Premium Learn weekly review: Increased safe-haven demand; US Q3 earnings reports have started!

Market Macro: Risk appetite falls as safe-haven demand rises

The conflict in the Gaza Strip during the third week of October, combined with strong retail sales data this week, has put pressure on the stock market as a risky asset. In the first four trading days of this week, the three major U.S. stock indexes, S&P, NASDAQ, and Dow, fell more than 1%, 1%, and 0.76%, respectively.

The conflict in the Gaza Strip is still ongoing, and there are reports that Israel's ground forces could enter at any time. The powder keg has not exploded again, but the fuse is still burning.

Powell's latest remarks on Wednesday did not give the market confidence. He emphasized that he would be cautious when considering the path of interest rate policy, while also saying that inflation is still too high and may require a longer period of economic slowdown and weak employment to reach target levels.

The recent rapid rise in bond yields is equivalent to an interest rate hike, but Powell retains the possibility of further interest rate hikes, making the market unable to relax.

Under pressure from the stock market, the safe-haven asset gold performed well this week. Gold Futures (DEC3) (GCmain.US) have broken through their highest level in nearly two months.

Week's Hot Topic: Q3 Earnings Season Hits for U.S. Stocks

The Q3 earnings season for the US stock market has officially begun, and all six major US banks have released their Q3 performance reports from last week to this week. Under the pressure of continued high interest rates, the market is concerned about whether the loan business volume will shrink and whether net interest income is healthy, which is the focus of attention on bank financial reports.

From the performance reports of the six major banks, $JPMorgan(JPM.US$, $Wells Fargo & Co(WFC.US$, $Citigroup(C.US$, and $Bank of America(BAC.US$'s core business net interest income were better than expected. Their stock prices rose after the release of their financial reports. However, management's concerns about the future are also evident in conference calls, focusing on the slowdown in the economy and the potential impact of reduced consumption.

After bank stocks, technology stocks have also been releasing their Q3 financial reports one after another. The market pays high attention to the financial reports of technology stocks and expects positive news. The five largest companies in the S&P 500 index in the third quarter, Apple, Microsoft, Alphabet, Amazon, and Nvidia (which account for 1/4 of the market value of the S&P 500), are expected to increase their profits by an average of 34% compared to the same period last year.

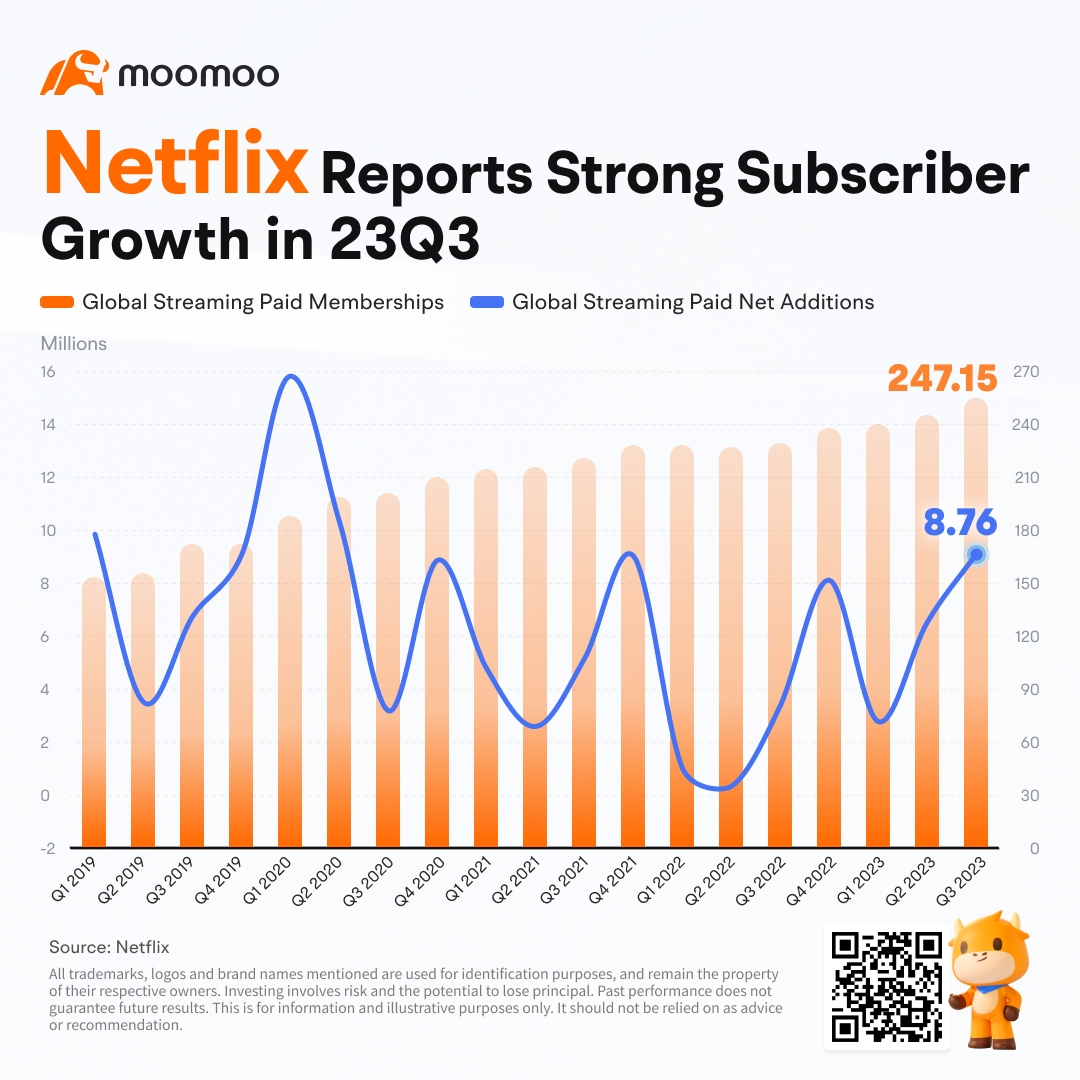

On Wednesday of this week, Netflix and Tesla were the first to announce their earnings reports. Benefiting from new streaming subscription users far exceeding expectations, rising from 2.41 million in the same period last year to 8.76 million, Netflix $Netflix(NFLX.US$ is also seeking pricing strategies in different markets to increase revenue. After the earnings report, stock prices soared by 16%.

While Tesla's third-quarter earnings report is not ideal, revenue of $23.35 billion, up 9% yoy, for the slowest revenue growth in three years, and below market expectations. At the same time, the price reduction strategy squeezed profits, gross profit and net profit were lower than analysts' expectations.

Musk also showed concern about the production prospects of the new Cybertruck on the call. Share prices fell more than 10% at one point during the trading session on the day after the earnings report!

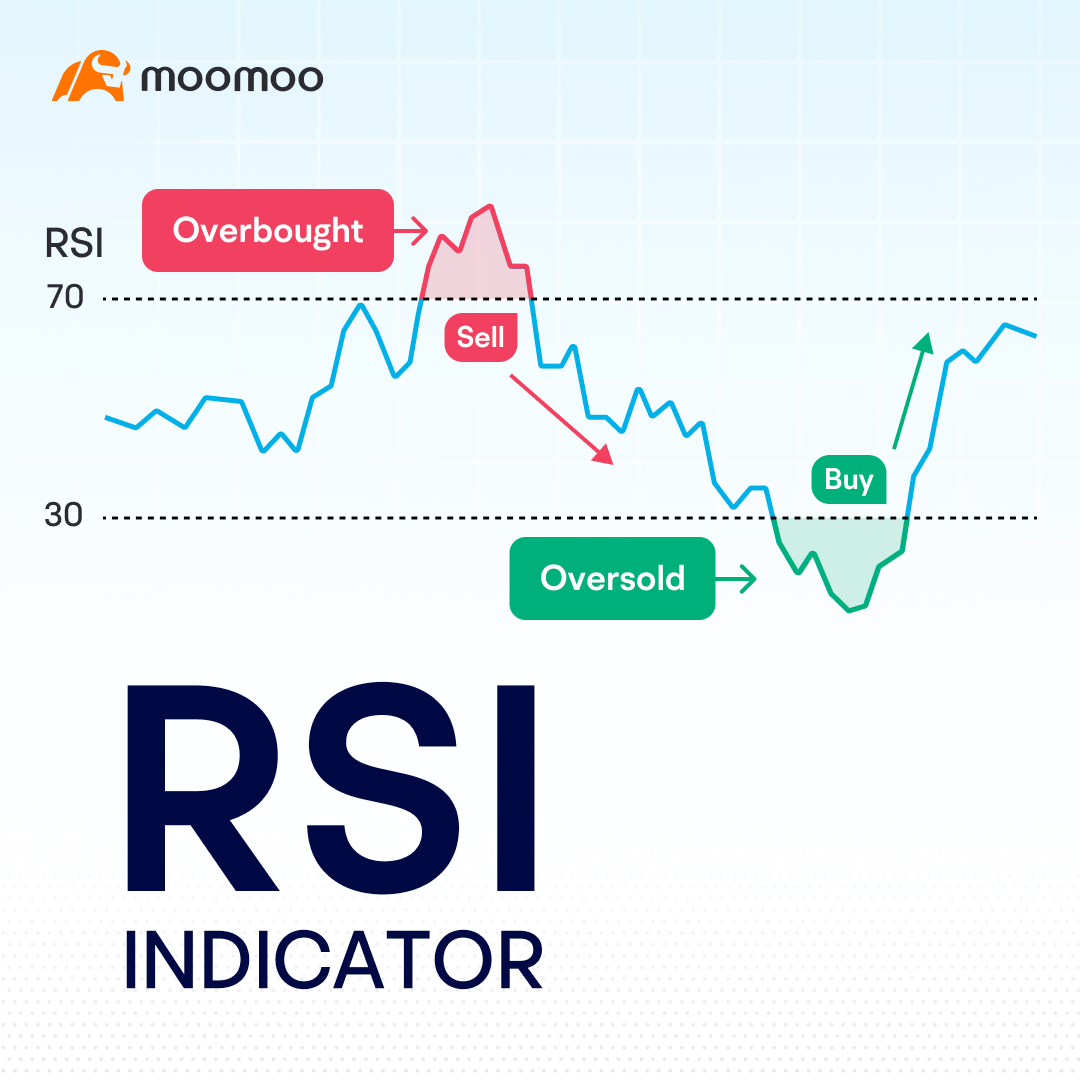

The relative strength index (RSI) is a momentum oscillator which provides information on whether or not an asset is overbought.

RSI compares a security’s gains with its losses over a given period of time.

The RSI indicator oscillates between 0 and 100. A value above 70 traditionally represents an overbought situation, while values below 30 are oversold. Here are key application points:

- A potential sell signal might occur when the RSI crosses back below 70 after being overbought. Conversely, a potential buy signal might be generated when RSI crosses back above 30 after being oversold.

- During an uptrend, RSI tends to remain above 40, with the 40-50 range acting as potential support. During a downtrend, RSI tends to stay below 60, with the 50-60 range acting as potential resistance levels.

Last week we explained in detail about the drug maker king LLY $Eli Lilly and Co(LLY.US$, one of the key growth drivers included the fact that Eli Lilly has a strong stockpile in the diet drug space.

However, in the weight loss drug market, Novo Nordisk is undoubtedly the current industry leader, with two drugs containing semaglutide (one of the most effective drugs now approved for weight loss), Ozempic and Wegovy, already on the market and projected to grow 20% annually. As a result, NVO shares are up 99% in the last 12 months.

For this week, we have analyzed how NVO has grown in the weight-loss drug space and what opportunities and challenges it may face in the future.

- Novo Nordisk has two injectable semaglutide drugs that are highly sought after by dieters: Wegovy and Ozempic.

- Although Novo Nordisk is already valued at 48x, some analysts say that the demand for weight-loss drugs is expected to bring the company an annual growth of 20%.

- Novo Nordisk will have large growth potential in the future as it makes inroads into the global market and the efficacy of the drug beyond weight loss.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Invest With CiciOP : Feel free to leave your comments about what you have learned this week.