Why Super Micro Computer Stock Is Soaring Again

On January 29, 2024, $Super Micro Computer(SMCI.US$, a partner of $NVIDIA(NVDA.US$ making storage and server offerings, announced its financial results for the second quarter of the fiscal year 2024, which ended on December 31, 2023, through an 8-K filing. The company, which specializes in high-performance server technology, is furthering its presence in the markets of AI, Cloud, Storage, and 5G/Edge with its advanced server offerings.

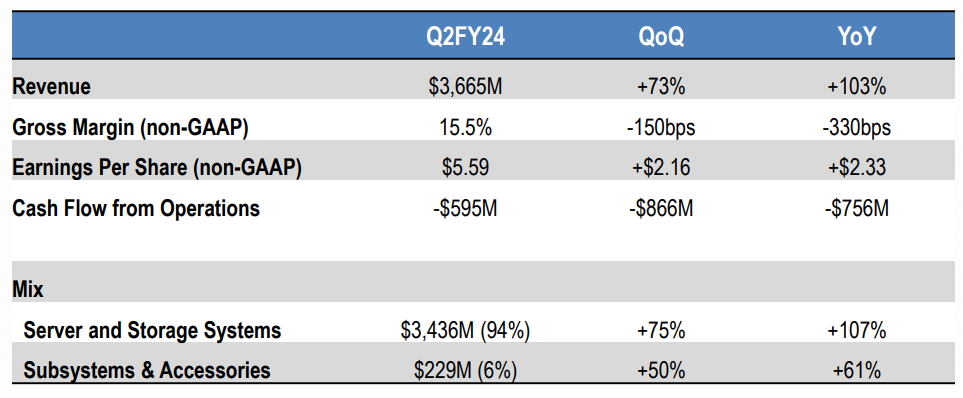

Super Micro Computer Inc experienced significant revenue growth of 103% year-over-year, with net sales hitting $3.665 billion, indicating growing market share and heightened demand for its AI-focused platforms and comprehensive IT solutions. The company's net income rose sharply to $296 million, nearly double that of the same quarter last year, with diluted earnings per share at $5.10, reflecting robust operational efficiency and strong market demand.

President and CEO Charles Liang commented on the results:

We continued to demonstrate our market leadership in fiscal Q2 2024, reporting record revenue results of $3.66B, year-over-year growth of 103%. While we continue to win new partners, our current end customers continue to demand more Supermicros optimized AI computer platforms and rack-scale Total IT Solutions. As our innovative solutions continue to gain market share, we are raising our fiscal year 2024 revenue outlook to $14.3 billion to $14.7 billion."

SMCI stock rose over 10% in extended trading.

Super Micro has raised its revenue projections for the entire fiscal year, attributing the increase to its products gaining more market share. The company now expects to generate between $14.3 billion and $14.7 billion in revenue, surpassing analysts' expectations of $13.8 billion. This updated forecast significantly exceeds the company's earlier revenue projections of $10 billion to $11 billion.

Despite this increase, gross margin dropped to 15.5% from 18.7% the previous year, hinting at industry competition and cost challenges. The company's use of $595 million in operational cash flow suggests notable investments or shifts in working capital needs. Wedbush Securities analysts highlighted in a recent note that Super Micro's sales are heavily reliant on the supply of Nvidia's graphics processing units (GPUs), which are fundamental to the growth in AI technology. Nvidia has seen its revenue more than triple in the third quarter compared to the previous year, driven by high demand from cloud and internet companies for its GPUs. Analysts anticipate a comparable surge in revenue for Nvidia in the fourth quarter as well.

Source: SUPERMICRO, CNBC, Seeking Alpha, Yahoo Finance

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment