kristianna44

liked

Follow the current trend to buy/sell

Investment is very simple, you can just follow the trend; but sometimes it’s extremely hard for human nature.![]() Investors like to complicate the simple things, and they are anxious about the buying/selling points.

Investors like to complicate the simple things, and they are anxious about the buying/selling points.![]()

![]()

![]() I think the way to profit is not to see the market correctly, but to have the arrogance to gain a lot when you follow the trend properly, and the courage to face the failure. Investors must learn to move forward in the mist and strengthen their confidence.

I think the way to profit is not to see the market correctly, but to have the arrogance to gain a lot when you follow the trend properly, and the courage to face the failure. Investors must learn to move forward in the mist and strengthen their confidence.

1. Cut loss and let profit run

I think investment is essentially a risk management game, not a profit-seeking. We have to set the stop loss level reasonably, since the indicator is what we can control, the profit is controlled by the market.![]()

Recently I pay attention to $Lucid Group(LCID.US$ which is the combination of $Tesla(TSLA.US$ and $Ferrari(RACE.US$ , I like this new energy car which appearance is high-end, so I bought the stock at $22.

2. Buying stocks is buying companies

Trend investors buy at a high price after an uptrend is formed which take advantage of the trend, and sell them at a higher price when the market changes.![]() When buying at a low price and the downtrend is forming, they should sell them at a lower price decisively so as not to loss much. Stock picking is not as good as picking time, and picking time is inferior to picking momentum.

When buying at a low price and the downtrend is forming, they should sell them at a lower price decisively so as not to loss much. Stock picking is not as good as picking time, and picking time is inferior to picking momentum.

For example, once my dad posited in $Sea(SE.US$ at 35 dollars, now the price has risen 10 times. This company directly copied the business models of $TENCENT(00700.HK$ and $Alibaba(BABA.US$ to Southeast Asia, and has ranked first in games and e-commerce in most countries. I am very optimistic about the company, so I bought it.

3. Read more investment books

I like to find answers in books, so I read a lot of classics which are written by Warren E. Buffett/Philip A. Fisher/Charlie Thomas Munger/Benjamin Graham/John Templeton/Peter Lynch. The stock market rises slowly but falls quickly, because the explosive power of fear far exceeds the desire of greed. The prices need purchasing power to rise, but can fall freely as long as their own gravity! Buffett said: "As long as an investor can avoid big mistakes, he won't worry about it next ".![]()

![]()

![]()

There is no “best” points for buying/selling, what we can do is to find the "most suitable" one. Every point of the transaction is the result of careful consideration, but there is no guarantee that every step is correct. I have heard lots of theories which are so difficult to implement. It is difficult to invest in terms of waiting, upholding and being emotional. Fundamentally speaking, it’s hard for us to break through ourselves.

Investment is very simple, you can just follow the trend; but sometimes it’s extremely hard for human nature.

1. Cut loss and let profit run

I think investment is essentially a risk management game, not a profit-seeking. We have to set the stop loss level reasonably, since the indicator is what we can control, the profit is controlled by the market.

Recently I pay attention to $Lucid Group(LCID.US$ which is the combination of $Tesla(TSLA.US$ and $Ferrari(RACE.US$ , I like this new energy car which appearance is high-end, so I bought the stock at $22.

2. Buying stocks is buying companies

Trend investors buy at a high price after an uptrend is formed which take advantage of the trend, and sell them at a higher price when the market changes.

For example, once my dad posited in $Sea(SE.US$ at 35 dollars, now the price has risen 10 times. This company directly copied the business models of $TENCENT(00700.HK$ and $Alibaba(BABA.US$ to Southeast Asia, and has ranked first in games and e-commerce in most countries. I am very optimistic about the company, so I bought it.

3. Read more investment books

I like to find answers in books, so I read a lot of classics which are written by Warren E. Buffett/Philip A. Fisher/Charlie Thomas Munger/Benjamin Graham/John Templeton/Peter Lynch. The stock market rises slowly but falls quickly, because the explosive power of fear far exceeds the desire of greed. The prices need purchasing power to rise, but can fall freely as long as their own gravity! Buffett said: "As long as an investor can avoid big mistakes, he won't worry about it next ".

There is no “best” points for buying/selling, what we can do is to find the "most suitable" one. Every point of the transaction is the result of careful consideration, but there is no guarantee that every step is correct. I have heard lots of theories which are so difficult to implement. It is difficult to invest in terms of waiting, upholding and being emotional. Fundamentally speaking, it’s hard for us to break through ourselves.

5

3

kristianna44

liked

There is never a correct timing to buy and sell that is same for everyone!

When it comes to trading, it is always buy low and sell high. Or sell high and buy low that happens in our trade as well.

It depends on your enter and exit positions to start off.

But always use fundamental analysis to decide if the stock is worth buying. For example, if the company cashflow position is properly managed? The revenue is achieved against budgeted or forecasted? The actual and forecasted figures give a good gauge on how well the management of the company is performing. Is there consistency in the performance on a periodic basis? Debt ratio and other ratios if it is performing according to benchmark.

Technical analysis is always gived a good additional information and dimension for you to read the trend better! When is a good time to buy and sell. Reading the chart with MAVOL & MACD lines will help us to see the position just before we decide to buy or sell after we had made a well informed fundamental analysis. When it crosses and intersects?

It will give us a better insight of when to buy or to sell.

Good Luck!

👍🏽👍🏽👍🏽

⭐️⭐️⭐️

🔥🔥🔥

When it comes to trading, it is always buy low and sell high. Or sell high and buy low that happens in our trade as well.

It depends on your enter and exit positions to start off.

But always use fundamental analysis to decide if the stock is worth buying. For example, if the company cashflow position is properly managed? The revenue is achieved against budgeted or forecasted? The actual and forecasted figures give a good gauge on how well the management of the company is performing. Is there consistency in the performance on a periodic basis? Debt ratio and other ratios if it is performing according to benchmark.

Technical analysis is always gived a good additional information and dimension for you to read the trend better! When is a good time to buy and sell. Reading the chart with MAVOL & MACD lines will help us to see the position just before we decide to buy or sell after we had made a well informed fundamental analysis. When it crosses and intersects?

It will give us a better insight of when to buy or to sell.

Good Luck!

👍🏽👍🏽👍🏽

⭐️⭐️⭐️

🔥🔥🔥

7

4

kristianna44

liked

Spoiler:

At the end of this post, there is a chance for you to win points!

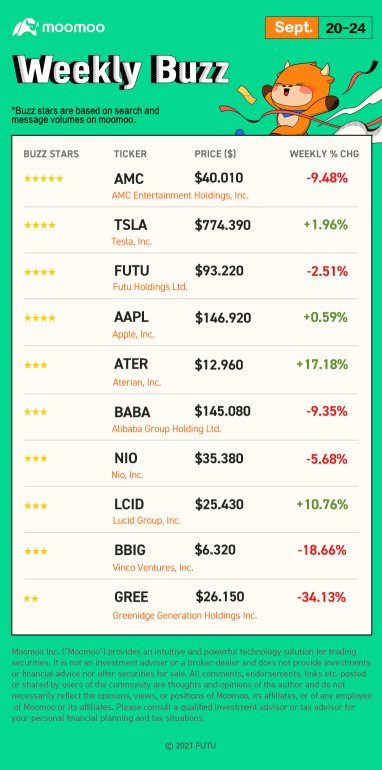

Happy Monday mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part One: Make Your Choices

Part Two: Buzzing Stocks List & Mooers Comments

Every major index moved higher last week. Here is the weekly buzzing stock list of last week:

1. AMC - Buzzing Stars: ⭐⭐⭐⭐⭐

After hitting a high of $52.79 on Sept. 13, $AMC Entertainment(AMC.US$ entered into a downtrend and declined to a low of $40.010 last Friday.

● Mooers comment

@demntia:

2. TSLA - Buzzing Stars: ⭐⭐⭐⭐

Tesla shares closed at $774.390 last Friday after delivering its beta button, which brings the next level of autonomous driving to its car owners.

● Mooers comment

@laksh: Tesla is just starting to warm up

Aside from the huge potential in the future, the near term catalysts as follows:

1) 3rd Quarter deliveries, 2nd Oct (Wall street est: 220k, personal opinion: 235-240k)

2) AGM Oct 7th in Giga Texas (Potentially something could be announced since they have chosen to do it here)

3) FSD Wide roll out (By 3rd of Oct many more drivers shd be driving using 10.1 after the 7 day period lapses to assess behavior)

Read More...

3. FUTU - Buzzing Stars: ⭐⭐⭐⭐

Closing at $93.220, FUTU stock registered a weekly decrease of 2.51%.

● Mooers comment

@GratefulPanda: Great little feature of moomoo

This is a small feature, but I really appreciate how my watchlist will automatically rearrange themselves to show the stocks from active markets at the top of my watchlist. Read more...

4. AAPL - Buzzing Stars: ⭐⭐⭐⭐

Apple shares rose 0.59% to $146.920 last week, with new Apple iPhone models hit the stores last Friday.

● Mooers comment

@GoldSeeker: Here to show off my iphone 13 pro

@Apollod Wed: The iPhone 13 series boxes have also shrunk.Is this for environmental protection?

5. ATER - Buzzing Stars: ⭐⭐⭐

Shares of ATER finally stood at $12.960 with a weekly increase of 17.18% after reaching an agreement with its lender High Trail to pay down its outstanding secured term debt last Thursday.

● Mooers comment

@several-Ad3818: $Aterian(ATER.US$ I tought it would have opened green. anyone has updates on short interest and available shares to short?

6. BABA - Buzzing Stars: ⭐⭐⭐

BABA stock was down 9.35% last week and its price closed at $145.080 with its news over the tech crackdown in China.

● Mooers comment

Share your idea with @orangejusabout Market sentiments >> Value

$Alibaba(BABA.US$ Unbelievable. A company with such huge profit margins and cash stockpile, is going down day after day from any and all negative news, even if it had nothing to do with it.

7. NIO - Buzzing Stars: ⭐⭐⭐

NIO stock was in a downtrend last week despite officially rolling out the new battery last Thursday, closing at $35.380 after declining 1.75% last Friday.

● Mooers comment

@sun2038: $NIO Inc(NIO.US$ bought at 36, thinking whether sell at 46. Not sure possible or not? Any prediction on future? thanks

What is your prediction?

8. LCID - Buzzing Stars: ⭐⭐⭐

LCID stock closed at $25.430 with a weekly rise of 10.76%, registering three weeks of continuous increase. The company is well-funded, and nearing the start of production of its first vehicle model, the "Lucid Air".

● Mooers comment

@Tangobull: $Lucid Group(LCID.US$ buy for future, EV Ferrari.

What's your view?

9. BBIG - Buzzing Stars: ⭐⭐⭐

As Fed hints at tapering, shares of BBIG closed at $6.320 last Friday following a four consecutive days fall.

● Mooers comment

@Timothy Roberts: $Vinco Ventures(BBIG.US$reached my target zone (61.8 Fib) & can correct even more. If you want to buy long term: Do it step by step;)

10. GREE - Buzzing Stars:⭐⭐

After Greenidge Generation and Support.com’s merger, GREE has now tumbled by 34.13% over the past week and 54.12% during the past month.

● Mooers comment

@Pocodo: $Greenidge Generation(GREE.US$ In this moment, I rather believe hat cow can climb tree than GREE can go GREEN. 😬😬😬

![]() Thanks for your reading!

Thanks for your reading!

Part Three: Weekly Topic

![]() Time to be rewarded for your great insights and knowledge!

Time to be rewarded for your great insights and knowledge!

This week, we'd like to invite you to comment below and share your view on:

"Everyone says I should invest in stocks, but I am nervous about the markets. Should I be? And what should I invest?"

Disclaimer: Comments below are made available for informational purposes only. Before investing, please consult a licensed professional.

We will select 10 TOP COMMENTS by next Monday.

Winners will get 288 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

Top Comment Technique:

● Fundamental / Technical / Capital Analyses

● Personal Trading Experience

● Any bright insights or knowledge

How to find Rewards Club?

Previous of WeeklyBuzz

Weekly Buzz: "The only green stocks I own right now."

Weekly Buzz: "I’ve definitely learned my lesson this year. "

At the end of this post, there is a chance for you to win points!

Happy Monday mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part One: Make Your Choices

Part Two: Buzzing Stocks List & Mooers Comments

Every major index moved higher last week. Here is the weekly buzzing stock list of last week:

1. AMC - Buzzing Stars: ⭐⭐⭐⭐⭐

After hitting a high of $52.79 on Sept. 13, $AMC Entertainment(AMC.US$ entered into a downtrend and declined to a low of $40.010 last Friday.

● Mooers comment

@demntia:

2. TSLA - Buzzing Stars: ⭐⭐⭐⭐

Tesla shares closed at $774.390 last Friday after delivering its beta button, which brings the next level of autonomous driving to its car owners.

● Mooers comment

@laksh: Tesla is just starting to warm up

Aside from the huge potential in the future, the near term catalysts as follows:

1) 3rd Quarter deliveries, 2nd Oct (Wall street est: 220k, personal opinion: 235-240k)

2) AGM Oct 7th in Giga Texas (Potentially something could be announced since they have chosen to do it here)

3) FSD Wide roll out (By 3rd of Oct many more drivers shd be driving using 10.1 after the 7 day period lapses to assess behavior)

Read More...

3. FUTU - Buzzing Stars: ⭐⭐⭐⭐

Closing at $93.220, FUTU stock registered a weekly decrease of 2.51%.

● Mooers comment

@GratefulPanda: Great little feature of moomoo

This is a small feature, but I really appreciate how my watchlist will automatically rearrange themselves to show the stocks from active markets at the top of my watchlist. Read more...

4. AAPL - Buzzing Stars: ⭐⭐⭐⭐

Apple shares rose 0.59% to $146.920 last week, with new Apple iPhone models hit the stores last Friday.

● Mooers comment

@GoldSeeker: Here to show off my iphone 13 pro

@Apollod Wed: The iPhone 13 series boxes have also shrunk.Is this for environmental protection?

5. ATER - Buzzing Stars: ⭐⭐⭐

Shares of ATER finally stood at $12.960 with a weekly increase of 17.18% after reaching an agreement with its lender High Trail to pay down its outstanding secured term debt last Thursday.

● Mooers comment

@several-Ad3818: $Aterian(ATER.US$ I tought it would have opened green. anyone has updates on short interest and available shares to short?

6. BABA - Buzzing Stars: ⭐⭐⭐

BABA stock was down 9.35% last week and its price closed at $145.080 with its news over the tech crackdown in China.

● Mooers comment

Share your idea with @orangejusabout Market sentiments >> Value

$Alibaba(BABA.US$ Unbelievable. A company with such huge profit margins and cash stockpile, is going down day after day from any and all negative news, even if it had nothing to do with it.

7. NIO - Buzzing Stars: ⭐⭐⭐

NIO stock was in a downtrend last week despite officially rolling out the new battery last Thursday, closing at $35.380 after declining 1.75% last Friday.

● Mooers comment

@sun2038: $NIO Inc(NIO.US$ bought at 36, thinking whether sell at 46. Not sure possible or not? Any prediction on future? thanks

What is your prediction?

8. LCID - Buzzing Stars: ⭐⭐⭐

LCID stock closed at $25.430 with a weekly rise of 10.76%, registering three weeks of continuous increase. The company is well-funded, and nearing the start of production of its first vehicle model, the "Lucid Air".

● Mooers comment

@Tangobull: $Lucid Group(LCID.US$ buy for future, EV Ferrari.

What's your view?

9. BBIG - Buzzing Stars: ⭐⭐⭐

As Fed hints at tapering, shares of BBIG closed at $6.320 last Friday following a four consecutive days fall.

● Mooers comment

@Timothy Roberts: $Vinco Ventures(BBIG.US$reached my target zone (61.8 Fib) & can correct even more. If you want to buy long term: Do it step by step;)

10. GREE - Buzzing Stars:⭐⭐

After Greenidge Generation and Support.com’s merger, GREE has now tumbled by 34.13% over the past week and 54.12% during the past month.

● Mooers comment

@Pocodo: $Greenidge Generation(GREE.US$ In this moment, I rather believe hat cow can climb tree than GREE can go GREEN. 😬😬😬

Part Three: Weekly Topic

This week, we'd like to invite you to comment below and share your view on:

"Everyone says I should invest in stocks, but I am nervous about the markets. Should I be? And what should I invest?"

Disclaimer: Comments below are made available for informational purposes only. Before investing, please consult a licensed professional.

We will select 10 TOP COMMENTS by next Monday.

Winners will get 288 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

Top Comment Technique:

● Fundamental / Technical / Capital Analyses

● Personal Trading Experience

● Any bright insights or knowledge

How to find Rewards Club?

Previous of WeeklyBuzz

Weekly Buzz: "The only green stocks I own right now."

Weekly Buzz: "I’ve definitely learned my lesson this year. "

+3

80

97

kristianna44

liked

Asia stocks to open steady as Treasury yields jump

Asia stocks are set to open mixed after a jump in Treasury yields weighed on U.S. equities and oil extended a rally spurred by supply concerns.

Futures fell for Japan and Australia, while Hong Kong contracts rose. U.S. futures were little changed. Investors rotated out of growth stocks as the benchmark 10-year U.S. yield briefly topped 1.5% -- a level not seen since June. The tech-heavy $NASDAQ 100 Index(.NDX.US$ underperformed. The $S&P 500 Index(.SPX.US$ dipped, though economically sensitive companies advanced -- like energy, financial and smaller firms.

Senate GOP blocks bill to raise debt limit, avert shutdown

Senate Republicans blocked a bill that would suspend the debt ceiling into December 2022 and keep the government operating past Sept. 30, forcing Democrats to find a new strategy to address two fast-approaching deadlines with acute economic consequences.

Republicans refused to back the debt ceiling suspension because they say they don't approve of Democrats' plans to spend trillions as part of President Joe Biden's far-reaching economic plan.

Chasing winners pays off as Tesla propels momentum ETF to record

While major equity indexes are stuck, one exchange-traded fund that chases past winners is breaking out.

The $iShares MSCI USA Momentum Factor ETF(MTUM.US$, which tracks stocks that have outperformed in recent months, climbed for a fifth day, surpassing its August peak to hit a fresh high. Helping buttress the gain was $Tesla(TSLA.US$, the fund's top holding that climbed 2.2% for its 14th gain in past 16 sessions. $JPMorgan(JPM.US$, the No. 2, advanced 2.4% to a record.

Netflix's gaming push is coming together, but lacks release date

$Netflix(NFLX.US$ Co-Chief Executive Officer Ted Sarandos said he's thrilled with the company's efforts to expand into gaming, but timing of the plan remains foggy. The embrace of video games marks Netflix's first significant foray beyond TV shows and films

Hot-dog restaurant chain Portillo's files to go public on Nasdaq

Hot-dog restaurant chain Portilo's filed to go public as a rising number of consumer companies tap the equity markets to support growth. The company listed the size of its planned initial public offering as $100 million.

The move adds to what has been a busy year for IPOs on U.S. exchanges, particularly for consumer companies. Restaurant payments firm $Toast(TOST.US$ and coffee chain $Dutch Bros(BROS.US$ recently jumped in their trading debuts, while companies including Authentic Brands and $Allbirds(BIRD.US$ are planning to go public.

TikTok tops 1 billion monthly users

More than 1 billion people use TikTok every month, according to a statement posted on the video-sharing app's website Monday. The app was the most downloaded nongame app in August 2021, according to Sensor Tower, an analytics firm.

TikTok said this summer that it plans to allow users to create longer videos, part of an effort to help its top users make more money.

Entertainment giant Endeavor to buy sports-betting business for $1.2 billion

Entertainment giant $Endeavor Group(EDR.US$ has agreed to buy an online sports-betting business from game developer $Scientific Games Corp(SGMS.US$ for $1.2 billion in cash and stock, the latest deal to build on the booming U.S. sports-wagering industry.

Casino operators, sports leagues and tech and media companies have struck a wave of deals, eyeing a burgeoning sports-betting market in the U.S. that could be valued around $40 billion within a decade by some industry estimates.

Oil prices hit three-year high as gas crunch starts to affect crude market

Brent, the international benchmark, rose for a fifth straight day, adding 1.4 per cent to $79.22 a barrel. The price of Brent has advanced about 50 per cent this year and 9 per cent this month.

The current global oil supply-demand deficit is larger than expected. $Goldman Sachs(GS.US$, one of the most influential banks in commodity markets, said it expected the rally to continue and forecast Brent to hit $90 a barrel by the end of the year, up from a previous estimate of $80.

Source: Bloomberg, WSJ, Financial Times

Asia stocks are set to open mixed after a jump in Treasury yields weighed on U.S. equities and oil extended a rally spurred by supply concerns.

Futures fell for Japan and Australia, while Hong Kong contracts rose. U.S. futures were little changed. Investors rotated out of growth stocks as the benchmark 10-year U.S. yield briefly topped 1.5% -- a level not seen since June. The tech-heavy $NASDAQ 100 Index(.NDX.US$ underperformed. The $S&P 500 Index(.SPX.US$ dipped, though economically sensitive companies advanced -- like energy, financial and smaller firms.

Senate GOP blocks bill to raise debt limit, avert shutdown

Senate Republicans blocked a bill that would suspend the debt ceiling into December 2022 and keep the government operating past Sept. 30, forcing Democrats to find a new strategy to address two fast-approaching deadlines with acute economic consequences.

Republicans refused to back the debt ceiling suspension because they say they don't approve of Democrats' plans to spend trillions as part of President Joe Biden's far-reaching economic plan.

Chasing winners pays off as Tesla propels momentum ETF to record

While major equity indexes are stuck, one exchange-traded fund that chases past winners is breaking out.

The $iShares MSCI USA Momentum Factor ETF(MTUM.US$, which tracks stocks that have outperformed in recent months, climbed for a fifth day, surpassing its August peak to hit a fresh high. Helping buttress the gain was $Tesla(TSLA.US$, the fund's top holding that climbed 2.2% for its 14th gain in past 16 sessions. $JPMorgan(JPM.US$, the No. 2, advanced 2.4% to a record.

Netflix's gaming push is coming together, but lacks release date

$Netflix(NFLX.US$ Co-Chief Executive Officer Ted Sarandos said he's thrilled with the company's efforts to expand into gaming, but timing of the plan remains foggy. The embrace of video games marks Netflix's first significant foray beyond TV shows and films

Hot-dog restaurant chain Portillo's files to go public on Nasdaq

Hot-dog restaurant chain Portilo's filed to go public as a rising number of consumer companies tap the equity markets to support growth. The company listed the size of its planned initial public offering as $100 million.

The move adds to what has been a busy year for IPOs on U.S. exchanges, particularly for consumer companies. Restaurant payments firm $Toast(TOST.US$ and coffee chain $Dutch Bros(BROS.US$ recently jumped in their trading debuts, while companies including Authentic Brands and $Allbirds(BIRD.US$ are planning to go public.

TikTok tops 1 billion monthly users

More than 1 billion people use TikTok every month, according to a statement posted on the video-sharing app's website Monday. The app was the most downloaded nongame app in August 2021, according to Sensor Tower, an analytics firm.

TikTok said this summer that it plans to allow users to create longer videos, part of an effort to help its top users make more money.

Entertainment giant Endeavor to buy sports-betting business for $1.2 billion

Entertainment giant $Endeavor Group(EDR.US$ has agreed to buy an online sports-betting business from game developer $Scientific Games Corp(SGMS.US$ for $1.2 billion in cash and stock, the latest deal to build on the booming U.S. sports-wagering industry.

Casino operators, sports leagues and tech and media companies have struck a wave of deals, eyeing a burgeoning sports-betting market in the U.S. that could be valued around $40 billion within a decade by some industry estimates.

Oil prices hit three-year high as gas crunch starts to affect crude market

Brent, the international benchmark, rose for a fifth straight day, adding 1.4 per cent to $79.22 a barrel. The price of Brent has advanced about 50 per cent this year and 9 per cent this month.

The current global oil supply-demand deficit is larger than expected. $Goldman Sachs(GS.US$, one of the most influential banks in commodity markets, said it expected the rally to continue and forecast Brent to hit $90 a barrel by the end of the year, up from a previous estimate of $80.

Source: Bloomberg, WSJ, Financial Times

51

4

kristianna44

reacted to

$AMC Entertainment(AMC.US$ either u all in or all out now and u see us at 💯 Money is only for those with patience look at the inflow its green means more and more buying ! Oh ya dont buy wrongly its AMC not AMCX i dont kw why people can buy wrongly haha/ btw the GME trend just like AMC it went from 40 to 75 and drop by to 40 and the next day it went to 150 and drop back to 80 and subsequently it went from 150 to 380 next day yes next day only who knows history will repeat soon or sooner !...

59

26

kristianna44

reacted to

Hi, mooers! We recently found out that a mooer, The Boxing Ring, is presenting interesting investment ideas every day. For example, his discussion on time-traveling got our attention. We are surprised about the events it holds and would love to support the events.

Thus, we are very excited to invite you to join the discussion and claim big rewards!

Before we start, let us give you a "spoiler": There will be 5 winners per weekday and 20 winners every weekend, that is, 45 winners every week. Since The Boxing Ring posts every day, I'm sure that you will have a chance to win the rewards!

How to join this event?

Step 1: Follow 'The Boxing Ring'.

Step 2: Join the latest discussion and comment on the posts to express your thoughts.

Every day, The Boxing Ring will present you with new trading ideas.

Special hints for you

We choose the top 2 'liked' comments and top 3 'insightful' comments to be the day-winners. Please feel free to discuss your trading ideas with other mooers!

You can either make the most insightful comment or win other people's attention to get more 'likes'.

Rewards:

288 moomoo points/person. Limited 1 entry per user per week.

Moomoo will announce last week's winners every Friday.

The first event starts next Monday (Sept 27).

Now, follow The Boxing Ring to join the events!

Thus, we are very excited to invite you to join the discussion and claim big rewards!

Before we start, let us give you a "spoiler": There will be 5 winners per weekday and 20 winners every weekend, that is, 45 winners every week. Since The Boxing Ring posts every day, I'm sure that you will have a chance to win the rewards!

How to join this event?

Step 1: Follow 'The Boxing Ring'.

Step 2: Join the latest discussion and comment on the posts to express your thoughts.

Every day, The Boxing Ring will present you with new trading ideas.

Special hints for you

We choose the top 2 'liked' comments and top 3 'insightful' comments to be the day-winners. Please feel free to discuss your trading ideas with other mooers!

You can either make the most insightful comment or win other people's attention to get more 'likes'.

Rewards:

288 moomoo points/person. Limited 1 entry per user per week.

Moomoo will announce last week's winners every Friday.

The first event starts next Monday (Sept 27).

Now, follow The Boxing Ring to join the events!

![[Giveaway] You're invited! Join the discussion and earn rewards](https://ussnsimg.moomoo.com/1992840384017466868.png/thumb)

![[Giveaway] You're invited! Join the discussion and earn rewards](https://ussnsimg.moomoo.com/7473838653236933331.jpg/thumb)

218

298

kristianna44

reacted to

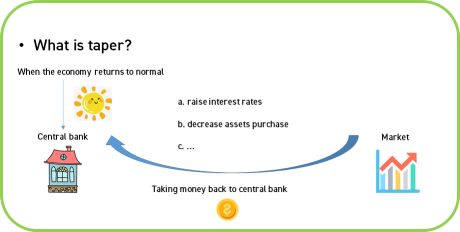

On Wednesday, the Fed said taper may come soon if the economy continues to progress, but didn't announce the specific dates.

This should be the biggest news for the financial market. But wait... what is taper and why is it so important?

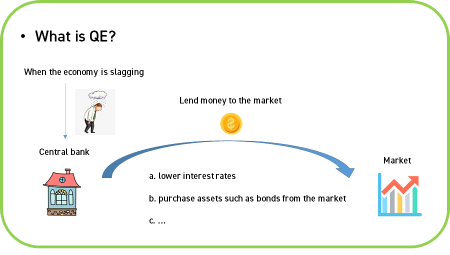

What is taper?

Before talking about taper, we should know what QE is —— the opposite of taper.

When the economy is slagging, the central bank tends to lend more money to the market. This aims to increase consumption and investment, which is a good way to take the sluggish market back to normal.

To lend money out, the central bank can lower interest rates or purchase assets such as bonds from the market. These measures are summarized as QE (Quantitative Easing).

Therefore, the opposite of QE —— taper, is taking money back to the central bank, by raising interest rates or decreasing assets purchases.

With rising interest rates, people who are using leverage may choose to sell their stocks because they can't afford the high cost of borrowing. As more people sell, the stock price will fall. As a result, the stock market may react negatively to taper.

How about this time?

On Wednesday, the Fed said the U.S. central bank could begin scaling back asset purchases in November and complete the process by mid-2022. However, after the Fed's announcement, US stocks staged a comeback from their September rout, which is a proof of strong market confidence.

If there is anything else you would like to know, ask me in the comment section below!![]()

This should be the biggest news for the financial market. But wait... what is taper and why is it so important?

What is taper?

Before talking about taper, we should know what QE is —— the opposite of taper.

When the economy is slagging, the central bank tends to lend more money to the market. This aims to increase consumption and investment, which is a good way to take the sluggish market back to normal.

To lend money out, the central bank can lower interest rates or purchase assets such as bonds from the market. These measures are summarized as QE (Quantitative Easing).

Therefore, the opposite of QE —— taper, is taking money back to the central bank, by raising interest rates or decreasing assets purchases.

With rising interest rates, people who are using leverage may choose to sell their stocks because they can't afford the high cost of borrowing. As more people sell, the stock price will fall. As a result, the stock market may react negatively to taper.

How about this time?

On Wednesday, the Fed said the U.S. central bank could begin scaling back asset purchases in November and complete the process by mid-2022. However, after the Fed's announcement, US stocks staged a comeback from their September rout, which is a proof of strong market confidence.

If there is anything else you would like to know, ask me in the comment section below!

184

52

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)