Options Market Statistics: Target Stock Jumps Despite Guidance Cut, Options Pop

News Highlights

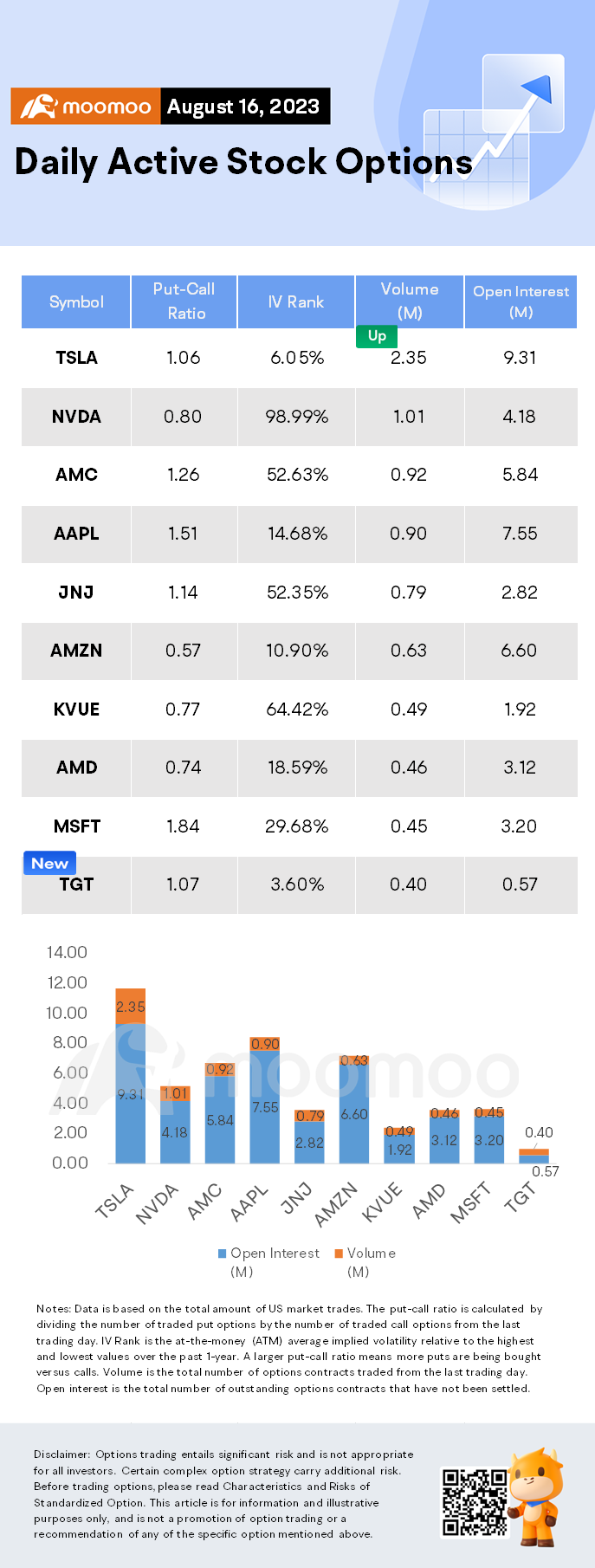

$Target(TGT.US$ shares rose by 2.96%, closing at $128.75. Its options trading volume is 0.40 million. Call contracts account for 48.2% of the whole trading volume. The most traded calls are contracts of $135 strike price that expire on August 18th. The total volume reaches 16,555 with an open interest of 11,583. The most traded puts are contracts of a $130 strike price that expires on August 18th; the volume is 15,431 contracts with an open interest of 4,552.

Target reported fiscal Q2 adjusted earnings Wednesday of $1.80 per diluted share, up from $0.39 a year earlier. Analysts polled by Capital IQ expected $1.42. Revenue for the quarter ended July 29 was $24.77 billion, compared with $26.04 billion a year earlier. Analysts surveyed by Capital IQ expected $25.23 billion.

For fiscal Q3, the retailer said it expects adjusted EPS of $1.20 to $1.60 and comparable sales to decline by mid-single digits Analysts surveyed by Capital IQ project EPS of $1.84 for the quarter on revenue of $26.12 billion.

$Tesla(TSLA.US$ shares fell by 3.16%, closing at $225.60. Its options trading volume is 2.35 million. Call contracts account for 48.5% of the whole trading volume. The most traded calls are contracts of $235 strike price that expire on August 18th. The total volume reaches 124,389 with an open interest of 13,295. The most traded puts are contracts of a $225 strike price that expires on August 18th; the volume is 118,385 contracts with an open interest of 20,924.

Tesla on Tuesday introduced cheaper, shorter-range versions of its Model S sedan and Model X SUV. Tesla on Sunday cut the price of two versions of its Model Y SUV by about $1,900 each in China. The EV maker's price wars in China, the U.S. and other countries sparked price cuts from legacy and electric automakers alike.

Tesla reported second-quarter earnings in mid-July, keeping intact its 2023 goal of making about 1.8 million vehicles, but warned investors to expect "slightly" lower production in the current quarter due to factory upgrades.

$NVIDIA(NVDA.US$ shares fell by 1.03%, closing at $434.86. Its options trading volume is 1.01 million. Call contracts account for 55.6% of the whole trading volume. The most traded calls are contracts of $450 strike price that expire on August 18th. The total volume reaches 51,660 with an open interest of 20,608. The most traded puts are contracts of a $440 strike price that expires on August 18th; the volume is 38,966 contracts with an open interest of 16,553.

Unusual Stock Options Activity

There were noteworthy activities in $Tesla(TSLA.US$ where multiple options have high volume to open interest ranking. The highest volume over open interest ratio reaches 33.97x with 35,637 contracts.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please readCharacteristics and Risks of Standardized Option.This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Source: Benzinga, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Matthew peters : Well maybe it’s happening cause all these looters just a thought