Options Market Statistics: Upstart Stock Sinks as Tough Lending Landscape Drives Downbeat Earnings Outlook, Options Pop

News Highlights

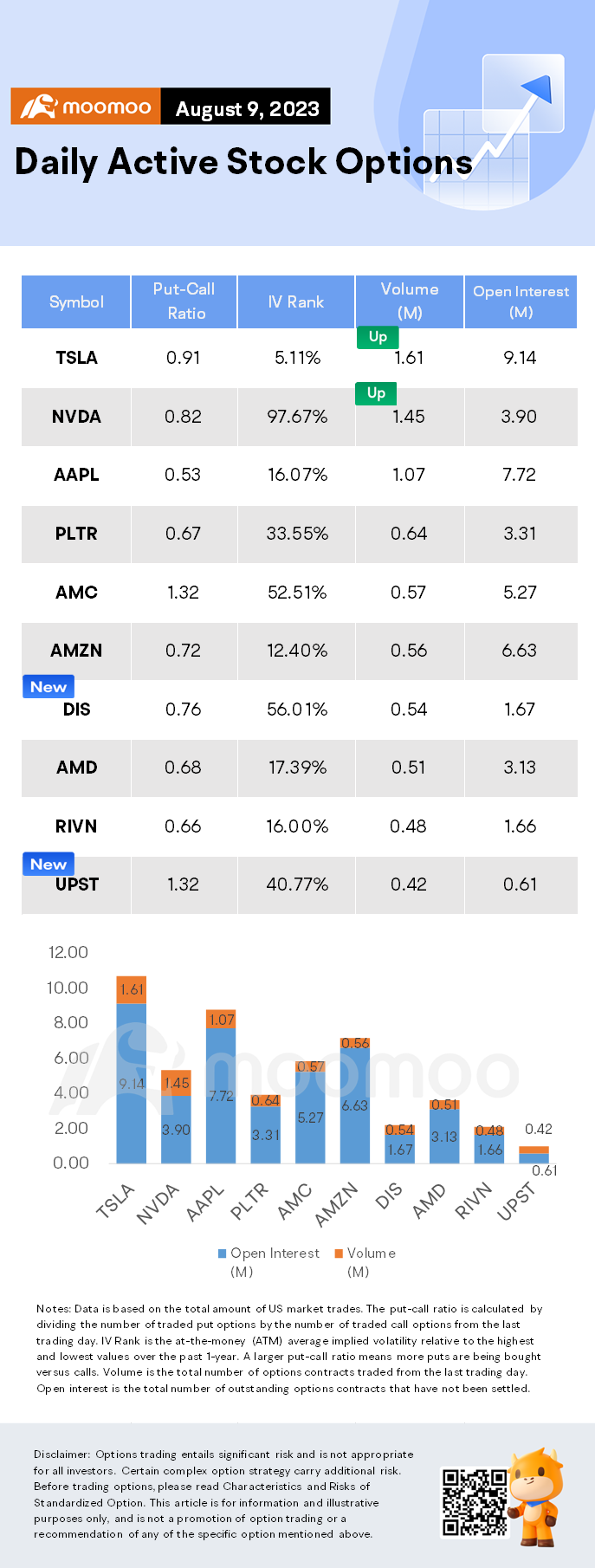

$NVIDIA(NVDA.US$ shares fell by 4.72%, closing at $425.54. Its options trading volume is 1.45 million. Call contracts account for 54.9% of the whole trading volume. The most traded calls are contracts of $430 strike price that expire on August 11th. The total volume reaches 45,857 with an open interest of 4,352. The most traded puts are contracts of a $420 strike price that expires on August 11th; the volume is 49,717 contracts with an open interest of 9,643.

When thinking of AI, Nvidia might be the first stock to come to mind. Its stock rallied at the tail-end of 2022 on hopes that artificial intelligence would drive its business, then continued gaining when these hopes became reality. But a strange thing has happened since the stock peaked on July 18 -- good news on AI isn't boosting shares the way it used to.

On Aug. 8, Nvidia revealed its next-generation version of the GH200 Grace Hopper Superchip, something that will make it faster and better at handling AI duties. The stock, though, finished that day down 1.7% at 446.64, just above its 50-day moving average near $429. And on Wednesday, the 50-day broke when Nvidia dropped 4.7% to $425.54, making it the biggest loser in the S&P 500 on no news at all.

$Disney(DIS.US$ shares fell by 0.73%, closing at $87.49. Its options trading volume is 0.54 million. Call contracts account for 57.0% of the whole trading volume. The most traded calls are contracts of $90 strike price that expire on August 11th. The total volume reaches 15,504 with an open interest of 8,465. The most traded puts are contracts of a $85 strike price that expires on August 11th; the volume is 15,665 contracts with an open interest of 5,162.

Media giant The Walt Disney Company reported third-quarter financial results after the market close Wednesday. The company reported operating income of $3.56 billion, which was flat on a year-over-year basis. Operating income was up 11% year-over-year for the company's Parks segment and down 18% year-over-year for the Media segment.

Disney reported higher operating results at international parks, with the segment seeing revenue that was 94% higher year-over-year. Domestic theme park revenue was up 4% year-over-year. The company noted that it saw a decline of operating income for domestic parks due to Walt Disney World having higher costs and lower volumes.

Our results this quarter are reflective of what we've accomplished through the unprecedented transformation we're undertaking at Disney to restructure the company, improve efficiencies, and restore creativity to the center of our business," Disney CEO Bob Iger said.

$Upstart(UPST.US$ shares fell by 34.24%, closing at $34.03. Its options trading volume is 0.42 million. Call contracts account for 43.1% of the whole trading volume. The most traded calls are contracts of $35 strike price that expire on August 11th. The total volume reaches 10,894 with an open interest of 165. The most traded puts are contracts of a $30 strike price that expires on August 11th; the volume is 11,503 contracts with an open interest of 3,700.

Upstart Holdings Inc. has struggled to contend with a tougher lending environment, and the company indicated Tuesday that its challenges are expected to continue.

The financial-technology company, which uses artificial intelligence to inform lending decisions, delivered a lower-than-expected forecast for the current quarter, as Chief Executive David Girouard called out high interest rates and "an environment where banks continue to be super cautious about lending."

For the third quarter, Upstart expects $140 million in revenue, while analysts had been anticipating $155 million. The company also models $5 million in adjusted earnings before interest, taxes, depreciation and amortization (Ebitda), while analysts were looking for $9.6 million in adjusted Ebitda.

Unusual Stock Options Activity

There were noteworthy activities in $NVIDIA(NVDA.US$ where multiple options have topped volume to open interest ranking. The highest volume over open interest ratio reaches 139.4x with 34,291 contracts.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please readCharacteristics and Risks of Standardized Option.This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Source: Benzinga, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

The Random Investor : Do we sell?

唯有杜康 The Random Investor: sell