Chris Ivan Ang

commented on

$NVIDIA(NVDA.US$ When is this going to drop. 853 is the first one, wait or run?

Translated

3

Chris Ivan Ang

voted

Ever dreamed of being at the Nasdaq bell ceremony? Eager to meet with the Nasdaq team and influential YouTubers? Don't miss out on this chance!

Moomoo partners with Nasdaq to bring you closer to the investment world. We're hosting a special event at the Nasdaq Market Site in the heart of New York. Be part of the bell-ring ceremony, gain insights from investment influencers, and connect with Nasdaq's professional traders! We're sending two lucky i...

Moomoo partners with Nasdaq to bring you closer to the investment world. We're hosting a special event at the Nasdaq Market Site in the heart of New York. Be part of the bell-ring ceremony, gain insights from investment influencers, and connect with Nasdaq's professional traders! We're sending two lucky i...

17

3

Chris Ivan Ang

reacted to

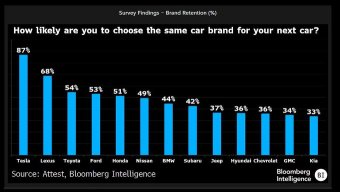

Holy smokas! Almost 90% of people who get $tsla stay with the brand

Once you go Tesla, you never go back

Bullish

$Tesla(TSLA.US$

Once you go Tesla, you never go back

Bullish

$Tesla(TSLA.US$

6

1

Chris Ivan Ang

voted

Hey, mooers! ![]() Welcome back to Moomoo's Feature Challenge, where we help you master powerful tools on moomoo and take on quiz challenges to win rewards!

Welcome back to Moomoo's Feature Challenge, where we help you master powerful tools on moomoo and take on quiz challenges to win rewards!![]()

Feeling lost in the maze of investing without key insights? Discover moomoo's "Financial Estimates" feature, your gateway to essential financial metrics! Today, let's unlock the power of financial data with the "Financial Estimates" feature!

🙋♀️What is Financial ...

Feeling lost in the maze of investing without key insights? Discover moomoo's "Financial Estimates" feature, your gateway to essential financial metrics! Today, let's unlock the power of financial data with the "Financial Estimates" feature!

🙋♀️What is Financial ...

+1

94

123

Chris Ivan Ang

reacted to

$Tesla(TSLA.US$ Conspiracy theory that when stocks soar, there is fake news that makes the stock price bad![]()

Translated

1

Chris Ivan Ang

reacted to

$Tesla(TSLA.US$ The more exciting, the more you buy

Translated

1

hands

hands

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)