly come up with excuses for every situation.

We all know Isaac Newton as a genius physicist, but he was a failure as an investor. He made the wrong investment decision when he invested in South Sea stocks, which led him to lose 20,000 pounds (about $4M today). He lost most of his life savings and famously said that “you can calculate the motions of heavenly stars, but not the madness of people” - a classic example of someone with attribution bias.

Mob Psychology and the Bandwagon Effect

This is accurately reflected in Squid Game. When players play ‘Red Light Green Light’, they are shocked to see other players get massacred. After the game is over, they later vote whether they want to continue playing the game or not. The surviving players fall into the trap of overconfidence and attribution bias.

Only 1 person out or 456 will survive and win the prize money. Statistically, every player has a 0.22% chance of survival. While this is statistically low, they’re taken away by the pile of cash hanging from the ceiling, and start believing that they’re special, and that they can win. Lotteries and gambling work in the same way, in which people bet on a probable case that is close to impossible. Sadly, most people approach trading like gambling.

In Squid Game, right before they play tug of war, a riot breaks out, and players are split into different factions. So when they’re told to team up for tug of war, teams are formed based on the factions that were formed the day before. This shows us mob psychology and the bandwagon effect.

Mob psychology, or mob mentaility, is when people follow the actions and behaviors of their peers when in large groups. The bandwagon effect falls within the scope of mob mentaility, and is a phenomenon in which people do something primarily because others are doing it , regardless of their own beliefs.

The same psychological phenomena can be applied to investors and traders in the market. Instead of trading based on their own trading rules, strategies, and analyses, they simply follow the actions of other market participants. These are the people who end up panic buying or selling, and falling victim to pump and dump schemes.

Conclusion

These psychological phenomena prevents us from making the right decisions in the market, and making the wrong decisions indicates that we lose money. Just like how most people in the Squid Game end up dying, there are many other people who entered the market with dreams of becoming a millionaire, only to lose everything. But unlike the Squid Game, the financial markets isn’t a winner-takes-all. If you can understand the characteristics and rules of each market, and do your due diligence on different ways to beat the market, you can have a statistical edge. As a trader, I would say that technical knowledge accounts to less than 5% of what it takes to be successful. It’s more about understanding your cognitive bias and controlling your emotions and psychological state.

What’s interesting about this series is that it depicts human sentiment in a very realistic way. We could see how market participants think and act by looking at the participants of the squid game.

A random guy appears at the subway station, and offers to play card flip, where he’d slap the player if he wins, and pay $100 if he loses. He actually ends up paying the players, stimulating their curiosity. Later, players are taken to a remote island where they have no clue what game they’re playing, with hopes of potentially winning life-changing money.

Beginners Luck turns to Attribution Bias

People who join the stock market are not different. They don’t know what game they’re playing, and what rules there are. Just as the subway guy invokes curiosity from the players by paying them small amounts of actual money, people are dragged into the stock market through stories of their friends and acquaintances making life-changing money by trading.

You try to remember the name of the stock or cryptocurrency your friend mentioned, and buy it without doing any due dilligence. You participate in the game of the market with 0 understanding of the game and rules.

When the stock/crypto you bought goes up (by chance), you fall into the trap of beginner’s luck. Beginner’s luck refers to a phenomenon or situation in which a beginner experiences a disproportionate ferquency of success against even experts in a certain field or activity. It’s often used in gambling and sports. But beginner’s luck leads to overconfidence and attribution bias.

Overconfidence refers to one’s excessive trust in his decisions based on gut-feeling and his cognitive abilities. This often leads to overtrading, and the market participant ends up paying excessive trading fees. Overconfident traders also tend to neglect statistics, and put all their eggs in one basket. They hardly listen to other people, and tend to choose the stocks/crypto they invest in themselves.

Attribution bias, or cognitive bias, is when people find reasons for their own and others’ behaviors. So when they’re in profit, they think that it’s all thanks to their amazing prediction. When they’re at a loss, it’s because the market was in an unfavorable situation, or simply because they were unlucky. Essentially, they constantly come up with excuses for every situation.

We all know Isaac Newton as a genius physicist, but he was a failure as an investor. He made the wrong investment decision when he invested in South Sea stocks, which led him to lose 20,000 pounds (about $4M today). He lost most of his life savings and famously said that “you can calculate the motions of heavenly stars, but not the madness of people” - a classic example of someone with attribution bias.

Mob Psychology and the Bandwagon Effect

This is accurately reflected in Squid Game. When players play ‘Red Light Green Light’, they are shocked to see other players get massacred. After the game is over, they later vote whether they want to continue playing the game or not. The surviving players fall into the trap of overconfidence and attribution bias.

Only 1 person out or 456 will survive and win the prize money. Statistically, every player has a 0.22% chance of survival. While this is statistically low, they’re taken away by the pile of cash hanging from the ceiling, and start believing that they’re special, and that they can win. Lotteries and gambling work in the same way, in which people bet on a probable case that is close to impossible. Sadly, most people approach trading like gambling.

In Squid Game, right before they play tug of war, a riot breaks out, and players are split into different factions. So when they’re told to team up for tug of war, teams are formed based on the factions that were formed the day before. This shows us mob psychology and the bandwagon effect.

Mob psychology, or mob mentaility, is when people follow the actions and behaviors of their peers when in large groups. The bandwagon effect falls within the scope of mob mentaility, and is a phenomenon in which people do something primarily because others are doing it , regardless of their own beliefs.

The same psychological phenomena can be applied to investors and traders in the market. Instead of trading based on their own trading rules, strategies, and analyses, they simply follow the actions of other market participants. These are the people who end up panic buying or selling, and falling victim to pump and dump schemes.

Conclusion

These psychological phenomena prevents us from making the right decisions in the market, and making the wrong decisions indicates that we lose money. Just like how most people in the Squid Game end up dying, there are many other people who entered the market with dreams of becoming a millionaire, only to lose everything. But unlike the Squid Game, the financial markets isn’t a winner-takes-all. If you can understand the characteristics and rules of each market, and do your due diligence on different ways to beat the market, you can have a statistical edge. As a trader, I would say that technical knowledge accounts to less than 5% of what it takes to be successful. It’s more about understanding your cognitive bias and controlling your emotions and psychological state.

33

12

rxuyEJKtVL

liked

$Tesla(TSLA.US$ is cooling off after gaining in five straight sessions.

The stock is still up 6% over the last week and 27% over the last six weeks.

Trading volume today on TSLA is more than 30M shares.

Despite the trillion dollar market cap for Tesla, the stock still has the fifth highest rating on moomoo in the auto sector.

The stock is still up 6% over the last week and 27% over the last six weeks.

Trading volume today on TSLA is more than 30M shares.

Despite the trillion dollar market cap for Tesla, the stock still has the fifth highest rating on moomoo in the auto sector.

35

14

rxuyEJKtVL

liked and commented on

$Netflix(NFLX.US$ Netflix is in the uptrend and currently, price has been pushed to the upside, after touching the ascending trend line and also the first support zone (S1).

On the other hand, the last 4H candle has been closed a little lower, below the trend line .

We still don’t know if this is a fake breakout or not… we should wait for the current 4H candle to see if it will be closed below the last candle and also below S1 or it will be closed above them.

If price closes a bearish candle below S1, we can expect more downside move and retrace around the second support zone (S2) which is around $615.

If price could close a bullish candle above S1, we can expect a rise towards the last high which is $690, and in the case of an upside breakout on that level, the next target would be $740

On the other hand, the last 4H candle has been closed a little lower, below the trend line .

We still don’t know if this is a fake breakout or not… we should wait for the current 4H candle to see if it will be closed below the last candle and also below S1 or it will be closed above them.

If price closes a bearish candle below S1, we can expect more downside move and retrace around the second support zone (S2) which is around $615.

If price could close a bullish candle above S1, we can expect a rise towards the last high which is $690, and in the case of an upside breakout on that level, the next target would be $740

65

12

rxuyEJKtVL

liked

Sifting through Q3's 13F filings, more hedge funds reduced holdings in $Amazon(AMZN.US$ than in any other stock, with six funds cutting their stakes. One fund, Daniel Loeb's Third Point, took a different tack and increased its holding in the ecommerce giant.

$Meta Platforms(FB.US$, known as Facebook in Q3, saw four funds trim stakes and two funds increase their stakes. Coatue Management, though, bulked up on the name.

$SoFi Technologies(SOFI.US$ which went public in the last month of Q2, was the stock that saw the most hedge funds head for the exits, with Temasek, Coatue and Third Point all shedding their shares.

Two recently IPO'd fintech stocks were the most popular new positions in hedge funds — $Robinhood(HOOD.US$ and $Blend Labs(BLND.US$. Coatue and Tiger Global took new stakes in both HOOD and BLND. Temasek added Blend, while Whale Rock added Robinhood.

$Nextdoor Holdings(KIND.US$, which went public in November through a SPAC merger with Khosla Ventures Acqusition II, also gained in popularity in Q3, with Ark Investment taking a new stake in the neighborhood-based social media platform and Starboard Value and Soroban bolstering their existing stakes.

Comparing HOOD, SOFI, BLND, AMZN, FB, and TSLA, megacap giants AMZN, FB and TSLA have the largest percentage of institutional ownership.

For all the general market interest in $Tesla(TSLA.US$, there weren't a lot of changes in funds' TSLA holdings. Cathie Wood's Ark Investment and Coatue pared their stakes in the EV and battery maker, while Whale Rock increased its stake.

$Workday(WDAY.US$ saw two hedge funds exit — Third Point and York Capital — while Ark Investment reduced its stake. Coatue, though, bucked the trend and increased its holding in the business software firm.

In Q3, Robinhood outperformed the S&P 500, while Amazon, SoFi, and Blend Labs all lagged the broader index as seen in the graph below.

$Berkshire Hathaway-A(BRK.A.US$ $Berkshire Hathaway-B(BRK.B.US$ stock portfolio stayed relatively steady during Q3 at ~$293B.

$Meta Platforms(FB.US$, known as Facebook in Q3, saw four funds trim stakes and two funds increase their stakes. Coatue Management, though, bulked up on the name.

$SoFi Technologies(SOFI.US$ which went public in the last month of Q2, was the stock that saw the most hedge funds head for the exits, with Temasek, Coatue and Third Point all shedding their shares.

Two recently IPO'd fintech stocks were the most popular new positions in hedge funds — $Robinhood(HOOD.US$ and $Blend Labs(BLND.US$. Coatue and Tiger Global took new stakes in both HOOD and BLND. Temasek added Blend, while Whale Rock added Robinhood.

$Nextdoor Holdings(KIND.US$, which went public in November through a SPAC merger with Khosla Ventures Acqusition II, also gained in popularity in Q3, with Ark Investment taking a new stake in the neighborhood-based social media platform and Starboard Value and Soroban bolstering their existing stakes.

Comparing HOOD, SOFI, BLND, AMZN, FB, and TSLA, megacap giants AMZN, FB and TSLA have the largest percentage of institutional ownership.

For all the general market interest in $Tesla(TSLA.US$, there weren't a lot of changes in funds' TSLA holdings. Cathie Wood's Ark Investment and Coatue pared their stakes in the EV and battery maker, while Whale Rock increased its stake.

$Workday(WDAY.US$ saw two hedge funds exit — Third Point and York Capital — while Ark Investment reduced its stake. Coatue, though, bucked the trend and increased its holding in the business software firm.

In Q3, Robinhood outperformed the S&P 500, while Amazon, SoFi, and Blend Labs all lagged the broader index as seen in the graph below.

$Berkshire Hathaway-A(BRK.A.US$ $Berkshire Hathaway-B(BRK.B.US$ stock portfolio stayed relatively steady during Q3 at ~$293B.

63

13

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

rxuyEJKtVL : Well said. As a fairly new trader myself, I have seen many of my peers fall into the mental traps you described, and consistently lose money until they give up entirely. I completely agree that the fundamentals and technical knowledge is a very small part of being successful in the market - in my opinion, that is the easy part to learn. Controlling your emotions, being patient through red days, and not getting caught up in the current moment/story/etc - That is the hard part.