Options Market Statistics: Super Micro Computer Stock Shot Up After Snagging a Coveted S&P 500 Slot

News Highlights

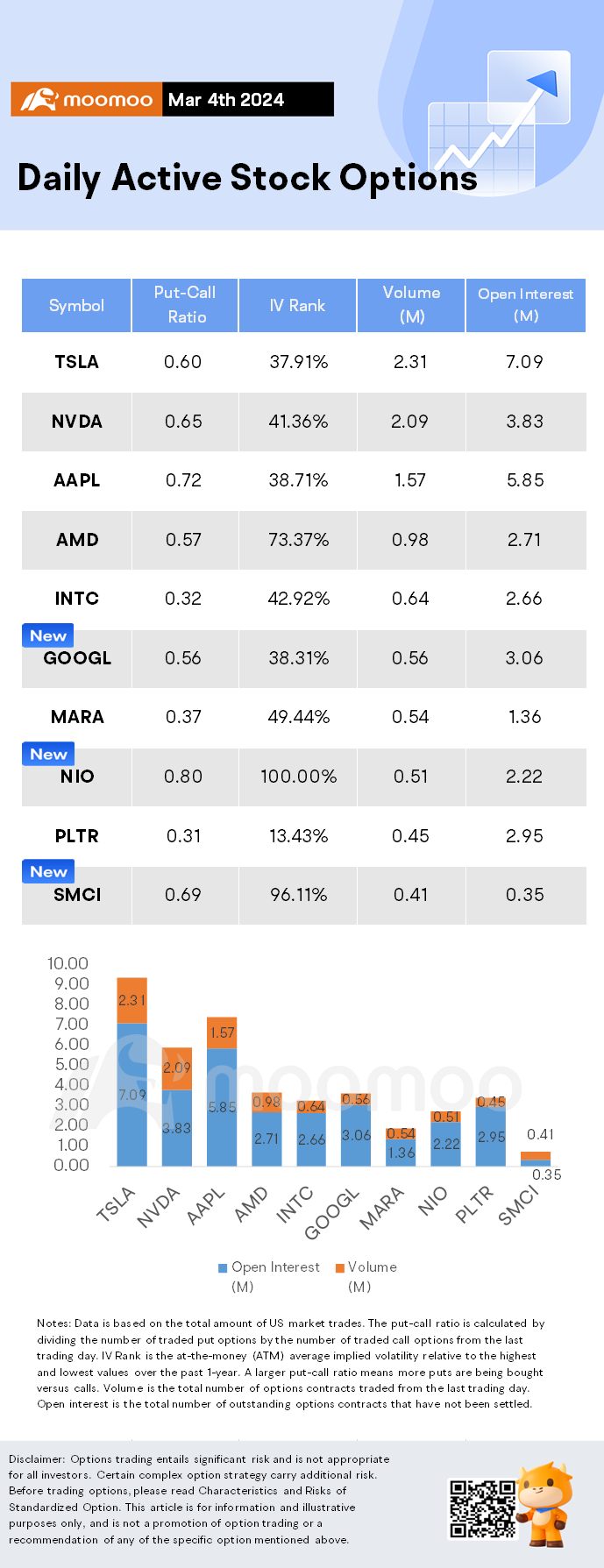

$NVIDIA(NVDA.US$ shares rose by 3.6%, closing at $852.37. Its options trading volume is 2.09 million. Call contracts account for 60.5% of the total trading volume. The most traded calls are contracts of $900 strike price that expire on Mar 8th. The total volume reaches 89,192 with an open interest of 7,718. The most traded puts are contracts of a $800 strike price that expires on Mar 8th; the volume is 51,702 contracts with an open interest of 5,211.

$Super Micro Computer(SMCI.US$ shares rose by 18.65%, closing at $1074.34. Its options trading volume is 0.41 million. Call contracts account for 59.1% of the total trading volume. The most traded calls are contracts of $1200 strike price that expire on Mar 8th. The total volume reaches 19,471 with an open interest of 1,734. The most traded puts are contracts of a $1000 strike price that expires on Mar 8th; the volume is 9,858 contracts with an open interest of 69.

Super Micro Computer's stock soared above the clouds after the S&P Dow Jones indices awarded it a coveted spot in the S&P 500.

After the news broke early on Monday, the 31-year-old server and computer infrastructure company hit a record rally, with shares popping more than 25% in trading, adding over $220 per share. Super Micro — which trades as SMCI on the Nasdaq — currently has a market capitalization of roughly $63 billion. The median market cap for S&P 500 companies is $33.7 billion.

Since the year began, the San Jose, California-based company has watched its stock practically erupt, fueled by the industrywide AI boom. In just over two months — or 64 days, to be precise — Super Micro's stock has gained $842 per share, or a 295% increase.

$NIO Inc(NIO.US$ shares fell by 7.79%, closing at $5.33. Its options trading volume is 0.51 million. Call contracts account for 55.6% of the total trading volume. The most traded calls are contracts of $12.5 strike price that expire on June 21st. The total volume reaches 31,695 with an open interest of 44,292. The most traded puts are contracts of a $5 strike price that expires on Mar 8th; the volume is 35,863 contracts with an open interest of 8,044.

Unusual Stock Options Activity

Some notable put activity is being seen in $Patterson-UTI Energy(PTEN.US$, which is primarily being driven by activity on the April 19th put. Volume on this contract is 34,361 versus open interest of 123.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

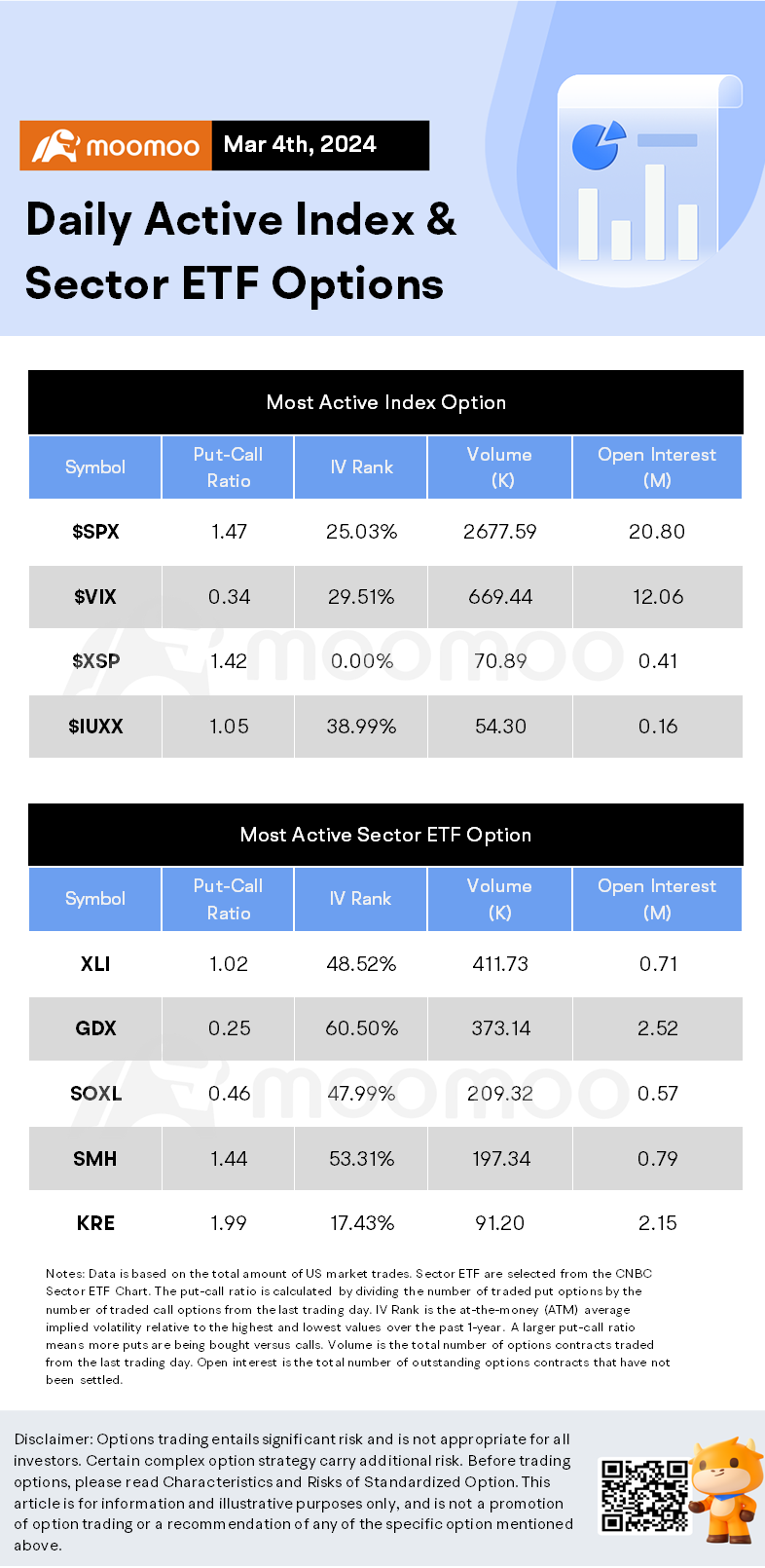

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, Barron's, The Motley Fool

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment