Options Market Statistics: Morgan Stanley Lowers Price Target of BAC to $32; BAC Shares Drop, Options Pop

News Highlights

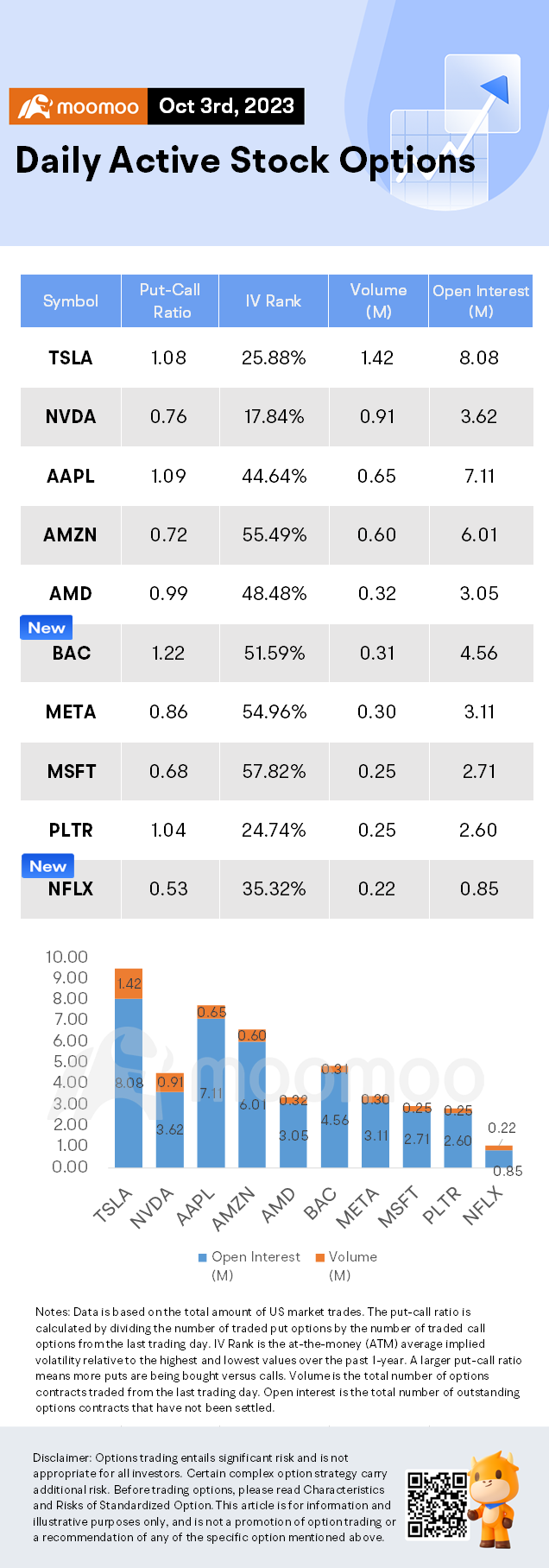

$Tesla(TSLA.US$ shares fell by 2.02%, closing at $246.53. Its options trading volume is 1.42 million. Call contracts account for 48.1% of the whole trading volume. The most traded calls are contracts of $260 strike price that expire on October 6th. The total volume reaches 58,216 with an open interest of 13,459. The most traded puts are contracts of a $250 strike price that expires on October 6th; the volume is 39,673 contracts with an open interest of 9,379.

Tesla's Q3 delivery numbers failed to meet expectations, prompting several analysts to voice concerns over the company's future prospects. Truist Securities, Bernstein, and GLJ Research each provided insights, with issues ranging from pricing strategies, factory upgrades, and doubts over real demand for Tesla vehicles.

The Truist Analyst: William Stein reiterated a Hold rating on Tesla, while lowering the price target from $254 to $243. Stein said Musk's views on pricing and acceptable margins limit the value of the automotive business, adding that recent updates to Tesla's AI have not been encouraging. The analyst also cautioned investors about macroeconomic forces possibly affecting the company's future prospects.

The Bernstein Analyst: Toni Sacconaghi remains bearish on Tesla, with an Underperform rating and a $150 price target. Sacconaghi told investors that hitting the revised 1.8 million delivery mark for full year 2023 is achievable, but it would require a significant boost during the fourth quarter. Gross margins are a main focal point for Bernstein, which expects potential downside given the recent price cuts. Longer-term, the analyst is skeptical over consensus forecasts for full year 2024, saying that more price cuts may not have been priced in.

The GLJ Research Analysis: Gordon Johnson reiterated a Sell rating on the stock with a $24.33 price target. Johnson, a known Tesla bear, was blunt about the company's misses for Q3, rejecting the commonly accepted rationale that the missed targets were due to line upgrades. Johnson said that Tesla is dealing with a "Herculean" demand problem, suggesting that the real demand for Tesla vehicles has taken a hit. The analyst suggested that rather than line upgrades, global demand for Tesla cars fell by 44,600 cars quarter over quarter.

GLJ also criticized the consistent narrative shifts around Tesla's delivery expectations, accusing Wall Street of neglecting its duty by adjusting delivery expectations downwards while still promoting a buy outlook for Tesla's stock. Johnson told investors that now is an "opportune" time to add short positions, or initiate a short position on the stock.

$Bank of America(BAC.US$ shares fell by 2.96%, closing at $25.91. Its options trading volume is 0.31 million. Call contracts account for 45.1% of the whole trading volume. The most traded calls are contracts of $29 strike price that expire on October 20th. The total volume reaches 26,373 with an open interest of 23,297. The most traded puts are contracts of a $24 strike price that expires on October 27th; the volume is 10,750 contracts with an open interest of 32,104.

Morgan Stanley analyst Betsy Graseck maintains Bank of America with a Equal-Weight and lowers the price target from $34 to $32.

$Netflix(NFLX.US$ shares fell by 0.94%, closing at $376.75. Its options trading volume is 0.22 million. Call contracts account for 65.4% of the whole trading volume. The most traded calls are contracts of $385 strike price that expire on October 6th. The total volume reaches 4,540 with an open interest of 1,311. The most traded puts are contracts of a $380 strike price that expires on October 6th; the volume is 4,121 contracts with an open interest of 2,038.

According to a Wall Street Journal report, Netflix will raise the price of its ad-free service a few months after the Hollywood actors strikes end. The magnitude of the price increases remains unknown.

People familiar with the matter reportedly said the company is likely to roll out the price increases in the U.S. and Canadian markets first, but could ultimately end up lifting prices in several markets globally.

The report indicates that prices across major ad-free streaming services have gone up by about 25% on average over the past year. Netflix is actually the only streaming giant that hasn't raised prices in the past year. The company last raised prices in January 2022. It launched its ad-supported tier last November.

Of all the analysts covering Netflix, 21 have positive ratings, nine have neutral ratings and two have negative ratings. The lowest price target is $215 and the highest price target is $600.

Unusual Stock Options Activity

Some notable call activity is being seen in $Las Vegas Sands(LVS.US$, which is primarily being driven by activity on the December 15th 45.00 call. Volume on this contract is 28,279 versus open interest of 641, so it's likely that nearly all of the volume represents fresh positioning.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Source: Benzinga, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment