You know who this is... Warren Buffett

He started his Investing partnership with $105,000.

Today, he manages Berkshire Hathaway with a market cap of $857,529,777,000

For 70 years, he has told us how to invest successfully.

Here are his 7 Golden Rules of Investing:

Today, he manages Berkshire Hathaway with a market cap of $857,529,777,000

For 70 years, he has told us how to invest successfully.

Here are his 7 Golden Rules of Investing:

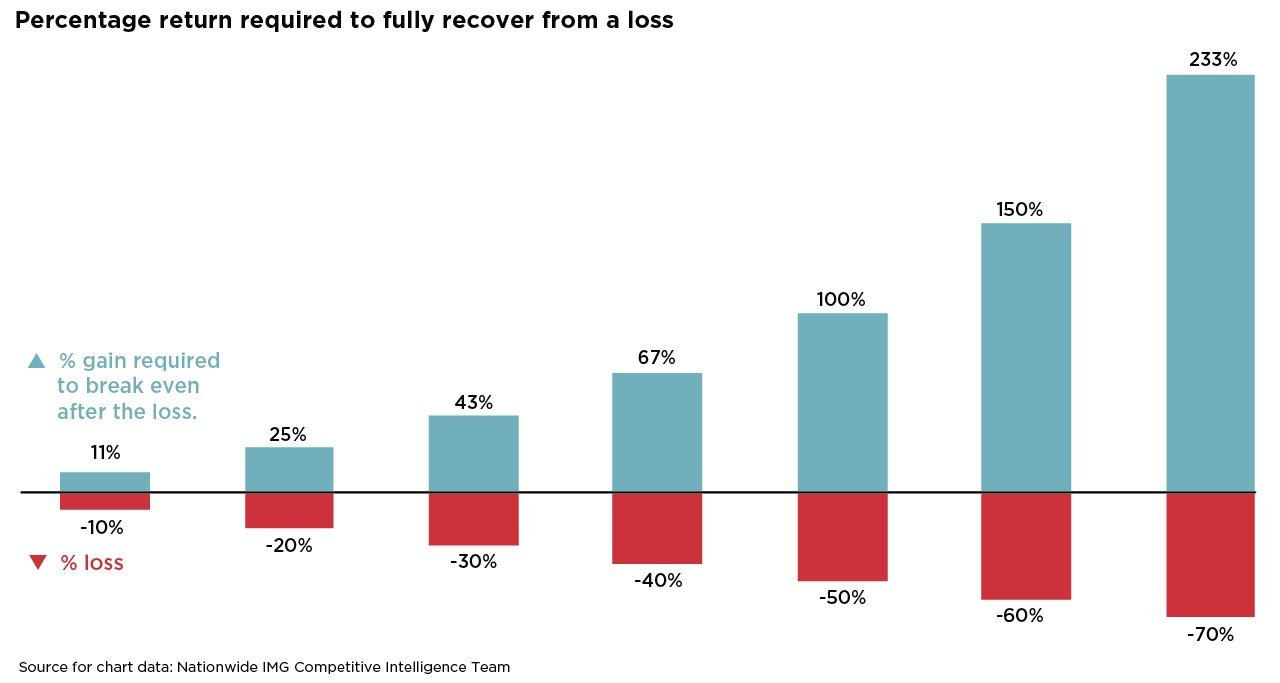

1. Never Lose Money

When I first heard this, I thought: "How underwhelming. This is obvious."

But I didn't understand all the implications back then.

Lost dollars are so much harder to replace than gained dollars are to lose.

2. Have a Margin of Safety

How do you make sure to never lose money?

Always pay less than something is worth. I know, once again, obvious...

Use a margin of safety. Be conservative, be skeptical, say no a lot.

Never accept to overpay. There's never a reason to pay too much.

How do you make sure to never lose money?

Always pay less than something is worth. I know, once again, obvious...

Use a margin of safety. Be conservative, be skeptical, say no a lot.

Never accept to overpay. There's never a reason to pay too much.

3. Never Own Stocks

Never own stocks! Own companies!

Yes, it's semantics. But it is important. Owning a stock means you play the "Pricing Game."

Owning a company is the "Value Game."

Never own stocks! Own companies!

Yes, it's semantics. But it is important. Owning a stock means you play the "Pricing Game."

Owning a company is the "Value Game."

4. Play the Value Game

The Value Game is a long-term game.

It's about owning companies that get better and better, offer more and more value, and letting them run.

Look at the Return on Invested Capital (ROIC), this will be your long-term return holding the company.

5. Only Own what You Understand

You'll never successfully invest when you don't understand what you own.

Why?

1. You'll panic sell at the worst times (when bad news hits)

2. You'll sell too early when the stock rises (because you don't know the true value)

6. Be Different

If you invest where everyone else invests, you'll get the same results as everyone else.

You got to deviate from the average investor. But this comes with the risk of underperformance as well!

The more you differ from the rest, the more knowledge you must have!

7. Be Lonely

The easiest way to differentiate is by investing where no one else looks.

The micro and small-cap space offers the best opportunities.

Every successful investor started there. And they would love to stay there. But they are too big now.

It's your turn!

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

lcsiong1873 : The US government has always used petroleum = US dollars to harvest chives from all over the world.