抱股散人

Set a live reminder

An overview of the US stock market and everything you need to know so that you start off on the right foot!

Topics covered:

- Overview of the US market

- Top US stock market indexes

- Why the US stock market

- Different ways to invest in the US market

- Other FAQs

You are free to ask any questions throughout the livestream!😊

Topics covered:

- Overview of the US market

- Top US stock market indexes

- Why the US stock market

- Different ways to invest in the US market

- Other FAQs

You are free to ask any questions throughout the livestream!😊

142

38

抱股散人

voted

$YTLPOWR(6742.MY$ The stock price suddenly turned red today, you guys will

Translated

2

2

抱股散人

voted

😊Hi, Malaysian mooers!

MAYBANK is set to release its next earnings report on May 24. How do you think the market will react to the company's quarterly results? Cast your vote to participate!

(Vote will close on 16:30 MYT May 24)

🎁 Rewards

👌 An equal share of 1,000 points: For mooers who correctly guess the price range of $MAYBANK(1155.MY$'s closing price at 16:45 MYT May 24 (e.g., If 50 mooers make a correct guess, ...

MAYBANK is set to release its next earnings report on May 24. How do you think the market will react to the company's quarterly results? Cast your vote to participate!

(Vote will close on 16:30 MYT May 24)

🎁 Rewards

👌 An equal share of 1,000 points: For mooers who correctly guess the price range of $MAYBANK(1155.MY$'s closing price at 16:45 MYT May 24 (e.g., If 50 mooers make a correct guess, ...

84

136

抱股散人

voted

Hi, mooers,

We are thrilled to announce that our highly anticipated US fractional shares trading feature is live!![]()

The Dow Jones Index has surpassed 40,000 points, with key constituent Apple having risen over 11% this month. The highly anticipated Nvidia is set to release its earnings after the U.S. market closed on the 22nd, with the potential for its stock price to exceed previous peaks.

Don't want to miss...

We are thrilled to announce that our highly anticipated US fractional shares trading feature is live!

The Dow Jones Index has surpassed 40,000 points, with key constituent Apple having risen over 11% this month. The highly anticipated Nvidia is set to release its earnings after the U.S. market closed on the 22nd, with the potential for its stock price to exceed previous peaks.

Don't want to miss...

37

27

抱股散人

liked

The latest US inflation data has slowed, increasing hopes that the Federal Reserve will cut interest rates, and encouraged the Malaysian ringgit exchange rate to continue to strengthen. Earlier this day, it climbed to a two-month high of RM4.67 against 1 US dollar.

$USD/MYR(USDMYR.FX$

This is also the 6th day in a row that the ringgit has strengthened.

According to data, foreign investors bought Malaysian stocks for 63.8 million US dollars (about RM298 million) yesterday (15th).

Dr. Mohd Avjani Zhanjia, chief economist at Muamalat Bank of Malaysia, said that the ringgit exchange rate may hover between 4.67 and 4.68.

He said that since the US inflation rate is expected to fall, the ringgit is likely to perform well today.

“Since there are few opportunities to raise interest rates and US inflation is progressing well, this is beneficial to the foreign exchange market.”

Source: Nanyang Siang Pao

Disclaimer: This content is for informational and educational purposes only, and does not constitute any specific investment, investment strategy, or recommendation endorsement. The reader shall bear any risk and responsibility arising from reliance on this content. Always conduct your own independent research and evaluation and consult professional advice if necessary before making any investment decisions. The author and related participants are not responsible for any loss or damage resulting from the use or reliance on the information contained in this article.

$USD/MYR(USDMYR.FX$

This is also the 6th day in a row that the ringgit has strengthened.

According to data, foreign investors bought Malaysian stocks for 63.8 million US dollars (about RM298 million) yesterday (15th).

Dr. Mohd Avjani Zhanjia, chief economist at Muamalat Bank of Malaysia, said that the ringgit exchange rate may hover between 4.67 and 4.68.

He said that since the US inflation rate is expected to fall, the ringgit is likely to perform well today.

“Since there are few opportunities to raise interest rates and US inflation is progressing well, this is beneficial to the foreign exchange market.”

Source: Nanyang Siang Pao

Disclaimer: This content is for informational and educational purposes only, and does not constitute any specific investment, investment strategy, or recommendation endorsement. The reader shall bear any risk and responsibility arising from reliance on this content. Always conduct your own independent research and evaluation and consult professional advice if necessary before making any investment decisions. The author and related participants are not responsible for any loss or damage resulting from the use or reliance on the information contained in this article.

Translated

9

抱股散人

voted

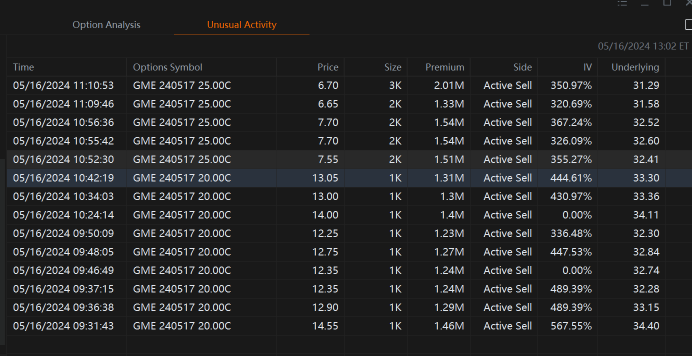

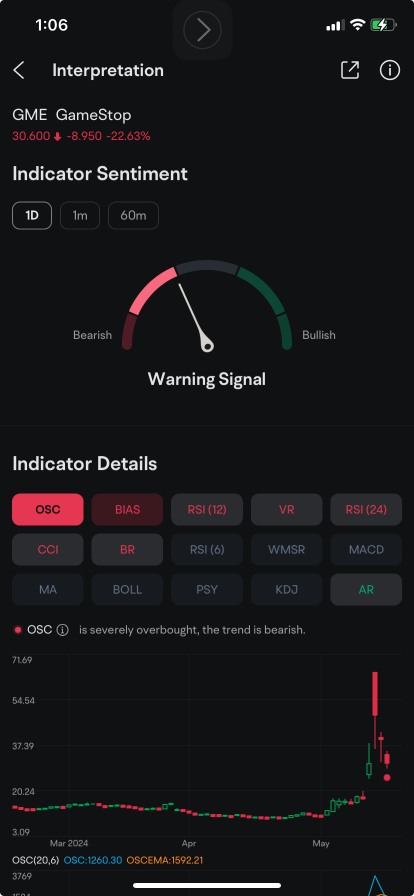

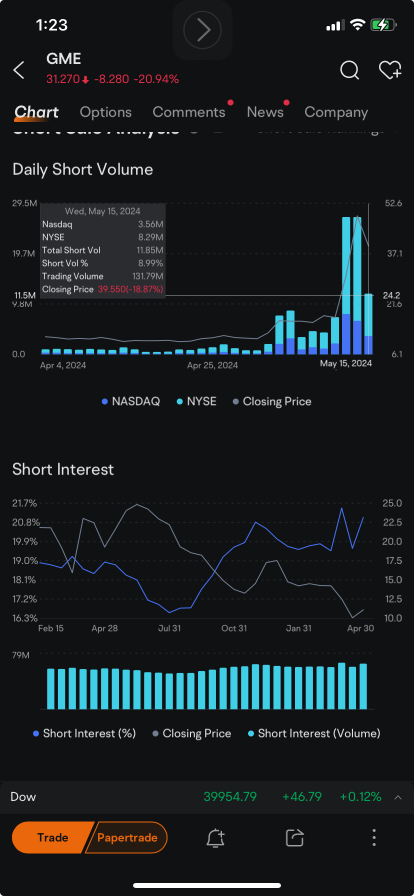

Whales sold a combined $11.7 million in short positions on $GameStop(GME.US$ that could benefit if the shares slump below $20 before the contracts turn into so-called zero-day-to-expiration (0DTE) options.

As of 10:42 a.m. Thursday, nine block trades were posted, each carrying a premium of more than $1.2 million. The sellers sold a combined 9,000 contracts that give the holders the right to sell a total of 900,000 shares ...

As of 10:42 a.m. Thursday, nine block trades were posted, each carrying a premium of more than $1.2 million. The sellers sold a combined 9,000 contracts that give the holders the right to sell a total of 900,000 shares ...

27

13

抱股散人

liked

As of May 16 at 12.30 p.m., all Malaysian stock indices were winning. The top 4 are suddenly traditional utilities, industry, energy, and construction. However, in May, healthcare (gloves) 🧤, industry, technology, and consumption are all raging.

The next two weeks will be performance judgment day, and you will be free to decide who is swimming naked when the time comes.

The next two weeks will be performance judgment day, and you will be free to decide who is swimming naked when the time comes.

Translated

57

抱股散人

voted

$GENTING(3182.MY$

As the domestic tourism industry continues to recover, Hong Leong Investment Bank believes that Genting, which is currently undervalued, is one of the main beneficiaries and deserves investors' attention.

Hong Leong Investment Bank analysts pointed out that they are in Genting Malaysia, respectively $GENM(4715.MY$and Genting Singapore $Genting Sing(G13.SG$Genting, which has a strategic stake, can benefit from the recovery of tourism in Malaysia and New Zealand.

The following are the company's range buying points, short-term upward targets, and stop-loss points.

$GENTING(3182.MY$

Source: Nanyang Siang Pao

Disclaimer: This content is for informational and educational purposes only, and does not constitute any specific investment, investment strategy, or recommendation endorsement. The reader shall bear any risk and responsibility arising from reliance on this content. Always conduct your own independent research and evaluation and consult professional advice if necessary before making any investment decisions. The author and related participants are not responsible for any loss or damage resulting from the use or reliance on the information contained in this article.

As the domestic tourism industry continues to recover, Hong Leong Investment Bank believes that Genting, which is currently undervalued, is one of the main beneficiaries and deserves investors' attention.

Hong Leong Investment Bank analysts pointed out that they are in Genting Malaysia, respectively $GENM(4715.MY$and Genting Singapore $Genting Sing(G13.SG$Genting, which has a strategic stake, can benefit from the recovery of tourism in Malaysia and New Zealand.

The following are the company's range buying points, short-term upward targets, and stop-loss points.

$GENTING(3182.MY$

Source: Nanyang Siang Pao

Disclaimer: This content is for informational and educational purposes only, and does not constitute any specific investment, investment strategy, or recommendation endorsement. The reader shall bear any risk and responsibility arising from reliance on this content. Always conduct your own independent research and evaluation and consult professional advice if necessary before making any investment decisions. The author and related participants are not responsible for any loss or damage resulting from the use or reliance on the information contained in this article.

Translated

19

4

抱股散人

liked

$MI(5286.MY$

Increased foreign exchange earnings helped Zhengqi Technology make a huge profit of 27 million

Foreign exchange earnings increased, and Zhengqi Technology (MI, 5286, Main Board Technology) recorded a net profit of RM26.794,000 in the first quarter of fiscal year 2024, a sharp increase of 3.19 times over the previous year.

Revenue for the quarter ending March 1 increased 39.4% year over year to RM17,125,000.

The company explained that net profit performance in the first quarter was due to higher revenue and increased foreign exchange earnings due to the strengthening of the US dollar. Net profit surged to 25%, compared to 8.3% in the same period last year.

According to the statement, the semiconductor equipment (SEBU) business contributed 57.2% of revenue in the first quarter, while the semiconductor materials business (SMBU) accounted for 42.8% of revenue.

Despite facing challenges in an uncertain macro context, Zhengqi Technology will gradually build a comprehensive and diversified business platform, and will continue to work on continuous product innovation and development and product differentiation to enhance its competitive advantage.

Unless anything unforeseen happens, the company remains cautious and conservative about the outlook for 2024. Given the many short-term risks and challenges, it is probably just wishful thinking that the semiconductor industry has been expecting a full recovery in the second half of 2024.

Source: Nanyang Siang Pao

Disclaimer: This content is for informational and educational purposes only, and does not constitute any specific investment, investment strategy, or recommendation endorsement. Readers should...

Increased foreign exchange earnings helped Zhengqi Technology make a huge profit of 27 million

Foreign exchange earnings increased, and Zhengqi Technology (MI, 5286, Main Board Technology) recorded a net profit of RM26.794,000 in the first quarter of fiscal year 2024, a sharp increase of 3.19 times over the previous year.

Revenue for the quarter ending March 1 increased 39.4% year over year to RM17,125,000.

The company explained that net profit performance in the first quarter was due to higher revenue and increased foreign exchange earnings due to the strengthening of the US dollar. Net profit surged to 25%, compared to 8.3% in the same period last year.

According to the statement, the semiconductor equipment (SEBU) business contributed 57.2% of revenue in the first quarter, while the semiconductor materials business (SMBU) accounted for 42.8% of revenue.

Despite facing challenges in an uncertain macro context, Zhengqi Technology will gradually build a comprehensive and diversified business platform, and will continue to work on continuous product innovation and development and product differentiation to enhance its competitive advantage.

Unless anything unforeseen happens, the company remains cautious and conservative about the outlook for 2024. Given the many short-term risks and challenges, it is probably just wishful thinking that the semiconductor industry has been expecting a full recovery in the second half of 2024.

Source: Nanyang Siang Pao

Disclaimer: This content is for informational and educational purposes only, and does not constitute any specific investment, investment strategy, or recommendation endorsement. Readers should...

Translated

18

抱股散人

reacted to and commented on

ColumnsRiverstone's turnover surpassed a 6-quarter high and distributed a 4-point Interim Dividend (RM)

$Riverstone(AP4.SG$

Today, RIVERSTONE, which is listed in Singapore 🇸🇬, announced its latest results, with net profit growing 54.3% year-on-year. The chart below shows RIVERSTONE's turnover and net profit over the past few years:

The latest quarterly turnover was RM249.5 mil, and management said that the supply relationship had returned to normal. It is expected that the next few quarters will be very good with the recovery of semiconductors and consumer electronics products. Therefore, FY2024's annual turnover is likely to exceed RM1,000 mil and is expected to grow by more than 10%.

Since RiverStone focuses on cleanroom gloves, it is a relatively niche market. After this pandemic, the company's net profit margin was even scarier than before the pandemic, reaching 28.9%. One reason is due to the sharp increase in cash and the environment of high interest rates. In the case of RM947.64 mil cash and 0 bank loans, the company can earn higher interest income.

The company has a positive outlook, with supply and hope to return to normal, with major customer sectors recovering in semiconductors and consumer electronics. In addition, the company is expected to pay a 4-point dividend (RM) in Q1, which is equivalent to a payout ratio of 82.1%. In an environment where profits are returning to growth, Riverst...

Today, RIVERSTONE, which is listed in Singapore 🇸🇬, announced its latest results, with net profit growing 54.3% year-on-year. The chart below shows RIVERSTONE's turnover and net profit over the past few years:

The latest quarterly turnover was RM249.5 mil, and management said that the supply relationship had returned to normal. It is expected that the next few quarters will be very good with the recovery of semiconductors and consumer electronics products. Therefore, FY2024's annual turnover is likely to exceed RM1,000 mil and is expected to grow by more than 10%.

Since RiverStone focuses on cleanroom gloves, it is a relatively niche market. After this pandemic, the company's net profit margin was even scarier than before the pandemic, reaching 28.9%. One reason is due to the sharp increase in cash and the environment of high interest rates. In the case of RM947.64 mil cash and 0 bank loans, the company can earn higher interest income.

The company has a positive outlook, with supply and hope to return to normal, with major customer sectors recovering in semiconductors and consumer electronics. In addition, the company is expected to pay a 4-point dividend (RM) in Q1, which is equivalent to a payout ratio of 82.1%. In an environment where profits are returning to growth, Riverst...

Translated

77

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)