#美股IPO

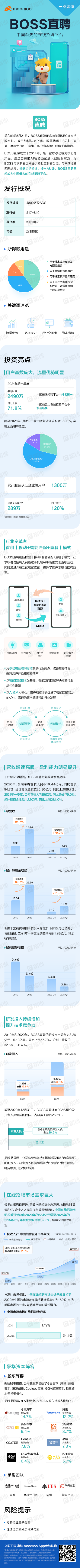

🔥 China's largest online recruitment platform- $Kanzhun(BZ.US$ Stock offering has started

🥇 Leading market position: the user base is huge, and the traffic advantage is obvious;

📈 Huge potential: China's online recruitment market is still in the early stages of development, and there is considerable room for growth;

🐂 Excellent reputation: industry innovator, pioneering the “mobile+intelligent matching+direct chat” model;

👍 Luxurious shareholder lineup: Today, investment institutions such as Capital, Tencent, Gaorong Capital, Ceyuan Venture Capital, and Coatue are favored!

🔥 China's largest online recruitment platform- $Kanzhun(BZ.US$ Stock offering has started

🥇 Leading market position: the user base is huge, and the traffic advantage is obvious;

📈 Huge potential: China's online recruitment market is still in the early stages of development, and there is considerable room for growth;

🐂 Excellent reputation: industry innovator, pioneering the “mobile+intelligent matching+direct chat” model;

👍 Luxurious shareholder lineup: Today, investment institutions such as Capital, Tencent, Gaorong Capital, Ceyuan Venture Capital, and Coatue are favored!

Translated

2

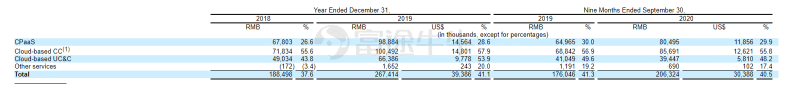

#美股IPO # $掌门教育(ZME.US$ The subscription has started!!!

🔥 China's leading K12 personalized online education platform-Zhuangmen Education has opened a stock offering

🥇 Leading market position: China's online K12 one-on-one after-class tutoring service ranks first in the market;

📈 Huge potential: China has the world's largest online education market and a broad track;

🐂 Excellent reputation: Over 50% of new customer referrals for one-on-one courses in 20 years;

👍 Good financial performance: net revenue in 20 years was 4,018 billion yuan, an increase of more than 50% over the previous year

🔥 China's leading K12 personalized online education platform-Zhuangmen Education has opened a stock offering

🥇 Leading market position: China's online K12 one-on-one after-class tutoring service ranks first in the market;

📈 Huge potential: China has the world's largest online education market and a broad track;

🐂 Excellent reputation: Over 50% of new customer referrals for one-on-one courses in 20 years;

👍 Good financial performance: net revenue in 20 years was 4,018 billion yuan, an increase of more than 50% over the previous year

Translated

#美股IPO #

🔥 The largest independent insurance technology platform in China- $Waterdrop(WDH.US$ Subscription has been opened

🥇 Industry leader: Water Drop Insurance is the largest independent insurance platform in China, and Water Drop Insurance is the largest medical fundraising platform in China;

📈 Huge potential: China's insurance market is the second largest in the world, and the racetrack is broad;

🐂 Strong shareholder lineup, holding shares in Tencent, Boyu Capital, Gao Rong Capital, Swiss Re, etc.;

👍 Total revenue CAGR of 256.6% from '18 to '20

🔥 The largest independent insurance technology platform in China- $Waterdrop(WDH.US$ Subscription has been opened

🥇 Industry leader: Water Drop Insurance is the largest independent insurance platform in China, and Water Drop Insurance is the largest medical fundraising platform in China;

📈 Huge potential: China's insurance market is the second largest in the world, and the racetrack is broad;

🐂 Strong shareholder lineup, holding shares in Tencent, Boyu Capital, Gao Rong Capital, Swiss Re, etc.;

👍 Total revenue CAGR of 256.6% from '18 to '20

Translated

3

1

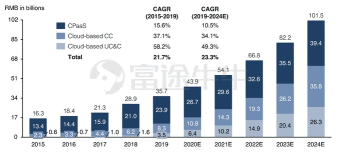

Domestic cloud communication leader $Cloopen Group(RAAS.US$An application has been submitted to the SEC to be listed on the New York Stock Exchange. The stock code is RAAS.

The Chinese version of “Twilio” with strong institutions has been supported by Sequoia for many rounds

Rong Lianyun's performance has grown rapidly since its launch in 2013, and has grown into the largest cloud communication service provider in China. A high-quality, high-potential racet+first-mover advantage has made institutional investors optimistic. Sequoia Capital has invested in multiple rounds in China.

Before going to the US for an IPO, Rong Lianyun completed Series F financing of US$125 million in November 2020, led by China's State-owned Venture Capital Fund (“China Venture Capital Fund”) and followed by institutions such as New Oriental Industrial Fund. Tencent also participated in this round of financing through its investor Image Frame Investment (HK) Limited.

The US stock market has a certain understanding of SaaS. There are many companies that can be targeted, and the SaaS sector was popular in the market last year. What Rong Lianyun can benchmark $Twilio(TWLO.US$There was also an astonishing increase last year. Twilio is the world's largest cloud communications service provider. The founder is Jeff Lawson, a former Amazon cloud product manager. The original intention was to allow developers to pay as needed to enjoy telecom services.

Although Twilio has not been profitable, its success has validated the track's potential and the viability of its business model. To sum it up...

The Chinese version of “Twilio” with strong institutions has been supported by Sequoia for many rounds

Rong Lianyun's performance has grown rapidly since its launch in 2013, and has grown into the largest cloud communication service provider in China. A high-quality, high-potential racet+first-mover advantage has made institutional investors optimistic. Sequoia Capital has invested in multiple rounds in China.

Before going to the US for an IPO, Rong Lianyun completed Series F financing of US$125 million in November 2020, led by China's State-owned Venture Capital Fund (“China Venture Capital Fund”) and followed by institutions such as New Oriental Industrial Fund. Tencent also participated in this round of financing through its investor Image Frame Investment (HK) Limited.

The US stock market has a certain understanding of SaaS. There are many companies that can be targeted, and the SaaS sector was popular in the market last year. What Rong Lianyun can benchmark $Twilio(TWLO.US$There was also an astonishing increase last year. Twilio is the world's largest cloud communications service provider. The founder is Jeff Lawson, a former Amazon cloud product manager. The original intention was to allow developers to pay as needed to enjoy telecom services.

Although Twilio has not been profitable, its success has validated the track's potential and the viability of its business model. To sum it up...

Translated

1

$17 Education & Technology(YQ.US$Moomoo has now started a hot subscription. It is expected to be officially listed on December 4, and is expected to become the largest education concept stock on NASDAQ. The underwriters for this IPO include Morgan Stanley, Goldman Sachs, Bank of America Securities, and Huaxing Capital.

According to the latest prospectus, the pricing range for the current IPO of One Education Technology is 9.5 to 11.5 US dollars/ADS, and it plans to issue a total of 27.4 million ADS shares (excluding over-allotment rights). Based on this calculation, the corresponding financing scale range is 260 million to 315 million US dollars.

Established in 2011, Together Education Technology (formerly Together) is a well-known K12 online homework platform in China. It is also an intelligent education company that provides “Internet +” solutions for basic education. Currently, the company's brand business includes: elementary school together, high school together, study together, study online school together.

The total number of users exceeds 100 million, and the advantages of segmentation are obvious

According to the prospectus, the Together Education Technology brand Work Together provides services to more than 900,000 teachers, 54.3 million students, and 45.2 million parents nationwide, covering one-third of the country's public primary and secondary schools.

According to the Frost & Sullivan report, the average MAU (monthly active users) of Work Together (a brand owned by Education Technology) in the first half of 2020 was number one in the field of online work in primary and secondary schools, and was larger than the sum of the following four companies...

According to the latest prospectus, the pricing range for the current IPO of One Education Technology is 9.5 to 11.5 US dollars/ADS, and it plans to issue a total of 27.4 million ADS shares (excluding over-allotment rights). Based on this calculation, the corresponding financing scale range is 260 million to 315 million US dollars.

Established in 2011, Together Education Technology (formerly Together) is a well-known K12 online homework platform in China. It is also an intelligent education company that provides “Internet +” solutions for basic education. Currently, the company's brand business includes: elementary school together, high school together, study together, study online school together.

The total number of users exceeds 100 million, and the advantages of segmentation are obvious

According to the prospectus, the Together Education Technology brand Work Together provides services to more than 900,000 teachers, 54.3 million students, and 45.2 million parents nationwide, covering one-third of the country's public primary and secondary schools.

According to the Frost & Sullivan report, the average MAU (monthly active users) of Work Together (a brand owned by Education Technology) in the first half of 2020 was number one in the field of online work in primary and secondary schools, and was larger than the sum of the following four companies...

Translated

![[IPO Broadcast] Together Education Technology, China's leading K12 online work platform](https://ussnsimg.moomoo.com/16069813251997-77777005-web-d259ea1d16ee1ac8.png/thumb)

November 16, Perfect Diary parent company $Yatsen(YSG.US$Subscriptions are popular. As of 5:00 p.m. on November 16, the number of Futu subscribers exceeded 17,000, and the subscription amount exceeded 770 million US dollars. It is expected that subscriptions will end at 6:00 EST on November 18, and will be officially listed on the New York Stock Exchange on the same day.

Scan the QR code in the picture to enter Moomoo's new Yixian e-commerce portal:

According to the latest prospectus, Yixian E-Commerce plans to issue 58.75 million American Depositary Shares (ADS) in this IPO. Each ADS share is equivalent to 4 Class A common shares, with an issuance range of $8.5 to $10.5 per ADS share. Based on this calculation, the corresponding financing range is between US$499 million and US$619 million.

Yixian E-commerce was founded in 2016. According to the Insight Consulting Report, the company achieved total sales of 3.5 billion yuan in 2019, ranking first among domestic makeup companies. Perfect Diary, which it incubates, has become the number one online makeup brand in China.

Currently, Yixian E-Commerce owns four high-growth makeup and skincare brands, PerfectDiary (PerfectDiary), Little Ondine (Little Ondine), Abby's Choice (Abby's Choice), and Galenic.

In recent years, the company has achieved diversified channel expansion and adopted a combination of online and offline methods to further promote customer and brand building...

Scan the QR code in the picture to enter Moomoo's new Yixian e-commerce portal:

According to the latest prospectus, Yixian E-Commerce plans to issue 58.75 million American Depositary Shares (ADS) in this IPO. Each ADS share is equivalent to 4 Class A common shares, with an issuance range of $8.5 to $10.5 per ADS share. Based on this calculation, the corresponding financing range is between US$499 million and US$619 million.

Yixian E-commerce was founded in 2016. According to the Insight Consulting Report, the company achieved total sales of 3.5 billion yuan in 2019, ranking first among domestic makeup companies. Perfect Diary, which it incubates, has become the number one online makeup brand in China.

Currently, Yixian E-Commerce owns four high-growth makeup and skincare brands, PerfectDiary (PerfectDiary), Little Ondine (Little Ondine), Abby's Choice (Abby's Choice), and Galenic.

In recent years, the company has achieved diversified channel expansion and adopted a combination of online and offline methods to further promote customer and brand building...

Translated

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)