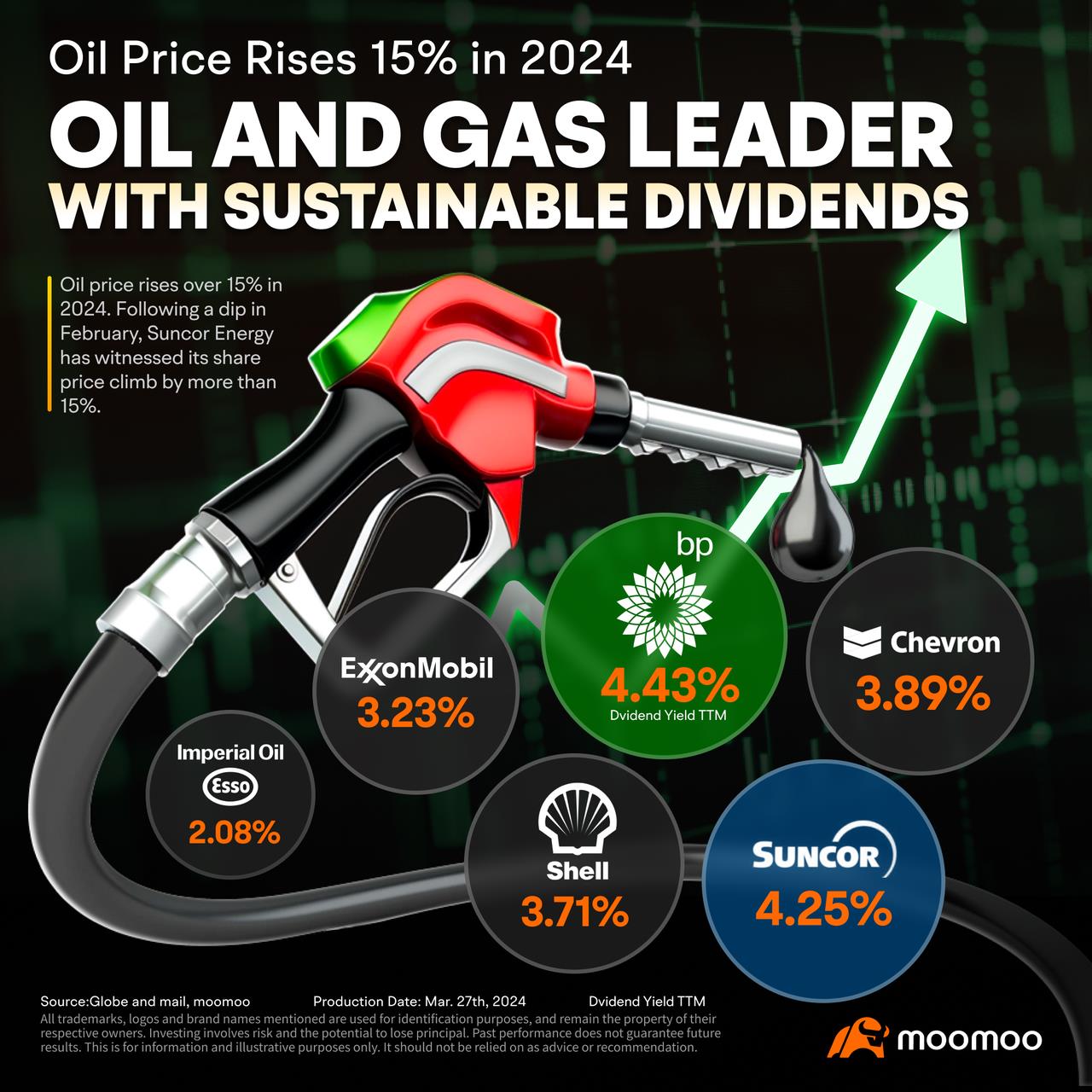

Oil Stocks With Sustainable Dividend: Suncor and 5 Companies Make the List

Crude oil prices have risen 15% since the beginning of the year, propelling energy stocks to new heights. Suncor hit an all-time high of $49.99 on Tuesday. Meanwhile, Imperial Oil reached a milestone, with shares climbing to an all-time high of $94.25 on Monday. Since a notable dip in February, both companies have witnessed a rebound of over 15%.

Sustaining the Momentum of Oil Stocks: The Oil Price Outlook

The International Energy Agency (IEA) recently increased its forecasts for global oil demand growth in 2024 by 110,000 barrels on a stronger U.S. economic outlook and a growing need for ship fuel as vessels navigate longer routes to circumvent Houthi attacks in the Red Sea. "Oil demand seems to be rekindling on the back of U.S. economic resilience," remarked Rohan Reddy, director of research at Global X, highlighting the resurgence in momentum for the oil price.

Investors are also closely monitoring OPEC+ cutbacks and geopolitics. OPEC+ members see no immediate need to alter the existing supply policy at their upcoming review meeting, with the current quotas set until June deemed effective by national officials. Furthermore, incidents affecting Russian energy infrastructure and the ongoing conflict between Israel and Hamas have also contributed to the rise in oil prices, according to analysts.

The shifting monetary policy landscape is playing a role as well. The Federal Reserve's indication of potential interest rate cuts later this year has spurred risk asset appetite, including oil. Analysts note that "US rate cuts in non-recessionary environments lead to higher commodity prices," with a particularly pronounced effect on crude oil prices over time as the growth impulse from looser financial conditions permeates the market.

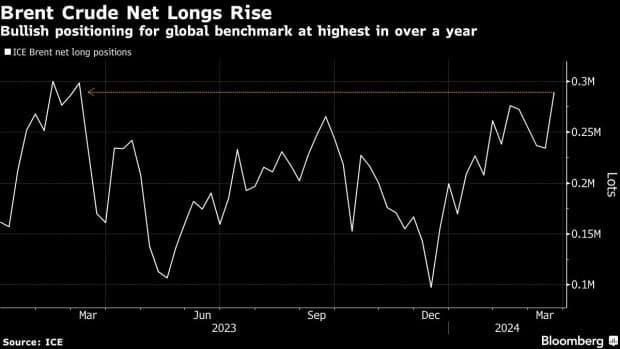

Hedge funds and other money managers have ramped up their long positions in oil, showing the most substantial wave of bullish interest since September 2023.

Invest Like Buffett: Energy Stocks With Juicy Dividends

Top energy companies, particularly those involved in global oil sand operations, stand to benefit from this environment. These firms have transformed into veritable free cash flow fountains. Integrated oil and gas companies are especially well-positioned for success compared to pure producers, as their refining and chemical segments can capitalize on lower crude and natural gas prices, providing a buffer during price declines.

Scott Clayton, an analyst from TSI Network, has spotlighted global integrated firms that are strong dividend payers with promising production and cash flow projections. He devised a scoring system based on several criteria, identifying six standout stocks:

· Steady dividend history

· Recent dividend growth

· Management's dividend commitment

· Operations in stable industries

· Limited exposure to foreign currency risks and political interference

· Robust financial health with manageable debt and sufficient cash reserves

· Long-term positive earnings and cash flow to support dividends

· Industry leadership status

Among the top picks are Canadian oil and gas giants $Imperial Oil Ltd(IMO.CA$ and $Suncor Energy Inc(SU.CA$, both of which leverage their oil sands and conventional well production to supply their refining operations. Additionally, $Chevron(CVX.US$ in California and $Exxon Mobil(XOM.US$ in Texas are utilizing their substantial cash flows to augment dividends and share buybacks. Notably, Warren Buffett's Berkshire Hathaway increased its stake in Chevron by 14.4% in Q4, making it the company's fifth-largest holding and signaling confidence in the high-yield dividend energy stock. London-based majors $BP PLC(BP.US$ and $Shell PLC(SHEL.US$ round out the list as two of the largest global oil and gas producers.

Source: Globe and Mail

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

FARAMARZ AKBARY :