What Happens to Financial Markets When Fed Hiking Cycle Looks Done

The US job market has cooled in October, meaning that the Federal Reserve will have enough space to maintain interest rates for December. This announcement reinforces predictions from the market that the central bank will conclude its most ambitious rate-hiking campaign in recent history. According to the Bureau of Labor Statistics report published on Friday, nonfarm payrolls rose by 150,000 in October, which is below expectations. The unemployment rate increased to 3.9%, while monthly wage growth slowed down.

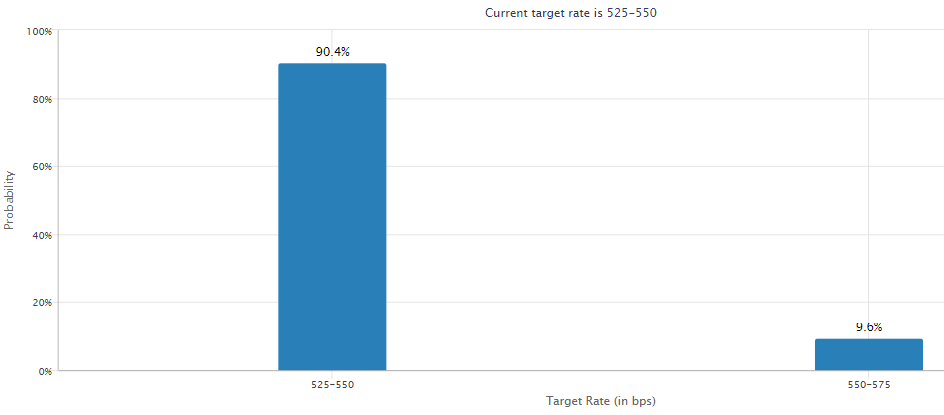

This was also reflected in financial markets, with bond yields falling. Traders who deal with contracts linked to the Federal Reserve's policy rate now estimate that there is only a 10% probability of a rate hike by January, compared to 30% before the employment report. Rate futures pricing now shows that there is a greater likelihood of a Fed rate cut by May 2024 than not, with several additional cuts anticipated later next year.

Put a fork in it – they are done," said Jay Bryson, $Wells Fargo & Co(WFC.US$ chief economist. "If you are an FOMC official, this is what you wanted to see. This is very good news for the Fed."

Fed's Tightening Cycle Is Nearly Done

Powell said last Wednesday that supply and demand conditions in the labor market were coming into better balance, citing a slowing in job gains, an increase in labor force participation and a rebound in immigration. While policymakers in September penciled in one more rate hike for the year, Powell downplayed the significance of that projection on last Wednesday. The Fed meets again Dec. 12-13.

Although Powell implied that there might be another rate hike in the future, he also suggested that he and his colleagues were uncertain whether monetary policy was restrictive enough to achieve the Fed's 2% inflation target. He mentioned that long-term borrowing costs, such as the increase in 30-year fixed-rate mortgages to almost 8%, could potentially help the Fed reach its goals.

Stocks Could Be Supported by Lower Interest Rates

The rise in Treasury yields has been a major concern for the stock market. However, Wall Street analysts, including Raymond James and Bill Ackman, predict that if there is an economic downturn, the yield on 10-year Treasury bonds will decrease, which would be good news for stocks. Even though there may be a flood of new Treasuries on the market, investors will likely continue to seek high-interest rates to deal with the economic weakness.

According to Larry Adam, chief investment officer at Raymond James' private client group, softer economic growth and ongoing disinflation are macro factors that should drive interest rates considerably lower over the next few months, regardless of supply/demand dynamics.

What Analysts Say

• "This is a really good report for the Fed," said Kathy Jones, $Charles Schwab(SCHW.US$'s chief fixed-income strategist. "Softer job growth with slightly higher unemployment and slowing wage growth. No change in Fed policy in December is likely. The Fed's rate hiking is probably done."

• Atlanta Fed President Raphael Bostic also said he's closely watching inflation data, but told Bloomberg TV he feels that the fresh jobs data adds to his long-held view that for now rates are "sufficiently restrictive."

• Overall, the latest jobs report was "tailor-made to match Powell's soft landing message from earlier this week," $JPMorgan(JPM.US$ chief U.S. economist Michael Feroli said in a note to investors.

Despite Friday's bond yield drop and surge in stock prices that has loosened financial conditions, Feroli said, it will be the economic data that determines what the Fed will do, "and the data say we're done with rate hikes."

Source: Bloomberg, Morningstar, Yahoo Finance, REUTERS

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

金融弟弟 : https://youtu.be/sS-nxZriTC8?si=VDipJSdigvUyIB4L

BILL DING :