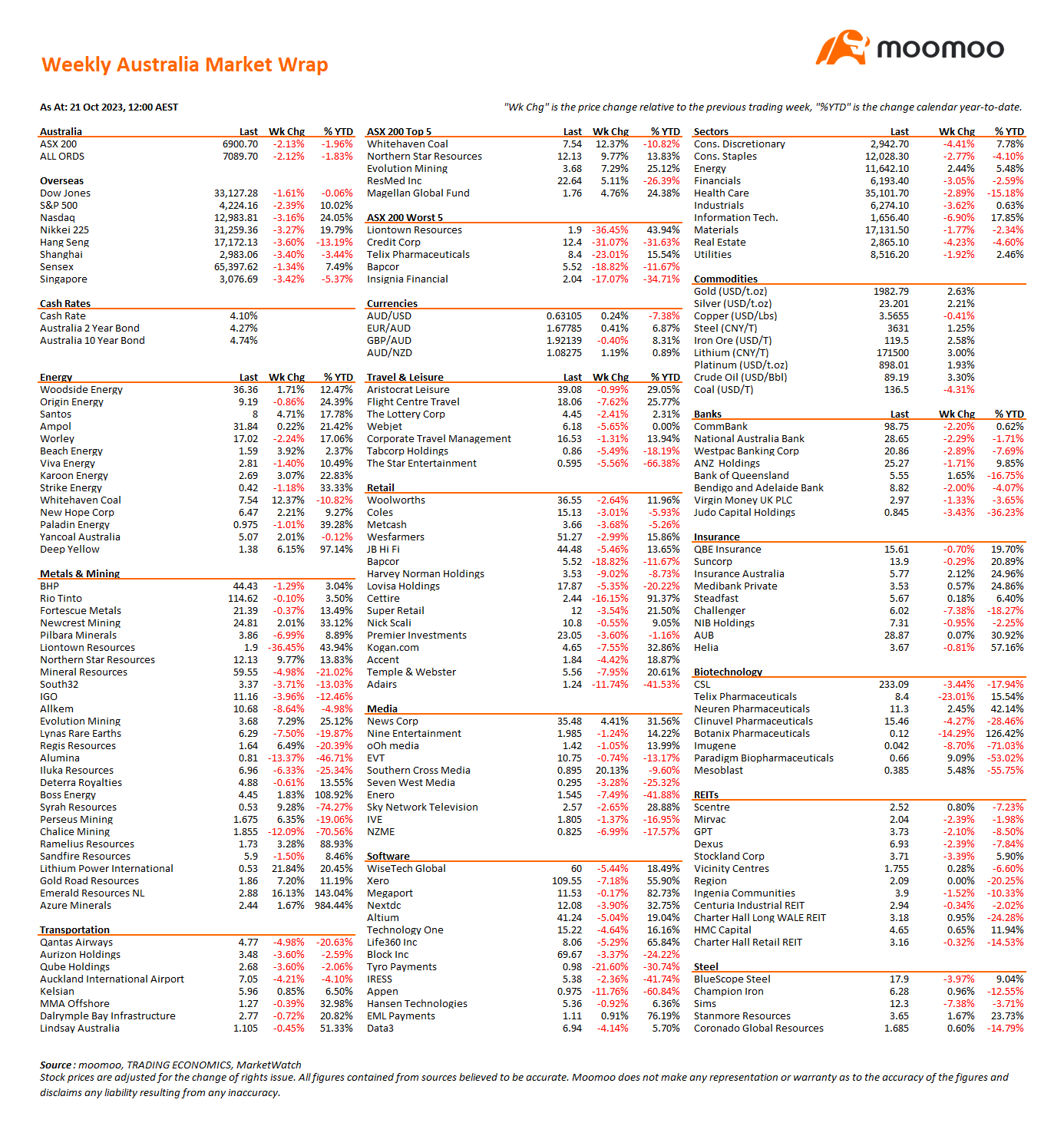

Weekly Australia Market Wrap for the Week-Ended 20 October 2023

Markets were a sea of red last week as the implications of the conflict in the Middle East expanding to the wider region started to be factored into investment calculations.

Bond yields continued to rise as investors opted to take risk off the table. Yields were not helped by Federal Reserve Chairman Powell’s comments recommitting to reining in inflation but mindful of the tightening financial conditions. This will be a delicate balancing act for the central banks as the leap in energy prices and uncertainty is likely to add to the risk of a recession.

US 10 year treasuries touched 5.00% for the first time since 2007 – a 16 year high – and the sharp move higher caused the Bank of Japan to intervene in its bond market to try and stabilise yields.

Data released by the US Treasury last week showed Japan and China were large sellers of US treasuries during August compounding the negative sentiment.

Australian 10 year bonds rose 26 basis points to 4.76% which was enough to stop the recent sharp falls in the Australia Dollar. It closed the week at $US0.6311 and will complicate the RBA’s fight to cap inflation.

Equity markets didn’t really stand a chance against the tide of rising yields and nervousness around energy prices and the Middle East. The Australian market shed 2.13%, China dropped 3.40%, Hong Kong lost 3.60% and Japan fell 3.27%.

The S&P 500 lost 2.39%, the Nasdaq shed 3.16% and the Dow Jones Index lost 1.61%.

In Australia the IT sector was hardest hit falling 6.90%. A number of companies in this sector have very high valuations and a number of them make little or no profits so this is one of the first sectors to get sold when investors get nervous.

Xero fell 7.18%, Appen shed 21.6%, IRESS dropped another 2.36%, WiseTech fell 5.44%, Altium lost 5.04% and Data3 lost 4.14%.

Not surprisingly Consumer Discretionary stocks were the next worst performers, falling 4.41%. When consumers get worried they don’t spend money on unnecessary items. High-end retailer Cettire saw a 16.15% drop in its share price along with Adairs (-11.74%), JB HiFi (-5.46%), Harvey Norman (-9.02%) and Lovisa (-5.35%).

Car accessories retailer Bapcor fell after a market update where it outlined sluggish conditions and not much optimism going forward. Its share price dropped 18.82% on the week.

Slowing global growth is not great for commodities but they were a rare bright spot in markets last week. Gold rose 2.63% to $US1982.79 an ounce. This represents a record price in Australian Dollars of $3140 an ounce. Newcrest Mining rose 2.01%, Northern Star jumped 9.77%, Evolution Mining rose 7.29%, Regis Resources gained 6.49% and Ramelius Resources rose 3.28%.

The Crude Oil price rose 3.30% to $89.19 a barrel as traders became nervous about the Middle East amid speculation that Iran may get involved and close down the Straits of Hormuz, one of the key waterways for Middle East oil exports.

Woodside rose 1.71%, Santos jumped 4.71% and Beach Energy climbed 3.92%.

Despite the Coal price falling 4.31% over the week Whitehaven rose 12.37% on the back of its purchase of two Queensland Coal mines from BHP. The two mines produce metallurgical coal which is a critical resource used in steelmaking. Whitehaven produces mainly thermal coal used in power generation which of course is under pressure from the ESG movement. Whilst the demand for thermal coal has been strong, Whitehaven is using the purchase as an opportunity to diversify away from the politically charged thermal coal. The market certainly liked the move.

Liontown Resources has endured a torrid week after US resources giant Albemarle walked away from its $3.00 per share takeover bid. Liontown shares closed the week at $1.90, down 36.45% after Gina Rinehart bought 19.9% of the company in a series of on-market share raids at an average price just below $3.00. This effectively scuttled the Albemarle bid and has forced Liontown to undertake a $365m capital raise that should take the company through to its first production targets. The raising was completed at a price of $1.80 per share. Arbitrage traders that were banking on the takeover going through at $3.00 have a severe case of Lithium burn.

The Lithium Carbonate price has almost halved since June and created mayhem amongst miners, investors and producers. In the space of twelve months the Lithium market has gone from a desperate supply shortage to overstocked inventories and questions around electric vehicle sales. Pilbara Minerals fell 6.99% over last week, Allkem dropped 8.64% and IGO lost 3.96%. Mineral Resources is not solely a Lithium producer but is also being buffeted by the sharp price falls in the commodity price. MinRes has fallen 19.69% since the start of September.

Lithium Power International (LPI) is one of a number of smaller companies trying its luck in the resource rich Atacama Desert in Chile. Recently however the Chilean Government began voice its plan to Nationalise a number of its Lithium deposits and LPI is one of those companies that appears to be targeted. Chilean State-owned Copper giant Codelco this week came to an agreement to buy LPI at a price of $0.57 per share. That is a rise of 21.84% in the past week and up from $0.22 a share a month ago. As they say, you can’t fight City Hall.

Last week there were signs that China’s growth could be finding support as its GDP for the September quarter was stronger than market expectations.

Australian jobs growth looks to be faltering which will cause the RBA some concerns as the strong immigration numbers will likely add to that pressure.

The RBA’s new Governor gave her first market update last week and her eyes will be firmly focused on the CPI due out this coming Wednesday for signs that inflation is moderating. Expectations are for a 1.1% qtr-on-qtr growth with annual inflation coming down from 6.0% to 5.3%.

Next week we will watch for the ECB meeting on Thursday, The Bank of Canada meeting on Wednesday and the US September quarter GDP due on Thursday.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment