$Opendoor Technologies(OPEN.US$

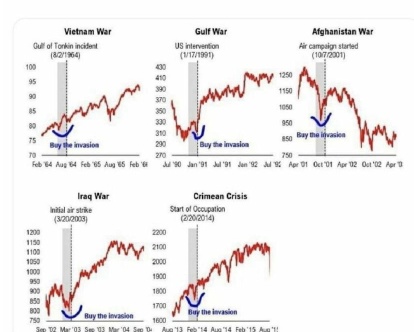

Information on the web. (If there are any inaccuracies in the image, I hope this can be corrected. Thank you) The performance of US stocks after several wars. Everyone take a look and think for yourself.

Of course, I'm praying for peace in the world 🙏

Information on the web. (If there are any inaccuracies in the image, I hope this can be corrected. Thank you) The performance of US stocks after several wars. Everyone take a look and think for yourself.

Of course, I'm praying for peace in the world 🙏

Translated

3

$Opendoor Technologies(OPEN.US$

I just carried a small bench and waited quietly for this day. Although I know, it takes time. The process will be tortuous and the road will be bumpy...

JMP Securities Reiterates Market Outperform on Opendoor Technologies, Maintains $4.5 Price Target

JMP Securities reaffirms that OpenDoor Technologies' market outperforms the market and maintains a target share price of $4.5

JMP Securities Analyst Nicholas Jones Reiterates Opendoor Technologies (NASDAQ: OPEN) with a Market Outperform and Evaluate $4.5 price target.

Nicholas Jones, an analyst at JMP Securities, reiterated that the OpenDoor Technologies (NASDAQ: OPEN) market outperformed the market and maintained a target share price of $4.5.

I just carried a small bench and waited quietly for this day. Although I know, it takes time. The process will be tortuous and the road will be bumpy...

JMP Securities Reiterates Market Outperform on Opendoor Technologies, Maintains $4.5 Price Target

JMP Securities reaffirms that OpenDoor Technologies' market outperforms the market and maintains a target share price of $4.5

JMP Securities Analyst Nicholas Jones Reiterates Opendoor Technologies (NASDAQ: OPEN) with a Market Outperform and Evaluate $4.5 price target.

Nicholas Jones, an analyst at JMP Securities, reiterated that the OpenDoor Technologies (NASDAQ: OPEN) market outperformed the market and maintained a target share price of $4.5.

Translated

4

1

$Opendoor Technologies(OPEN.US$

What a sigh of old blood spewed out 😶🌫️

If really bad news comes out. There's nothing to say either. But today it seems that the March CPI was 0.1% higher than expected (am I missing something? —-Expect correction) OPEN dropped 10%. If the CPI were a few percent higher, would Opendoor probably become a “Closedoor”?

If the Federal Reserve clearly stated, it will not cut interest rates in the past two years; they will still raise interest rates. Then it should have dropped a little more. However, according to reports: “Federal Reserve Meeting Minutes: At the March meeting of the Federal Reserve, almost all participants agreed that it would be appropriate to shift to a less restrictive policy stance at some point this year. —— (There is no denying that interest rates will be cut this year. (Of course, there are certain conditions)” Grandpa Biden also just said, “Interest rate cuts will be postponed for at least a month.” There is no denying the path of cutting interest rates.

If you take a closer look, the turnover rate is not too high, and the volume of transactions is not huge. The visual inspection agency has not scrambled to escape in a trampled manner. Most of them probably feel like a mirror.

The empty man had his mouth full of oil today. I don't know if anyone also bought a ferry ticket to board a boat in this vast ocean.

The hardest thing before Open seems to have been solved, but now I just want to go to battle lightly and start a new chapter.

It's always exploring, and it's working hard. Everything has been refined and improved in the direction of improvement. It's already working with Zillow, Red...

What a sigh of old blood spewed out 😶🌫️

If really bad news comes out. There's nothing to say either. But today it seems that the March CPI was 0.1% higher than expected (am I missing something? —-Expect correction) OPEN dropped 10%. If the CPI were a few percent higher, would Opendoor probably become a “Closedoor”?

If the Federal Reserve clearly stated, it will not cut interest rates in the past two years; they will still raise interest rates. Then it should have dropped a little more. However, according to reports: “Federal Reserve Meeting Minutes: At the March meeting of the Federal Reserve, almost all participants agreed that it would be appropriate to shift to a less restrictive policy stance at some point this year. —— (There is no denying that interest rates will be cut this year. (Of course, there are certain conditions)” Grandpa Biden also just said, “Interest rate cuts will be postponed for at least a month.” There is no denying the path of cutting interest rates.

If you take a closer look, the turnover rate is not too high, and the volume of transactions is not huge. The visual inspection agency has not scrambled to escape in a trampled manner. Most of them probably feel like a mirror.

The empty man had his mouth full of oil today. I don't know if anyone also bought a ferry ticket to board a boat in this vast ocean.

The hardest thing before Open seems to have been solved, but now I just want to go to battle lightly and start a new chapter.

It's always exploring, and it's working hard. Everything has been refined and improved in the direction of improvement. It's already working with Zillow, Red...

Translated

4

$Opendoor Technologies(OPEN.US$

According to reports, “Opendoor Technologies (NYSE: OPEN)'s short listing volume has risen 5.1% since the last report. The company recently reported that it has shorted 77.12 million shares, or 13.82% of all common shares available for trading. Depending on their trading volume, it takes an average of 3.99 days for traders to fill short positions.”

Most of Opendoor's shares are in the hands of institutions and company insiders.

However, the “toxic real estate” (property that lost money) that Opendoor bought before has basically been digested (sold — although there were losses, the company did not cancel the order, and it is also a corporate contract spirit that abides by the principles of the transaction. It can be considered that wherever it falls, it climbs up wherever it falls)

Recently, for the 2017-2019 settlement (before the company went public), the payment was finally paid. This payment was reported as early as 2022's 10K, and the company has already prepared this amount. It won't affect current earnings. Also, there is still plenty of cash that Opendoor can use now. At least for now, they won't go bankrupt because of this money. Moreover, after the company went public, it had a very professional legal and regulatory team. The mistakes made before should have been perfected.

Sooner or later, interest rates will be cut in the foreseeable future.

Personally, I think, based on these circumstances.

Should I choose to make an empty dessert, or let the empty one...

According to reports, “Opendoor Technologies (NYSE: OPEN)'s short listing volume has risen 5.1% since the last report. The company recently reported that it has shorted 77.12 million shares, or 13.82% of all common shares available for trading. Depending on their trading volume, it takes an average of 3.99 days for traders to fill short positions.”

Most of Opendoor's shares are in the hands of institutions and company insiders.

However, the “toxic real estate” (property that lost money) that Opendoor bought before has basically been digested (sold — although there were losses, the company did not cancel the order, and it is also a corporate contract spirit that abides by the principles of the transaction. It can be considered that wherever it falls, it climbs up wherever it falls)

Recently, for the 2017-2019 settlement (before the company went public), the payment was finally paid. This payment was reported as early as 2022's 10K, and the company has already prepared this amount. It won't affect current earnings. Also, there is still plenty of cash that Opendoor can use now. At least for now, they won't go bankrupt because of this money. Moreover, after the company went public, it had a very professional legal and regulatory team. The mistakes made before should have been perfected.

Sooner or later, interest rates will be cut in the foreseeable future.

Personally, I think, based on these circumstances.

Should I choose to make an empty dessert, or let the empty one...

Translated

4

$Opendoor Technologies(OPEN.US$

“The National Association of Realtors will pay $418 million in compensation and will amend several rules that housing experts say will reduce housing costs.

4 ways a settlement can change the real estate industry:

Under the settlement, NAR will pay $418 million in damages, but more importantly, it agreed to rewrite some rules that have long been critical to the US real estate industry.”

This controversy has been around for a long time. It's almost over now. Real estate companies' commissions have been reduced, which is bad for real estate companies. However, with reduced commissions, it may be easier for consumers to buy and sell properties. If trading volume increases and small profits are sold more, some of the negative effects of lower commissions may be offset. Unlike ordinary real estate companies, Opendoor has buying and selling. If the seller doesn't have to bear or reduce the buyer's brokerage fees, it may be beneficial to Opendoor to a certain extent. As long as the company doesn't go bankrupt, interest rate cuts are imminent. This is probably all the darkness before dawn.

“The National Association of Realtors will pay $418 million in compensation and will amend several rules that housing experts say will reduce housing costs.

4 ways a settlement can change the real estate industry:

Under the settlement, NAR will pay $418 million in damages, but more importantly, it agreed to rewrite some rules that have long been critical to the US real estate industry.”

This controversy has been around for a long time. It's almost over now. Real estate companies' commissions have been reduced, which is bad for real estate companies. However, with reduced commissions, it may be easier for consumers to buy and sell properties. If trading volume increases and small profits are sold more, some of the negative effects of lower commissions may be offset. Unlike ordinary real estate companies, Opendoor has buying and selling. If the seller doesn't have to bear or reduce the buyer's brokerage fees, it may be beneficial to Opendoor to a certain extent. As long as the company doesn't go bankrupt, interest rate cuts are imminent. This is probably all the darkness before dawn.

Translated

2

$Opendoor Technologies(OPEN.US$

Recently, in the S&P 500 index, the real estate sector has lagged behind in terms of return. Gold on paper, such as Bitcoin, has risen so much. Real estate is a brick 🧱, so it should make people feel more secure. Money is rotating, and I feel like sooner or later it will flow into this sector.

Opendoor will attend the Morgan Stanley Technology, Media, and Telecom conference in early March. I don't know if more people will follow.

Recently, in the S&P 500 index, the real estate sector has lagged behind in terms of return. Gold on paper, such as Bitcoin, has risen so much. Real estate is a brick 🧱, so it should make people feel more secure. Money is rotating, and I feel like sooner or later it will flow into this sector.

Opendoor will attend the Morgan Stanley Technology, Media, and Telecom conference in early March. I don't know if more people will follow.

Translated

Translated

1

4

$Opendoor Technologies(OPEN.US$

Opendoor traded about 2.8 million shares at $3.42 at the close and after yesterday afternoon. The same is true today (24/2/1). Approximately 3 million were sold at $3.53. Is it an institutional swap? (Was this the case a lot before?)

Opendoor traded about 2.8 million shares at $3.42 at the close and after yesterday afternoon. The same is true today (24/2/1). Approximately 3 million were sold at $3.53. Is it an institutional swap? (Was this the case a lot before?)

Translated

2

I love Opendoor. Interest rate cuts are beneficial to real estate stocks. Interest rates will be cut sooner or later this year. And now home mortgages are now at a recent new low. As long as this company doesn't go bankrupt, the hardest time should be over. Already invested a little bit. (However, there are financial reports on 2/15, which may fluctuate. (If the financial report stabilizes a little, they will buy more)

Translated

4

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)