Warren Buffett's Berkshire Trims Apple Stake by 13%, Cites Valuation Concerns

👉 Key Highlights:

📍 Berkshire Hathaway reduces Apple stake by 13% in Q1.

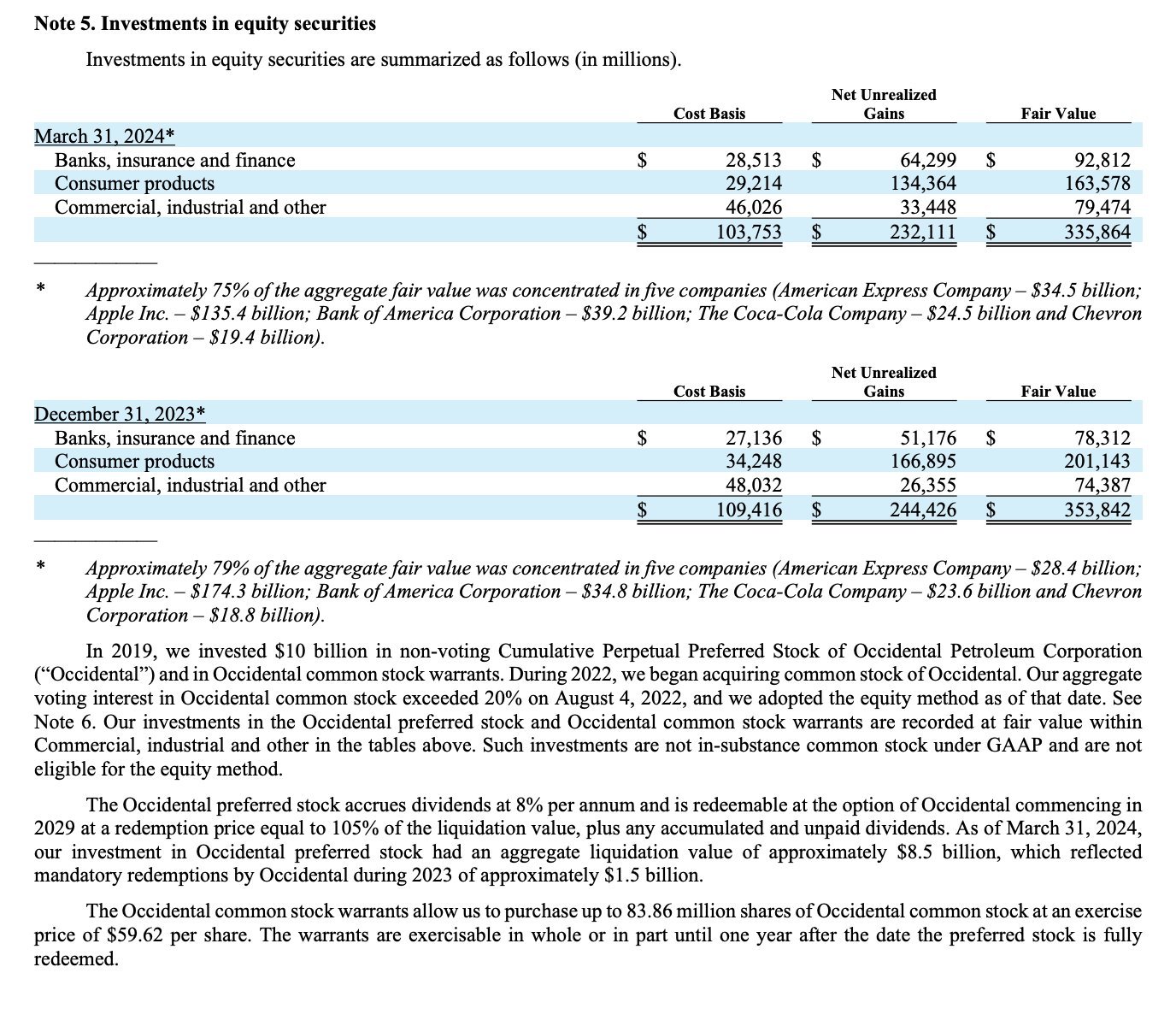

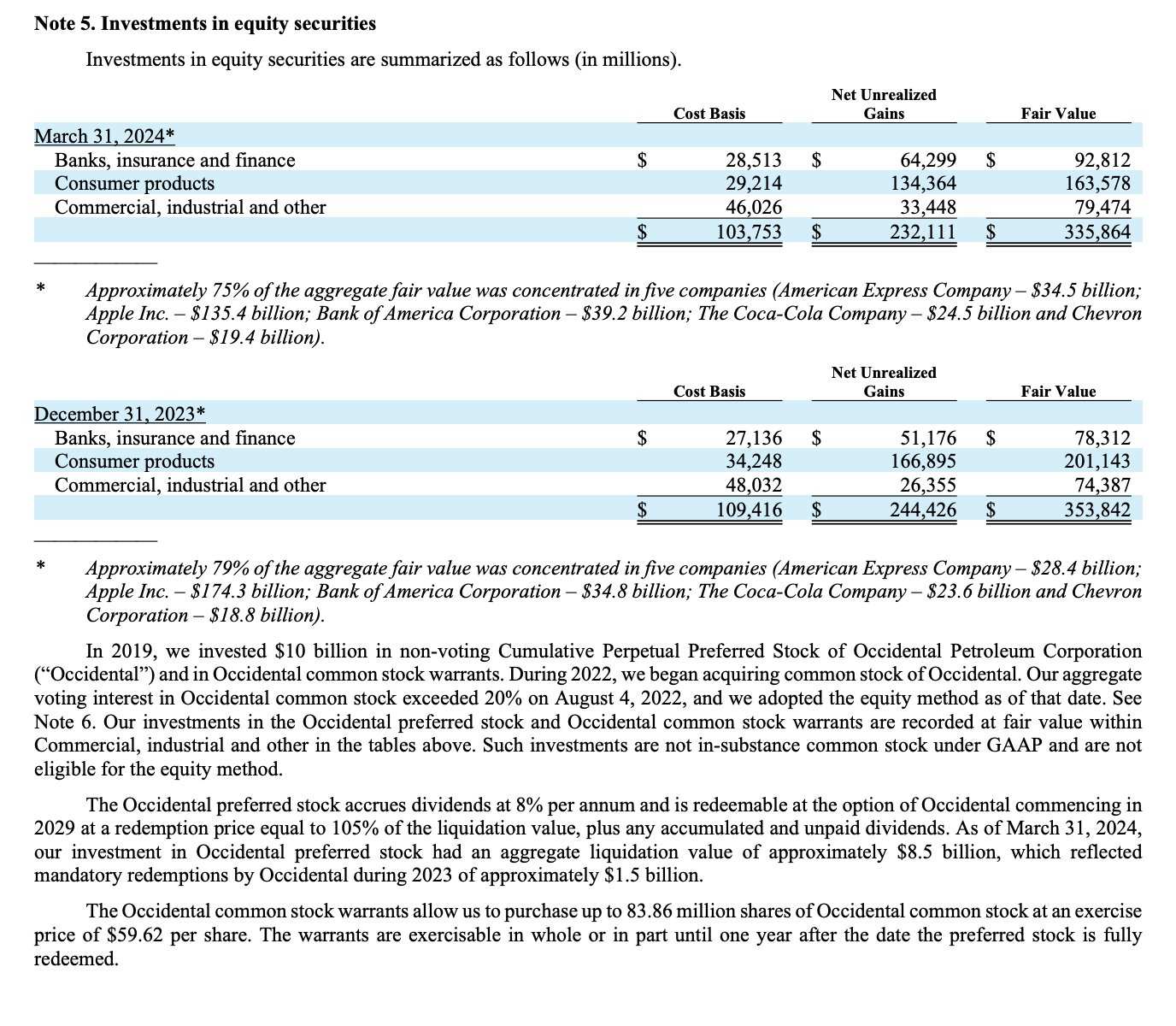

📍 Apple remains Berkshire’s largest holding, valued at $135.4 billion.

📍 Sold approximately 116 million shares, following a smaller sale last quarter.

📍 Buffett hints valuation concerns influenced the decision.

📍 Apple's stock has faced pressure despite large repurchase plan.

📍 Berkshire remains largest Apple shareholder among institutions.

📍 Berkshire Hathaway reduces Apple stake by 13% in Q1.

📍 Apple remains Berkshire’s largest holding, valued at $135.4 billion.

📍 Sold approximately 116 million shares, following a smaller sale last quarter.

📍 Buffett hints valuation concerns influenced the decision.

📍 Apple's stock has faced pressure despite large repurchase plan.

📍 Berkshire remains largest Apple shareholder among institutions.

👉 Context/Background:

Warren Buffett's strategy of reducing his stake in Apple comes amid high valuations after the stock's significant gain in 2023. This adjustment reflects Buffett’s cautious approach to portfolio management, especially in a fluctuating market environment.

Warren Buffett's strategy of reducing his stake in Apple comes amid high valuations after the stock's significant gain in 2023. This adjustment reflects Buffett’s cautious approach to portfolio management, especially in a fluctuating market environment.

👉 Why This Matters:

📍 Signals potential overvaluation concerns among top investors.

📍 Signals potential overvaluation concerns among top investors.

📍 Could influence other investors’ perceptions of Apple’s market positioning.

👉 Market Insights:

📍 Berkshire's sale might prompt a reassessment of Apple's valuation by the market.

📍 Watch for potential impacts on Apple’s stock price and investor sentiment.

📍 Berkshire's sale might prompt a reassessment of Apple's valuation by the market.

📍 Watch for potential impacts on Apple’s stock price and investor sentiment.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

brave Capybara_5105 : This is a false representation, Warren never said anything like valuation concerns. These articles spread false rumours.

brave Capybara_5105 : Indeed he praised Apple - exact words “one of the greatest products, and probably the greatest product ever,” but it was after deciding that the iPhone was such a product that he bought Apple.

Svetlana Polishuk :