Sea's 3Q23 Earnings Preview: Here Are the Key Factors to Watch

$Sea(SE.US$ is set to release its third-quarter 2023 results on Nov 14.

The majority of analysts covering the company have reconfirmed their estimates over the last 30 days.

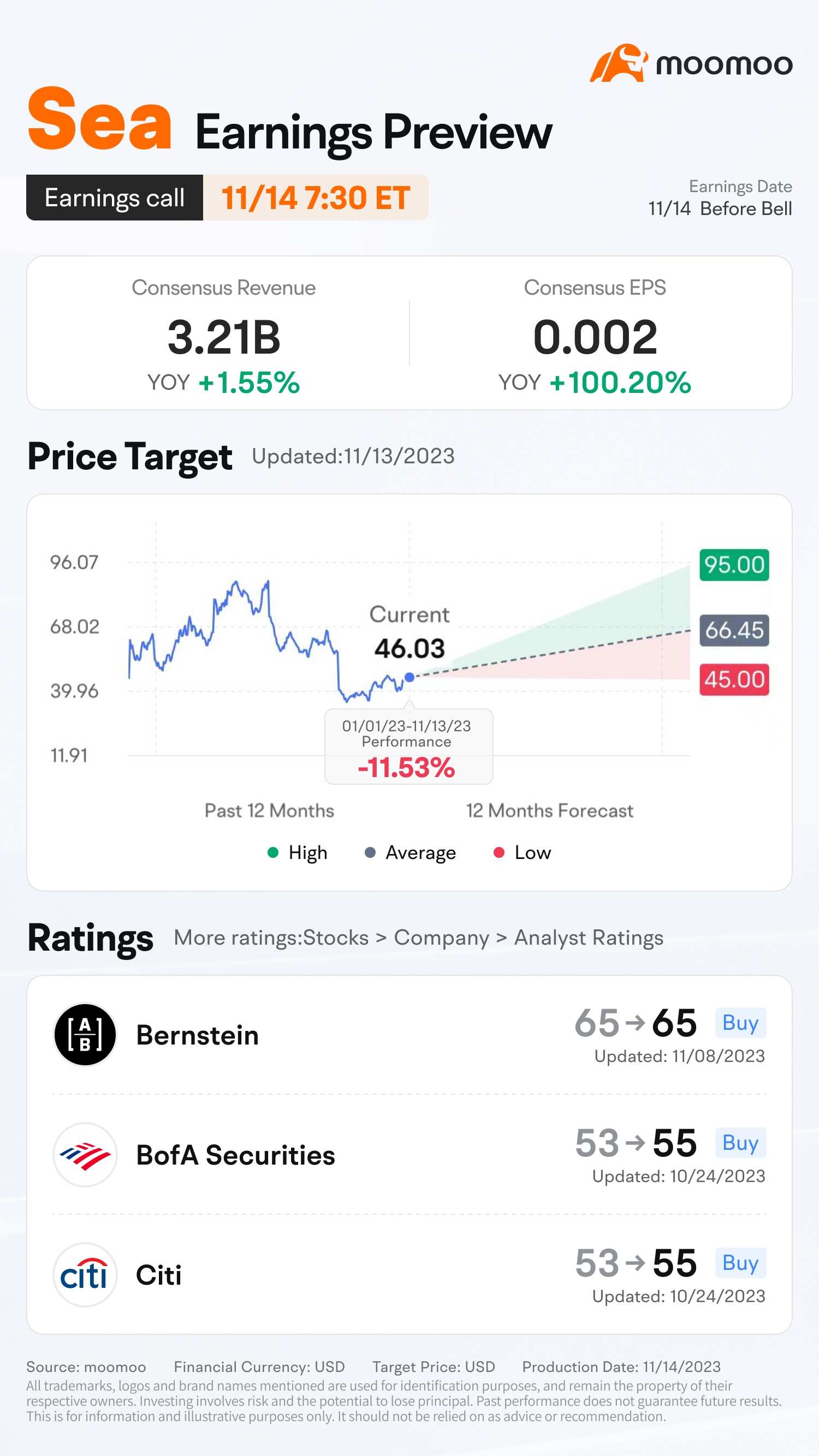

The consensus mark for revenues is currently pegged at $3.21 billion, indicating a 1.55% year-over-year growth, slowing down from the 17.4% year-over-year increase in revenue the company had recorded in the same quarter last year. The consensus earnings is at 0.2 cents. Sea reported a loss of 66 cents in the year-ago quarter.

Out of 21 Wall Street analysts who provided price predictions for the next year, 15 recommended buying Sea's stock, while the other 6 suggested holding onto them. These ratings indicate that Wall Street expects Sea's business to remain stable leading up to the earnings report.

The average price target is $66.45 with a high forecast of $95.00 and a low forecast of $45.00. The average price target represents a 44.36% change from the last price of $46.03.

Factors at Play for Q3 Results

Sea's e-commerce business is anticipated to have benefited from synergies with Shopee, particularly through enhanced artificial intelligence capabilities, more flexible payment methods, and increased affordability.

Aside from Shopee, Sea's gaming division and financial technology segment are also important drivers of growth for the company.

According to The Zacks, Sea's digital financial services division might experience 38.5% year-over-year growth due to the expansion of its service offerings, which has allowed the company to reach a wider range of users and diversify its customer base.

In the third quarter, Sea's digital entertainment unit is anticipated to have benefited from efforts to increase user engagement and improve gameplay. The launches in its new game pipeline, as well as developments with AI, are likely to have contributed to enhancing game operations on the Garena platform.

Sea has been focusing on improving logistics by minimizing delivery losses, reducing wait times, and providing seamless experiences for both sellers and buyers. These initiatives are likely to have contributed to the growth of the company's revenue in the third quarter. Its effort to manage costs, which includes optimizing customer service processes and reducing logistics expenses might benefit its profitability.

Challenges Ahead

Sea encountered a challenging macroeconomic environment, which included inflation, rising interest rates, and competition from a rival. The Q3 earnings results are expected to reflect these trends.

Despite TikTok's recent setbacks in Indonesia, the competition between TikTok and other platforms continues in various markets, particularly the US. Shopee may face more difficulties warding off TikTok's challenge.

During the upcoming earnings conference, Sea will face questions about how it plans to counter TikTok's significant competitive pressure.

Source: Seeking Alpha, The Zack, Yahoo Finance

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment