$Tesla(TSLA.US$ Can 180 shareholders still hold up?

Translated

2

14

cautions

The importance of a trend depends on 3 aspects: the time period, the length of the trend line, and the number of times the price has been hit. The trend at the weekly level is more important than the daily level. The longer the trend lasts, the more times the price hits the trend, the more important it is.

In practice, we find that the steeper the angle between the trend line and the horizon, the shorter the trend duration, and the longer it calms down.

In addition, transaction volume is also an important indicator for confirming trends. In an upward trend, turnover increases when prices rise and shrinks when prices fall. In a downward trend, turnover increases when prices fall and shrinks when prices rise. However, if the trading volume does not match the operation of the stock price, it is a sign of a trend reversal.

The importance of a trend depends on 3 aspects: the time period, the length of the trend line, and the number of times the price has been hit. The trend at the weekly level is more important than the daily level. The longer the trend lasts, the more times the price hits the trend, the more important it is.

In practice, we find that the steeper the angle between the trend line and the horizon, the shorter the trend duration, and the longer it calms down.

In addition, transaction volume is also an important indicator for confirming trends. In an upward trend, turnover increases when prices rise and shrinks when prices fall. In a downward trend, turnover increases when prices fall and shrinks when prices rise. However, if the trading volume does not match the operation of the stock price, it is a sign of a trend reversal.

Translated

CWeb is currently under short-term pressure around 58, and the short trend is quite obvious. Focus on going back and forth, around 49.5

Translated

Under normal circumstances, the first 30 minutes after opening is the most active period of one-day trading, reflecting the value judgment of ordinary retail investors. Retail investors usually choose to close or open positions when they have just opened, so often the opening price is usually close to the daily high or low, and then the price gradually becomes rational. Institutions generally choose to operate when the market is about to close to avoid holding positions overnight.

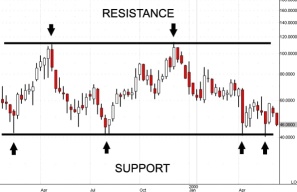

The K-line chart, on the other hand, is composed of columns formed after daily trading, and then various graphs, trends, etc. are formed. Let's discuss pressure levels and support levels together.

The concept of support and pressure

Resistance (resistance): When the selling market strongly stops the upward trend and the stock price in the market reaches a certain level, it seems to create a resistance line that puts pressure on the stock price and affects the continued rise of the stock price. We call it a pressure line or pressure level.

Support (support): When buying strongly blocks the downward trend, and when the stock price in the market reaches a certain level, there seems to be a resistance line that supports the stock price and affects the continued decline in the stock price. We call it a support line or support level.

The K-line chart, on the other hand, is composed of columns formed after daily trading, and then various graphs, trends, etc. are formed. Let's discuss pressure levels and support levels together.

The concept of support and pressure

Resistance (resistance): When the selling market strongly stops the upward trend and the stock price in the market reaches a certain level, it seems to create a resistance line that puts pressure on the stock price and affects the continued rise of the stock price. We call it a pressure line or pressure level.

Support (support): When buying strongly blocks the downward trend, and when the stock price in the market reaches a certain level, there seems to be a resistance line that supports the stock price and affects the continued decline in the stock price. We call it a support line or support level.

Translated

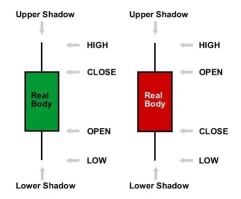

Let's get familiar with the K-line chart

A K-line chart is a columnar line drawn based on the four price levels formed by the price or index during a certain period of time.

In the figure below, the rectangle in the middle is called an entity. It reflects group mentality. The thin line above the entity is called the upper shadow line, and the lower thin line is called the lower shadow line, and the shadow generally reflects the level of fear of traders. Entities are divided into positive lines and negative lines. We generally use red or green to indicate them.

A K-line chart is a columnar line drawn based on the four price levels formed by the price or index during a certain period of time.

In the figure below, the rectangle in the middle is called an entity. It reflects group mentality. The thin line above the entity is called the upper shadow line, and the lower thin line is called the lower shadow line, and the shadow generally reflects the level of fear of traders. Entities are divided into positive lines and negative lines. We generally use red or green to indicate them.

Translated

1

The Dow continued to decline in the short term. Yesterday's closing was almost flat. Today is also quite critical. It depends on how the market performs. Today, I see support for 33300, and the pressure is around 33827. What do you think of it? $Dow Jones Industrial Average(.DJI.US$

Translated

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

人定胜天OP sincere Hamster_2458: No way, this is so expensive

人定胜天OP 102787375: Very resistant, I don't know if you're making money or losing money

人定胜天OP sentosa island: Who told you I was afraid, I didn't get this ticket myself

人定胜天OP Newbie x1: It's time to stop loss. Trust me, it will continue to decline in the near future, but it will be very slow and difficult to pull back

人定胜天OP 102334963: They are all a group of high-ranking people