The Market

Good morning everyone! Yesterday we hit some great trades.

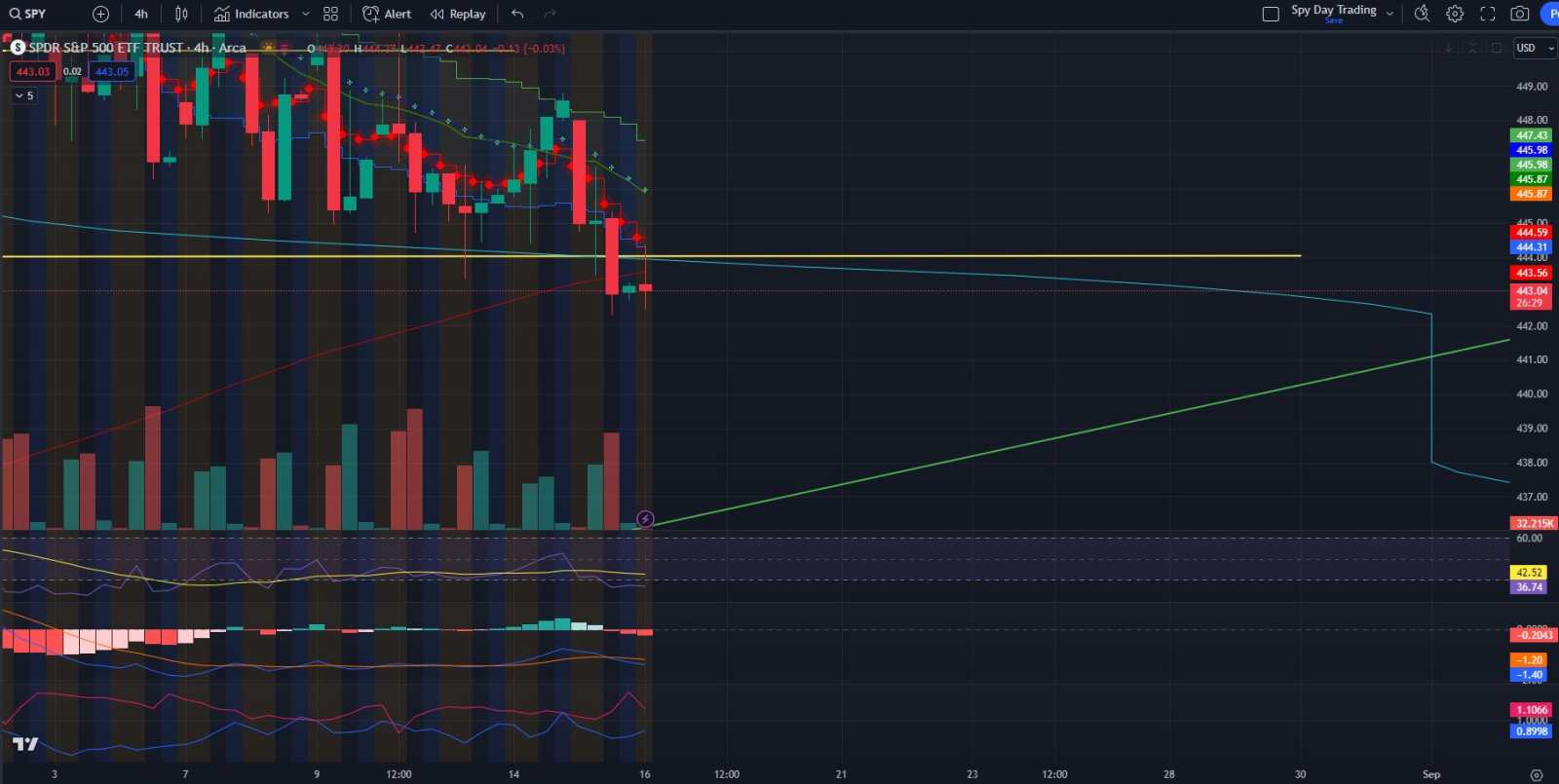

We closed below the 4 hour 200SMA, and then premarket we got rejected and so far have not closed above it. This makes me bearish. Wish I woke up earlier, I would have taken that short trade.

For reference, the 200SMA is incredibly significant.

We haven't seen the 200SMA in actrion since the previous larger golden cross to the upside out of the coil range we created. Some refer to it as a squeeze range.

Also, completely coincidental that my monthly cup and handle prediction is lining up with the 200SMA.

If the death cross continues to play out then we might see much lower lows. A death cross is different than a golden cross. However, they are both incredibly influential in market sentiment with their own respective meanings. Should we cross over and keep moving away from the 200SMA on the 4 hour then I see SPY going to at least 430 in the coming month. I may load up on more $ProShares UltraPro Short QQQ ETF(SQQQ.US$ just to cover. This is because a lot of traders and investors take positions based on the 4 hour movement. The more people who realize the possible bearish weeks ahead might start getting short or selling for profits.

Remember

We are at a HUGE resistance level on the SPY, one never before seen throughout history, built up over 4 months at the all time highs. Getting short up here really is not a bad idea in my opinion. Furthermore, as the market rallied, hedge funds were short and recently covered into long positions. This gives investors a bearish outlook.

In other news:

Michael Burry opened a 1.6 Billion short position on $SPDR S&P 500 ETF(SPY.US$ and $Invesco QQQ Trust(QQQ.US$ with other banks following in his footsteps also beginning to short the market.

We must also remember that earlier this year Saudi Arabia announced they too have taken a massive short position on US markets.

It is really not hard to see why they took their positions. The market is at all time highs while inflation is running through the street like a mad man and recession is charing its phone. Honestly, it's pretty fundamental. Why would you get long at the top? Again, anything could happen which causes the market to go up or down. I could be entirley wrong, so do your own research and take trades based off your personal finances. None of this is financial advice.

WOAH I JUST NOTICED THIS

THE DAILY IS ALSO AT THE 200SMA. This could really be bad if we close below it in the following days and reject any retest to go and close above it. We are at some key levels right now.

I hope everyone makes some money today

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment