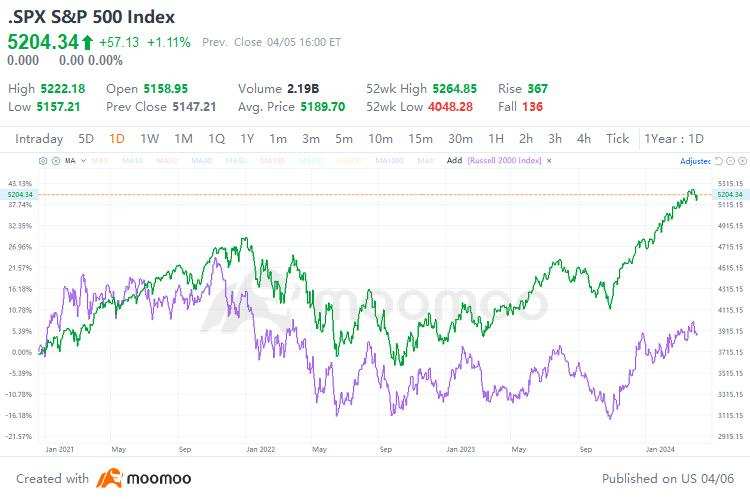

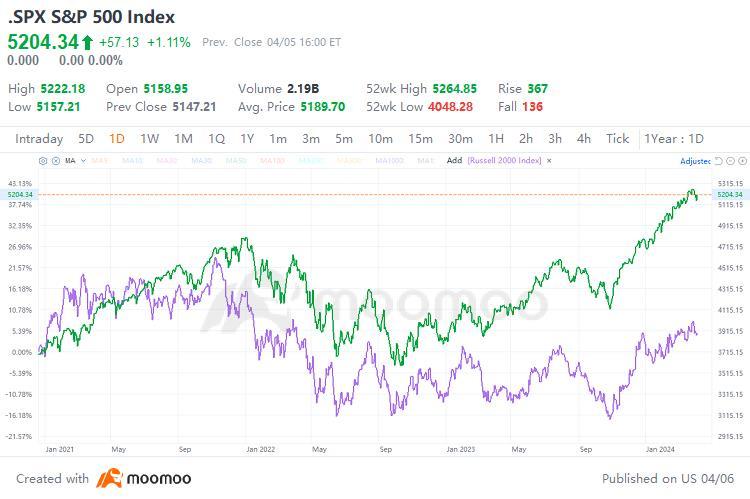

Small caps suffer worst run against larger stocks in over 20 years

US small-cap stocks are suffering their worst run of performance relative to large companies in more than 20 years, highlighting the extent to which investors have chased megacap technology stocks while smaller groups are weighed down by high interest rates.

The Russell 2000 index has risen 24 per cent since the beginning of 2020, lagging behind the S&P 500’s more than 60 per cent gain over the same period. The gap in performance shakes up a long-term historical norm in which fast-growing small-caps have tended to deliver punchier returns for investors who can stomach the higher volatility.

The unusually wide spread between the two closely watched indices has opened up in recent years as small-cap stocks with relatively weak balance sheets and modest pricing power have been especially hurt by high inflation and a steep rise in borrowing costs, according to analysts, putting off many investors. “I’ve been investing in small-caps for almost 30 years and you haven’t seen big money moving into the space since 2016 or 2017,” said Greg Tuorto, a small-cap portfolio manager at Goldman Sachs Asset Management. “You need a little greed, you need some of those animal spirits, maybe a pick-up in M&A [mergers and acquisitions] or a booming IPO market, for small-caps to really take off,” he added.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment