TSMC Earnings Bolster Shares: What Are the Bullish Factors for the Next Rally?

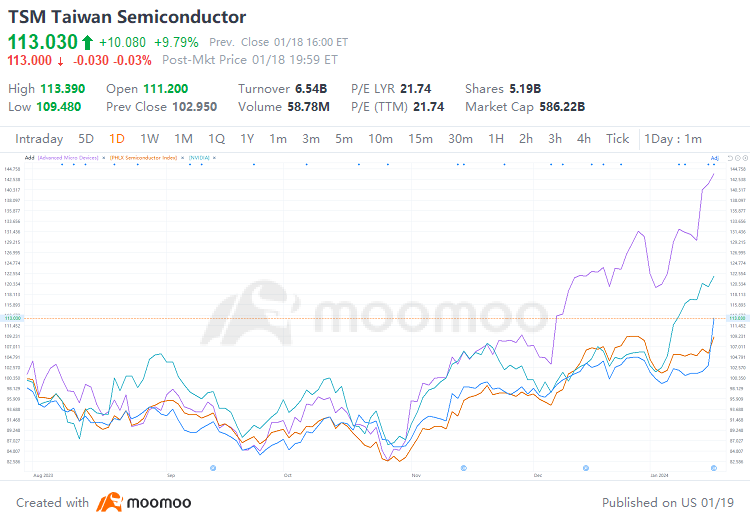

$Taiwan Semiconductor(TSM.US$, the world's largest contract chipmaker and a key supplier for $Apple(AAPL.US$ and $NVIDIA(NVDA.US$, released an impressive financial report on January 18 and beat both market expectations and its own guidance, leading to a surge of 9.79% in its stock price. It also inspired other chip stocks to rise and pushed the chip index to approach its historical high during the trading session. Both $Advanced Micro Devices(AMD.US$ and Nvidia stocks hit record highs, contributing to a 3.4% increase in the $PHLX Semiconductor Index(.SOX.US$.

What Are the Highlights of TSMC's Financial Report?

In the fourth quarter, TSMC's revenue increased 13.6% from the previous quarter to $19.62 billion, despite a 1.5% year-over-year decline. This slightly surpassed the company's previous forecast of $18.8 billion to $19.6 billion. The net profit drop to $7.6 billion, but increased by 13.1% from the previous quarter, beating the market expectation.

Wendell Huang, TSMC Vice President, said, "Our fourth quarter business was supported by the continued strong ramp of our industry-leading 3-nanometer technology."

In the fourth quarter, 15% of wafer revenue was attributed to the 3-nanometer process technology, while the 5-nanometer and 7-nanometer technologies accounted for 35% and 17%, respectively. Overall, advanced technologies, defined as those at 7-nanometer and below, made up 67% of revenue and provided a strong guarantee for the company's good profitability.

Demand for high-performance computing(HPC) and smartphone chips improved in the fourth quarter. Sales generated from HPC applications, which encompasses generative AI, grew by 17% from the previous quarter. Revenue from smartphone chips spiked by 27%, and there was an increase of 13% in sales from automotive applications.

Besides, TSMC's management has announced that the company's capital budget for 2024 will be in the range of $28 billion to $32 billion. The average amount is very similar to the investment of 2023, and still represents a relatively high level. The majority of the funds will be allocated towards advanced process technologies.

What Are the Bullish Factors in the Future?

AI Boom

Progress in computing hardware has been a key ingredient for AI and will remain increasingly critical to realize future AI applications. TSMC is considered one of the major beneficiaries of the AI boom due to its role as the contract manufacturer for Nvidia's 5-nanometer semiconductors.

The company expected that the annual growth rate for AI computing could reach 50% in the coming years and AI processor could account for 15%-20% of its revenue in the next five years.

"So far today, everything you saw on the AI [computing chips] is from TSMC." The company CEO C.C. Wei said, "We already see that momentum... The demand for AI suddenly picked up since March or April last year after the boom of ChatGPT."

Morgan Stanley's Charlie Chan forecasts that AI-related semiconductors will constitute 15% of TSMC's revenue by 2027, with an 18% annual growth rate.

Smartphone Market

After almost three years of sluggish performance, the smartphone market is experiencing a slow recovery. According to Qualcomm CEO Cristiano Amon, the integration of generative AI in smartphones is expected to spur "a new upgrade cycle" in 2024 after years of sluggish sales.

In the fiercely competitive market, Apple topped smartphone shipments for first time in 2023 and incorporated TSMC's more advanced and pricier 3nm chips into their latest iPhone 15 series.

Chris Miller's book "The Chip War" states that TSMC is the only company in the world that has the capability to meet Apple's requirements: "Today, no company besides TSMC has the skill or the production capacity to build the chips Apple needs."

Optimist Outlook

TSMC has announced that it expects to generate between $18 billion and $18.8 billion in revenue in the first quarter of 2024. This represents an increase of more than $1.25 billion compared to the same quarter in 2023.

TSMC's revenue should grow in the low-to-mid-20% range in 2024, Mr Wei said. That's a rebound from the modest decline of 2023.

Our business has bottomed out on a year-over-year basis, and we expect 2024 to be a healthy growth year for TSMC, supported by continued strong ramp of our industry-leading 3-nanometer technologies, strong demand for the 5-nanometer technologies and robust AI-related demand.

According to analysts from Jefferies, TSMC's "full-year outlook is much better than expected", largely due to various factors such as heightened involvement with Apple "as all iPhone models will be equipped with TSMC's N3 process".

Source: CNBC, Investing, IDC, Bloomberg, MarketWatch

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

frank Crane_3546 : Go for it! TSMC!

Revelation 6 : When you’ve got it, you’ve got it.

RAF Trader 108 : Excellent review on TSMC, who are the other Semi manufacturer are able to compete?