pacoman

reacted to

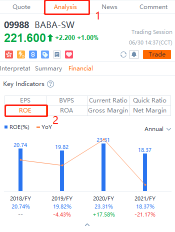

You may have seen the term "ROE" in analyst reports or financial statements many times. Do you know what it is and how the ratio can generate useful information?

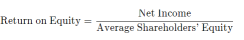

Return on equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders' equity.

What does ROE tell you?

Most of the times, financial ratios need to be compared with peers' data to generate useful information. ROE is no exception. For example, the average ROE in the utility sector could be 10% or less, while a technology or retail firm with smaller balance sheet accounts may have ROE levels of 18% or more.

...

Return on equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders' equity.

What does ROE tell you?

Most of the times, financial ratios need to be compared with peers' data to generate useful information. ROE is no exception. For example, the average ROE in the utility sector could be 10% or less, while a technology or retail firm with smaller balance sheet accounts may have ROE levels of 18% or more.

...

+1

97

27

pacoman

reacted to

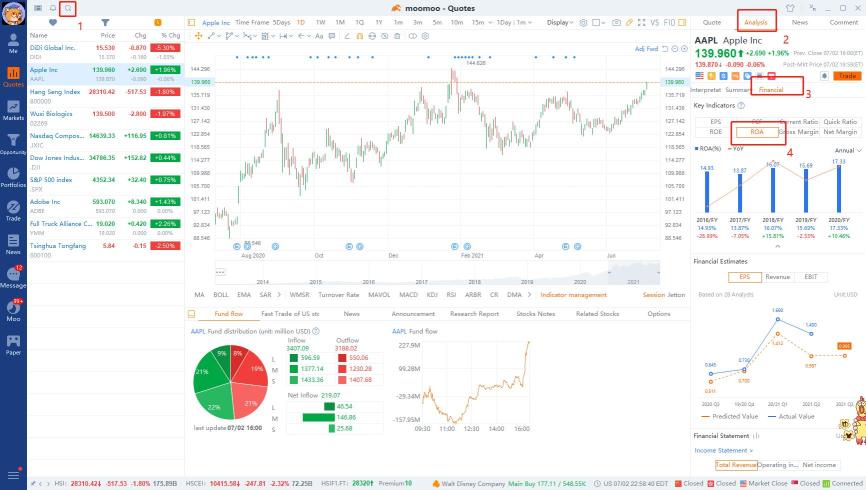

You may have seen the term "ROA" in analyst reports or financial statements many times. Do you know what it is and how the ratio can generate useful information?

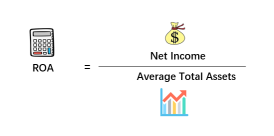

What is ROA?

The return on assets (ROA) shows the percentage of how profitable a company's assets are in generating revenue.

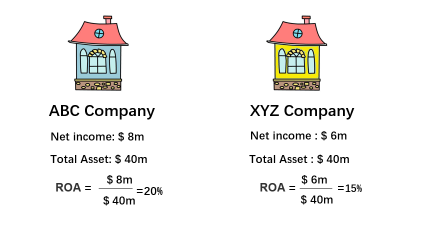

What does ROA tell you?

Return on assets (ROA) is an indicator of how profitable a company is relative to its total assets.

ROA is displayed as a percentage; the higher the ROA is, the better. Higher ROA indicates more asset efficiency.

...

What is ROA?

The return on assets (ROA) shows the percentage of how profitable a company's assets are in generating revenue.

What does ROA tell you?

Return on assets (ROA) is an indicator of how profitable a company is relative to its total assets.

ROA is displayed as a percentage; the higher the ROA is, the better. Higher ROA indicates more asset efficiency.

...

+1

260

80

pacoman

reacted to

Previously, we have walked you through some basic financial ratios, such as the current ratio, which reveals - How do I avoid buying shares of a company that might go bankrupt?

In this chapter, we will guide you to find out what other factors can we use to identify risky investments.

Why we need D/E ratios?

When investors perform due diligence before investing, many amateur players simply glance at the top line (revenue) and the bottom line (profit/earning) on the income statement.

...

In this chapter, we will guide you to find out what other factors can we use to identify risky investments.

Why we need D/E ratios?

When investors perform due diligence before investing, many amateur players simply glance at the top line (revenue) and the bottom line (profit/earning) on the income statement.

...

+1

87

19

pacoman

reacted to

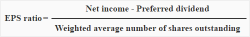

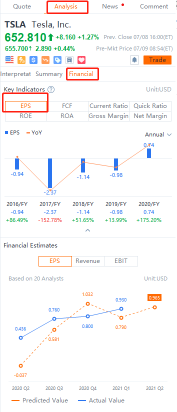

Introduction: EPS

Earnings per share (EPS) is one of the most widely used ways to gauge company profitability.

EPS measures the net income earned on each share of a company's common stock. Basically, it gives you an idea of how profitable a company is.

How is EPS used?

1. There is no rule of thumb to interpret earnings per share of a company. The higher the EPS figure, the better it is. A higher EPS is the sign of higher earnings, strong financial position, and, therefore, a reliable company for investors to invest their money.

...

Earnings per share (EPS) is one of the most widely used ways to gauge company profitability.

EPS measures the net income earned on each share of a company's common stock. Basically, it gives you an idea of how profitable a company is.

How is EPS used?

1. There is no rule of thumb to interpret earnings per share of a company. The higher the EPS figure, the better it is. A higher EPS is the sign of higher earnings, strong financial position, and, therefore, a reliable company for investors to invest their money.

...

+2

132

41

pacoman

reacted to

The quick ratio, also known as the acid-test ratio, helps investors determine a company's short-term liquidity.A company must hold enough liquid assets to cover their short-term debt like short-term bank loans or payroll or else face a possible liquidity crisis, which could lead to bankruptcy.

Driven by the frenzy of WallStreetBets investors, US Cinema AMC entertainment holdings have become one of the most popular stocks of the market in the first half of 2021. However, there is at least one person who is less happy about this madness, which it’s Jianlin Wang, the previous stakeholder of AMC and the founder of Dalian Wanda Group. The company sold almost all of its stake in AMC around May just before AMC stock’s 400% rally, due to a...

Driven by the frenzy of WallStreetBets investors, US Cinema AMC entertainment holdings have become one of the most popular stocks of the market in the first half of 2021. However, there is at least one person who is less happy about this madness, which it’s Jianlin Wang, the previous stakeholder of AMC and the founder of Dalian Wanda Group. The company sold almost all of its stake in AMC around May just before AMC stock’s 400% rally, due to a...

+3

109

12

pacoman

reacted to

By Melody

As we start our investing journey, we might run into all kinds of situations. One of these situations would be the case where we hold shares of a company that has filed for bankruptcy. As soon as it happens, we will see a significant drop in share prices.

In order to avoid being in this situation, what should we do?

First, we have to understand why companies go bankrupt.

Businesses that go bankrupt don't usually do so because they're not profitable. Rather, they go bankrupt because their c...

As we start our investing journey, we might run into all kinds of situations. One of these situations would be the case where we hold shares of a company that has filed for bankruptcy. As soon as it happens, we will see a significant drop in share prices.

In order to avoid being in this situation, what should we do?

First, we have to understand why companies go bankrupt.

Businesses that go bankrupt don't usually do so because they're not profitable. Rather, they go bankrupt because their c...

+1

201

50

pacoman

reacted to

Stock investing requires careful analysis of financial data to find out the company's true worth.

Key financial ratios allow investors to convert raw data(from financial statements) into concise, actionable information. This information is used to evaluate a company's performance, compare companies, industries and conduct fundamental analysis.

In this article, we will take a glance into a company's liquidity, operational efficiency, and profitability ratios to reveal insights regarding the company's performance.

1. Liquidity ratios

Liquidity ratios measure a company's ability to meet short-term debt obligations without raising additional capital. Liquidity ratios include the current ratio, quick ratio, and working capital ratio.

The current ratio is calculated by dividing current assets by current liabilities.

The quick ratio is calculated by dividing liquid assets by current liabilities.

The working capital ratio is calculated simply by dividing total current assets by total current liabilities.

2. Solvency ratios

Solvency ratios also called leverage ratios, measure the amount of debt a company incurs in relation to its equity and assets to evaluate the likelihood of a company staying afloat over the long haul, by paying off its long-term debt as well as the interest on its deb...

Key financial ratios allow investors to convert raw data(from financial statements) into concise, actionable information. This information is used to evaluate a company's performance, compare companies, industries and conduct fundamental analysis.

In this article, we will take a glance into a company's liquidity, operational efficiency, and profitability ratios to reveal insights regarding the company's performance.

1. Liquidity ratios

Liquidity ratios measure a company's ability to meet short-term debt obligations without raising additional capital. Liquidity ratios include the current ratio, quick ratio, and working capital ratio.

The current ratio is calculated by dividing current assets by current liabilities.

The quick ratio is calculated by dividing liquid assets by current liabilities.

The working capital ratio is calculated simply by dividing total current assets by total current liabilities.

2. Solvency ratios

Solvency ratios also called leverage ratios, measure the amount of debt a company incurs in relation to its equity and assets to evaluate the likelihood of a company staying afloat over the long haul, by paying off its long-term debt as well as the interest on its deb...

171

50

pacoman

reacted to

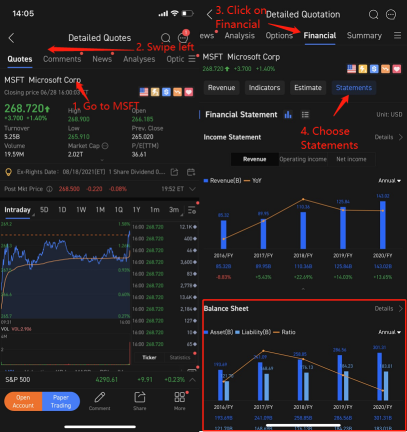

Financial statements are written records that convey the business activities and the financial performance of a company. You can obtain much information from the statements.

Read: SEC Filings: What are they? How can they assist trading?

How to quickly spot key information in SEC filings?

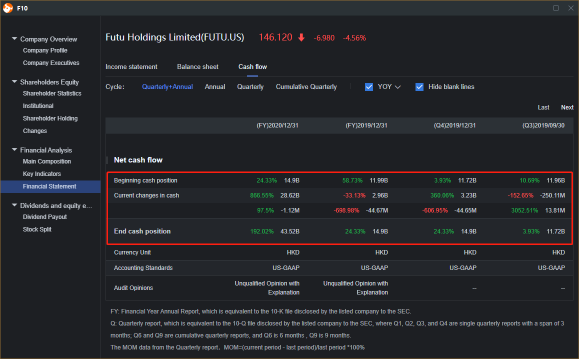

The cash flow statement (CFS) displays the company's cash inflows and outflows. It complements the balance sheet and income statement.

The CFS normally d...

Read: SEC Filings: What are they? How can they assist trading?

How to quickly spot key information in SEC filings?

The cash flow statement (CFS) displays the company's cash inflows and outflows. It complements the balance sheet and income statement.

The CFS normally d...

+2

167

48

pacoman

reacted to

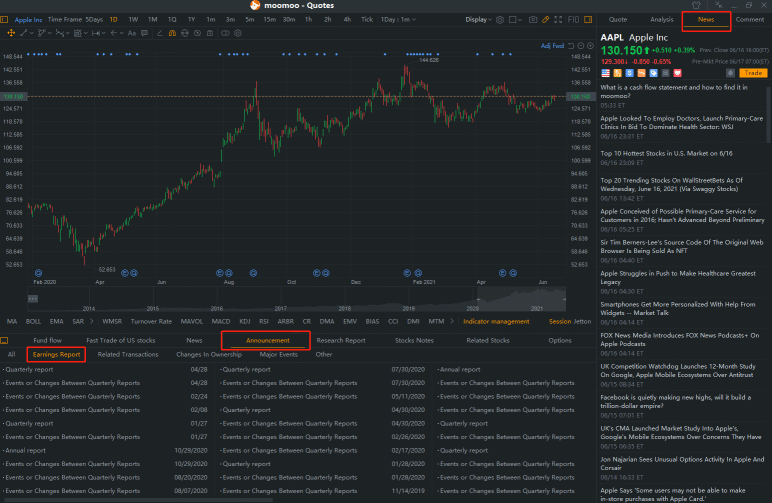

Financial statements are written records that convey the business activities and the financial performance of a company. You can obtain much information from the statements.

Read: SEC Filings: What are they? How can they assist trading?

How to quickly spot key information in SEC filings?

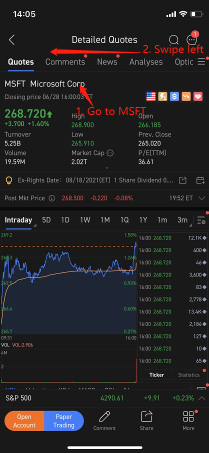

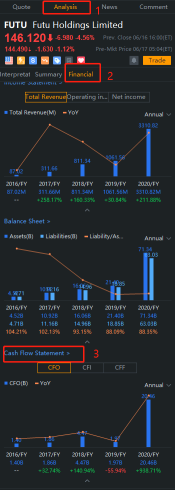

Once you want to invest in a company, in most cases you will want to know its financial performance, and it's convenient for users to find the earnings report and key financial indicators in moomoo....

Read: SEC Filings: What are they? How can they assist trading?

How to quickly spot key information in SEC filings?

Once you want to invest in a company, in most cases you will want to know its financial performance, and it's convenient for users to find the earnings report and key financial indicators in moomoo....

+2

181

67

pacoman

voted

$Gitlab(GTLB.US$ shares jumped 35% in their first day of trading on Thursday after it sold shares well above its expected range in its IPO.

$Gitlab(GTLB.US$ is a cloud-based depository of software. The platform allows developers to share and contribute to each other’s work.

Since its founding almost a decade ago, GitLab has been chasing down GitHub in the source repository market, which also includes Atlassian’s Bitbucket. $Microsoft(MSFT.US$ acquired GitHub in 2018 for $7.5 billion, and since that time GitLab has grown rapidly as the only big independent player in the market.

Revenue in the second quarter jumped 69% from a year earlier to $58.1 million. However, because GitLab spends the equivalent of three-quarters of its revenue on sales and marketing, largely to build its developer user base, the company recorded a net loss of $40.2 million in the latest quarter.

GitLab raised close to $650 million in the offering, and investors purchased over $150 million of additional stock from an entity affiliated with GitLab CEO Sid Sijbrandij.

Despite having an outstanding beginning, Gitlab is still facing severe competition. Github, Red Hat, Bitbucket, Atlassian, etc. are all its strong competitors. Github poses the greatest threat, it is currently the world's largest code hosting platform, used by more than 50 million developers. The top three customers are $Microsoft(MSFT.US$ , $Facebook(FB.US$ , and $Alphabet-C(GOOG.US$ .

Will Gitlab overcome all the obstacles and thrive? Will you bet on it? Vote and comment to tell mooers about your thoughts.

Source:

GitLab jumps 35% in its Nasdaq debut after code-sharing company priced IPO above expected range

$Gitlab(GTLB.US$ is a cloud-based depository of software. The platform allows developers to share and contribute to each other’s work.

Since its founding almost a decade ago, GitLab has been chasing down GitHub in the source repository market, which also includes Atlassian’s Bitbucket. $Microsoft(MSFT.US$ acquired GitHub in 2018 for $7.5 billion, and since that time GitLab has grown rapidly as the only big independent player in the market.

Revenue in the second quarter jumped 69% from a year earlier to $58.1 million. However, because GitLab spends the equivalent of three-quarters of its revenue on sales and marketing, largely to build its developer user base, the company recorded a net loss of $40.2 million in the latest quarter.

GitLab raised close to $650 million in the offering, and investors purchased over $150 million of additional stock from an entity affiliated with GitLab CEO Sid Sijbrandij.

Despite having an outstanding beginning, Gitlab is still facing severe competition. Github, Red Hat, Bitbucket, Atlassian, etc. are all its strong competitors. Github poses the greatest threat, it is currently the world's largest code hosting platform, used by more than 50 million developers. The top three customers are $Microsoft(MSFT.US$ , $Facebook(FB.US$ , and $Alphabet-C(GOOG.US$ .

Will Gitlab overcome all the obstacles and thrive? Will you bet on it? Vote and comment to tell mooers about your thoughts.

Source:

GitLab jumps 35% in its Nasdaq debut after code-sharing company priced IPO above expected range

39

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)