@everyone

PDD CALL 6/5 AT THE MONEY

YANG CALL (day trade; buy and sell today. Do not hold this)

HYG CALL 87 STRIKE BUY 100 CONTRACTS

TLT CALL

Star2top Plays TodayStar2

HYG CALL $87 strike (Buy 100 if you can)

TLT CALL

Reason: They Are Recession Proof Stocks One Is for Our Government

HYG-HIGH Corporate YIELD BONDS which are sold to generate income during times of need. (Requested RECISSION)

TLT-Treasury Bonds That Are Sold to Give Us Money for Things Like Bailouts and FUNNY PACKAGES. Like the One That's Working on Being Paid.

MESSAGE FOR DISCORD TOGETS TO GET ALL THE LATEST PLAYS AND LEARNING CONTENT! for phree lol

PDD CALL 6/5 AT THE MONEY

YANG CALL (day trade; buy and sell today. Do not hold this)

HYG CALL 87 STRIKE BUY 100 CONTRACTS

TLT CALL

Star2top Plays TodayStar2

HYG CALL $87 strike (Buy 100 if you can)

TLT CALL

Reason: They Are Recession Proof Stocks One Is for Our Government

HYG-HIGH Corporate YIELD BONDS which are sold to generate income during times of need. (Requested RECISSION)

TLT-Treasury Bonds That Are Sold to Give Us Money for Things Like Bailouts and FUNNY PACKAGES. Like the One That's Working on Being Paid.

MESSAGE FOR DISCORD TOGETS TO GET ALL THE LATEST PLAYS AND LEARNING CONTENT! for phree lol

Translated

1

2

Okay, so to explain why I posted this image. When Looking Over Stocks You Want to Check These Three Things Sales Rev, Profit Margin and Funding.

Sales Rev; something of value to sell to generate income.

Profit Margin; Are the Items They Have Selling and If So Are They Giving A Positive Return. (Aka Lamborghini money! ) 😂

Incentives; Once All Incurable Are Paid Manufacturing/Payroll, ect. How much did the company put away $$$.

It's Possible to Have Good Revenue and ?$#@$ Poor Profit. (NO ONE PLEASE THAT JUNK! 🥺😭)

Also, you can also have great revenue and profit margins, but the earnings are poor because the production is too high or ?$#@$ money poor management.

JUST SOME STUFF I TODAY 🧐

Sales Rev; something of value to sell to generate income.

Profit Margin; Are the Items They Have Selling and If So Are They Giving A Positive Return. (Aka Lamborghini money! ) 😂

Incentives; Once All Incurable Are Paid Manufacturing/Payroll, ect. How much did the company put away $$$.

It's Possible to Have Good Revenue and ?$#@$ Poor Profit. (NO ONE PLEASE THAT JUNK! 🥺😭)

Also, you can also have great revenue and profit margins, but the earnings are poor because the production is too high or ?$#@$ money poor management.

JUST SOME STUFF I TODAY 🧐

Translated

4

1

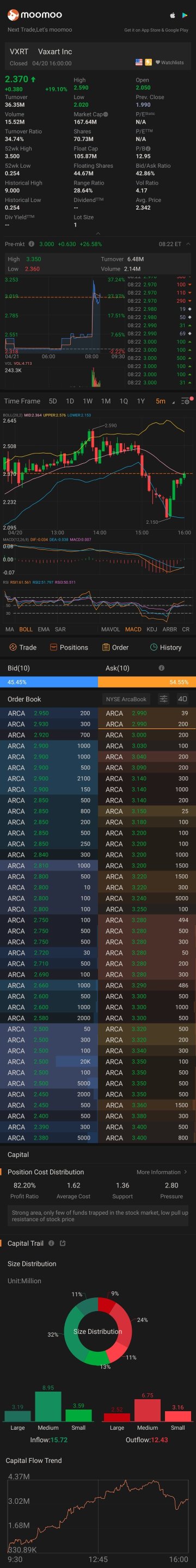

$Vaxart(VXRT.US$ It has recent news and has been bouncing a bit from 2.7-3 it's a great example to study as the market is about to open. what we will see is a big sell off from swing traders/panic sales followed by a POTENTIAL rise. Im posting this more so as an example of market psychology so you can see why something looking good will drop so suddenly. Sit back and watch and if you are happy with the stock find an entry, but do be safe. This is more for learning purposes.

Translated

2

5

Now is a great time to scan the news for strong catalysts. You'd also like to do a screener when the market hits, but if you work like I do morning time scans aren't so bad either.

Translated

1

2

@ariel manosca

The red circles are points of consolidation. Typically at each of these high and low points we look for a candle stick indication to signal a reversal. When a stock has reached a high point it can either break resistance or dip and try again. As traders it's our jobs to locate these entries and trends(this being an upward trend #BULLISH) seek to find an entry upon these dips. You don't ever want to go into a trade without a confirmation of direction. Consolidation is important because it shows you the psychology of the market when something consolidates consider it a moment of rest it isn't a signal to sell or buy. the direction the market will take is typically defined after this moment of consolidation. The first sign of consolidation at the high shows the following bar being a bullish red candlestick forming under the green bar followed by a

The red circles are points of consolidation. Typically at each of these high and low points we look for a candle stick indication to signal a reversal. When a stock has reached a high point it can either break resistance or dip and try again. As traders it's our jobs to locate these entries and trends(this being an upward trend #BULLISH) seek to find an entry upon these dips. You don't ever want to go into a trade without a confirmation of direction. Consolidation is important because it shows you the psychology of the market when something consolidates consider it a moment of rest it isn't a signal to sell or buy. the direction the market will take is typically defined after this moment of consolidation. The first sign of consolidation at the high shows the following bar being a bullish red candlestick forming under the green bar followed by a

Translated

4

3

I have more to share, but I don't want to keep you all for now. Ciao and Happy Hunting ![]()

Translated

These things sound simple, but it requires patience. Lots of study and a keen eye for detail. Think outside of the box it doesn't all have to be analytical charts and graphs, but they do help. Familiarize yourself to what these things are so when you see them you can utilize them. Most importantly use STOP LOSS whenever you trade. Please, don't make my mistake and think you can react faster than the market lol (you can't) if it goes south cut your losses short and fight another day. Utilize stop losses! that is your greatest defence. You want to protect your capital after all you need it to make you more. So, don't sit there watching them burn into the abyss when all you had to do was set it to a 3% loss limit.

Translated

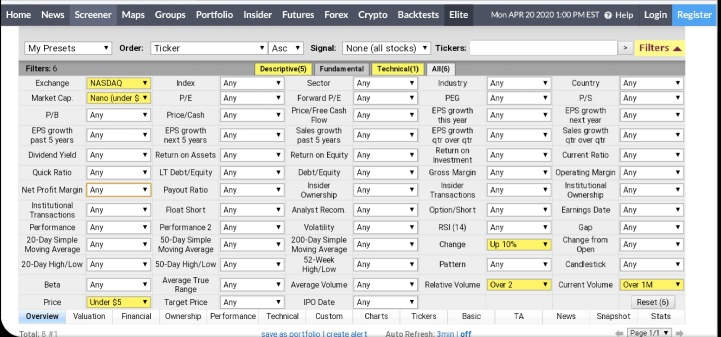

How do you find Penny Stocks?

So, I want to use a screener at Finviz.com. Ill post a photo of my preferences settings.

Exchange is motivation, but you set it to whatever one you are using. I use Nasdaq which im sure most of you do as well.

Price is put under $5 (underwear penny stock is under 10) but I'm poor haha 😅

Change shows the price change within the previous day I like to use 10% because you only get 3 trades within the week. So, try to pick the best of the best.

Relative volume allows us to see where the ingredients are at. This just means that the volume has double the amount of motivation. So, if its average is 100k it's now 200k, Becau

So, I want to use a screener at Finviz.com. Ill post a photo of my preferences settings.

Exchange is motivation, but you set it to whatever one you are using. I use Nasdaq which im sure most of you do as well.

Price is put under $5 (underwear penny stock is under 10) but I'm poor haha 😅

Change shows the price change within the previous day I like to use 10% because you only get 3 trades within the week. So, try to pick the best of the best.

Relative volume allows us to see where the ingredients are at. This just means that the volume has double the amount of motivation. So, if its average is 100k it's now 200k, Becau

Translated

Some terms to know when starting out.

Bullish: Forward trending; price rising rapidly or with great upward momentum. This is typically due to a form of catalyst(Penny stocks; without news= Dud)

Bearish: Downward trending; Price dropping rapidly. This is also due to poor news or relatable world events. (Example; OPEC oil war vs All oil companies)

🏆Catalysts: News; Typically mergers, Direct offerings, product releases, Quarterly and FDA approvals. All are powerful forms of news that would either make or break a stock. Keep an eye on the news! it's highly important.

Support: It means a level or price in which a stock tends to have trouble moving passed ( downward trend)

Resistance: A level or price a stock has trouble breaking. (Upward trend)

Fun fact;

+ Whenever you break you resistance level it becomes your new support level. Keep this in mind! it'll help you find entry into tr

Bullish: Forward trending; price rising rapidly or with great upward momentum. This is typically due to a form of catalyst(Penny stocks; without news= Dud)

Bearish: Downward trending; Price dropping rapidly. This is also due to poor news or relatable world events. (Example; OPEC oil war vs All oil companies)

🏆Catalysts: News; Typically mergers, Direct offerings, product releases, Quarterly and FDA approvals. All are powerful forms of news that would either make or break a stock. Keep an eye on the news! it's highly important.

Support: It means a level or price in which a stock tends to have trouble moving passed ( downward trend)

Resistance: A level or price a stock has trouble breaking. (Upward trend)

Fun fact;

+ Whenever you break you resistance level it becomes your new support level. Keep this in mind! it'll help you find entry into tr

Translated

9

3

https://youtu.be/C3KRwfj9F8Q

This guy really gives great information as to what candlesticks and how to go about trading with them. 😎 this is just one piece of the puzzle guys. watch this a few times and try Out some free charts to practice on using “chartmantra” to track your progression. Next, I want you guys to learn how to find and resist Resistance and Support.

This guy really gives great information as to what candlesticks and how to go about trading with them. 😎 this is just one piece of the puzzle guys. watch this a few times and try Out some free charts to practice on using “chartmantra” to track your progression. Next, I want you guys to learn how to find and resist Resistance and Support.

Translated

3

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)