52ha0RA2RL

liked

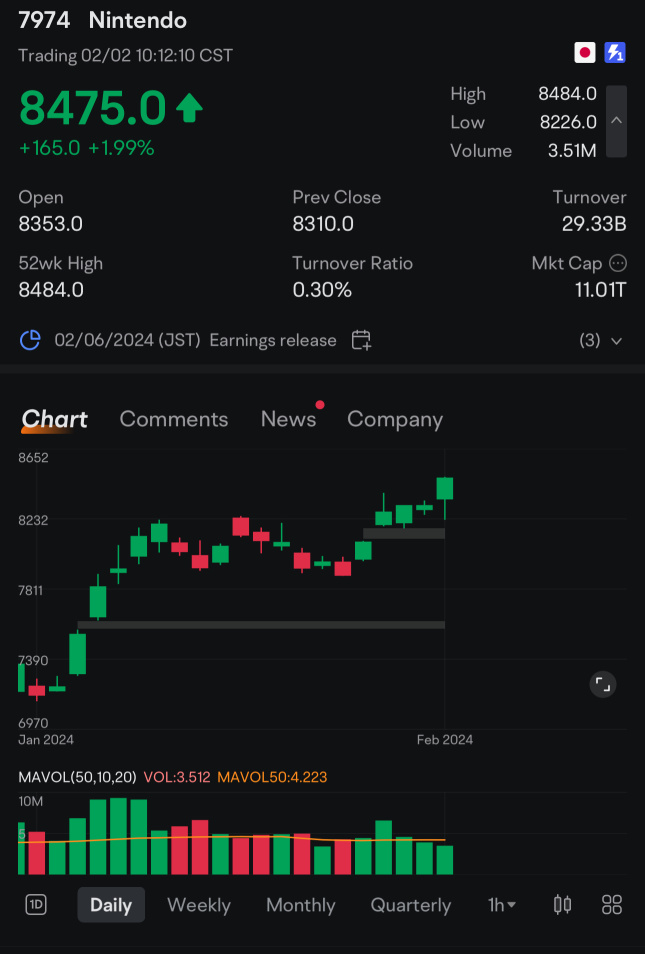

I re-entered this name and put my stop @pre gap high. $Nintendo(7974.JP$ has fully fund my Feb trip in Japan.😁

20

52ha0RA2RL

liked

My first entry stop <5%. Gap up base showing strengh and turning up after da base.

Illiquid small cap, trade with caution.

$Wacom(6727.JP$

Illiquid small cap, trade with caution.

$Wacom(6727.JP$

24

52ha0RA2RL

liked

26

52ha0RA2RL

liked

Amazon reported its financial results and business developments during the third quarter of 2023 earnings call. Here are the key highlights:

1) Financial performance: Amazon reported revenue of 143.1 billion US dollars, up 11% year on year; operating profit reached 11.2 billion US dollars, up 343% year on year; free cash flow for the past 12 months was adjusted to 20.2 billion US dollars, an increase of 41.7 billion US dollars over the same period last year.

2) Storage business: Amazon achieved a major reform of the fulfillment network by transforming the US's single national fulfillment network into eight separate regions. This reform exceeded the company's initial expectations, shortening transportation distances, reducing service costs, and enabling faster delivery to customers by increasing local inventory levels and optimizing connections between fulfillment centers and distribution stations.

3) AWS and artificial intelligence: Amazon's cloud computing business (AWS) revenue increased 12% year over year to $23.1 billion. AWS is investing heavily in generative artificial intelligence (AI) and has partnered with leading large language model (LLM) manufacturers such as Anthropic. Amazon has also launched services such as Amazon Bedrock to enable customers to access, customize, and deploy third-party and Amazon's own LLM.

4) Advertising business: Amazon's advertising business continues to grow, mainly driven by sponsored products. Thanks to the application of machine learning algorithms, the relevance and effectiveness of advertising has improved.

5) International business: Amazon's international business connection...

1) Financial performance: Amazon reported revenue of 143.1 billion US dollars, up 11% year on year; operating profit reached 11.2 billion US dollars, up 343% year on year; free cash flow for the past 12 months was adjusted to 20.2 billion US dollars, an increase of 41.7 billion US dollars over the same period last year.

2) Storage business: Amazon achieved a major reform of the fulfillment network by transforming the US's single national fulfillment network into eight separate regions. This reform exceeded the company's initial expectations, shortening transportation distances, reducing service costs, and enabling faster delivery to customers by increasing local inventory levels and optimizing connections between fulfillment centers and distribution stations.

3) AWS and artificial intelligence: Amazon's cloud computing business (AWS) revenue increased 12% year over year to $23.1 billion. AWS is investing heavily in generative artificial intelligence (AI) and has partnered with leading large language model (LLM) manufacturers such as Anthropic. Amazon has also launched services such as Amazon Bedrock to enable customers to access, customize, and deploy third-party and Amazon's own LLM.

4) Advertising business: Amazon's advertising business continues to grow, mainly driven by sponsored products. Thanks to the application of machine learning algorithms, the relevance and effectiveness of advertising has improved.

5) International business: Amazon's international business connection...

Translated

21

52ha0RA2RL

liked

In an earnings call for the fourth quarter of 2023, Meta reported a positive quarter and outlined its views on the future, with a special emphasis on the long-term vision of artificial intelligence (AI) and the metaverse. Here's a summary of the main highlights:

1) Financial performance: Meta reported total revenue of $40.1 billion for the fourth quarter, up 25% year over year. Net profit was $14 billion and earnings per share were $5.33. The company emphasized the importance of improving its financial position by improving efficiency and controlling costs.

2) User growth: Mark Zuckerberg said more than 3.1 billion people around the world use at least one Meta app every day. This shows the broad appeal of Meta services and an increase in user engagement.

3) Artificial intelligence and product innovation: Zuckerberg placed special emphasis on Meta's long-term vision in the field of AI, which aims to provide every user, creator, and enterprise with world-class AI assistants. He also mentioned future ideas for achieving seamless AI interaction on devices such as smart glasses.

4) Metaverse progress: Despite AI receiving more attention recently, Zuckerberg confirmed that the metaverse remains one of the company's key long-term strategies. He mentioned that the Quest 3 sold well during the holiday season, which bodes well for mixed reality devices.

5) Advertising business and social apps: Susan Li mentioned that the advertising business continues to show strong growth, particularly in online commerce and gaming...

1) Financial performance: Meta reported total revenue of $40.1 billion for the fourth quarter, up 25% year over year. Net profit was $14 billion and earnings per share were $5.33. The company emphasized the importance of improving its financial position by improving efficiency and controlling costs.

2) User growth: Mark Zuckerberg said more than 3.1 billion people around the world use at least one Meta app every day. This shows the broad appeal of Meta services and an increase in user engagement.

3) Artificial intelligence and product innovation: Zuckerberg placed special emphasis on Meta's long-term vision in the field of AI, which aims to provide every user, creator, and enterprise with world-class AI assistants. He also mentioned future ideas for achieving seamless AI interaction on devices such as smart glasses.

4) Metaverse progress: Despite AI receiving more attention recently, Zuckerberg confirmed that the metaverse remains one of the company's key long-term strategies. He mentioned that the Quest 3 sold well during the holiday season, which bodes well for mixed reality devices.

5) Advertising business and social apps: Susan Li mentioned that the advertising business continues to show strong growth, particularly in online commerce and gaming...

Translated

19

52ha0RA2RL

liked

Today is February 2nd. In February, support from tech giants helped US stocks get off to a good start. The Dow Jones Index rebounded to record highs. The S&P 500 Index and the Nasdaq Index each rose more than 1%, ending two consecutive days of decline, and the S&P 500 Index achieved its biggest one-day gain in three weeks. NVIDIA's stock price rebounded more than 2% to a record high, while Qualcomm shares fell 5%. Despite this, regional bank stocks still suffered a severe setback, falling more than 5% in the intraday period and eventually falling by more than 2%; among them, New York Community Bank (NYCB) shares fell 11%, showing two consecutive days of double-digit declines after the release of Wednesday's earnings report. Overall, US stocks performed strongly: the Dow Jones Industrial Average rose 0.97%, the S&P 500 rose 1.25%, and the Nasdaq Composite rose 1.30%.

Financial reports released after the market on Thursday showed that Meta shares rose sharply by more than 10%, Amazon shares rose by more than 9%, while Apple shares fell by more than 3%. Apple's revenue growth resumed in the fourth quarter, with both earnings per share (EPS) and service revenue reaching record highs. CEO Tim Cook promised to launch new AI features this year, although the decline in revenue in Greater China exceeded expectations. In January, the US manufacturing purchasing managers' index (ISM) unexpectedly rose to 49.1, and new orders surged, but the employment situation remained weak, and signs of inflation resurfaced. The yield on 10-year US Treasury bonds fell sharply by more than 10 basis points in the intraday period, setting...

Financial reports released after the market on Thursday showed that Meta shares rose sharply by more than 10%, Amazon shares rose by more than 9%, while Apple shares fell by more than 3%. Apple's revenue growth resumed in the fourth quarter, with both earnings per share (EPS) and service revenue reaching record highs. CEO Tim Cook promised to launch new AI features this year, although the decline in revenue in Greater China exceeded expectations. In January, the US manufacturing purchasing managers' index (ISM) unexpectedly rose to 49.1, and new orders surged, but the employment situation remained weak, and signs of inflation resurfaced. The yield on 10-year US Treasury bonds fell sharply by more than 10 basis points in the intraday period, setting...

Translated

18

52ha0RA2RL

liked

$CCK(7035.MY$

Seems to have find support after a pullback. Will need to secure above 0.895 in upcoming days in order for it to challenge 0.935 again for more upside. Expecting more pullback to retest 0.870 next should it fails to hold.

Seems to have find support after a pullback. Will need to secure above 0.895 in upcoming days in order for it to challenge 0.935 again for more upside. Expecting more pullback to retest 0.870 next should it fails to hold.

10

52ha0RA2RL

liked

The S&P index left its all-time high. The Nasdaq index fell to a two-year high, while the Dow Jones index hit a record high for four consecutive days. Analyst Guo Mingyi predicts that iPhone shipments will be drastically reduced this year, causing Apple's stock price to drop by nearly 2%. Microsoft once hit a record intraday high and then turned down. Although it once rose more than 1% after the financial report was over, it then turned down. Google's stock price fell to an all-time high, falling more than 5% after the earnings report. Despite the overall decline in chip stocks, Nvidia's stock price continued to hit record highs, but AMD fell more than 6% after the earnings report. After the earnings report, GM shares rose by nearly 8%, while UPS shares fell by more than 8%. The pan-European stock index hit a two-year high for three consecutive days, and the French stock market hit a record high. In the US stock market, the Dow Jones index rose 0.35%, the S&P 500 index fell 0.06%, and the Nasdaq index fell 0.76%.

Microsoft's earnings report for the fourth quarter of last year exceeded market expectations. Although cloud growth still needs to be accelerated, the stock price fell by more than 2% after the market. Google's revenue and profit both exceeded expectations, but advertising revenue fell short of expectations, and the stock price fell more than 5% after the market. AMD's guidance on first-quarter results fell short of expectations, and problems with AI chips caused its stock price to drop 6% after the market.

After the US job vacancy data was released, the 10-year US Treasury yield quickly broke away from a two-week low. It once rose above 4.10%, but then declined again. The US dollar index rebounded after reversing the daily decline for a while, setting a new daily high. Gold futures, which rose more than 2% in the intraday period, gave back most...

Microsoft's earnings report for the fourth quarter of last year exceeded market expectations. Although cloud growth still needs to be accelerated, the stock price fell by more than 2% after the market. Google's revenue and profit both exceeded expectations, but advertising revenue fell short of expectations, and the stock price fell more than 5% after the market. AMD's guidance on first-quarter results fell short of expectations, and problems with AI chips caused its stock price to drop 6% after the market.

After the US job vacancy data was released, the 10-year US Treasury yield quickly broke away from a two-week low. It once rose above 4.10%, but then declined again. The US dollar index rebounded after reversing the daily decline for a while, setting a new daily high. Gold futures, which rose more than 2% in the intraday period, gave back most...

Translated

19

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)