GreenHarvest

commented on

ColumnsMoomoo to Launch in Australia: Will Offer Australian Investors One-Stop Online Investment Services

Sydney, Dec. 20, 2021 – On December 20, 2021, moomoo, a leading one-stop digital investment platform, announced that it will be launching in Australia. The company will provide Australian investors with premium online investment services. Moomoo has been on a path of exponential international growth and Australia marks its third expansion overseas after a successful launch in US and Singapore. The company made the announcement after its affiliated company secured an Australian Financial Services License granted by the Australian Securities and Investments Commission (ASIC) through an acquisition

As a tech-driven digital investment platform, moomoo’s mission is to make investing easier and more social. After building a strong community of investors and winning awards in the US and Singapore, the company is excited about bringing its services to Australian investors to help them take advantage of all investing opportunities.

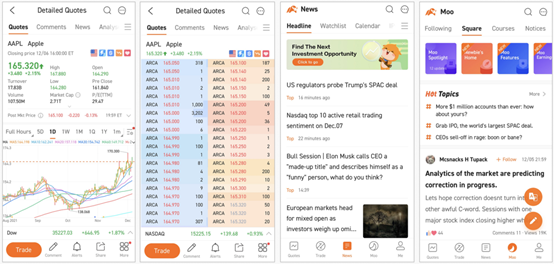

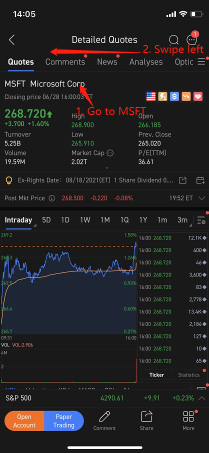

Moomoo stands out from other platforms by offering:

- a free online account-opening experience that can be completed in just minutes;

- a combination of powerful technologies spanning stock trading and market data;

- an interactive online community of 17 million investors worldwide;

- tools that enable the community to share their investing insights anytime, anywhere.

Investors can now trade stocks on the platform and access free real-time quotes, in-depth market analysis, and comprehensive financial news coverage.

Moomoo has quickly become a popular tech-driven brokerage platform among local investors since its launch in the US and Singapore. In the US, moomoo has resonated with sophisticated and retail investors alike, with powerful yet user-friendly tools capable of guiding even professional traders toward more informed decisions. In this year, moomoo won the “Best Active Trading App 2021” by Investing Simple, a leading US financial website, and was also nominated for the Benzinga 2021 awards for “Best Trading Technology” and “Best Investment Research Tech”.

Moomoo has attracted over 220,000 registered users and more than 100,000 paying clients in less than three months since entering the Singapore market. Within just six months of its launch, moomoo’s market share of retail investors in Singapore neared 15%. As of Q3, moomoo has become one of the fastest growing one-stop investment platforms in Singapore, constantly holding a place among the top three financial apps as measured by download volume.

Australia marks moomoo’s next stop. Drawing on its successes in the US and Singapore, moomoo is expected to open up a brand-new market in Australia and bring a unique investment experience to local investors.

About Moomoo

Moomoo positions itself as the next-generation one-stop investment platform that integrates investment transactions, up-to-date news, real-time market data, and an active trading community. Moomoo's mission is to provide investors of all levels with an intuitive and powerful investing platform. Moomoo leverages deep technological R&D capabilities and future-focused operating model to constantly improve the user experience and drive industry-wide innovation. For more information, please visit the official website www.moomoo.com/au.

As a tech-driven digital investment platform, moomoo’s mission is to make investing easier and more social. After building a strong community of investors and winning awards in the US and Singapore, the company is excited about bringing its services to Australian investors to help them take advantage of all investing opportunities.

Moomoo stands out from other platforms by offering:

- a free online account-opening experience that can be completed in just minutes;

- a combination of powerful technologies spanning stock trading and market data;

- an interactive online community of 17 million investors worldwide;

- tools that enable the community to share their investing insights anytime, anywhere.

Investors can now trade stocks on the platform and access free real-time quotes, in-depth market analysis, and comprehensive financial news coverage.

Moomoo has quickly become a popular tech-driven brokerage platform among local investors since its launch in the US and Singapore. In the US, moomoo has resonated with sophisticated and retail investors alike, with powerful yet user-friendly tools capable of guiding even professional traders toward more informed decisions. In this year, moomoo won the “Best Active Trading App 2021” by Investing Simple, a leading US financial website, and was also nominated for the Benzinga 2021 awards for “Best Trading Technology” and “Best Investment Research Tech”.

Moomoo has attracted over 220,000 registered users and more than 100,000 paying clients in less than three months since entering the Singapore market. Within just six months of its launch, moomoo’s market share of retail investors in Singapore neared 15%. As of Q3, moomoo has become one of the fastest growing one-stop investment platforms in Singapore, constantly holding a place among the top three financial apps as measured by download volume.

Australia marks moomoo’s next stop. Drawing on its successes in the US and Singapore, moomoo is expected to open up a brand-new market in Australia and bring a unique investment experience to local investors.

About Moomoo

Moomoo positions itself as the next-generation one-stop investment platform that integrates investment transactions, up-to-date news, real-time market data, and an active trading community. Moomoo's mission is to provide investors of all levels with an intuitive and powerful investing platform. Moomoo leverages deep technological R&D capabilities and future-focused operating model to constantly improve the user experience and drive industry-wide innovation. For more information, please visit the official website www.moomoo.com/au.

153

42

GreenHarvest

commented on

By Melody

As we start our investing journey, we might run into all kinds of situations. One of these situations would be the case where we hold shares of a company that has filed for bankruptcy. As soon as it happens, we will see a significant drop in share prices.

In order to avoid being in this situation, what should we do?

First, we have to understand why companies go bankrupt.

Businesses that go bankrupt don't usually do so because they're not profitable. Rather, they go bankrupt because their c...

As we start our investing journey, we might run into all kinds of situations. One of these situations would be the case where we hold shares of a company that has filed for bankruptcy. As soon as it happens, we will see a significant drop in share prices.

In order to avoid being in this situation, what should we do?

First, we have to understand why companies go bankrupt.

Businesses that go bankrupt don't usually do so because they're not profitable. Rather, they go bankrupt because their c...

+1

201

50

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

GreenHarvest : Great for moomoo!