US Equity Commissions Expected to Decline as Traditional Equity Managers Missed Out on the Surge in 2023?

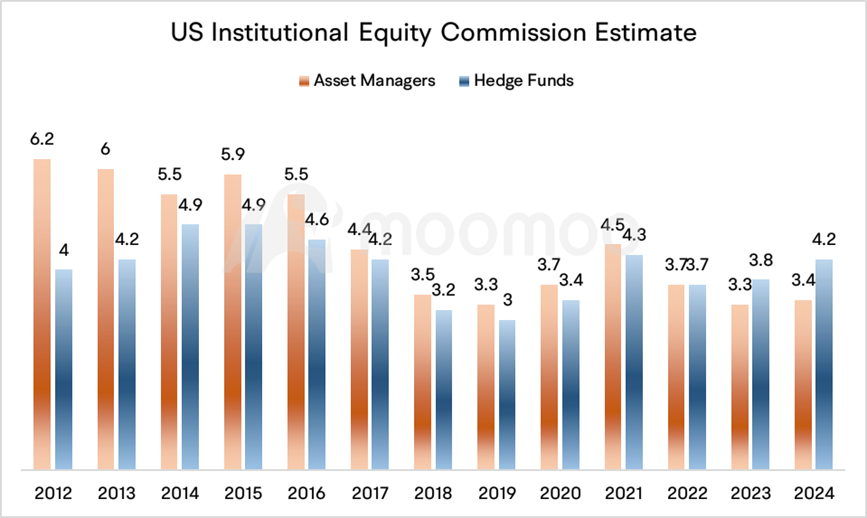

Institutional equity commissions in the US are anticipated to decrease by 2.7% in 2023, with hedge-fund brokerage commissions exceeding those of traditional long-only asset managers and ETFs. Long-only investors moved into bond and money markets due to a sharp rise in longer-term interest rates into mid-2023, while more actively trading hedge funds increased their presence in US equities. Traditional managers' equity commissions are expected to fall by 10.2% to $3.3 billion, while hedge funds are predicted to increase their wallet from $3.7 billion to $3.8 billion in 2022. As rates rose in 2023, traditional investors reduced their stock allocations.

■ US Equity Share Volume Expected to Decline by 8.2%

Although large-cap stocks rallied through 2023, share volume did not keep pace. US equity volume shrank by 8.2% on an average daily basis in 2023 compared to 2022, even though the S&P 500 rallied close to 22% YTD. Since institutional commissions depend on shares traded, an overall decline of 8% in turned-over shares does not bode well for institutional commissions, particularly for less actively turned-over investment strategies typically used by fundamental equity managers. Much of this was believed to be driven by higher interest rates and the perception that a guaranteed 5% return was safer than equity investments.

■ Traditional Investors and Equity Managers Fall Short in 2023

Despite the S&P 500 appreciating almost 20%, and possibly more by year-end, investors only poured $61 billion into US equity mutual funds and ETFs, according to the Investment Company Institute. In contrast, there was a 35.5% index increase vs. net fund inflows of $329 billion in 2021. Although 2021 benefited from a wave of retail traders pushing meme stocks higher, investors pushed 5.4 times more cash into US equity funds and ETFs for just one-third more performance. Over 100 head and senior US equity traders report that while market performance was blistering, higher interest rates deterred US investors.

■ Will Traditional Equity Managers Joined the Market Frenzy Albeit Late?

The epic slide in Treasury yields suddenly unleashed last week by the Federal Reserve forced many asset managers and individual investors to rethink the stock market in 2024.

Fidelity International strategist Tom Stevenson attributes investors missing out on the stock market surge to the fact that most stock gains in the first half year were driven by magnificent Seven. Still, he admitted that since the beginning of June, the rally has broadened out to other sectors.

Bloomberg reported today that State Street's $478 billion SPDR S&P 500 ETF (ticker SPY) unprecedently raked in $20.8 billion on last Friday, the biggest inflow since the fund’s inception in 1993.

The S&P 500 and Nasdaq 100's rebalancings were set to take effect, making it the final trading day before funds have to readjust their portfolios to align with new index compositions. On the same day, approximately $5 trillion worth of options expired, prompting Wall Street managers to either roll over existing positions or start new ones.

“The flow that we saw on Friday was 100% organic from clients and investors and traders,” Matt Bartolini, head of SPDR Americas Research at State Street Global Advisors, said. “It also reflects the massive Santa Claus rally that we have seen in the past few days — so momentum-trading going into SPY as well.”

Source: Bloomberg

By Moomoo News Calvin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

SpyderCall : good read