Wall Steet Today | Apple's Stock Records Longest Losing Streak in Almost 21 Months

MACRO

Stock Losses Deepen During Early Corporate Earnings

Stocks fell worldwide, while bonds climbed with gold on concern the Israel-Hamas war will escalate into a wider conflict in the Middle East. The S&P 500 dropped over 1%, breaching the 200-day moving average. The benchmark 10-year Treasury yield heading toward 5% for the first time in 16 years.

The benchmark yield, used to price everything from mortgages to student and auto loans, touched 4.996% before finishing Thursday’s New York session at 4.987%. The 10-year yield hasn’t ended above 5% since July 19, 2007.

Traders also waded through a raft of corporate earnings. Of the 86 companies in the S&P 500 that have announced results through Friday morning, 74% beat analysts’ profit estimates, compared with 78% for the whole season a year ago, according to data compiled by Bloomberg.

Individual shares reacted to earnings announcements in the week or so since Corporate America started reporting results. But the conflict in the Middle East and elevated Treasury yields have taken precedence, causing S&P 500 constituents to move in unison as global events increasingly sway markets.

SECTORS

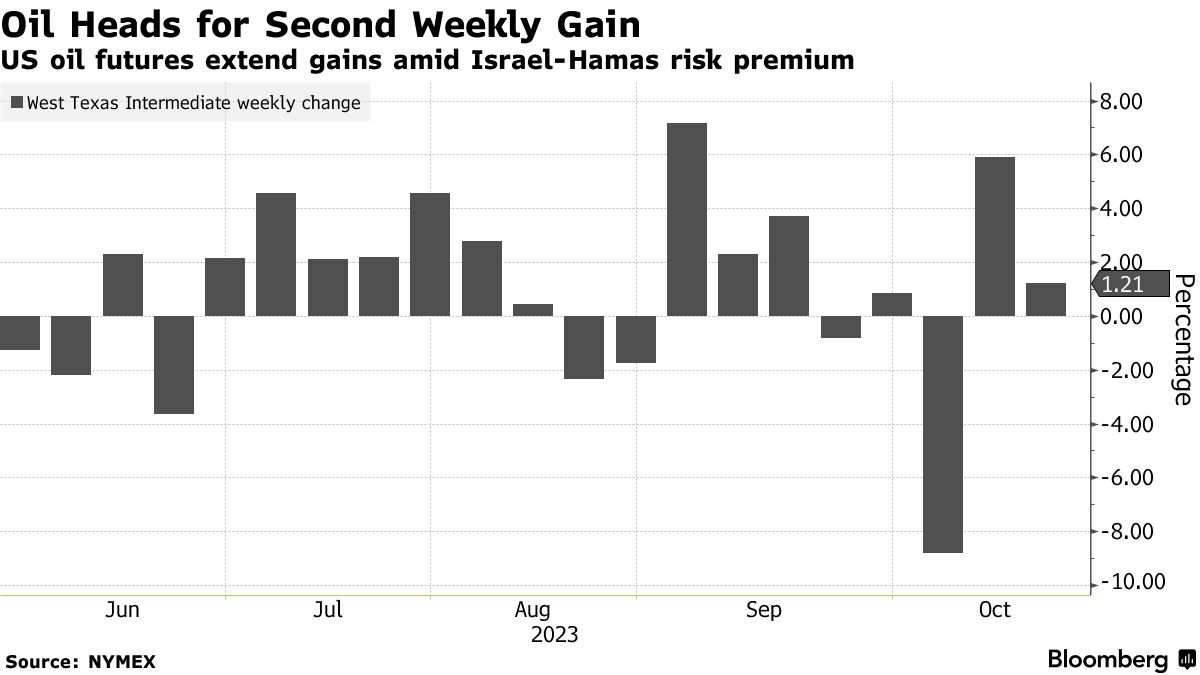

Oil Rises for Second Week Amid Israel-Hamas War Developments

Oil posted a second weekly gain as developments in the Middle East raised concerns that the conflict may spread, though US efforts to delay Israel’s invasion of Gaza caused prices to edge down on Friday.

After initially resisting a delay in what officials said would be a massive military operation to eradicate Hamas, Israel agreed under US pressure to hold off on its attack, Bloomberg reported, citing people familiar with the effort. The developments brought prices down on Friday after a spate of incidents that traders saw raising the potential for the war to draw in Iran boosted futures earlier in the day.

West Texas Intermediate’s more active December contract fell to settle near $88 a barrel on Friday, while still posting a second straight weekly gain.

Gold Rises For a Fourth Day as War in Israel Boosts Safe Haven Buying

Gold prices rose again early on Friday, climbing to an 11-week high as the metal continues to attract safe-haven buying as Israel's war against Hamas continues. Gold for December delivery reached past $2,000 per ounce, rising for a fourth straight day to the highest since July 31.

The rise comes amid high treasury yields and a strong dollar, usually bearish notes for the precious metal. However, Israel's war on Hamas after the group's terror attacks earlier this month has investors on edge and turning to gold as a safe haven.

COMPANIES

Oracle Down 6% After Company's AI Event

Shares of software and IT stocks are trading lower after the 10-year Treasury yield briefly crossed 5% before pulling back in Friday's session. Weakness in $Oracle(ORCL.US$following its AI executive forum may also be weighing on some of its peers.

Apple's Stock Records Longest Losing Streak in Almost 21 Months

$Apple(AAPL.US$ were falling toward their longest losing streak in nearly 21 months Friday as analysts continued to look for nuggets about early iPhone 15 sales trends.

Regions Financial’s Drops, MIssing Profit, Revenue, and Net Intest Income

$Regions Financial(RF.US$ stock tumbled after the bank’s third-quarter profit and revenue missed expectations, as total loans increased but deposits fell and as the regional banking industry faced “economic and regulatory uncertainty.”

HP Drops After Disappointing 2024 Forecast

$Hewlett Packard Enterprise(HPE.US$slumped after the firm’s fiscal forecast fell short of analysts’ expectations.

SolarEdge, Rivals Hammered After It Warns of 'Significantly Lower' Profits on Weak Europe Demand

$SolarEdge Technologies(SEDG.US$ Inc. late Thursday cut its outlook for third-quarter profits and gross margins and said it expects "significantly lower" fourth-quarter revenue as it faced a slowdown in solar-power installations in Europe.

Amex Points to Strong Spending and Credit Trends

$American Express(AXP.US$ shares dropped after topping profit expectations for its third quarter while calling out healthy spending and “strong” credit metrics.

AT&T Stock Is Having Its Best Week in a Year

$Apple(AAPL.US$was recently up 3%, on pace for its best week since last October, buoyed by upbeat news about cellphone customer growth and its outlook for free cash flow.

Source: Bloomberg, Dow Jones, CNBC

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

72734102 : News Flash! American Express is hiding the fact that word is out about boycotting AXP! Because they basically turned over to the FBI personal information about “their Own Customers” who went to the Capitol on January 6 th to question a lot of Suspicious Facts pertaining to the elections. Not nice to poop on Your own Customers. So millions are Boycotting and shredding their American Expression Cards. As word spreads this will drop AXP considerably More. Sad! We sold our shares immediately on hearing this info AXP is “not” revealing to share holders.