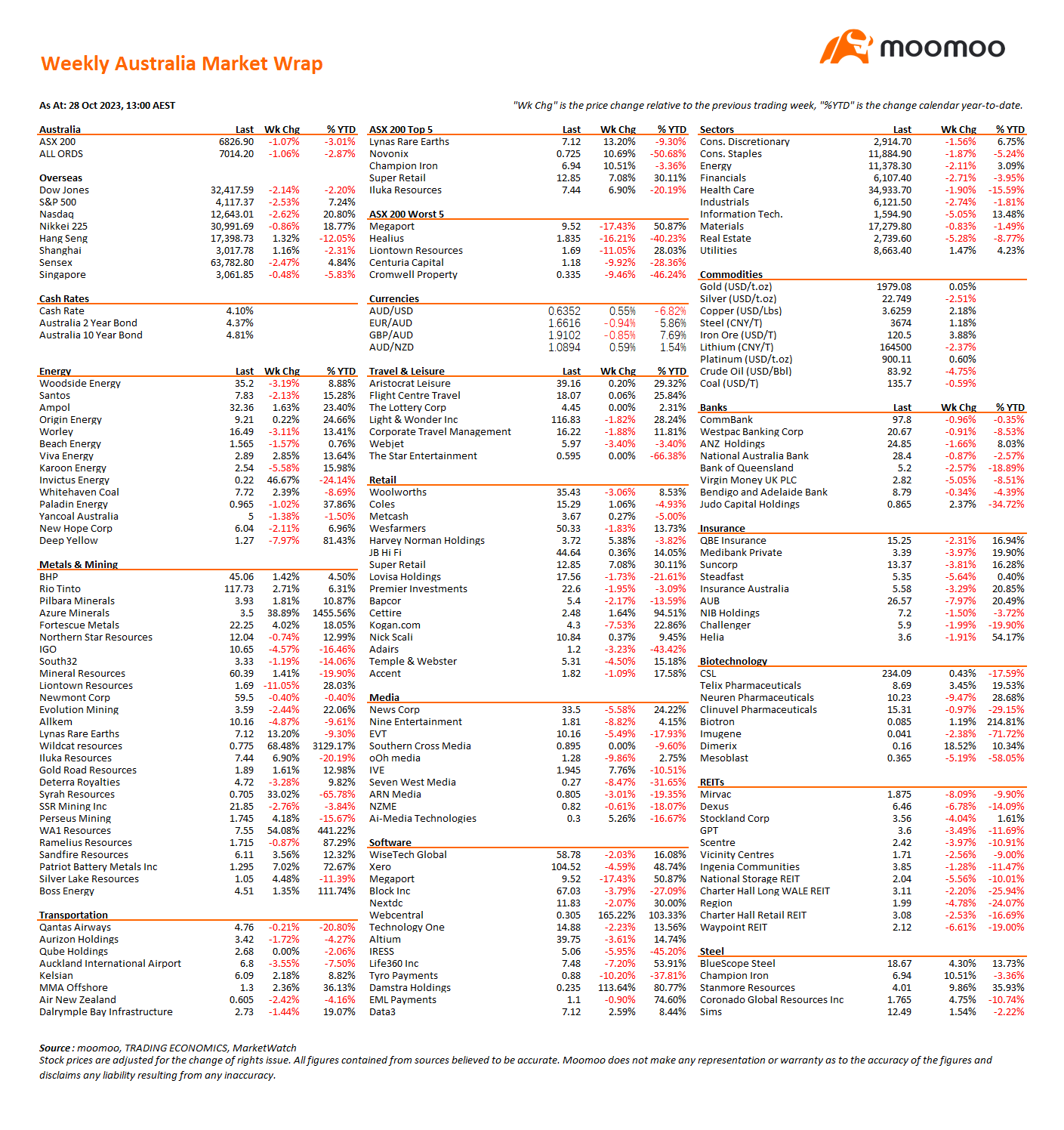

Weekly Australia Market Wrap for the Week-Ended 27 October 2023

Most major equity markets fell again last week after around one third of the S&P 500 reported their quarterly earnings, bond yields continued to see upward pressure and inflation worries re-appeared on the horizon. Adding to the market worry was the ground invasion of Gaza by the Israeli Defence Force and the threat that the battle could spread further into the region.

The US markets were weaker with the S&P 500 down 2.53%, the Dow Jones down 2.14% and the Nasdaq 2.62% lower. Eurozone shares were 0.3% lower and Japan dropped 0.86%. Hong Kong shares rose 1.32% and China shares gained 1.16% after media began reporting the Chinese government will unleash a fresh round of stimulus for its faltering economy. The stimulus was confirmed later in the week when it issued 1 trillion RMB of new bonds.

Equity markets in Australia lost around 1.00% for the week as a strong inflation report pushed the case for another rate rise when the RBA Board meets on Melbourne Cup day.

The Australian market is down around 9.80% since February this year.

Inflation rose by 5.4% year-on-year during the September quarter but markets were expecting a lower number. Rises in petrol prices and electricity were largely factored in but there were unexpected rises in insurance, services, take-away meals and rents. This resulted in the ‘trimmed mean’ measure only slowing to 5.2% year-on-year, well above the RBA forecast as recently as August.

During the week both the Bank of Canada and the ECB left rates on hold.

The US bond market is the key indicator for many market watchers and two weeks ago it hit 5.00%, it’s highest level in 16 years. The market however took that as an opportunity to buy and yields pushed back lower to 4.84%. It seems that there is little chance of cash rates falling anytime soon but rates may well rise further.

The crude oil market has been highly volatile in recent weeks with initial spikes - due to the potential for Iran to become further involved in the Middle East conflict - reversing to see a 4.75% drop in the price per barrel to $83.92.

The Energy sector in Australia fell 2.11% with Santos shedding 2.13% and Woodside falling 2.53%. Invictus Energy had a good week with strong gas flows at its project in Zimbabwe. Shares rocketed 46.67% higher across the week.

The worst performing sectors were Real Estate (-5.28%) and IT (-5.50%). Interest rate worries hit Real Estate stocks with Mirvac shedding -8.09%, Dexus dropping 6.78%, Stockland losing 4.04%and Waypoint dropping 6.61%.

Megaport was one of the biggest losers in the IT sector, losing 17.43% after the company released its quarterly result. The stock is not for the faint hearted, having lost 80% of its value since reaching a peak of $21.46 in November 2021 before tripling since August this year. It closed the week at $9.52.

Xero dropped 4.59%, WiseTech Global shed 2.03% and Block Inc lost 3.79%.

Other sectors to weaken were Industrials (-2.74%), Financials (-2.71%), Health Care (-1.90%) and Consumer Staples (-1.87%).

The Utility sector was the only sector in the black rising 1.47% as investors chased security of earnings.

Commodity prices were mixed with Copper (+2.18%), Steel (+1.18%) and Iron Ore (+3.88%) rising and Lithium (-2.37%) and Coal (-0.57%) falling.

The big miners lifted with BHP (+1.42%), Rio Tinto (+2.71%) and Fortescue (+4.02%) showing solid gains.

Lithium stocks were mixed with Pilbara rising 1.81% but IGO falling 4.57%, Allkem dropping 4.87% and Liontown shedding 11.05%.

Gina Rinehart’s Hancock Prospecting stepped in again to disrupt a takeover bid when Chilean giant SQM announced a $1.6 billion bid for Azure Minerals.

Incredibly Hancock jumped into the market to secure an 18% stake in Azure on the same day that the SQM deal was announced. Azure shares jumped 38.89% on the week.

Lynas Rare Earths has had a bumpy ride over the past few years but last week rose 13.20% after the Malaysian Government extended the company’s licence to process rare earth minerals until 2026. The company was facing the bleak scenario of having to shut down production in the critical metals processing so the outcome was warmly welcomed.

Graphite miner Syrah Resources has jumped 33% in a week and 54.94% in six trading days as the world’s largest producer of graphite, China, announced export curbs on the critical mineral (used heavily in EV battery production).

Australia’s largest white goods retailer, Harvey Norman, announced that first quarter pre-tax profits had halved as Australians kept their wallets closed. The company however announced a share buyback of up to $442 million in an attempt to support its share price. It seemed to do the trick as the stock rose 5.38% over the week.

This week we will be watching the US Fed meeting (Wed), Eurozone GDP growth (Tue), Bank of England meeting (Thurs, rates likely to stay on hold), Bank of Japan meeting (Tues) and Retail Sales in Australia (Mon).

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment