101657276lye

liked

Hi, mooers! ![]()

How time flies! Moomoo SG's wealth management has been a part of our journey for over two years now.![]()

This year, we've enriched our partnership with diverse fund houses. To add to that, we're excited about our new Funds Talk column, which brings insights from four different fund houses on a range of subjects, including brand culture and investment strategies. This column offers mooers a direct line to these funds for a de...

How time flies! Moomoo SG's wealth management has been a part of our journey for over two years now.

This year, we've enriched our partnership with diverse fund houses. To add to that, we're excited about our new Funds Talk column, which brings insights from four different fund houses on a range of subjects, including brand culture and investment strategies. This column offers mooers a direct line to these funds for a de...

212

99

101657276lye

liked

The past week has been a dark period in the history of crypto, with the total market capitalization of this industry dipping as low as $1.2 trillion for the first time since July 2021. ![]()

![]()

![]() The turmoil, in large part, has been due to the real-time disintegration of $Terra(LUNA.CC$.

The turmoil, in large part, has been due to the real-time disintegration of $Terra(LUNA.CC$.

Last week, Terra has officially stopped block production as the blockchain's native token hit a low of $0.0003, near zero.![]()

![]()

![]()

In a tumble start...

Last week, Terra has officially stopped block production as the blockchain's native token hit a low of $0.0003, near zero.

In a tumble start...

1093

961

101657276lye

liked

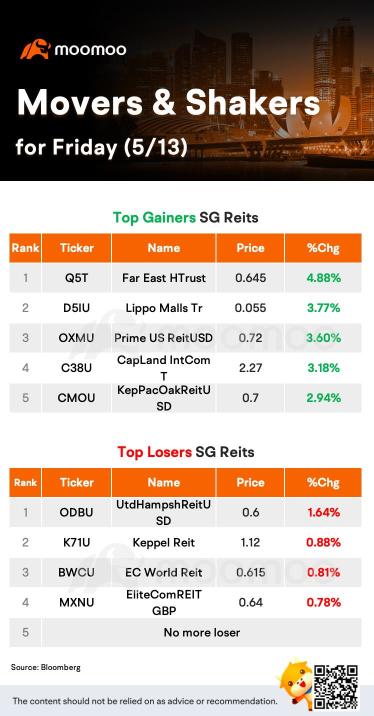

Singapore real estate investment trusts can benefit from their safe-haven status during a time of market volatility as the U.S. Fed raises interest rates, analysts from DBS say in a research note.

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

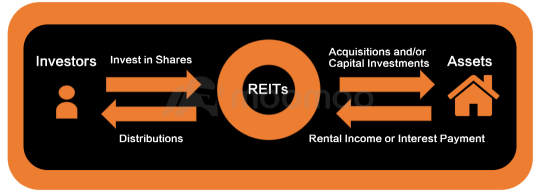

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

1534

1276

101657276lye

liked

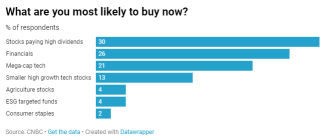

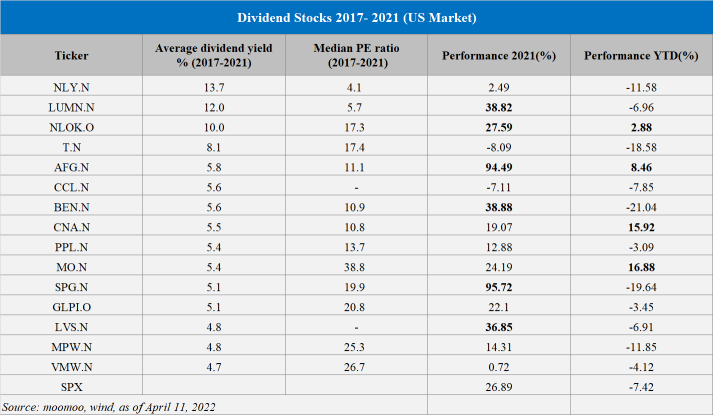

- Dividend stocks investing is back in the market

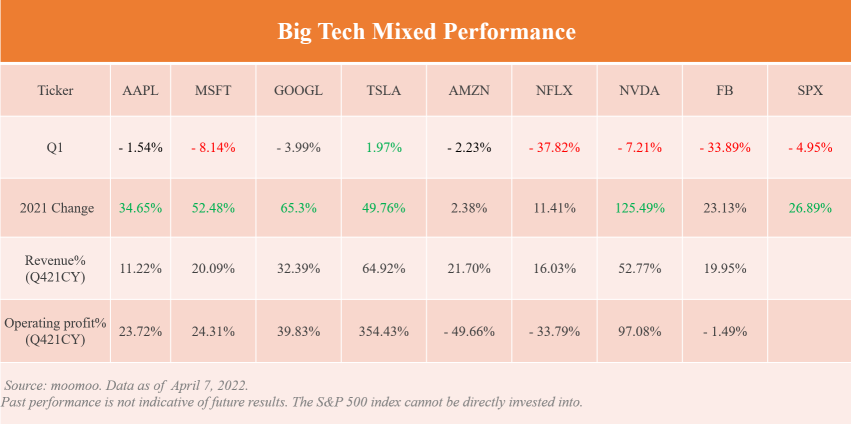

How to survive a volatile market has been on investors' minds since an uneven start to 2022. The market has ended Q1 in the negative territory with the $S&P 500 Index(.SPX.US$ down 4.95% and mixed big tech performance.

Multiple headwinds disrupted the stock and bond markets. Investors have become more vulnerable and therefore more sensitive and conservative in investing amid the chaos of high infl...

How to survive a volatile market has been on investors' minds since an uneven start to 2022. The market has ended Q1 in the negative territory with the $S&P 500 Index(.SPX.US$ down 4.95% and mixed big tech performance.

Multiple headwinds disrupted the stock and bond markets. Investors have become more vulnerable and therefore more sensitive and conservative in investing amid the chaos of high infl...

+4

186

29

101657276lye

liked

4

5

101657276lye

liked

$AGNC Investment Corp(AGNC.US$CEO Peter Federico says the Federal Reserve's guidance on its timeline for tapering its asset purchases "reaffirms our prior view that mortgage spread volatility should be limited because the Federal Reserve has been transparent and effective in setting expectations."

During the quarter the mREIT's 9% dividend yield, " coupled with a modest increase in tangible net book value in the third quarter, drove our strong economic return of 2.3%," he added.

Q3 net spread and dollar roll income per share of $0.75, tops the consensus estimate of $0.65 and slips from $0.76 in Q2 2021.

Includes $0.33 per common share of dollar roll income associated with AGNC's $30.3B average net long position in forward purchases and sales of agency MBS in the TBA market.

Excludes less than -$0.01 per common share of estimated "catch-up" premium amortization cost due to change in projected constant prepayment rate ("CPR") estimates.

Tangible net book value per common share of $16.41 at Sept. 30 vs. $16.39 at June 30, 2021.

2.3% economic return on tangible common equity in the quarter is comprised of $0.36 dividends per common share and $0.02 increase in TNBV per common share; compares with -5.5% in the previous quarter.

Cash and unencumbered agency MBS totaled ~$5.2B at Sept. 30 vs. ~$4.7B at June 30, excludes unencumbered CRT and non-agency securities and assets held at the company's broker-dealer subsidiary, Bethesda Securities.

AGNC's investment portfolio had a weighted average CPR of 22.5% in Q3 vs. 25.7% in Q2. The weighted average projected CPR for the remaining life of the company's agency securities held as of Sept. 30, 2021 decreased to 10.7% from 11.6% as of June 30, 2021.

Conference call on Oct. 26 at 8:30 AM ET.

Earlier, AGNC Investment EPS beats by $0.10.

During the quarter the mREIT's 9% dividend yield, " coupled with a modest increase in tangible net book value in the third quarter, drove our strong economic return of 2.3%," he added.

Q3 net spread and dollar roll income per share of $0.75, tops the consensus estimate of $0.65 and slips from $0.76 in Q2 2021.

Includes $0.33 per common share of dollar roll income associated with AGNC's $30.3B average net long position in forward purchases and sales of agency MBS in the TBA market.

Excludes less than -$0.01 per common share of estimated "catch-up" premium amortization cost due to change in projected constant prepayment rate ("CPR") estimates.

Tangible net book value per common share of $16.41 at Sept. 30 vs. $16.39 at June 30, 2021.

2.3% economic return on tangible common equity in the quarter is comprised of $0.36 dividends per common share and $0.02 increase in TNBV per common share; compares with -5.5% in the previous quarter.

Cash and unencumbered agency MBS totaled ~$5.2B at Sept. 30 vs. ~$4.7B at June 30, excludes unencumbered CRT and non-agency securities and assets held at the company's broker-dealer subsidiary, Bethesda Securities.

AGNC's investment portfolio had a weighted average CPR of 22.5% in Q3 vs. 25.7% in Q2. The weighted average projected CPR for the remaining life of the company's agency securities held as of Sept. 30, 2021 decreased to 10.7% from 11.6% as of June 30, 2021.

Conference call on Oct. 26 at 8:30 AM ET.

Earlier, AGNC Investment EPS beats by $0.10.

15

2

101657276lye

liked

$Kaixin Holdings(KXIN.US$ It hasn't even fallen below the 2.65 skyrocketed midpoint, so why sell it. Hold on.

Translated

5

101657276lye

liked

$Adagio Therapeutics(ADGI.US$ it's early, we could be in the 20s today

7

3

101657276lye

liked

A short squeeze can occur when a heavily shorted stock rises in value instead of falling. Short sellers could be looking to close out their position and can face a loss if they have to buy back the shares they initially borrowed at a higher price. ![]()

![]()

![]()

Here is a look at Fintel's top five short squeeze candidates for the week of Dec. 13.![]()

![]()

![]()

Men's health pharmaceutical company $Petros Pharmaceuticals(PTPI.US$ tops the Fintel leaderboard for the week. The stock has 25.4% of its float short with short interest up 459% in recent weeks, according to Fintel. Short interest is up 2,470% in the last month on shares of PTPI. Fintel shows a cost to borrow of 254%, which is one of the highest on record.

Life sciences company $iSpecimen(ISPC.US$ comes in second place on the Fintel leaderboard for the week. The company has 19.7% of its public float shorted. Short interest is up over 4,400% in ISPC shares from the prior report. Fintel points out that institutional ownership is down in ISPC shares in the recent quarter. Insiders have been buying shares consistently over the last few weeks. The cost to borrow on ISPC shares is 175%, which Fintel said would normally top the list if not for the high number assigned to PTPI shares.

Biotechnology company $Longeveron(LGVN.US$ ranks third on this week's list. Fintel shows 30.5% of the company's public float short. Short interest of 1.2 million shares is up 477% in the last month, according to the report. LGVN has a high cost to borrow of 152%.

Biopharmaceutical company $Vallon Pharmaceuticals(VLON.US$ has 22.8% of its float short. Short interest has risen 855% from previous reports, according to Fintel. The cost to borrow on VLON shares is 62.1%. Fintel highlighted that institutional shares have declined over 30% in the most recent quarter.

Material handling industry company $Greenland Technologies(GTEC.US$ joins the short squeeze leaderboard in fifth place. Short interest in GTEC is up over 1,500% from the previous report. The cost to borrow on GTEC shares is 41%.

Mooers, let's look for the next $GameStop(GME.US$ or $AMC Entertainment(AMC.US$.![]()

![]()

![]()

Source: Benzinga, Fintel

Here is a look at Fintel's top five short squeeze candidates for the week of Dec. 13.

Men's health pharmaceutical company $Petros Pharmaceuticals(PTPI.US$ tops the Fintel leaderboard for the week. The stock has 25.4% of its float short with short interest up 459% in recent weeks, according to Fintel. Short interest is up 2,470% in the last month on shares of PTPI. Fintel shows a cost to borrow of 254%, which is one of the highest on record.

Life sciences company $iSpecimen(ISPC.US$ comes in second place on the Fintel leaderboard for the week. The company has 19.7% of its public float shorted. Short interest is up over 4,400% in ISPC shares from the prior report. Fintel points out that institutional ownership is down in ISPC shares in the recent quarter. Insiders have been buying shares consistently over the last few weeks. The cost to borrow on ISPC shares is 175%, which Fintel said would normally top the list if not for the high number assigned to PTPI shares.

Biotechnology company $Longeveron(LGVN.US$ ranks third on this week's list. Fintel shows 30.5% of the company's public float short. Short interest of 1.2 million shares is up 477% in the last month, according to the report. LGVN has a high cost to borrow of 152%.

Biopharmaceutical company $Vallon Pharmaceuticals(VLON.US$ has 22.8% of its float short. Short interest has risen 855% from previous reports, according to Fintel. The cost to borrow on VLON shares is 62.1%. Fintel highlighted that institutional shares have declined over 30% in the most recent quarter.

Material handling industry company $Greenland Technologies(GTEC.US$ joins the short squeeze leaderboard in fifth place. Short interest in GTEC is up over 1,500% from the previous report. The cost to borrow on GTEC shares is 41%.

Mooers, let's look for the next $GameStop(GME.US$ or $AMC Entertainment(AMC.US$.

Source: Benzinga, Fintel

26

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)