Looking promising, I just hope Tesla doesn't divest the robotics business and sell it separately.

Translated

Tesla, big news!

Tesla, big news!

HUXB2020

voted

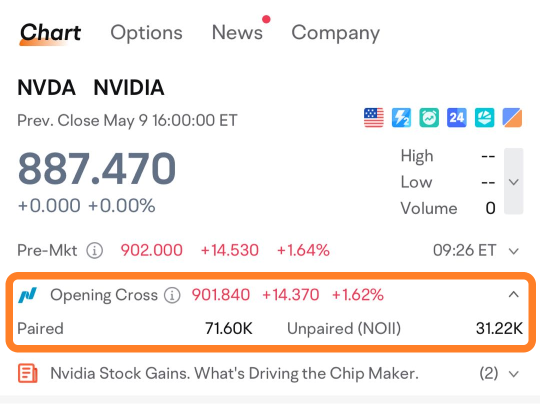

$NVIDIA(NVDA.US$ is releasing its Q1 earnings on May 22, after the U.S. stock market close. How will the whole market react to the AI giant's results? Vote your answer to participate!

Rewards

● An equal share of 10,000 points:

For mooers who correctly guess the price range of $NVIDIA(NVDA.US$'s opening price at 9:30 AM ET May 23 (e.g., If 50 mooers make a correct guess, they will get 200 points!)

(The vote will close ...

Rewards

● An equal share of 10,000 points:

For mooers who correctly guess the price range of $NVIDIA(NVDA.US$'s opening price at 9:30 AM ET May 23 (e.g., If 50 mooers make a correct guess, they will get 200 points!)

(The vote will close ...

153

348

HUXB2020

liked

$British American Tobacco(BTI.US$🎯 2024.3.20 The current price is 30, and the position lost 1.2% due to dividends

New data: 23H2.

Revenue shrank by 1.35% in 2023. Operating profit was affected by huge depreciation and amortization expenses, and net profit was also significantly lost.

If we calculate net profit in 2022, the price-earnings ratio is 8.3, but if we calculate the 5-year average net profit of US$2.8 billion, the price-earnings ratio is 24.8.

The dividend rate is 9.5%. Overall, the valuation is within a reasonable range, but there is a lack of growth.

New data: 23H2.

Revenue shrank by 1.35% in 2023. Operating profit was affected by huge depreciation and amortization expenses, and net profit was also significantly lost.

If we calculate net profit in 2022, the price-earnings ratio is 8.3, but if we calculate the 5-year average net profit of US$2.8 billion, the price-earnings ratio is 24.8.

The dividend rate is 9.5%. Overall, the valuation is within a reasonable range, but there is a lack of growth.

Translated

3

HUXB2020

liked

Question 1:

We all know that TQQQ is three times as long as QQQ, so buying one TQQQ share is equivalent to buying how many QQQ shares? In other words, after buying x shares tqqq, what is the ratio of x and y to achieve the same profit/loss?

If your answer is 3, then you've made a mistake. A clear understanding of the leverage ratio is very important for leveraged ETFs.

The current price of qqq is 426, and tqqq is 56; the ratio of the two rates of change is three times, that is, qqq increased by 1% and tqqq increased by 3%. The actual change in stock price is that qqq rose 4.26, and tqqq rose 1.68. The calculation shows that 4.26/1.68 = 2.5, which means that the increase in 1 share of qqq requires buying 2.5 shares of tqqq to eat.

Question 2:

What is the utilization rate of funds?

As can be seen from the above question, in the case where the profit is the same, the ratio of QQQ and TQQ shares is 1:2.5, and the amount required to invest is 426:140 = 3. Therefore, everyone should be aware that triple leverage is based on capital rather than number of shares. At this point, the results are very intuitive. Next, let's discuss the options issue.

The current monthly option call ATM price is qqq: tqqq = 9.2:3.4 = 2.7. The result we got in question 1 is 2.5, which is very close. However, there is also a share leverage ratio for options.

How to choose:

1...

We all know that TQQQ is three times as long as QQQ, so buying one TQQQ share is equivalent to buying how many QQQ shares? In other words, after buying x shares tqqq, what is the ratio of x and y to achieve the same profit/loss?

If your answer is 3, then you've made a mistake. A clear understanding of the leverage ratio is very important for leveraged ETFs.

The current price of qqq is 426, and tqqq is 56; the ratio of the two rates of change is three times, that is, qqq increased by 1% and tqqq increased by 3%. The actual change in stock price is that qqq rose 4.26, and tqqq rose 1.68. The calculation shows that 4.26/1.68 = 2.5, which means that the increase in 1 share of qqq requires buying 2.5 shares of tqqq to eat.

Question 2:

What is the utilization rate of funds?

As can be seen from the above question, in the case where the profit is the same, the ratio of QQQ and TQQ shares is 1:2.5, and the amount required to invest is 426:140 = 3. Therefore, everyone should be aware that triple leverage is based on capital rather than number of shares. At this point, the results are very intuitive. Next, let's discuss the options issue.

The current monthly option call ATM price is qqq: tqqq = 9.2:3.4 = 2.7. The result we got in question 1 is 2.5, which is very close. However, there is also a share leverage ratio for options.

How to choose:

1...

Translated

16

HUXB2020

commented on

Before starting the text, please be clear: in the market, apart from the most basic treasury bonds and monetary funds, there are almost no risk-free arbitrage opportunities. Low returns do not necessarily correspond to low risks, but high returns necessarily correspond to high risks.

I think stock market investment is an impossible triangle: low risk, high return, short time. Only two of these three can exist at the same time. Even if they are investment geniuses and have a very high winning rate when choosing the right time, they can only increase the chance of appearing in the third place, and cannot completely deviate from this rule. For us retail investors, the easiest and most effective method is to exchange time for space, buy and hold, use longer time, lower risk, and ultimately obtain high profits. Please always remember:When you see attractive high returns, never give up your capital until you understand what kind of risk this investment actually has.

Back to the topic, I don't think TSly or any of the other YieldMax individual stocks covered call ETFs are suitable for simple buy-and-hold, and it's almost impossible to rely on tsly alone to obtain stable income. $YIELDMAX TSLA OPTION INCOME STRATEGY ETF(TSLY.US$ $Tesla(TSLA.US$

TSLY's distribution rate is over 50%. Although it can continue to collect premium in volatile markets and falling markets, there are two things to keep in mind:

1. The price of the premium received...

I think stock market investment is an impossible triangle: low risk, high return, short time. Only two of these three can exist at the same time. Even if they are investment geniuses and have a very high winning rate when choosing the right time, they can only increase the chance of appearing in the third place, and cannot completely deviate from this rule. For us retail investors, the easiest and most effective method is to exchange time for space, buy and hold, use longer time, lower risk, and ultimately obtain high profits. Please always remember:When you see attractive high returns, never give up your capital until you understand what kind of risk this investment actually has.

Back to the topic, I don't think TSly or any of the other YieldMax individual stocks covered call ETFs are suitable for simple buy-and-hold, and it's almost impossible to rely on tsly alone to obtain stable income. $YIELDMAX TSLA OPTION INCOME STRATEGY ETF(TSLY.US$ $Tesla(TSLA.US$

TSLY's distribution rate is over 50%. Although it can continue to collect premium in volatile markets and falling markets, there are two things to keep in mind:

1. The price of the premium received...

Translated

9

4

HUXB2020

voted

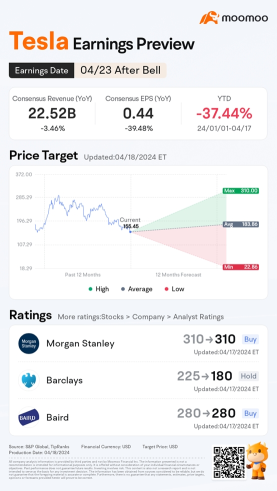

Tesla is releasing its Q1 2024 earnings after the market closes on April 23.

Since its Q4 earnings release, shares of $Tesla(TSLA.US$ have seen a decrease of 29%.![]() Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now!

Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

Since its Q4 earnings release, shares of $Tesla(TSLA.US$ have seen a decrease of 29%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

133

370

HUXB2020

commented on

$Tesla(TSLA.US$

I won 300 shares today. If Elon Musk doesn't sell, I won't sell them.

When he voted to sell the stock, I sold it.

I won 300 shares today. If Elon Musk doesn't sell, I won't sell them.

When he voted to sell the stock, I sold it.

Translated

2

1

HUXB2020

voted

News is circulating that Elon Musk is messaging investors for a chance to invest in his startup xAI, which he is building out of X (Twitter).

Based on reports from Bloomberg and Business Insider, the messages are said to have given investors the opportunity the invest through special purpose vehicles, which means they invest via a single entity.

Currently, xAI is seeking investments at a $15 billion pre-money valuation, with ...

Based on reports from Bloomberg and Business Insider, the messages are said to have given investors the opportunity the invest through special purpose vehicles, which means they invest via a single entity.

Currently, xAI is seeking investments at a $15 billion pre-money valuation, with ...

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)