Wall Street Lowered Tesla's Stock Price Targets Before Q3 Earnings Report

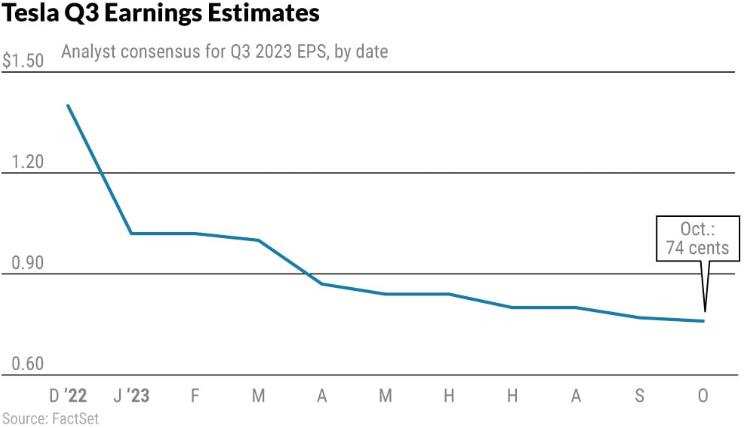

$Tesla(TSLA.US$ is set to announce its third-quarter earnings and revenue on October 18th. Analysts predict the company's overall bottom line will fall nearly 30% from last year, resulting in a projected EPS of 74 cents per share. However, revenues are expected to rise by 12%, reaching around $24.16 billion.

This difference is likely reflected in Tesla's automotive margins, which have narrowed significantly over the past twelve months due to the company's price-cutting strategy. While Musk's strategy has boosted demand, it has also impacted the group's profit margins, which were 18.7% for the three months ending in June, down from the previous year's tally of 22.4%.

Additionally, demand concerns have surfaced, particularly in China, Tesla's biggest market. The weaker-than-expected third-quarter deliveries of 435,059 new cars over the three months ended in September have fueled these worries.

A Test of Elon Musk's Market-Share Growth Strategy

Tesla's slowing sales will test the company's 2023 strategy, outlined earlier this year by CEO Elon Musk. The strategy focuses on market-share growth at the expense of profit, which the company has been pursuing by aggressively cutting prices for its Model 3 sedan and Model Y SUV in key markets worldwide.

Earlier this month, Tesla announced plans to cut the cost of its Model Y SUV and Model 3 sedan by as much as 4.2% for U.S. customers. The company has already reduced the price of its flagship Model 3 by around 17% since the beginning of the year, with an even steeper 26% decrease in costs for the Model Y.

Despite the company's price decline strategy, order figures have not fully compensated for the loss of profits. Tesla produced 430,488 vehicles in Q3, representing a 17.6% increase YoY but down from the 479,700 units produced in Q2 2023. The sequential decline in production and delivery volumes was due to planned factory shutdowns for upgrades, as already notified by the company on its Q2 earnings call.

In addition, China's Passenger Car Association reported that Tesla sold just over 74,000 cars in the world's largest market last month, marking an 11% decline compared to the same month the previous year and the 84,159 total recorded in August. These developments concern investors as China is a crucial market for Tesla, and the slump may impact the company's bottom line in the coming quarters.

Furthermore, Tesla faces shrinking operating margins due to unexpectedly higher costs in scaling up the production of new battery cells, the Cybertruck, and other large projects. Operating margins fell to single digits in Q2 2023, reaching 9.6%, the lowest level in the past five quarters. Tesla's operating margins in the remaining quarters of 2023 will likely be impacted by continued investments for capacity expansion of not just vehicle factories but also supercharging network service, internal applications, and battery processes.

Wall Street's Expectations for Tesla

Wells Fargo reiterated an equal weight rating on Tesla, cutting its 12-month price target to $260 from $265. The firm also predicts gross profit margins will fall to 16.3% in Q3, with expectations of further weakness in Q4. The full-year EPS prediction for Tesla has been lowered from $3.20 to $2.95 by Wells Fargo.

Similarly, UBS analyst Joseph Spak lowered his 12-month stock price target for Tesla to $266 from $290. This comes a month after the firm increased its TSLA target to $290 from $270.

Jefferies analyst Philippe Houchois also reduced the company's price target on Tesla stock to $250 from $265. The firm anticipates Q3 revenue will total $23.87 billion with EPS of 64 cents.

Despite recent concerns regarding Tesla's sales figures and profitability, some analysts remain optimistic about the company's prospects. Tesla bulls are betting on a fourth-quarter rebound in deliveries driven by the new Model 3 in China and the expected launch of Cybertruck deliveries.

Earlier in September, Morgan Stanley's Adam Jonas raised his 12-month price target for Tesla to $400 from $250. He noted that Dojo, Tesla's custom supercomputer, could add more than $500 billion to the company's market value through quicker robotaxi adoption and network services enhancement. On Monday, Jonas also released a new investor note speculating on an EV-smartphone convergence.

Meanwhile, Wedbush analyst Dan Ives, a longtime Tesla bull, believes that the company is entering the next growth stage and expects a solid fourth quarter, particularly with the launch of the revamped Model 3 in China and the anticipated release of the Cybertruck. Ives projects third-quarter earnings of 78 cents per share for Tesla.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

SpyderCall : Good stuff. You should do a lot more earnings previews for some of these companies before their earnings release

73817579 : Competition and late delivery of the truck is hurting the stock, not to mention the war in Russia, and now the Middle East conflict IMO, which is worth researching weapon tech stocks...