What to Expect From Upcoming Big Tech Earnings

The highly anticipated earnings season for tech giants has kicked off. The 'Magnificent Seven' accounted for around two-thirds of the S&P 500 gains last year but can they repeat those extraordinary returns in 2024?

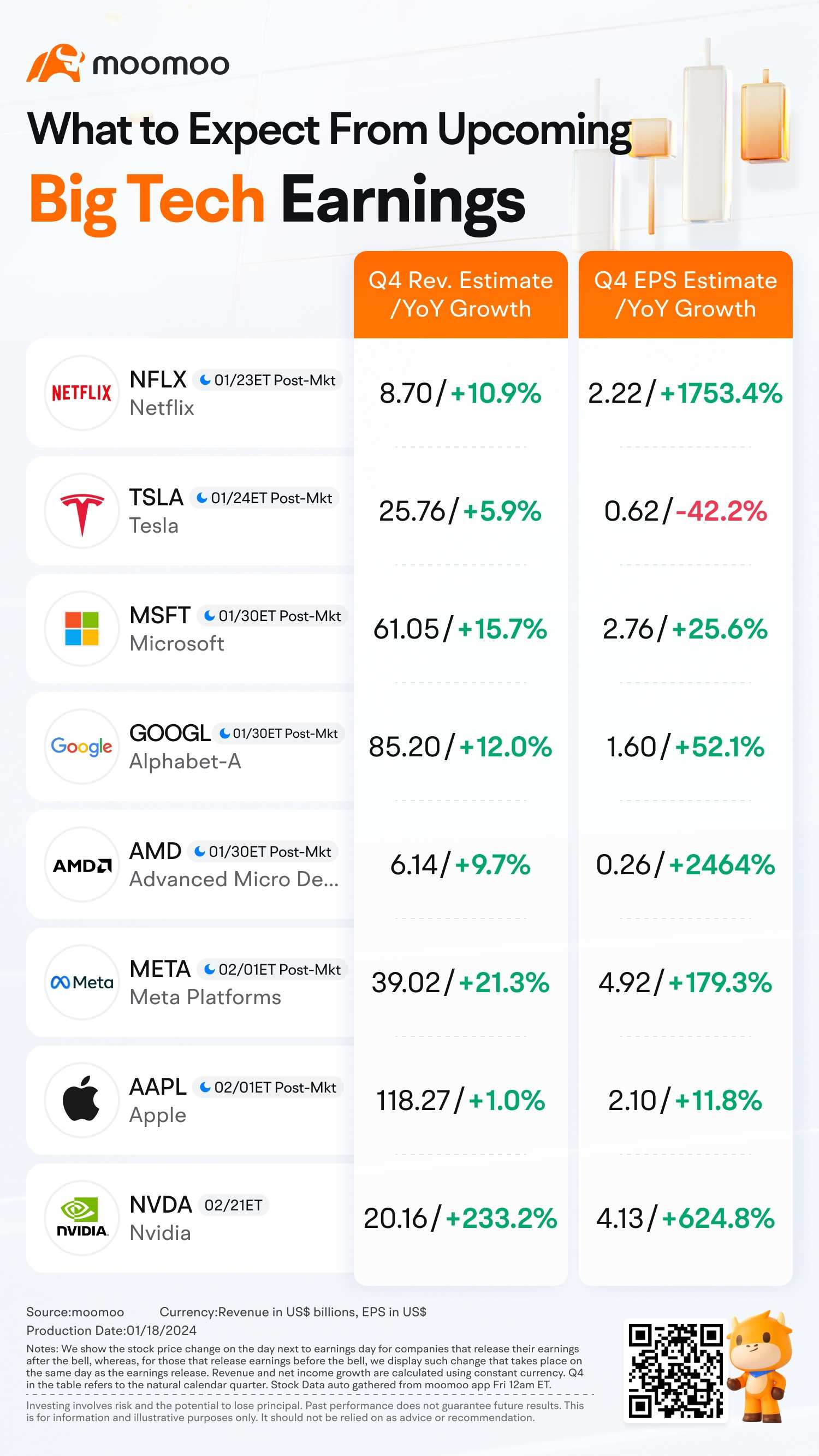

Netflix

• Netflix is expected to post quarterly earnings of $2.22 per share in the fourth quarter of 2023, which represents a year-over-year change of 1753.4%.

• Revenues are expected to be $8.70 billion, up 10.9% from the year-ago quarter.

Netflix's pivot to offer an advertising-supported subscription seems to be paying off nicely for the streaming service, Oppenheimer said.

The accelerated pace of new subscribers and, more importantly, how this impacts revenue, has encouraged Oppenheimer analysts led by Jason Helfstien to lift their price target on Netflix to $600 from $475, a 24% premium to Thursday's closing price. The firm maintains its Outperform rating on the stock.

Netflix disclosed earlier this week that it surpassed 23M ad-supported subscribers, up from 15M in November. "Advertising has significant incremental margins," the analysts said. They said increased revenue amplified by password sharing rules and optimizing subscriber plan choices translates into about $17.5B in additional cash for content, stock buybacks or both.

Tesla

• Shares in Elon Musk's EV maker doubled in value over 2023, gaining 102%, as the company is expected to report revenues of $25.76 billion, up 5.9% from the year-ago quarter.

• Shares in Elon Musk's EV maker doubled in value over 2023, gaining 102%, as the company is expected to report revenues of $25.76 billion, up 5.9% from the year-ago quarter.

• Analyst forecast for the next set of quarterly results is $0.62 earnings per share, which represents a YoY decline of 42.2%.

Tesla has reported 485,000 deliveries for Q4 2023, marking an increase of about 20% versus the last year.

“Tesla has already given insight into its performance via the quarterly vehicle production and delivery data released ahead of the financial results. In the fourth quarter it produced 494,989 vehicles and delivered 484,507 vehicles, the bulk of which were Model 3 or Y,” Dan Coatsworth, investment analyst at AJ Bell, said.

“It managed to hit a 1.8 million annual delivery target which effectively gave it breathing space amid market worries that competition was biting at its heels, particularly China’s BYD which surpassed Tesla as the world's biggest maker of electric vehicles last quarter,” he added.

There are concerns around a stall in its automotive sales with no new model launch and delayed Cybertruck ramp-up.

Microsoft

• The consensus analyst forecast for the next set of quarterly results is earnings per share at $2.76 and revenue at $61.05 billion.

Microsoft managed to steal the title of most valuable company in the world from Apple in 2024, with the software giant's bet on AI paying off.

CEO Satya Nadella has made a push for Microsoft to assume a global leadership role in AI. The company has a significant stake in leading AI startup ChatGPT maker, OpenAI, and reportedly invested up to $13 billion in the startup. This alliance has been considered one of the tech industry's most lucrative tie-ups.

“The big issues are whether Microsoft can sustain robust growth in cloud computing and how it can take AI to the next level,” Dan Coatsworth, investment analyst at AJ Bell, said.

“Seen by most as the dominant AI software play, its apps are already critical to millions of businesses, so wrapping functionality into Windows, Microsoft 365, Azure and more through its Copilot tools offers immense potential.” Coatsworth added.

But it is not all champagne and caviar for Microsoft. Its success has naturally attracted the attention of various regulators and competition authorities and like its mega cap peers, there are growing concerns that the company has become too dominant. Antitrust probes are likely to be a key focus for investors in 2024.

Advanced Micro Devices

• AMD is estimated to release its report earnings on January 30. This semiconductor maker is expected to post quarterly earnings of $0.26 per share in its upcoming report, which represents a year-over-year change of 2464%.

• Revenues are expected to be $6.14 billion, up 9.7% from the year-ago quarter.

AMD stock sets all-time high on Thursday following an upbeat forecast about the chip market and an optimistic call from analysts at TD Cowen.

AMD was up 1.56% to $162.67 Thursday after Taiwan Semiconductor Manufacturing said it expects revenue growth this year to be more than double the rate of the broader chip market. TSMC manufactures AMD chips.

In addition to the bullish forecast from TSMC, TD Cowen analyst Matthew Ramsay increased his price target on the shares to $185 from $130 and maintained his Outperform rating.

A major reason for Ramsay's belief in the stock is AMD's potential success in the artificial-intelligence space. "While Nvidia remains the AI leader, we believe sizable upside opportunities remain for AMD as well," he wrote in a research note. AMD's MI300 is a data center graphics processing unit and the company's offering for AI projects and applications.

"The potential of MI300 within the AI TAM (total addressable market) is still ahead for AMD with potentially large upside over the next couple years as an increasingly capable GenAI alternative," Ramsay said.

Apple

• Apple will release its earnings report on Feb.1,2024. The iPhone maker is forecast to grow earnings and revenue by 11.8% and 1% from the prior year respectively, with EPS of $2.1 and $118.27 billion in revenue.

Apple shares rose 3.3% on Thursday, after Bank of America upgraded the iPhone maker to buy from neutral, hitting its biggest one-day percentage gain since May.

Artificial intelligence will be a driver for the company’s hardware and services business, according to BofA analyst Wamsi Mohan, who wrote that he sees a “stronger multi-year iPhone upgrade cycle driven by need for the latest hardware to enable Generative AI features to be introduced in 2024/2025.”

Mohan also thinks the upcoming launch of Apple's virtual reality headset has potential, writing that revenue for the product “could surpass iPad revs over time as spatial computing takes hold offering differentiated use cases driving services upside.” It lifted its price target to $225 from $208.

However, before this, the stock has received at least three downgrades in 2024, with Redburn Atlantic citing valuation concerns and both Piper Sandler and Barclays seeing risks to iPhone sales.

The weakness to start the year has pushed Apple below Microsoft in valuation. Currently, Apple has a market capitalization of $2.92 trillion, just shy of the software giant's $2.93 trillion.

Mooers, which tech giant are you most looking forward to? Which company do you think will outperform expectations?

Source: Yahoo Finance, Barrons, Bloomberg, Seeking Alpha

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

WOLFE (白狼) : Tesla nv fails to dishearten the hearts of many, and Elon is the only one playing the show when investors began to shun him

Fighting for claims and control when his stocks has plummeted is his only defence against so many opposing his tide.

Fighting for claims and control when his stocks has plummeted is his only defence against so many opposing his tide.

ZnWC : This article that I read estimated EPS to be 0.74. But EPS changes with share price so the estimate will change again (like weather forecast). Currently all EV stocks are facing a sell-off; can check the share prices of BYD, Nio, Xpeng, Li Auto, Rivian etc.

If you look at past data, it is never a fair comparison to use stock of a different industry to compare earnings (like compare Apple with Tesla who are selling different products). If you compare with other EV companies, Tesla revenue and net income will look very much better and may even meet expectations.

As always read the earnings data with a growth mindset, don't just look at what the media (or someone) want you to see.

Tesla Q4 2023 Earnings Preview

https://www.moomoo.com/community/feed/111777358544902?global_content=%7B%22invite%22%3A%22101709443%22%2C%22promote_content%22%3A%22mm%3Afeed%3A111777358544902%22%7D&data_ticket=212ca245a589f1e400fb2e247953bc77&futusource=nnq_personal_host

BelleWeather : NVIDIA still has my heart - I fear AMD isn’t nearly as strong in the longterm.