Icere toh

voted

It takes just a quick glance, maybe three seconds, for someone to evaluate you when you meet for the first time. In this short time, the other person forms an opinion about you based on several clues. And the same goes for an app.

For all the mooers who choose to stay, what's your first impression of moomoo?

If the choices above cannot fully express your feeling, what other words would you use to describe it?

For all the mooers who choose to stay, what's your first impression of moomoo?

If the choices above cannot fully express your feeling, what other words would you use to describe it?

28

10

Icere toh

liked

$NikkoAM-StraitsTrading MSCI China Electric Vehicles and Future Mobility ETF(EVS.SG$ If you don't sell, it will only rise. Get it steady 😂😂😂

Translated

6

1

Icere toh

liked

$Tritech(5G9.SG$ ✅ Follow

Translated

4

Icere toh

liked

Expensify plans to list on the Nasdaq Global Market under the ticker symbol "EXFY." The company is known for its cloud software, which helps businesses manage their finances.

Expensify boosted the price range for its initial public offering. It would sell 9.73 million shares at $25 to $27 each, up from the $23 to $25 price range it set last week. At $27 a share, Expensify’s valuation is $2.18 billion.

The offering is being led by JPMorgan Chase & Co., Citigroup Inc. and Bank of America Corp.

Business Overview

Cloud-based expense management software platform Expensify, based in Portland, Oregon, helps the smallest to the largest businesses simplify the way they manage money.

Since its founding in 2008, it has added over 10 million members to the community, and processed and automated over 1.1 billion expense transactions on the platform.

For the quarter ended June 30, 2021, an average of 639,000 paid members across 53,000 companies and over 200 countries and territories used Expensify to make money easy.

In its filing, Expensify touts its platform as delivering “Expense reports that don’t suck.”

Employees can report an expense for reimbursement by snapping a photo of a receipt. The software can take care of paying a customer's bills, it can create, send and manage invoices, and it can also book flights for business travel.

In addition, Expensify has a business credit card and features that allow users to split bills, request payments and chat with friends.

In 2020, the company saw a total addressable market of roughly $21.5 billion in the U.S., U.K., Canada and Australia, according to the filing.

The platform strategy enables a viral “bottom-up” business model. As of June 30, 2021, 60% of Expensify's revenue can be attributed to an instance where an employee used our application first and recommended it to their manager.

Financial Performance

Expensify reported a loss of $1.7 million, on revenue of $88 million in 2020, compared to a profit of $1.2 million on revenue of $80.5 million in 2019.

But in just the first six months of 2021, the company reported sales of $65 million, up from $40.6 million in the year-ago period.

The company's profit also jumped fourfold to $14.7 million in the first six months of this year, from $3.5 million the same period last year.

Click to view the prospectus

Expensify boosted the price range for its initial public offering. It would sell 9.73 million shares at $25 to $27 each, up from the $23 to $25 price range it set last week. At $27 a share, Expensify’s valuation is $2.18 billion.

The offering is being led by JPMorgan Chase & Co., Citigroup Inc. and Bank of America Corp.

Business Overview

Cloud-based expense management software platform Expensify, based in Portland, Oregon, helps the smallest to the largest businesses simplify the way they manage money.

Since its founding in 2008, it has added over 10 million members to the community, and processed and automated over 1.1 billion expense transactions on the platform.

For the quarter ended June 30, 2021, an average of 639,000 paid members across 53,000 companies and over 200 countries and territories used Expensify to make money easy.

In its filing, Expensify touts its platform as delivering “Expense reports that don’t suck.”

Employees can report an expense for reimbursement by snapping a photo of a receipt. The software can take care of paying a customer's bills, it can create, send and manage invoices, and it can also book flights for business travel.

In addition, Expensify has a business credit card and features that allow users to split bills, request payments and chat with friends.

In 2020, the company saw a total addressable market of roughly $21.5 billion in the U.S., U.K., Canada and Australia, according to the filing.

The platform strategy enables a viral “bottom-up” business model. As of June 30, 2021, 60% of Expensify's revenue can be attributed to an instance where an employee used our application first and recommended it to their manager.

Financial Performance

Expensify reported a loss of $1.7 million, on revenue of $88 million in 2020, compared to a profit of $1.2 million on revenue of $80.5 million in 2019.

But in just the first six months of 2021, the company reported sales of $65 million, up from $40.6 million in the year-ago period.

The company's profit also jumped fourfold to $14.7 million in the first six months of this year, from $3.5 million the same period last year.

Click to view the prospectus

+2

20

7

Icere toh

liked

Earnings and stock price have a direct relation with each other. It can easily be safe to assume that if the earnings are good and the stock is undervalued, the stock price will go up in future. similar can be said about the low earnings and an overvalued stock.

The reason earnings are directly related to the stock price is because, if the stock price is overvalued, then sometimes organizations has to cut their employee salaries, bonuses or sometimes their jobs to cover up the appropriate earnings for their overvalued stock price. This was seen after the pandemic hit, people lost jobs and most quit. Which affected the S&P in a direct way as low workers caused the industries to have higher earnings and stock prices to go up.

However, after pandemic also people started leaving jobs(due to other reasons) and now causing the even higher earnings for companies to get their stock up now. Currently, the US is suffering one of the greatest quits in jobs of the history.

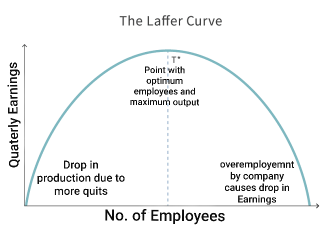

But I expect the companies won't be able to post greater earnings than this. As we know, this also follows the "laffer curve".

with one side being completely employed and posting lower earnings as explained below in the graph.

The point t* denotes the optimum level of employees to achieve the maximum earnings which we are looking at now, in the form of higher stock prices(direct relation). However, if this continues we can be looking at the declining slope of earnings due to low employees and lower production caused by that. This will cause the stock prices to go down in near future.

Another factor to consider for the earnings and the stock price is the market capture. This market capture is caused by greater innovation, increased efficiency and better marketing by the organization. For example AMD has improved their microprocessors in a way that they contain more transistors per chip, performs greater operations per cycle, consumes less energy and more resistant to heat. The similar processors of the similar or higher price range of Intel are lower in benchmark than the AMD processors. Thus causing AMD to capture the microprocessor market(more sales more earnings) and posting higher earnings every year. Now, AMD is also competing against Nvidia in graphics unit market. A recent research shows that AMD graphics cards are more efficient in cryptocurrency mining compared to the Nvidia cards. This shows a promising future for increase in earnings by AMD and causing the stock to rise even further.

Source: investopedia

The Graph shows the increase in earnings of AMD that causes the stock price to go up. With few exceptions of news affecting stock price, but later adjusted thus following the earnings only in long run.

The reason earnings are directly related to the stock price is because, if the stock price is overvalued, then sometimes organizations has to cut their employee salaries, bonuses or sometimes their jobs to cover up the appropriate earnings for their overvalued stock price. This was seen after the pandemic hit, people lost jobs and most quit. Which affected the S&P in a direct way as low workers caused the industries to have higher earnings and stock prices to go up.

However, after pandemic also people started leaving jobs(due to other reasons) and now causing the even higher earnings for companies to get their stock up now. Currently, the US is suffering one of the greatest quits in jobs of the history.

But I expect the companies won't be able to post greater earnings than this. As we know, this also follows the "laffer curve".

with one side being completely employed and posting lower earnings as explained below in the graph.

The point t* denotes the optimum level of employees to achieve the maximum earnings which we are looking at now, in the form of higher stock prices(direct relation). However, if this continues we can be looking at the declining slope of earnings due to low employees and lower production caused by that. This will cause the stock prices to go down in near future.

Another factor to consider for the earnings and the stock price is the market capture. This market capture is caused by greater innovation, increased efficiency and better marketing by the organization. For example AMD has improved their microprocessors in a way that they contain more transistors per chip, performs greater operations per cycle, consumes less energy and more resistant to heat. The similar processors of the similar or higher price range of Intel are lower in benchmark than the AMD processors. Thus causing AMD to capture the microprocessor market(more sales more earnings) and posting higher earnings every year. Now, AMD is also competing against Nvidia in graphics unit market. A recent research shows that AMD graphics cards are more efficient in cryptocurrency mining compared to the Nvidia cards. This shows a promising future for increase in earnings by AMD and causing the stock to rise even further.

Source: investopedia

The Graph shows the increase in earnings of AMD that causes the stock price to go up. With few exceptions of news affecting stock price, but later adjusted thus following the earnings only in long run.

42

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)