What Should Investors Know About Upcoming Meta Earnings?

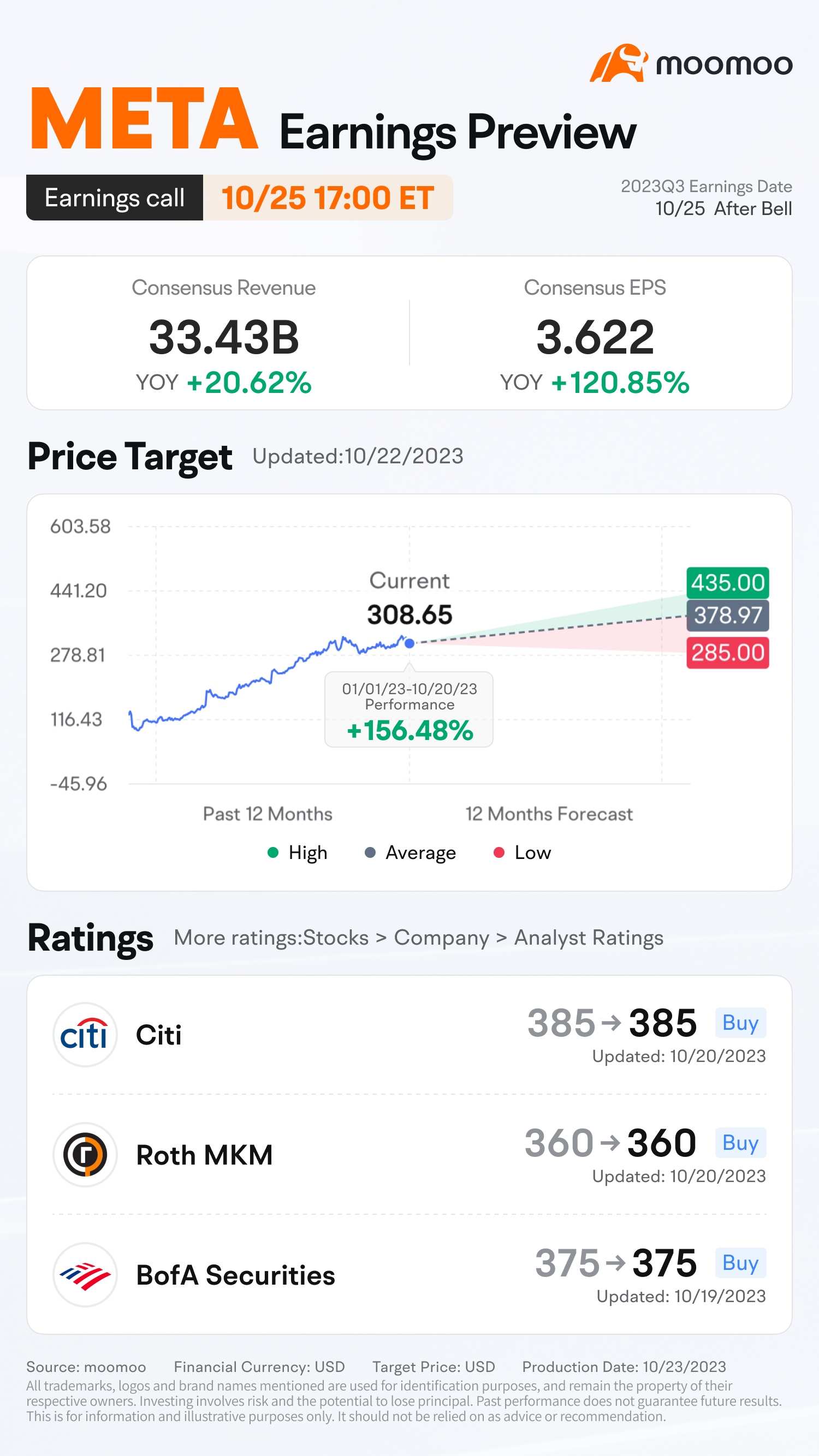

Wall Street expects the Facebook parent $Meta Platforms(META.US$ to earn $3.62 per share on revenue of $33.43 billion. This compares to the year-ago quarter when earnings were $1.64 per share on revenue of $27.71 billion.

Despite the recent downturn in tech stocks, Meta stock has remained a standout performer among mega-cap companies. Over the last six months, its shares have surged over 40%, outperforming the $S&P 500 Index(.SPX.US$'s modest 2% increase. Additionally, the stock has soared nearly 160% year-to-date, compared to the S&P 500 index's 10% rise, with a 2% increase in the past thirty days. Given this impressive momentum, investors are keen to understand the potential for further growth.

Here are key expectations to watch:

The expectations for Meta's third-quarter report are quite high, with many analysts anticipating robust performance and optimistic future projections.

With street cautious on expense/capex guide, key driver for stock will be 4Q revenue guidance, and we expect a strong 4Q vs sector as Meta can benefit from: 1) eCommerce ad acceleration (easy comps & China driven ad competition), 2) Ramping Reels and messaging monetization, and 3) Growing AI/ML capabilities," $Bank of America(BAC.US$ analyst Justin Post wrote in a note.

What History Shows

The social media giant's earnings are expected to have more than doubled year over year, per LSEG. Meta consistently tops analyst earnings expectations, with an 87% beat rate, per Bespoke. The stock also averages a 2% gain on earnings days.

Management's Initiatives

Meta's management has implemented successful cost-cutting measures, resulting in lower expense guidance for 2023. These initiatives have improved the company's financial standing and will continue to do so in the long term.

The recent quarter showed revenue growth of 11% YoY, while adjusted EPS increased from $2.46 to $2.98. Gross margin remained steady above 81%, with operating margin expanding to almost 32%, driving a surge of almost 50% in cash flow from operations. Meta's core digital advertising business, which boasts around 3 billion monthly active users, has also shown growth potential. In its upcoming report, Meta must demonstrate its prominence among big tech and continued improvements in these areas.

Business Growing Focus - AI

After $Microsoft(MSFT.US$'s launch of ChatGPT, other tech companies have also entered the AI race. Meta reduced its investment in its Reality Lab or Metaverse through a reduction in headcount while increasing spending on AI development. The company anticipates an increase in total capital expenditures in 2024 due to investments in both data centers and servers, primarily to support AI work. On July 18, Meta launched its AI chatbot, LIama 2, an open-source large language model designed to generate family-friendly output using reinforcement learning techniques.

Meta's core business remains in its ad income, which accounts for 98% of its overall revenue. Hence, the family of apps is expected to take the AI tailwind as its AI chatbot, Liama 2, may gather tractions from users, in turn improving the ad revenue. In the second quarter, Meta's ad impressions increased by 34% year on year, and the average price per ad decreased by 16% year on year. This makes its user growth another key matrix in the earnings report, which is expected to maintain stable growth in the coming quarters.

Risk and Uncertainty

Although the high barriers to exit for Meta's 3 billion users are acknowledged, the risk of a disruptive and innovative technology (like TikTok) emerging and luring them away from Meta's apps cannot be ignored. While there is no expectation of competition in the form of a substitute for Meta, increased engagement on one network could come at the expense of others, reducing engagement and the potential return for advertisers.

Furthermore, despite Meta's dominant position in the social network market, it is heavily reliant on online advertising revenue. Hence, an extended downturn in online ad spending poses a significant negative impact on the company's fair value estimate.

Additionally, Meta's dependence on user behavioral data presents environmental, social, and governance risks. Regulatory agencies worldwide may limit the data that Meta can collect and how it can be used. Inadequate data privacy and security could also pose harm to users.

Source: CNBC, Nasdaq, Morningstar

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Winnerspayout : We the people are the Republic One Nation we in every Land equality resolve innovate Solutions

Brought to you this message Senior partner with Laws Enterprise & R2A1OGS/AG

101823892_antony : don't sell will hit 330 tomm

safri_moomoor : ok thanks all