Tesla Delivers Record Q4 Cars, But 2024 'Looks Tough' for the Company

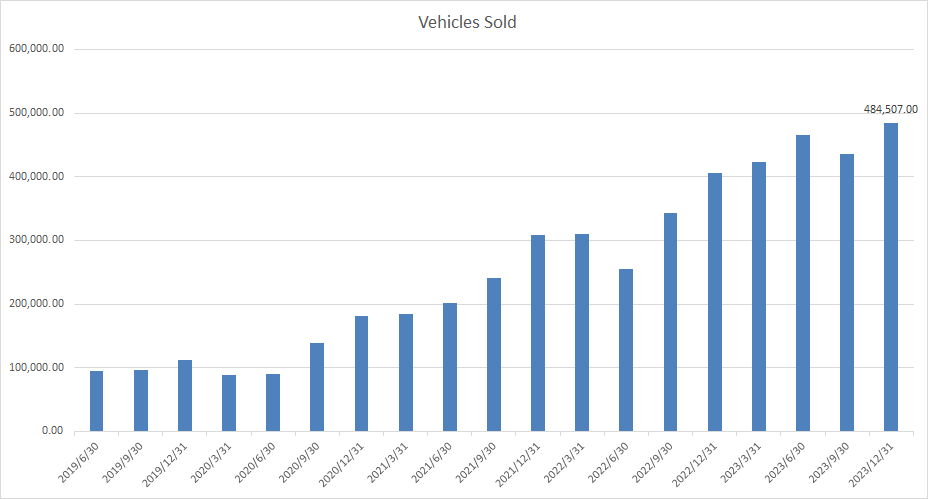

$Tesla(TSLA.US$ has achieved a remarkable feat by setting a new delivery record in the fourth quarter and meeting its 2023 delivery target, which has put to rest concerns of investors about any possible setbacks as competition intensifies worldwide. The company's Q4 delivery figure of 484,507 units surpassed the Street's estimate of 483,173 units. This is an all-time record quarter for Tesla, with a significant increase of nearly 20,000 units compared to its previous record of 466,000 units delivered in Q2 of 2023.

What Analysts & Experts Say

• Tesla's delivery numbers are "much, much, much better than domestic U.S. car companies," said Gary Bradshaw, portfolio manager at Tesla shareholder Hodges Capital.

Smaller rival $Rivian Automotive(RIVN.US$ also reported deliveries on Tuesday, with the company missing market estimates amid a broader pullback in EV demand.

The weakness has led U.S. automakers including $Ford Motor(F.US$ and $General Motors(GM.US$ to become more cautious about their EV production capacity plans.

• "This was an important quarter for Tesla to show strong deliveries with clear momentum into 2024 as demand has upticked since 3Q based on all our global checks," Wedbush analyst Dan Ives wrote in a note to clients shortly after Tesla released delivery figures.

Pricing was stable and actually increased in China throughout the quarter as the price war in China has finally hit a calm period which is music to the ears of Tesla bulls."

Wedbush analysts indicated that the fourth quarter's delivery high was driven by "strong data out of the key China region" which gives the firm "incremental confidence in [its] bullish call into 2024."

• Bernstein analysts noted while delivery numbers were up, the firm raised concerns about "profitability," saying that "2024 looks tough."

2024 'Looks Tough' for Tesla

Analysts at Bernstein have predicted a difficult year ahead for Tesla in 2024, stating that the electric vehicle giant will experience lower margins and a shortfall in volumes.

While Tesla's Q4 deliveries were broadly in line with expectations, the analysts believe that auto gross margins ex-credits will be lower than expected due to price cuts and significant discounting of "inventory" models in the quarter. Bernstein is below consensus on deliveries and EPS for FY24 and does not believe that Tesla can continue to cut prices to maintain demand without potentially becoming free cash flow negative.

The stock now trades at ~200x trailing TTM FCF, and nearly100x EPS, which is out of whack relative to higher margin growth tech companies," they added. "Moreover, we believe more investors will begin to increasingly question the company's growth narrative, particularly since we believe that Tesla will struggle to grow deliveries 20% in 2024 (and 2025)."

Source: Tesla, CNBC, REUTERS, Investing.com

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

IamMoooo : Dont believe on these analyst, they will always say something just for attention.