Options Market Statistics: Nvidia Options Pop as Traders Bet on the Company's Earnings

News Highlight

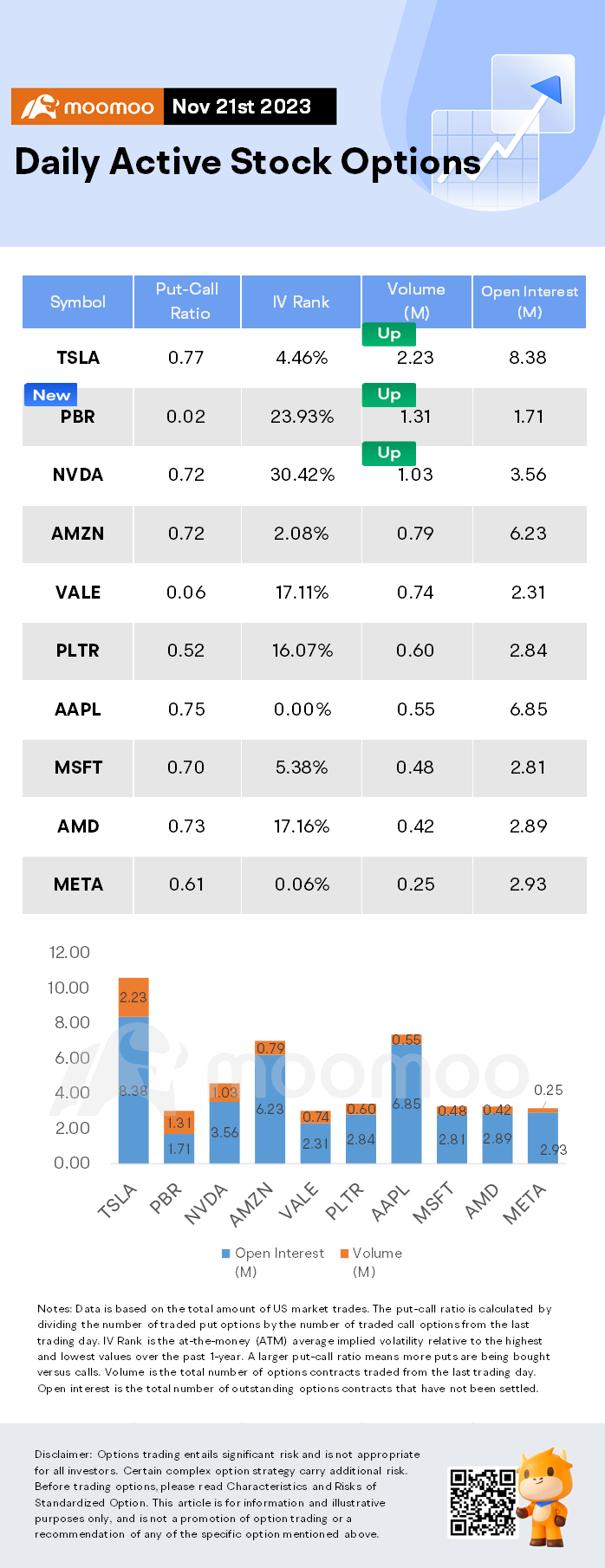

$NVIDIA(NVDA.US$ shares fell by 0.92%, closing at $499.44. Its options trading volume is 1.03 million. Call contracts account for 58.0% of the whole trading volume.

Nvidia shares moved down 1% in extended trading on Tuesday after the chipmaker reported fiscal third-quarter results that surpassed Wall Street's predictions. But the company called for a negative impact in the next quarter because of export restrictions affecting sales to organizations in China and other countries.

We expect that our sales to these destinations will decline significantly in the fourth quarter of fiscal 2024, though we believe the decline will be more than offset by strong growth in other regions," Nvidia's finance chief, Colette Kress, said in a letter to shareholders.

On a conference call with analysts, Kress said Nvidia is working with some clients in the Middle East and China to obtain U.S. government licenses for sales of high-performance products. Nvidia is trying to develop new data center products that comply with government policies and don't require licenses, but Kress said she didn't think they would be meaningful in the fiscal fourth quarter.

$Tesla(TSLA.US$ shares rose by 2.38%, closing at $241.20. Its options trading volume is 2.23 million. Call contracts account for 56.6% of the whole trading volume.

Tesla's plans in India have reignited, with the company discussing billions of dollars worth of investment in the country.

Recently, more details about Tesla's investment proposal in India were released. According to Bloomberg, Tesla is allegedly planning to invest about $2 billion initially on a new plant in India. In addition, Tesla has plans to buy $15 billion worth of auto parts from India. Tesla is also mulling over the idea of producing batteries in India to reduce costs.

Tesla India gains new legs as government considers reducing import tariffs

$Petroleo Brasileiro SA Petrobras(PBR.US$ shares fell by 1.55%, closing at $15.85. Its options trading volume is 1.31 million. Call contracts account for 97.6% of the whole trading volume.

Unusual Stock Options Activity

Some notable put activity is being seen in $Tesla(TSLA.US$, which is primarily being driven by activity on the Jan 19th 2024 450.00 put. Volume on this contract is 62,520 versus open interest of 2,103.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Louay Hamed : $Tesla(TSLA.US)$ shares rose by 2.38%, closing at $241.20. Its options trading volume is 2.23 million. Call contracts account for 56.6% of the whole trading volume.

Tesla's plans in India have reignited, with the company discussing billions of dollars worth of investment in the country.

Md Abdula : @Invest With Cici $AAX (5238.MY)$