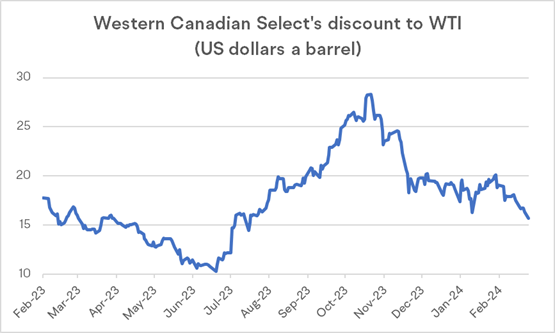

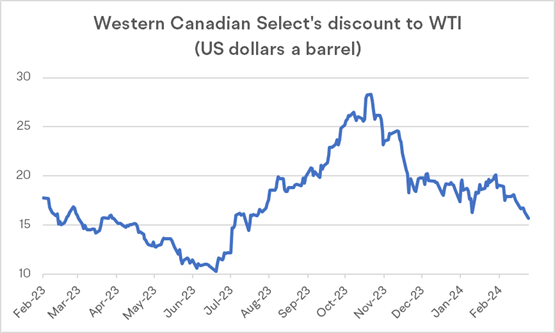

Trans Mountain Pipeline Seen Driving Canadian Oil to Three-Year High

Canada's relatively cheap heavy crude is set to spike temporarily in the coming months as an expansion of the Trans Mountain crude pipeline set to start operation in the second quarter.

Western Canadian Select’s discount to U.S. benchmark West Texas Intermediate (WTI) may shrink from its current level of about US$17.10 per barrel to less than $10 a barrel between May and July, according to Jeremy Irwin, senior oil markets analyst at Energy Aspects. The last time the discount was in single digits was in April 2021.

Canadian Crude's Discount Expected to Shrink

Source: Bloomberg

According to the Energy Information Administration, Canada sent 3.14 million barrels of oil to the U.S. Midwest in last November, accounting for almost half of the U.S.’s crude imports. Refiners in the U.S. Midwest have long benefited from discounted Canadian oil, partly because of a lack of pipelines.

So the expansion of the Trans Mountain pipeline is expected to drive up the price of Canadian crude oil, which will add the capacity to ship an additional 590,000 barrels of oil a day from Alberta to a Pacific Coast port and reduce producers’ reliance on American refiners. At the same time as the pipeline is due to start up in the second quarter, major oil-sands companies including $Imperial Oil Ltd(IMO.CA$ , $Canadian Natural Resources Ltd(CNQ.CA$ , and $Suncor Energy Inc(SU.CA$. will see an expansion in their production capabilities.

Source: MooMoo

Like other Canadian oil producers, $Canadian Natural Resources Ltd(CNQ.CA$ is awaiting the startup of the Trans Mountain pipeline expansion. In its Q4 earnings call, the company announced that it has committed to shipping 94,000 barrels per day on the twinned line, which will give Alberta oil producers additional export capacity to the West Coast.

However, some analysts have warned that while the deluge of new crude will be a boon to an industry that has struggled to grow recently, it threatens to expand a global supply surplus and revive the pipeline shortages that have bedeviled Canadian drillers for years, something that could once again severely depress the price of the country’s oil exports.

S&P Global estimates that the supply of western Canadian oil available for export is set to rise by about 500,000 barrels a day by the end of next year. The added volumes will take up almost all of the 590,000 barrels a day of new capacity on Trans Mountain.

If these analysts are correct, the expansion of the Trans Mountain pipeline will only offer temporary relief to drillers and oil-sands producers.

Source: BNN Bloomberg, S&P Global

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

FARAMARZ AKBARY :